TIDMAIQ

RNS Number : 9884G

AIQ Limited

30 July 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014.

30 July 2021

For Immediate Release

AIQ Limited

("AIQ" or the "Company" or, together with Alchemist Codes and

Alcodes International, the "Group")

Interim Results

The Board of AIQ (LSE: AIQ) announces the Company's unaudited

consolidated interim results for the six months ended 30 April

2021.

Summary

-- As previously announced, the COVID-19 pandemic had a profound

impact on Alchemist Codes Sdn Bhd ("Alchemist Codes") and the

business model of its OctaPLUS e-commerce platform:

o Retailers transitioned to focus on direct-to-consumer online

sales & marketing, which had a severe impact on OctaPLUS'

affiliate marketing commission model

o Economic uncertainty resulted in customers delaying purchasing

decisions for IT consultancy projects and government lockdown

measures in Malaysia and Hong Kong prevented management meeting

with potential customers and business contacts resulting in

negligible sales activity

-- The Board implemented a number of cost-cutting measures and

initiated a strategic review to assess the viability of Alchemist

Codes, which concluded post period:

o Divestment of certain e-commerce software and technology

developed in-house by Alchemist Codes

o Focus on building the IT consultancy business of Alcodes

International in Hong Kong

o Efficiency measures expected to generate savings of

approximately GBP400,000 on an annualised basis

-- Revenue for the six months to 30 April 2021 was GBP12,079 (H1 2020*: GBP25,409)

-- Net loss for the period was GBP915,425 (H1 2020*: GBP612,993)

-- Cash and cash equivalents at 30 April 2020 of GBP1.0 million

(31 October 2020: GBP1.8 million)

* The six-month period to 30 April 2020 included approximately

one month's operations of Alchemist Codes following the acquisition

in March 2020.

Graham Duncan, Chairman of AIQ, said:

"As previously stated, the COVID-19 pandemic had a profound

impact on Alchemist Codes, particularly given that the business was

at a relatively early stage of development. Both the roll-out of

its OctaPLUS e-commerce platform and its IT consultancy business

were met with severe headwinds such that little progress could be

made and sales activity during the period was negligible. As a

result, and combined with the continued uncertainty over the

post-pandemic economic recovery and market outlook, the Board

undertook significant cost-cutting measures and a fundamental

strategic review, which completed post period. We have taken steps

to preserve cash while seeking to reposition the business by

widening its focus beyond e-commerce. While it is early days, we

have received some initial interest in the support we can provide

for digital assets. The Board is closely monitoring the progress of

the Group and will take further action if required."

Enquiries

AIQ Limited c/o +44 (0)20 7618 9100

Graham Duncan, Chairman

VSA Capital Limited (Financial Adviser

& Broker) +44 (0)20 3005 5000

Andrew Raca (Corporate Finance)

Luther Pendragon (Financial PR) +44 (0)20 7618 9100

Claire Norbury

Operational Review

As noted in the Group's final results announcement, the

prolonged and multifaceted impact of the COVID-19 pandemic, which

was compounded by Alchemist Codes being at a relatively early stage

of development, resulted in negligible sales activity during the

first half of the year to 30 April 2021. In particular, the

forecast growth in registered users and customer spend on the

OctaPLUS e-commerce platform did not materialise and the rate of

commission from retailers was significantly below expectations.

This reflected the impact of the pandemic on the OctaPLUS business

model. The IT business in Malaysia continued to be subject to a

series of strict government lockdowns - known as "movement control

orders" (MCO) - as a result of the pandemic, including being

prohibited from entering office premises, which restricted

opportunities for management to meet physically with its customers,

prospective customers and business partners. In addition, the

economic downturn and uncertainty caused customers to delay

purchasing decisions or reallocate resources.

Following the establishment of Alcodes International Limited

("Alcodes International"), a wholly-owned subsidiary of Alchemist

Codes, in Hong Kong in July 2020, initial progress was made during

the period in securing IT projects by leveraging the government

grant schemes for IT solutions providers. This accounted for 69% of

the Group's revenues for the six months to 30 April 2021, albeit an

insignificant amount.

Consequently, and combined with the continued significant

uncertainty over the post-pandemic market recovery, in the results

for the year to 31 October 2020, as announced on 30 April 2021, the

Board recognised an impairment of goodwill and intangibles of

GBP2.4 million from the investment in acquiring Alchemist Codes.

The Board also undertook a series of cost-cutting measures and

commenced a strategic review to determine the future of the

business. This strategic review completed post period as described

below.

Strategic review

The focus of the Board in its review was on preserving cash

within the business whilst income levels remain depressed. This has

resulted in decisions to cut costs, dispose of non-core activities

and prioritise new sources of revenue.

Summary of actions

-- Divestment of certain e-commerce software and technology

developed in-house by Alchemist Codes to Wepin Sdn Bhd ("Wepin")

for RM200,000 (approximately GBP35,000), which completed on 28 May

2021.

-- Eight in-house developers from Alchemist Codes, along with six members of the sales team and administrative staff, are now employed by Wepin.

-- Charles Yong, CEO of Alchemist Codes, is now also employed by

Wepin. Mr Yong remains an Executive Director of AIQ.

-- The OctaPLUS platform and a small team have been retained to

develop the product and seek methods to monetise the registered

user base.

-- Alcodes International, headquartered in Hong Kong, has seen

initial sales (albeit still very low amounts) from IT consultancy

projects. Executive Director Edwin Li, who is based in Hong Kong,

will focus on building the IT consultancy business and look to

expand it into other technology areas such as digital assets.

-- In addition to other reductions, total headcount of the Group

has been cut by over 60% to 14 employees.

-- The Board and senior management have taken a voluntary cut of

20% in their fees, backdated from 1 May 2021.

-- As a result of these efficiency measures, the Group will

recognise savings of approximately GBP400,000 on an annualised

basis.

Financial Review

Revenue for the six months to 30 April 2021 was GBP12,079, with

sales being severely impacted by the pandemic as described above,

compared with GBP25,409 for the first half of the previous year, a

period which included an approximately one-month contribution from

Alchemist Codes following the acquisition in March 2020. The

majority of revenue during the period was based on the sale of

software products and services, with a small contribution from

cashback generated by OctaPLUS. Alcodes International contributed

GBP8,383 with the remainder being generated by Alchemist Codes.

The Group recognised a gross loss for the period of GBP196,801

compared with a gross profit of GBP10,099 for the first half of the

previous year. This was as a result of the lower revenue and the

period to 30 April 2021 reflecting six months of operations of

Alchemist Codes compared with approximately one month for the

earlier period following the acquisition in March 2020.

Administrative expenses were GBP573,030 (H1 2020: GBP288,798)

reflecting the inclusion of Alchemist Codes for the full six-month

period against just one month in the comparative period of the

prior year. The Group recognised losses on foreign exchange of

GBP138,498 (H1 2020: gain GBP61,843) due to the weakness of the

Malaysian Ringgit and Hong Kong Dollar against the Pound. However,

the Group did not incur any transaction costs during the period

compared with GBP406,070 in the first half of the prior year.

Operating loss was GBP908,329 (H1 2020: GBP622,926) with the

increase reflecting the gross loss for the period offset by

significant transaction costs in the prior period. Net finance

costs were GBP7,096 compared with net finance income of GBP9,933

for the previous period. Consequently, loss before tax for the six

months to 30 April 2021 was GBP915,425 (H1 2020: GBP612,993). The

Group was not subject to taxation during the period or the first

half of the prior year.

As a result of the greater net loss, the loss per share

increased to 1.4 pence (H1 2020: 1.1 pence loss per share).

The Group had cash and cash equivalents of GBP1.0 million at 30

April 2021 (31 October 2020: GBP1.8 million; 30 April 2020: GBP3.2

million) and GBP0.7 million currently.

Current Trading and Outlook

Since period end, the Group has seen an increase in revenue run

rate, albeit still very low amounts. The majority of the revenue

continues to be generated by Alcodes International through the

provision of IT solutions in Hong Kong. In addition, and as noted

above, the Group has received approximately GBP35,000 in the second

half of the year from the divestment of certain e-commerce software

and technology.

Following the completion of the strategic review, the Group has

commenced exploring opportunities for expanding its focus beyond

e-commerce and to target potential customers in North Asia and

Australia. The Group has received initial interest in its ability

to provide digital asset support. While it is too early to

determine if this strategy will be successful, any significant

benefits would likely only be recognised from next year. The Board

will update the market on these activities as appropriate in due

course.

As a result, due to the impact of the pandemic in Malaysia in

the first half and the early nature of the business in Hong Kong,

the Group continues to anticipate that revenue for the year to 31

October 2021 will be lower than that for the year to 31 October

2020. The Board is closely monitoring the progress of the Group and

will take further action to cut costs if required.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 April 2021

Note Six months Six months Year ended

ended ended 31 Oct 2020

30 Apr 2021 30 Apr 2020 Audited

Unaudited Unaudited GBP

GBP GBP

Revenue 7 12,079 25,409 154,649

Cost of sales (208,880) (15,310) (143,268)

-------------- -------------- --------------

Gross (loss)/profit (196,801) 10,099 11,381

Administrative expenses (573,030) (288,798) (1,367,162)

Transaction costs 5 - (406,070) (380,495)

Impairment of intangible

assets - - (2,400,931)

Gain/(loss) on foreign

exchange (138,498) 61,843 (2,926)

Operating loss (908,329) (622,926) (4,140,133)

Finance income 263 9,933 13,852

Finance costs (7,359) - (4,306)

Loss before taxation (915,425) (612,993) (4,130,587)

Taxation - - 493,000

-------------- -------------- --------------

Loss attributable

to equity holders

of the Company for

the period (915,425) (612,993) (3,637,587)

============== ============== ==============

Other comprehensive

income (as may be

reclassified to

profit

and loss in subsequent

periods, net of

taxes):

Exchange difference

on translating foreign

operations 30,223 (6,682) (7,619)

-------------- -------------- --------------

Comprehensive income

attributable to

equity holders of

the Company for

the period (885,202) (619,675) (3,645,206)

============== ============== ==============

Loss per share -

basic and diluted

(GBP per share) 8 (0.014) (0.011) (0.061)

The accompanying notes form an integral part of these

consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 April 2021

Note 30 Apr 2021 31 Oct 2020

Unaudited Audited

GBP GBP

Assets

Non-current assets

Property, plant and equipment 184,995 204,684

Right-of-use assets 208,167 270,727

Intangible assets 6 - -

Rental deposits 29,560 31,453

------------ ------------

Total non-current assets 422,722 506,684

------------ ------------

Current assets

Trade receivables 6,288 7,799

Prepayments and other receivables 46,241 61,660

Tax receivable 23,274 24,764

Cash and cash equivalents 1,022,585 1,827,379

------------ ------------

Total current assets 1,098,388 1,921,602

------------ ------------

Total assets 1,521,110 2,428,466

------------ ------------

Equity and liabilities

Capital and reserves

Ordinary shares 9 647,607 647,607

Share premium 6,019,207 6,019,207

Foreign currency translation

reserve 22,604 (7,619)

Accumulated losses (5,710,896) (4,795,471)

------------ ------------

Total equity 978,522 1,863,724

------------ ------------

Liabilities

Current liabilities

Trade payables 146,146 155,468

Accruals and other payables 183,675 136,573

Lease liabilities 91,036 94,012

Total current liabilities 420,857 386,053

------------ ------------

Non-current liabilities

Lease liabilities 121,731 178,689

Total non-current liabilities 121,731 178,689

------------ ------------

Total equity and liabilities 1,521,110 2,428,466

------------ ------------

The accompanying notes form an integral part of these

consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 April 2021

Share Share Foreign Accumulated Total equity

Capital premium currency losses

translation

reserve

GBP GBP GBP GBP GBP

Balance as at 31

October 2019 (Audited) 518,394 3,848,420 - (1,157,884) 3,208,930

Total comprehensive

loss for the

period - - (6,682) (612,993) (619,675)

Issue of shares 129,213 2,170,787 - - 2,300,000

Balance at 30 April

2020 (Unaudited ) 647,607 6,019,207 (6,682) (1,770,877) 4,889,255

---------- ---------- ------------- ------------- --------------

Total comprehensive

loss for the

period - - (937) (3,024,594) (3,025,531)

Balance at 31 October

2020 (Audited ) 647,607 6,019,207 (7,619) (4,795,471) 1,863,724

---------- ---------- ------------- ------------- --------------

Total comprehensive

profit/(loss)

for the financial

period - - 30,223 (915,425) (885,202)

Balance at 30 April

2021 (Unaudited ) 647,607 6,019,207 22,604 (5,710,896) 978,522

---------- ---------- ------------- ------------- --------------

The accompanying notes form an integral part of these

consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 April 2021

Six-month Six-month Year ended

period period 31 Oct 2020

ended ended Audited

30 Apr 2021 30 Apr 2020 GBP

Unaudited Unaudited

GBP GBP

Cash flows from operating activities

Loss before taxation (915,425) (612,993) (4,130,587)

Adjustment for:-

Depreciation charges 60,137 319 31,031

Amortisation charges - 35,258 239,765

Impairment of intangible assets - - 2,400,931

Interest income (263) (9,933) (13,852)

Loss/(gain) on foreign exchange 146,100 (61,843) 16,623

------------- ------------- --------------

Operating loss before working

capital changes (709,451) (649,192) (1,456,090)

Decrease/(increase) in receivables 13,916 (34,251) (33,544)

Increase in payables 47,602 6,887 19,579

Increase/(decrease) in amount

owing to directors - 12,976 (290,317)

Tax paid - - (18,184)

------------- ------------- --------------

Cash used in operations (647,933) (663,580) (1,778,556)

Interest received 263 9,933 13,852

------------- ------------- --------------

Net cash used in operating activities (646,670) (653,647) (1,764,704)

------------- ------------- --------------

Cash flows from investing activities

Cash acquired on purchase of

subsidiary (Note 5) - 111,073 111,073

Acquisition of plant and equipment (4,975) - (194,244)

Net cash used in investing activities (4,975) 111,073 (83,171)

------------- ------------- --------------

Cash flows from financing activities

Repayment of lease liabilities (44,803) - (22,637)

Net cash used in financing activities (44,803) - (22,637)

------------- ------------- --------------

Net decrease in cash and cash

equivalents (697,448) (542,574) (1,870,512)

Cash and cash equivalents at

beginning of the period 1,827,379 3,703,592 3,703,592

Effect of exchange rates on cash

and cash equivalents (107,346) 57,377 (5,701)

Cash and cash equivalents at

end of the period 1,022,585 3,218,395 1,827,379

------------- ------------- --------------

Material non-cash transactions:

The Company's acquisition of Alchemist Codes in March 2020 was a

non-cash transaction satisfied wholly by the issue of shares in the

Company, as described in Note 5 below.

The accompanying notes form an integral part of these

consolidated financial statements.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

AIQ Limited ("the Company") was incorporated and registered in

The Cayman Islands as a private company limited by shares on 11

October 2017 under the Companies Law (as revised) of The Cayman

Islands, with the name AIQ Limited, and registered number

327983.

The Company's registered office is located at 5th Floor Genesis

Building, Genesis Close, PO Box 446, Cayman Islands, KY1-1106.

On 20 March 2020, the Company completed the acquisition of the

entire issued share capital of Alchemist Codes Sdn Bhd ("Alchemist

Codes"), (together, the "Group"), a Malaysian incorporated

information technology solutions developer focusing on the

e-commerce sector. The comparative information therefore included

one month's trading results compared with six months in the current

period.

The Company has a standard listing on the London Stock

Exchange.

The consolidated financial statements include the financial

statements of the Company and its controlled subsidiaries (the

"Group").

2. PRINCIPAL ACTIVITIES

The principal activity of the Company is to seek acquisition

opportunities and to act as a holding company for a group of

subsidiaries that are involved in the technology sector, with a

particular focus on e-commerce.

The principal activities of the subsidiaries comprise designing

and developing information technology solutions for clients and,

for Alchemist Codes, also the development of its own e-commerce

solution. In addition, Alcodes International is now seeking to

expand into further technology areas such as digital assets.

3. ACCOUNTING POLICIES

a) Basis of preparation

The condensed consolidated interim financial statements have

been prepared in accordance with the Disclosure and Transparency

Rules of the Financial Conduct Authority and International

Accounting Standard 34 "Interim Financial Reporting" (IAS 34).

Other than as noted below, the accounting policies applied by the

Group in these condensed interim financial statements are the same

as those set out in the Group's audited financial statements for

the year ended 31 October 2020. These financial statements have

been prepared under the historical cost convention and cover the

six-month period to 30 April 2021.

These condensed financial statements do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the audited financial statements for the year

ended 31 October 2020.

The condensed interim financial statements are unaudited and

have not been reviewed by the auditors and were approved by the

Board of Directors on 29 July 2021.

The financial information is presented in Pounds Sterling (GBP),

which is the presentational currency of the Company.

A summary of the principal accounting policies of the Group are

set out below.

b) Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiaries made up to the end

of the reporting period. Subsidiaries are entities over which the

Group has control. The Group controls an investee if the Group has

power over the investee, exposure to variable returns from the

investee, and the ability to use its power to affect those variable

returns.

The consolidated financial statements present the results of the

Company and its subsidiaries as if they formed a single entity.

Inter-company balances and transactions between Group companies are

therefore eliminated in full. The financial information of

subsidiaries is included in the Group's financial statements from

the date that control commences until the date that control

ceases.

On 20 March 2020, the Company completed a conditional share

purchase agreement with Alchemist Codes for the acquisition by the

Company of 100% of the issued share capital of Alchemist Codes,

which is more fully described in Note 5.

The acquisition of Alchemist Codes by the Company does not meet

the definition of a reverse acquisition under IFRS 3 due to:

- a greater proportion of share capital in the Group being held

by shareholders of AIQ Limited, rather than pre-acquisition

shareholders of Alchemist Codes;

- AIQ Limited's shareholders have the ability to appoint or

remove a majority of the members of the Board;

- greater Board representation in the Group of the AIQ Limited

Board of directors rather than pre-acquisition members of the

Alchemist Codes' Board; and

- the composition of the senior management of the Group consists

mostly of AIQ Limited management.

The acquisition of Alchemist Codes has therefore been accounted

for under the acquisition method.

Under the acquisition method, the results of Alchemist Codes are

included from the date of acquisition. At the date of acquisition,

the fair values of the net assets of Alchemist Codes have been

determined and these values are reflected in the consolidated

financial statements. The cost of acquisition is measured at the

aggregate of the fair values, at the date of exchange, of assets

given, liabilities incurred or assumed, and equity instruments

issued by the Group in exchange for control of the acquiree, plus

any costs directly attributable to the business combination. Any

excess of the purchase consideration of the business combination

over the fair value of the identifiable assets and liabilities

acquired is recognised as goodwill. Goodwill, if any, is not

amortised but reviewed for impairment at least annually. If the

consideration is less than the fair value of assets and liabilities

acquired, the difference is recognised directly in the statement of

comprehensive income.

Acquisition-related costs are expensed as incurred.

In July 2020, the Group established a wholly-owned Hong Kong

subsidiary, Alcodes International Limited.

c) Going concern

The financial statements are required to be prepared on the

going concern basis unless it is inappropriate to do so.

The Group incurred losses of GBP0.9 million during the period

and cash outflows of GBP0.7 million. As at 30 April 2021, the Group

had net current assets of GBP0.7 million and cash of GBP1.0

million. The Group's cash position was approximately GBP0.7 million

at the date of this report.

The Group meets its day-to-day working capital requirements

through cash generated from the capital it raised on admission to

the London Stock Exchange and from the operations of its

subsidiaries.

COVID-19 has been identified as having a significant impact on

the Group in the period due to the prolonged public lockdown in

Malaysia. The Board has taken, and continues to take, a number of

actions to protect operating cash flow in the short term. In

particular, the Board undertook a strategic review to assess the

viability of Alchemist Codes and to stem the losses of the business

and reduce the cost base, whilst also seeking to evaluate its

future, as further explained in Note 10.

Notwithstanding these actions, a material uncertainty exists

that may cast significant doubt on the Group's ability to continue

as a going concern with the uncertainty of future trading

performance giving rise to a material uncertainty over the going

concern status of the Group. The Directors consider the Group to be

a going concern but have identified a material uncertainty in this

regard.

4. SUBSIDIARIES

Name Place of Registered Principal Effective interest

incorporation address activity

30.04.2021 31.10.2020

---------------- ------------------ ---------------------- ----------- -----------

2-9, Jalan

Puteri 4/8,

Bandar Puteri,

47100 Puchong,

Alchemist Selangor Darul Design and

Codes Sdn Ehsan development

Bhd Malaysia Malaysia of software 100% 100%

---------------- ------------------ ---------------------- ----------- -----------

Cyberport 3,

3 Cyberport

Alcodes International Road, Telegraph Software

Limited* Hong Kong Bay, Hong Kong and app development 100% 100%

---------------- ------------------ ---------------------- ----------- -----------

* Held by Alchemist Codes Sdn Bhd

5. ACQUISITION OF ALCHEMIST CODES SDN BHD

On 20 March 2020, the Company completed a conditional share

purchase agreement (the "SPA") with Alchemist Codes for the

acquisition by the Company of 100% of the issued share capital of

Alchemist Codes (the "Transaction"), and, on 26 March 2020

readmission of the enlarged share capital to trading on the Main

Market of the London Stock Exchange. Alchemist Codes is a Malaysian

incorporated information technology solutions developer focusing on

the e-commerce sector.

Under the terms of the SPA, the consideration was GBP2.3

million, which was settled through the allotment and issue of

12,921,346 ordinary shares of 1 pence each in the capital of AIQ

(the "Consideration Shares") at 17.8 pence per share.

The following table summarises the consideration paid for

Alchemist Codes, the fair value of assets acquired, and liabilities

assumed at the acquisition date.

Book value Fair value Fair value

adjustments

------------------------------------ ----------- ------------- -----------

Consideration GBP GBP GBP

------------------------------------ ----------- ------------- -----------

Consideration shares 2,300,000

Total consideration 2,300,000

------------------------------------ ----------- ------------- -----------

Recognised amounts of identifiable

assets acquired and liabilities

assumed

------------------------------------ ----------- ------------- -----------

Cash and cash equivalents 111,073 - 111,073

Property, plant and equipment 17,038 - 17,038

Software 38,676 - 38,676

Trade and other receivables 80,011 - 80,011

Trade and other payables (55,818) - (55,818)

OctaPLUS platform - 1,328,996 1,328,996

Messenger App - 726,150 726,150

Deferred tax (493,000) (493,000)

------------------------------------ ----------- ------------- -----------

Total identifiable net assets 190,980 1,562,146 1,753,126

Goodwill 546,874

Total 2,300,000

------------------------------------ ----------- ------------- -----------

The goodwill and intangibles arising on the acquisition were

fully impaired at 31 October 2020, as more fully described in the

Company's annual report for the year.

Transaction costs of GBP380,495 were expensed in the year ended

31 October 2020 relating to the acquisition of Alchemist Codes and

re-admission to the Official List of the London Stock Exchange. No

amounts were directly attributable to issuing new shares which

would otherwise be deducted from equity.

6. INTANGIBLE ASSETS

OctaPLUS Messenger

Goodwill Software Platform App Total

Cost GBP GBP GBP GBP GBP

At 1 November 2019 - - - -

Additions through

business combinations - 38,678 - - 38,678

Arising on purchase

price allocation 53,874 - 1,328,996 726,150 2,109,020

Currency translation

differences - (1,600) - - (1,600)

As at 30 April 2020

(Unaudited) 53,874 37,078 1,328,996 726,150 2,146,098

--------------- ----------- ---------- ---------- -----------

Deferred tax on

purchase price allocation 493,000 - - - 493,000

Currency translation

differences - 1,602 - - (1,602)

As at 31 October

2020 (Audited) 546,874 38,678 1,328,996 726,150 2,640,696

--------------- ----------- ---------- ---------- -----------

Additions - - - - -

As at 30 April 2021

(Unaudited) 546,874 38,676 1,328,996 726,150 2,640,696

--------------- ----------- ---------- ---------- -----------

Accumulated amortisation

and impairment

At 1 November 2019 - - - - -

Amortisation for

the period - 1,006 22,150 12,102 35,258

Currency translation

differences - (60) - - (60)

As at 30 April 2020

(Unaudited) - 946 22,150 12,102 35,198

------- --------- ------- ------- -------

Amortisation for

the period - (946) 132,900 72,613 204,567

Impairment provision 546,874 38,676 1,173,946 641,435 2,400,931

As at 31 October

2020 (Audited) 546,874 38,676 1,328,996 726,150 2,640,696

--------- ------------- ---------- --------- ----------

Amortisation for

the period - - - - -

As at 30 April 2021

(Unaudited) 546,874 38,676 1,328,996 726,150 2,640,696

--------- ---------------- -------------- ------------ ------------

Carrying amounts

At 30 April 2021

(Unaudited) - - - - -

=== =====

At 31 October 2020

(Audited) - - - - -

=== =====

At 30 April 2020

(Unaudited) 53,874 36,132 1,303.846 714,048 2,110,900

======== ======== ========== ======== ==========

All of the Group's goodwill and intangible assets related to the

Alchemist Codes business and were fully impaired in the year ended

31 October 2020. No further amounts have been capitalised during

the period ended 30 April 2021.

7. REVENUE

Six months Six months

ended ended Year ended

30 Apr 2021 30 Apr 2020 31 Oct 2020

Unaudited Unaudited Audited

GBP GBP GBP

Sale of software products 10,635 11,509 99,596

Maintenance income - 13,900 41,725

Cashback income 1,332 - 13,043

Other 112 - 285

Total 12,079 25,409 154,649

-------------- -------------- --------------

A total of GBP8,386 of revenues were generated in Hong Kong and

GBP3,693 of revenues were generated in Malaysia. In the six months

ended 30 April 2020 and the year ended 31 October 2020, all

revenues were generated in Malaysia. The period ended 30 April 2020

included one month's revenues from Alchemist Codes.

8. LOSS PER SHARE

The Company presents basic and diluted earnings per share

information for its ordinary shares. Basic loss per share is

calculated by dividing the loss attributable to ordinary

shareholders of the Company by the weighted average number of

ordinary shares in issue during the reporting period. Diluted

earnings per share are determined by adjusting the loss

attributable to ordinary shareholders and the weighted average

number of ordinary shares outstanding for the effects of all

dilutive potential ordinary shares.

There is no difference between the basic and diluted loss per

share, as the Company has no potential ordinary shares.

Six months Six months Year ended

ended 30 ended 30 31 Oct 2020

Apr 2021 Apr 2020

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax attributable to

owners of the Company (915,425) (612,993) (3,637,587)

Weighted average number of shares:

* Basic 64,760,721 54,750,228 59,818,130

Loss per share (expressed as GBP

per share)

* Basic (0.014) (0.011) (0.061)

9. SHARE CAPITAL

Six months Six months Year

ended ended ended

30 Apr 2021 30 Apr 2021 31 Oct

2020

Unaudited Unaudited Audited

GBP GBP GBP

As at beginning of period 647,607 518,394 518,394

Issued during the period - 129,213 129,213

As at end of period 647,607 647,607 647,607

------------ ------------------ ------------------

Nominal

value

Number GBP

Authorised

Ordinary shares of GBP0.01 each 800,000,000 8,000,000

Issued and fully paid:

As at 1 November 2020 64,760,721 647,607

Issue of shares in the period - -

At 30 April 2021 64,760,721 647,607

------------ ----------

10. SUBSEQUENT EVENTS

In April 2021, the Board initiated a strategic review to assess

the viability of Alchemist Codes and to stem the losses of the

business, whilst also seeking to evaluate its future.

The Board concluded this review in June 2021 and implemented the

actions noted below.

The focus of the Board in its review was on preserving cash

within the business whilst income levels remain depressed. This

resulted in decisions to cut costs, dispose of non-core activities

and prioritise new sources of revenue as follows:

- Divestment of certain e-commerce software and technology

developed in-house by Alchemist Codes to Wepin Sdn Bhd ("Wepin")

for RM200,000 (approximately GBP35,000), which completed on 28 May

2021.

- Eight in-house developers from Alchemist Codes, along with six members of the sales team and administrative staff, are now employed by Wepin.

- Charles Yong, CEO of Alchemist Codes, now also employed by

Wepin. Mr Yong remains an Executive Director of AIQ, with

substantially all of his costs now being paid by Wepin.

- OctaPLUS platform and small team retained to develop product

and seek methods to monetise the registered user base.

- Alcodes International, headquartered in Hong Kong, has seen

initial sales from IT consultancy projects. Executive Director

Edwin Li, who is based in Hong Kong, will focus on building the IT

consultancy business and look to expand it into other technology

areas such as digital assets.

- In addition to other reductions, total headcount of the Group

is being cut by over 60% to 14 employees.

- Board and senior management have taken a voluntary cut of 20%

in their fees, backdated from 1 May 2021.

As a result of these efficiency measures, the Group will

recognise savings of approximately GBP400,000 on an annualised

basis.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDRBUDDGBC

(END) Dow Jones Newswires

July 30, 2021 02:00 ET (06:00 GMT)

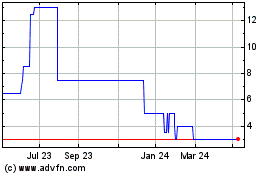

Aiq (LSE:AIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

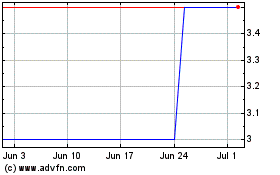

Aiq (LSE:AIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024