TIDM4BB

3 June 2021

4basebio UK Societas

("4basebio", the "Company" or the "Group")

Final Results

The Board of 4basebio UK Societas is pleased to report the results for the

financial year ended 31 December 2020.

Highlights

* Spin out of DNA operations from 4basebio AG (now 2Invest AG) before year

end

* Expansion into 12,000 square foot freehold office, laboratory and

warehousing space near Cambridge in Q3 2020

* Development of UK DNA and nanoparticle scaling and validation team Q4 2020

* Admission of newly formed 4basebio UK Societas Group to AIM in February

2021

* Signed research collaboration and evaluation license agreements with Royal

Holloway University of London for development of a non-viral vector for

treatment of Duchenne muscular dystrophy in April 2021

Overview

The 4basebio UK Societas group of companies ("the Group") was spun out of

4basebio AG, a German listed company, on 8 December 2020. The Company seat was

subsequently transferred to the UK and the Company was admitted to AIM on 17

February 2021.

The Group is a specialist life sciences group of companies focused on supplying

therapeutic DNA for gene therapies and gene-based vaccines and providing

solutions for effective and safe delivery of these DNA/RNA based products to

patients.

Its focus is the validation, scaling and supply of proprietary high quality GMP

(Good Manufacturing Practice) grade synthetic DNA as well as proprietary

non-viral nanoparticles which can efficiently and safely deliver fully

functional genes to patients. These products and technologies are also

available for customers and partners with whom we endeavour to combine our

capabilities and know-how to develop gene therapy solutions for clinical

development and commercialisation.

This announcement contains inside information for the purposes of the UK Market

Abuse Regulation and the Directors of the Company are responsible for the

release of this announcement.

For further enquiries, please contact:

4basebio UK Societas +44 (0)12 2396 7943

Heikki Lanckriet, CEO

+44 (0)20 7213 0880

Cairn Financial Advisers LLP (Nominated Adviser)

Jo Turner / Sandy Jamieson

finnCap Ltd (Broker)

Geoff Nash/Richard Chambers/Charlotte Sutcliffe +44 (0)20 7220 0500

Walbrook PR +44 (0)20 7933 8780 or

4basebio@walbrookpr.com

Anna Dunphy / Paul McManus Mob: +44 (0)7876 741 001 / +44 (0)7980 541

893

Chairman's statement

I am delighted to be able to deliver my first statement as Chairman of the

newly formed 4basebio UK Societas Group of companies. Since the decision was

taken by the 4basebio AG board in 2020 to spin out the DNA assets of that group

into 4basebio UK Societas and admit its shares to trading on AIM, the Company

and Group has witnessed significant change.

4basebio UK Societas, formally 4basebio SE, was a German registered European

stock corporation which was used to facilitate the spin out from 4basebio AG.

Following approval of the spin out by the 4basebio AG Extraordinary General

Meeting of 3 November 2020 and subsequent confirmation by the German commercial

register on 8 December 2020, its registered seat was moved to the UK on 22

December 2020.

Following Brexit and the requisite change to the SE legislation, the Company's

status was automatically changed to a UK stock corporation, a UK Societas. The

Company will seek shareholder approval at the forthcoming Annual General

Meeting to become a UK PLC. This will not affect its quoted status on AIM.

This process followed acknowledgement by the Board of 4basebio AG that the

market valuation of its DNA business would benefit over time from a separate

listing, distinct from 4basebio AG which now acts as an investment company. To

that end, the AIM Market of London Stock Exchange (AIM) was identified as a

highly suitable market due to the breadth of peer companies, London's large and

sophisticated investor base and the UK operational footprint of the Company,

with its Head Office near Cambridge.

With the spin out and flotation process now completed, the focus of the Board

is now very much on the commercialisation of the Group's technology and growing

stakeholder value over time.

During the latter part of 2020, the Group made the decision to accelerate its

development activities by establishing a UK science group alongside the

existing Spanish team. That UK group now stands at seven staff with further

hires planned over coming months.

The Group continues to focus on its validation and scaling programmes, both in

house and with selected academic and commercial partners. Near term objectives

are centred on the Group's proprietary synthetic hpDNAT being validated for use

in AAV (adeno-associated viral vectors) and in vitro transcription (IVT), as

well as delivering GMP readiness. While we remain relatively early in this

process, it is becoming increasingly clear that these specific areas present a

significant supply challenge for large pharma and biotech which are seeking

alternative DNA solutions, both due to existing supply constraints and certain

challenges in using plasmid DNA.

The Group remains fundamentally at a pre revenue stage but the Board is

optimistic that this approach will prove fruitful with revenue and market

opportunities opening up during the course of 2021 and 2022 in particular.

Tim McCarthy

Chairman

2 June 2021

Consolidated statement of profit or loss and other comprehensive income

for the year ended 31 December

2020 2019

£'000 £'000

Revenues 462 202

Cost of goods sold (188) (230)

Gross profit 274 (28)

Sales and marketing expenses (141) (118)

Administration expenses (516) (237)

Research and non-capitalised development expenses (343) (254)

Other operating expenses (1) (11)

Other operating income 105 228

Loss from operations (622) (420)

Finance expense (94) (109)

Financial result (94) (109)

Loss before tax (716) (529)

Income tax expense (3) 106

Loss for the period (719) (423)

Loss per share

* Diluted and Undiluted (in £/share) (0.08) (0.05)

Items that may be reclassified to the income statement in

subsequent periods

Exchange rate adjustments 162 -

Total comprehensive income (557) (423)

Consolidated statement of financial position

31 December

2020 2019

£'000 £'000

Assets

Intangible assets 785 450

Property, plant and equipment 1,478 78

Other non-current assets 34 29

Non-current assets 2,297 557

Inventories 131 102

Trade receivables 39 77

Other current assets 341 339

Cash and cash equivalents 15,001 80

Current assets 15,512 598

Total assets 17,809 1,155

Liabilities

Financial liabilities (416) (446)

Trade payables (96) (101)

Other current liabilities (301) (19)

Current liabilities (813) (566)

Financial liabilities (1,301) (2,142)

Other liabilities (237) (337)

Non-current liabilities (1,538) (2,479)

Total liabilities (2,351) (3,045)

Net assets 15,458 (1,890)

Share capital 11,130 6,362

Share premium 706 0

Merger reserve 688 0

Capital reserve 13,099 1,356

Foreign exchange reserve 175 13

Accumulated loss (10,340) (9,621)

Total Equity 15,458 (1,890)

Consolidated statement of changes in equity

for the year ended 31 December 2020

in £'000 Share Share Merger Capital Foreign Profit and Total equity

capital premium reserve reserve exchange loss reserve

Balance at 1 January 2020 6,362 - - 1,356 13 (9,621) (1,890)

Capital contributions from - - - 11,743 - - 11,743

4basebio AG (now 2Invest AG)

Combination accounting (6,258) - 688 - - - (5,570)

Capital contributions from

4basebio AG (now 2Invest AG)

Loss after income tax - - - - - (719) (719)

Shares issued for cash 3,209 706 - - - - 3,915

Foreign Exchange difference - - - - 162 - 162

arising on translation of

4basebio S.L.U.

Shares issued to acquire 7,817 - - - - - 7,817

subsidiaries

Balance at 31 December 2020 11,130 706 688 13,099 175 (10,340) 15,458

in £'000 Share Share Merger Capital Foreign Profit and Total equity

capital premium reserve reserve exchange loss reserve

Balance at 1 January 2019 6,362 - - 1,356 13 (9,198) (1,467)

Loss after income tax and total - - - - - (423) (423)

comprehensive income for the

period

Balance at 31 December 2019 6,362 - - 1,356 13 (9,621) (1,890)

Consolidated statement of cash flows

for the year ended 31 December

2020 2019

£'000 £'000

Net loss for the period (719) (423)

Adjustments to reconcile net loss for the period to net

cashflows

Income taxes 3 (106)

Interest charge 94 104

Depreciation of property, plant and equipment 83 15

Amortisation and impairment of intangible assets 4 194 236

Other non-cash items 11 25 (57)

Working capital changes:

Trade receivables and other current assets 91 116

Trade payables and other current liabilities (876) (167)

Inventories (24) 13

Tax receipt 107 -

Net Cash flows from operating activities (1,022) (269)

Investments in property, plant and equipment and intangible assets (351) (3)

Investments in capitalised development (498) (200)

Cash acquired with 4basebio Limited (now 4basebio UK Limited) 2,295 0

Cash flows from investing activities 1,446 (203)

Cash in(out)flow due to changes in financing (1,024) 629

Capital contributions by way of cash 15,626 0

Interest paid (116) (104)

IFRS16 leases (59) (37)

Cash flows from financing activities 14,427 487

Net change in cash and cash equivalents 14,851 16

Exchange differences 70 (4)

Cash and cash equivalents at the beginning of the period 80 69

Cash and cash equivalents at the end of the period 15,001 80

Notes to the financial statements

1. Basis of preparation

The consolidated financial statements of 4basebio UK Societas (or "the Group")

for the financial year ending 31 December 2020 have been prepared in accordance

with the International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB).

The directors, having considered the circumstances giving rise to the formation

of the Group and relevant guidance in IFRS 3.B13 to IFRS 3.B17, have concluded

that the combination in which the Company issued 8,622,231 shares to the

shareholders of its former parent entity as consideration for the spin-off

assets comprising shareholdings in 4basebio S.L.U. and 4basebio Limited (now

4basebio U.K. Limited), should be treated as a continuation of 4basebio S.L.U.

at historic book values. Further details of this consideration are set out in

note 13.

Therefore, although these consolidated financial statements have been issued in

the name of 4basebio UK Societas, the legal acquirer, the Group's activity is

in substance the continuation of the financial information of 4basebio S.L.U.,

to which the comparative financial information presented, for the year ended 31

December 2019, relates. The consolidated financial statements comprise the

results of 4basebio S.L.U. and 4basebio UK Societas for the full year and

4basebio UK Limited from 8 December 2020 the date of the transaction.

The financial information included as comparatives for the year ended 31

December 2019 reflect the results and position of 4basebio S.L.U.;

consequently, the financial information included as comparatives within these

consolidated financial statements does not constitute statutory accounts, but

has been prepared under IFRS and in accordance with the group accounting

policies disclosed.

The financial statements have been prepared on the historical cost basis.

Historical cost is generally based on the fair value of the consideration given

in exchange for goods and services. For calculation reasons, rounding

differences of +/- one unit (£'000, % etc.) may occur in the information

presented in these financial statements.

Fair value is the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at

the measurement date, regardless of whether that price is directly observable

or estimated using another valuation technique. In estimating the fair value of

an asset or a liability, the Group takes into account the characteristics of

the asset or liability if market participants would take those characteristics

into account when pricing the asset or liability at the measurement date. Fair

value for measurement and/or disclosure purposes in these consolidated

financial statements is determined on such a basis, except for leasing

transactions that are within the scope of IFRS 16.

2. Going concern

The directors have, at the time of approving the financial statements, a

reasonable expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Thus they continue to adopt

the going concern basis of accounting in preparing the financial statements.

3. Earnings per share

2020 2019

Numerator [in £'000]

Result for the period (719) (423)

Denominator [number of shares]

Weighted average number of registered shares in

circulation (ordinary shares) for calculating 9,197,913 8,622,231

the undiluted earnings per share

Diluted and Undiluted earnings per share (0.08) (0.05)

4basebio UK Societas was incorporated on 11 October 2019 with issued share

capital of 120,000 ordinary shares. On 11 November 2020, a further 3,575,242

ordinary shares were issued for cash. On 8 December 2020 a further 8,622,231

ordinary shares were issued in consideration for the acquisition of 4basebio

S.L.U. and 4basebio Limited (now 4basebio UK Limited).

The calculation of the diluted and undiluted earnings per share for continuing

operations was based on the weighted average number of shares as determined

above. The numerator is defined as result after tax from continuing operations.

The comparative has been restated to reflect the number of shares prior to the

combination which is considered to be 8,622,231; this is the number of shares

adjusted for the exchange ratio of the combination. See note 13 for further

details relating to the business combination.

4. Events after the reporting period

Admission to AIM

On 17 February 2021, the Company's shares were admitted to trading on the AIM

market of London Stock Exchange.

Forward exchange contracts

Subsequent to year end and prior to the approval of these financial statements,

the Group entered into a number of foreign exchange forward contracts to sell

Euros and buy Pounds. The Group's cash balances are primarily held in Euros

following the spin out of activities from 4basebio AG, while a significant

proportion of its expenditure is incurred in Pounds. During the remainder of

2021, the Group is contracted to sell ?2 million at an average price of £

0.8659.

Legal action versus Company

Subsequent to year end, the Company received notification in respect of four

separate legal actions being commenced by shareholders in 4basebio AG (now

2Invest AG) in relation to the spin out process of 4basebio SE (now 4basebio UK

Societas). These actions are being pursued in Germany.

The spin out process approved by the Extraordinary General Meeting of 4basebio

AG provided for shareholders in 4basebio AG to receive one share in 4basebio SE

for every six shares held by each shareholder in 4basebio AG on the specified

settlement date. Under German law, shareholders of 4basebio AG were entitled

to seek compensation in lieu of receiving shares in 4basebio SE, such

compensation set at ?1.30 per share where an objection was made at the time of

the Extraordinary General Meeting. Shareholders with about 40,000 shares

objected to the spin out at the time. Consequently, these claims are seeking

from 4basebio UK Societas compensation in excess of the ?1.30 per share, such

amount yet to be specified.

The directors note that such claims processes are common in Germany and are

often prolonged and consider these actions to be without merit. The Company

has engaged German legal counsel to advise on these matters.

Royal Holloway evaluation licence and research and collaboration agreement

On 27 April 2021, 4basebio Discovery signed an evaluation licence and research

and collaboration agreement with Royal Holloway University of London to enable

collaboration on a payload and vector and to evaluate their efficacy for

treatment of muscular dystrophy. The initial project is expected to extend

over two years, with an option for 4basebio Discovery to enter into a

commercial licence under terms already agreed between the parties.

5. Approval of the financial statements

The financial statements were approved by the board of directors and authorised

for issue on 2 June 2021. A copy of the financial statements, together with the

Notice of AGM which will be announced separately, will shortly be sent to all

shareholders and will be available from the Company's website.

END

(END) Dow Jones Newswires

June 03, 2021 02:00 ET (06:00 GMT)

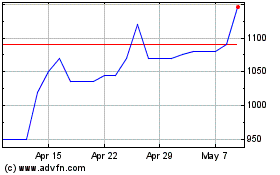

4basebio (LSE:4BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

4basebio (LSE:4BB)

Historical Stock Chart

From Apr 2023 to Apr 2024