TIDMGDWN

RNS Number : 2296I

Goodwin PLC

11 August 2021

PRELIMINARY ANNOUNCEMENT

Goodwin PLC today announces its preliminary results for the year

ended 30th April 20201.

CHAIRMAN'S STATEMENT

The pre-tax profit for the Group for the twelve month period

ended 30th April 2021, was GBP16.5 million (2020: GBP12.1 million),

an increase of 36% on a revenue of GBP131 million (2020: GBP145

million). The Directors propose an increased dividend of 102.24p

(2020: 81.71p) per share.

In what has been another year of unique challenges, I am

delighted that excellent progress has been made particularly during

the second half of the year in many areas with the Group's workload

as at the time of writing remaining healthy at GBP165 million

(2020: GBP183 million).

Despite the placement of large capital projects having slowed as

expected due to the world having to adapt to new working

arrangements, headway has been made within the Mechanical

Engineering Division on the nuclear propulsion engineering products

and the nuclear waste containment box supply agreement. The

performance achieved in the year is a reflection of the Group's

strength through diversification, supplying a wide range of

customers, countries and markets. Following the Group's decisive

actions last financial year with the global onset of Covid-19, the

Group protected its workforce and ensured our manufacturing

facilities continued to operate. In doing so, we placed ourselves

in a strong position to tackle the headwinds that were faced during

the year ended 30th April, 2021.

Whilst Covid-19 has been the most recent global 'Black Swan'

event, it is coupled with another shockwave sweeping the globe,

namely the pace of the uptake of greener energy with the oil majors

now rapidly investing in green energy products rather than new

oilfields. So when looking at the Mechanical Engineering Division,

our steel foundry, Goodwin Steel Castings Limited, has faced a

difficult year due to the accelerated decline of capital flows into

oil projects. Whilst it has progressed well with transitioning its

business away from the oil industry, it has also been hindered by

Covid-19 delaying documentation approvals that would have enabled

the foundry to achieve higher levels of casting activity in the

year within its new targeted markets.

Looking forward, Goodwin Steel Castings should soon start to

accelerate the production of 30 tonne cast nuclear waste boxes, the

initial castings of which are being successfully delivered to

Goodwin International Limited for machining, painting and assembly.

The foundry is also having good success winning work for naval

vessels both in the UK and the USA, all for long running programmes

that will span decades to come in an area where there are

significant time barriers to entry for other foundries.

Profitability in our submersible pump businesses in India,

Australia, Africa and Brazil has materially improved, a reflection

of the four companies maturing and the global metal prices having

dramatically recovered. They have all performed admirably by

carrying out more servicing for existing customers on the sizeable

global fleet of Goodwin pumps now deployed. The submersible pump

companies in the financial year just completed generated 14% of the

Group pre-tax profitability. With minerals pricing across the board

generally being high, our target customers that use our pumps are

profitable and are expected to continue with their delayed capital

expenditure in the new financial year.

Goodwin International has had another successful year with a

good mix of business, supplying a growing range of capabilities to

their valve, nuclear waste, naval propulsion and ship construction

customers. Within the year a new 1.5 acre facility, with multiple

100 tonne overhead cranes and a new radiography bay, has become

operational and has started to fill up with work already on

order.

Valve sales to the oil industry in the last financial year

represented 43% of activity for Goodwin International and in this

new financial year, whilst Goodwin International's overall sales

output remains extremely robust as they have orders on hand, the

valve activity for the oil industry is expected to drop to less

than 33% of activity as the manufacture relating to nuclear waste

products, propulsion, and naval hull components is rapidly

increasing.

Easat Radar Systems' recovery to profitability has also been

impacted due to the severe decline in global air traffic associated

with Covid-19, starving many airports of cash. Whilst market

expectations forecast that air traffic levels are to return to

their historic 2019 levels by 2022 / 2023, infrastructure

surveillance projects continue to be planned and Easat has a

growing pipeline of opportunities with the bids being submitted

substantially increasing in size and therefore margin

potential.

The Board has high expectations for Easat Radar Systems as it

moves away from selling only the mechanical parts of a radar

system. Since the integration with NRPL, based in Finland, in 2015,

followed by a period of design enhancements to their transceivers

and interrogators, we are now marketing and selling complete air

traffic control and coastal surveillance systems inclusive of the

air traffic control systems and screens, recorded radios and runway

lighting control to guide planes on the tarmac should the customer

so desire. The sales value of a complete system is in excess of ten

times that of the original mechanical components that were

previously manufactured, and, now, with our vertically integrated

product offering, we have a system that not only performs

excellently but is internationally competitive. The major area of

growth for Easat over the coming years will be in the Far East,

where in the year, despite the travel restrictions and national

lockdown, Easat has successfully commissioned two of the three

turnkey radar systems for which it had orders.

Whilst Goodwin Steel Castings and Easat Radar Systems have not

recently been firing on all cylinders, the Board firmly believes

that both businesses will become profitable again moving forward

with the transitions they have both been through.

Within the Refractory Engineering Division, increased levels of

consumer spending in the second half of the year on luxury goods,

horticulture and construction, as a consequence of Covid-19

restrictions redirecting consumer spending away from entertainment,

hospitality and travel towards these sectors, has resulted in

strong performance, making up for the low activity levels in the

first half of the financial year due to the onset of Covid-19.

Business levels remain strong with continued high levels of pent-up

consumer spending. The Division achieved a record pre-tax profit of

GBP9.3 million (2020: GBP7 million), equating to 46% of the Group

profitability.

Customer acceptance trials of the patented Silica Free

Investment Powder, X-Sil, are underway and it is hoped that regular

sales will start within the year ahead, further increasing the

Group's market share within the industry sector.

Sales of the patented AVD Lith-EX lithium battery fire

extinguishers and vermiculite-containing fluids continue to gain

momentum with industry sectors, insurance companies and

accreditation bodies waking up to the need and requirement for

products and standards that specify their use on lithium battery

fires which other extinguishing agents do not effectively

extinguish.

Key industry sectors adopting the products include electric car

manufacturers, car repair workshops, battery manufacturers, battery

recyclers, energy storage systems, e-mobility manufacturers,

e-mobility storage and repair, marine and military.

Sales of patented Soluform concrete bag work doubled within the

year with good prospects for future growth with the use of the

product in large scale projects such as HS2 and Thames Tideway

Tunnel, along with many other projects for the formation of

headwalls, culverts, scour protection, retaining walls and bridge

pier protection.

As at 30th April, 2021, the Group finished the year with a net

debt and gearing of GBP17.4 million and 15.4% respectively, as

calculated in note 26 (d) to the financial statements to be

published shortly. The strength of the Group's cash generation was

a result of staying operational throughout the pandemic, which

meant that the Group has been able to stay within its funding

headroom without the need to approach our financial lenders for

additional facilities. Furthermore, the Group has not needed to

cancel any capital expenditure projects; raise additional funds

from shareholders; nor has it any outstanding deferral of tax

payments with HMRC. The CCFF loan that was drawn down as an

insurance policy during the financial year and referred to in the

previous Chairman's Statement, was fully repaid on 26th April,

2021.

Armed with a strong balance sheet and a renewed set of bank

facilities we are well placed to benefit from the recovery of the

global economy and deliver strong returns on the capital that has

been invested to date. The Board remains confident of the Group's

ability to continue to develop new and existing activities that

will deliver additional sustainable growth in the long-term.

The Board is once again indebted to our Directors, managers and

employees around the world for their unwavering efforts in keeping

the Group operational, controlling cost and delivering what can

only be described as an extraordinary Group result in the year of

Covid-19 just completed.

11(th) August, 2021 T.J.W. Goodwin

Chairman

Alternative performance measures mentioned above are defined in

note 6.

OBJECTIVES, STRATEGY AND BUSINESS MODEL

The Group's main OBJECTIVE is to have a sustainable long-term

engineering based business with good potential for profitable

growth while providing a fair return to our shareholders.

The Board's STRATEGY to achieve this is:

-- to supply a range of technically advanced products to growth

markets in the mechanical engineering and refractory engineering

segments in which we have built up a global reputation for

engineering excellence, quality, efficiency, reliability,

competitive price and delivery;

-- to manufacture advanced technical products profitably, efficiently and economically;

-- to maintain an ongoing programme of investment in plant,

facilities, sales and marketing, research and development with a

view to increasing efficiency, reducing costs, increasing

performance, delivering better products for our customers,

expanding our product range and global customer base and keeping us

at the forefront of technology within our markets, whilst at all

times taking appropriate steps to ensure the health and safety of

our employees and customers;

-- to control our working capital and investment programme to ensure a safe level of gearing;

-- to maintain a strong capital base to retain investor,

customer, creditor and market confidence and so help sustain future

development of the business;

-- to support a local presence and a local workforce in order to stay close to our customers;

-- to invest in training and development of skills for the Group's future;

-- to manage the environmental and social impacts of our

business to support long-term sustainability.

BUSINESS MODEL

The Group's focus is on manufacturing within two sectors,

mechanical engineering and refractory engineering, and through this

division of our manufacturing activities, our overseas business

facilities and our global sales and marketing activities, the Group

benefits from market diversity. Further details of our business and

products are shown on our website www.goodwin.co.uk

Mechanical Engineering

The Group specialises in supplying industrial goods, generally

on a project basis, more often than not involving the complementary

skillset of other Group companies to deliver the requirement. The

projects normally involve international procurement, high integrity

castings, forgings or wrought high alloy steels, precision CNC

machining, complex welding and fabrication, and other operations as

are required. In addition to specialist projects, the Group

manufactures and sells a wide range of dual plate check valves,

axial nozzle check valves and axial piston control and isolation

valves to serve the oil, petrochemical, gas, liquefied natural gas

(LNG), mining, nuclear power generation, nuclear waste treatment

and water markets.

We generate value by creating leading edge technology designs,

globally sourcing the best quality raw material at good prices,

manufacturing in highly efficient facilities using up to date

technology to provide very reliable products to the required

specification, at competitive prices and with timely

deliveries.

Our mechanical engineering markets also include high alloy

castings, machining and general engineering products which

typically form part of large construction projects such as nuclear

waste treatment plants, high integrity offshore structural

components and bridges, chemical plants, oil refineries and naval

vessels.

The Group through its foundry, Goodwin Steel Castings, has the

capability to pour high performance alloy castings up to 35 tonnes,

radiograph and also finish CNC machine and fabricate them at the

foundry's sister company, Goodwin International. This capability is

targeting the defence industry and nuclear decommissioning, the oil

and gas industry, as well as large, global projects requiring high

integrity machined castings.

Goodwin International Limited, the largest company in the

mechanical engineering division, not only designs and manufactures

dual plate check valves, axial nozzle check valves and axial piston

control and isolation valves but also undertakes specialised CNC

machining and fabrication work for nuclear decommissioning

projects. Goodwin International also has a division that is

focussed on manufacturing / machining high precision, high

integrity components for naval marine vessels. Noreva GmbH also

designs, manufactures and sells axial nozzle check valves. Both

Goodwin International and Noreva purchase the majority of the value

of their sand mould castings from Goodwin Steel Castings Limited

for their ranges of check valves and this vertical integration

gives rise to competitive benefits, increased efficiencies and

timely deliveries.

At Goodwin Pumps India Private Limited we manufacture a superior

range of submersible slurry pumps for end users in India, Brazil,

Australia and Africa. Easat Radar Systems Limited and its

subsidiary, NRPL Aero Oy, design and build bespoke high-performance

radar antenna systems for the global market of major defence

contractors, civil aviation authorities and border security

agencies. Easat has a sister company, Easat Radar Systems India

Private Limited, that also manufactures, sells and maintains radar

systems for air traffic control. We create value on these by

innovative design, assembly and testing in our own facilities using

bought in or engineered in-house components.

Refractory Engineering

Within the Refractory Engineering Division, Goodwin Refractory

Services Limited (GRS) primarily generates value from designing,

manufacturing and selling investment casting powders, rubbers and

waxes to the jewellery casting industry. GRS also manufactures and

sells investment casting powders to the tyre mould and aerospace

industries. The Refractory Engineering Division has five other

investment powder manufacturing companies located in China, India

and Thailand which sell the consumable investment casting products

directly and through distributors to the jewellery casting industry

and also directly to tyre mould and aerospace industries.

These companies are vertically integrated with another of our UK

companies, Hoben International Limited, which manufactures

cristobalite, which it sells to the six casting powder

manufacturing companies as well as producing ground silica that

also goes into casting powders and other UK uses of silica such as

wind turbine blade manufacture. Hoben International manufactures

different grades of perlite, and a patented range of biodegradable

bags, known as Soluform, for the placement of concrete in or around

rivers and other construction applications.

The other UK refractory company is Dupré Minerals Limited which

focuses on producing exfoliated vermiculite that is used in

insulation, brake linings and fire protection products, including

technical textiles that can withstand exposure to high temperatures

and for lithium battery fire extinguishers. Dupré also sells

consumable refractories to the shell moulding precision casting

industry. Dupre has designed, patented and is now selling a range

of fire extinguishers and an extinguishing agent for lithium

battery fires that utilises a vermiculite dispersion as the fire

extinguishing agent.

GOODWIN PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

for the year ended 30th April, 2021

2021 2020

GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 131,231 144,512

Cost of sales (92,230) (109,743)

GROSS PROFIT 39,001 34,769

Other income 763 690

Distribution expenses (2,988) (2,792)

Administrative expenses (19,682) (19,809)

OPERATING PROFIT 17,094 12,858

Finance costs (net) (640) (809)

Share of profit of associate company 60 66

PROFIT BEFORE TAXATION 16,514 12,115

Tax on profit (3,508) (3,775)

PROFIT AFTER TAXATION 13,006 8,340

ATTRIBUTABLE TO:

Equity holders of the parent 12,494 7,866

Non-controlling interests 512 474

PROFIT FOR THE YEAR 13,006 8,340

BASIC EARNINGS PER ORDINARY SHARE 167.82p 107.93p

DILUTED EARNINGS PER ORDINARY SHARE 164.23p 103.31p

GOODWIN PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30th April, 2021

2021 2020

GBP'000 GBP'000

PROFIT FOR THE YEAR 13,006 8,340

OTHER COMPREHENSIVE INCOME / (EXPENSE)

ITEMS THAT WILL NOT BE RECLASSIFIED SUBSEQUENTLY

TO PROFIT OR LOSS:

Goodwill arising from purchase of non-controlling

interest in subsidiaries - (72)

ITEMS THAT MAY BE RECLASSIFIED SUBSEQUENTLY TO

PROFIT OR LOSS:

Foreign exchange translation differences (1,371) (1,007)

Effective portion of changes in fair value of

cash flow hedges 1,296 (355)

Ineffectiveness in cash flow hedges transferred (657) -

to profit or loss

Change in fair value of cash flow hedges transferred

to profit or loss 1,932 522

Effective portion of changes in fair value of

cost of hedging (37) (843)

Ineffectiveness in cost of hedging transferred 631 -

to profit or loss

Change in fair value of cost of hedging transferred

to profit or loss 381 395

Tax (charge) / credit on items that may be reclassified

subsequently to profit or loss (673) 77

OTHER COMPREHENSIVE INCOME / (EXPENSE) FOR THE

YEAR, NET OF INCOME TAX 1,502 (1,283)

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 14,508 7,057

PROFIT FOR THE YEAR ATTRIBUTABLE TO:

Equity holders of the parent 14,081 6,587

Non-controlling interests 427 470

14,508 7,057

GOODWIN PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30th April, 2021

Total

attributable

Cash to equity

Share-based flow Cost holders

Share Translation payments hedge of hedging Retained of the Non-controlling Total

capital reserve reserve reserve reserve earnings parent interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

YEARED

30TH APRIL,

2021

Balance at

1st May, 2020 736 361 5,244 (499) (743) 99,918 105,017 4,585 109,602

Total

comprehensive

income:

Profit for

the year - - - - - 12,494 12,494 512 13,006

Other

comprehensive

income:

Foreign exchange

translation

differences - (1,255) - - - - (1,255) (116) (1,371)

Effective portion

of changes

in fair value - - - 1,252 (42) - 1,210 49 1,259

Ineffectiveness

transferred

to profit or

loss - - - (617) 596 - (21) (5) (26)

Change in fair

value

transferred

to profit or

loss - - - 1,957 362 - 2,319 (6) 2,313

Tax - - - (492) (174) - (666) (7) (673)

TOTAL

COMPREHENSIVE

INCOME /

(EXPENSE)

FOR THE YEAR - (1,255) - 2,100 742 12,494 14,081 427 14,508

Transactions

with owners:

Issue of shares 17 - - - - - 17 - 17

Dividends paid - - - - - (6,016) (6,016) (125) (6,141)

Recycling of

translation

reserve on

disposal of

subsidiary - 42 - - - - 42 - 42

BALANCE AT

30TH APRIL,

2021 753 (852) 5,244 1,601 (1) 106,396 113,141 4,887 118,028

Total

attributable

Cash to equity

Share-based flow Cost holders

Share Translation payments hedge of hedging Retained of the Non-controlling Total

capital reserve reserve reserve reserve earnings parent interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

YEARED

30TH APRIL,

2020

Balance at

1st May, 2019 720 1,044 4,991 (573) (426) 99,409 105,165 4,126 109,291

Total

comprehensive

income:

Profit for

the year - - - - - 7,866 7,866 474 8,340

Other

comprehensive

income:

Foreign exchange

translation

differences - (964) - - - - (964) (43) (1,007)

Goodwill arising

from purchase

of NCI interest

in subsidiaries - - - - - (72) (72) - (72)

Effective portion

of changes

in fair value - - - (446) (802) - (1,248) 50 (1,198)

Change in fair

value

transferred

to profit or

loss - - - 522 398 - 920 (3) 917

Tax - - - (2) 87 - 85 (8) 77

TOTAL

COMPREHENSIVE

INCOME /

(EXPENSE)

FOR THE YEAR - (964) - 74 (317) 7,794 6,587 470 7,057

Transactions

with owners

Issue of shares 16 - - - - - 16 - 16

Dividends paid - - - - - (6,927) (6,927) - (6,927)

Tax on

equity-settled

share-based

payment

transactions - - 253 - - - 253 - 253

Acquisition

of NCI without

a change in

control - - - - - - - (11) (11)

Recycling of

translation

reserve on

disposal of

subsidiary - (77) - - - - (77) - (77)

Reclassification - 358 - - - (358) - - -

BALANCE AT

30TH APRIL,

2020 736 361 5,244 (499) (743) 99,918 105,017 4,585 109,602

GOODWIN PLC

CONSOLIDATED BALANCE SHEET

at 30th April, 2021

2021 2020

GBP'000 GBP'000

NON-CURRENT ASSETS

Property, plant and equipment 77,063 69,626

Right-of-use assets 3,691 5,343

Investment in associate 829 816

Intangible assets 24,813 24,695

Derivative financial assets 191 749

Other financial assets at amortised cost - 252

106,587 101,481

CURRENT ASSETS

Inventories 34,547 44,887

Contract assets 15,844 6,558

Trade receivables and other financial assets 20,540 24,486

Other receivables 5,627 4,566

Derivative financial assets 4,106 456

Cash and cash equivalents 15,160 9,840

95,824 90,793

TOTAL ASSETS 202,411 192,274

CURRENT LIABILITIES

Borrowings 1,607 14,624

Contract liabilities 14,332 18,965

Trade payables and other financial liabilities 21,730 23,485

Other payables 4,025 3,298

Derivative financial liabilities 2,016 1,071

Liabilities for current tax 1,174 1,873

Provisions for liabilities and charges 608 160

45,492 63,476

NON-CURRENT LIABILITIES

Borrowings 33,066 15,599

Derivative financial liabilities - 202

Provisions for liabilities and charges 251 324

Deferred tax liabilities 5,574 3,071

38,891 19,196

TOTAL LIABILITIES 84,383 82,672

NET ASSETS 118,028 109,602

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Share capital 753 736

Translation reserve (852) 361

Share-based payments reserve 5,244 5,244

Cash flow hedge reserve 1,601 (499)

Cost of hedging reserve (1) (743)

Retained earnings 106,396 99,918

TOTAL EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT 113,141 105,017

NON-CONTROLLING INTERESTS 4,887 4,585

TOTAL EQUITY 118,028 109,602

GOODWIN PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 30th April, 2021

2021 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING ACTIVITIES

Profit from continuing operations

after tax 13,006 8,340

Adjustments for:

Depreciation of property, plant

and equipment 5,696 5,874

Depreciation of right of use assets 972 827

Amortisation and impairment of intangible

assets 1,566 1,328

Finance costs (net) 640 809

Foreign exchange losses 292 203

(Profit) / loss on sale of property,

plant and equipment (745) 52

Profit on disposal of subsidiary (32) (172)

Share of profit of associate company (60) (66)

Tax expense 3,508 3,775

OPERATING PROFIT BEFORE CHANGES

IN WORKING CAPITAL AND PROVISIONS 24,843 20,970

Decrease in inventories 10,344 4,748

Increase in contract assets (9,242) (2,863)

Decrease / (increase) in trade and

other receivables 2,885 (2,549)

(Decrease) / increase in contract

liabilities (4,428) 874

Increase in trade and other payables 1,047 2,310

Increase in unhedged derivative

balances (438) (980)

CASH GENERATED FROM OPERATIONS 25,011 22,510

Interest paid (734) (844)

Corporation tax paid (3,068) (2,493)

NET CASH INFLOW FROM OPERATING ACTIVITIES 21,209 19,173

CASH FLOW FROM INVESTING ACTIVITIES

Proceeds from sale of property,

plant and equipment 1,958 139

Acquisition of property, plant and

equipment (11,738) (6,062)

Additional investment in existing

subsidiaries - (83)

Acquisition of intangible assets (719) (1,855)

Development expenditure capitalised (1,420) (1,105)

NET CASH OUTFLOW FROM INVESTING

ACTIVITIES (11,919) (8,966)

CASH FLOWS FROM FINANCING ACTIVITIES

Issue of shares 17 16

Payment of capital element of lease

liabilities (1,635) (1,463)

Dividends paid (6,016) (6,927)

Dividends paid to non-controlling

interests (125) -

Proceeds from new loans 35,048 7,658

Repayment of loans and committed

facilities (30,772) -

NET CASH OUTFLOW FROM FINANCING

ACTIVITIES (3,483) (716)

NET INCREASE IN CASH AND CASH EQUIVALENTS 5,807 9,491

Cash and cash equivalents at beginning

of year 9,449 493

Effect of exchange rate fluctuations

on cash held (96) (535)

CASH AND CASH EQUIVALENTS AT OF YEAR 15,160 9,449

PRINCIPAL RISKS AND UNCERTAINTIES

The Group's operations expose it to a variety of risks and

uncertainties. The Directors confirm that they have carried out a

robust assessment of the principal risks facing the Company,

including those that would threaten its business model, future

performance, solvency or liquidity.

Covid-19 risk: The Covid-19 pandemic continues to have a global

impact in varying degrees affecting the population, travel, supply

chains, and the global marketplace. The spread temporarily impacted

market demand for certain of our products in the first half of the

financial year just completed, as well as delaying the placement of

larger capital orders by our customers. We have also been

contending with increased costs and shipping times from our

overseas suppliers which have also been exacerbated by the

grounding of the "Ever Green" container ship in the Suez Canal

which whilst afloat has only just docked. It is being suggested

that the combination of Covid-19 and the Ever Green incident will

result in shipping costs and times being disrupted for at least

another two years. The intercountry supply chain may face

difficulties in the short to medium term in timely and economically

fulfilling our requirements due to the stretched international

shipping network, but fortunately we have so far been able to work

around these issues. During the year the Group continued to

dynamically adapt as circumstances changed to protect the wellbeing

of the workforce and to ensure facilities remained operational and

able to satisfy the orders in hand, which maintained the Group's

financial strength.

Market risk: The Group provides a range of products and

services, and there is a risk that the demand for these products

and services will vary from time to time because of competitor

action or economic cycles or international trade friction or even

wars. As shown in note 3 to the financial statements to be

published shortly , the Group operates across a range of

geographical regions, and its turnover is split across the UK,

Europe, USA, the Pacific Basin and the Rest of the World.

This spread reduces risk in any one territory. Similarly, the

Group operates in both mechanical engineering and refractory

engineering sectors, mitigating the risk of a downturn in any one

product area as was seen over the past three financial years.

The potential risk of the loss of any key customer is limited

as, typically, no single customer accounts for

more than 10% of annual turnover.

As described in the Business Model, and to emphasize the Group's

spread of market risk, the mechanical engineering division

generates significant sales not only from valves it supplies to

oil, gas, chemical and water markets, but increasingly significant

amounts from other areas such as nuclear new build and

decommissioning, naval propulsion marine applications, and ship

hull components. With the submersible pumps that are supplied to

the mining industries and radar systems that are supplied for civil

and defence applications it is clear that the mechanical

engineering is now well diversified. Within the refractory

engineering division, we manufacture and sell vermiculite and

perlite products to the insulating, horticulture and fire

prevention industries and our investment casting powder companies

indirectly sell to the jewellery consumer market through the supply

of investment casting moulding powders, waxes, silicone and natural

rubber and so again we see a good spread of business within this

division.

Technical risk: The Group develops and launches new products as

part of its strategy to enhance the long-term value of the Group.

Such development projects carry business risks, including

reputational risk, abortive expenditure and potential customer

claims which may have a material impact on the Group. The potential

risk here is seen as manageable given the Group is developing

products in areas in which it is knowledgeable and new products are

tested prior to their release into the market.

Product failure/Contractual risk: The risks that the Group

supplies products that fail or are not manufactured to

specification are risks that all manufacturing companies are

exposed to but we try to minimise these risks through the use of

highly skilled personnel operating within robust quality control

system environments, using third party accreditations where

appropriate. With regard to the risk of failure in relation to new

products coming on line, the additional risks here are minimised at

the research and development stage, where prototype testing and the

deployment of a robust closed loop product performance quality

control system provides feed back to the design department for the

products we manufacture and sell. The risk of not meeting safety

expectations, or causing significant adverse impacts to customers

or the environment, is countered by the combination of the controls

mentioned within this section and the purchase of product liability

insurance. The risk of product obsolescence is countered by

research and development investment.

Supply chain and equipment risk: Failure of a major supplier or

essential item of equipment presents a constant risk of disruption

to the manufacturing in progress. Where reasonably possible,

management mitigates and controls the risk with the use of dual

sourcing, continual maintenance programmes, and by carrying

adequate levels of stocks and spares to reduce any disruption.

Health and safety: The Group's operations involve the typical

health and safety hazards inherent in manufacturing and business

operations. The Group is subject to numerous laws and regulations

relating to health and safety around the world. Hazards are managed

by carrying out risk assessments and introducing appropriate

controls, as well as attending safety training courses.

Acquisitions: The Group's growth plan over recent years has

included a number of acquisitions. There is the risk that these, or

future acquisitions, fail to provide the planned value. This risk

is mitigated through financial and technical due diligence during

the acquisition process and the Group's inherent knowledge of the

markets they operate in.

Financial risk: The principal financial risks faced by the Group

are changes in market prices (interest rates, foreign exchange

rates and commodity prices). Detailed information on the financial

risk management objectives and policies is set out in note 26 to

the financial statements to be published shortly. The Group has in

place risk management policies that seek to limit the adverse

effects on the financial performance of the Group by using various

instruments and techniques, including credit insurance, stage

payments, forward foreign exchange contracts, secured and unsecured

credit lines. As reported elsewhere within these financial

statements the Company on 2nd July 2021 has acted to mitigate the

possible impact of higher interest rates by taking out an interest

rate swap derivative fixing GBP30 million of notional debt at less

than 1% versus the variable inter-bank lending rate (SONIA) for a

period of ten years.

Regulatory compliance: The Group's operations are subject to a

wide range of laws and regulations. Both within Goodwin PLC and its

subsidiaries, the Directors and Senior Managers within the

companies make best endeavours to ensure we comply with the

relevant laws and regulations.

IT security: The Group performs regular and remote off site

backups of its IT systems, from time to time engaging external

companies to test and report any weaknesses and deficiencies found

to enable solutions to be put in place to mitigate and minimise the

risk of an IT security breach.

Brexit: As envisaged and disclosed in previous annual reports

Brexit has not been seen as a significant issue to the Group, the

previously identified risks have been managed or mitigated and the

Board no longer consider this as a significant uncertainty

FORWARD-LOOKING STATEMENTS

The Group Strategic Report contains forward-looking type

statements and information based on current expectations, and

assumptions and forecasts made by the Group. These expectations and

assumptions are subject to various known and unknown risks,

uncertainties and other factors, which could lead to substantial

differences between the actual future results, financial

performance and the estimates and historical results given in this

report. Many of these factors are outside the Group's control. The

Group accepts no liability to publicly revise or update these

forward-looking statements or adjust them for future events or

developments, whether as a result of new information, future events

or otherwise, except to the extent legally required.

Responsibility statement of the Directors in respect of the

Directors Report and Accounts

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole; and

-- the Group Strategic Report includes a fair review of the

development and performance of the business and the position of the

Issuer and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

We consider the Directors' Report and Accounts, taken as a

whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Group's

position and performance, business model and strategy.

Board of Directors:

T. J. W. Goodwin, Chairman

M. S. Goodwin, Managing Director, Mechanical Engineering

Division

S. R. Goodwin, Managing Director, Refractory Engineering

Division

J. Connolly, Director

B. R. E. Goodwin, Director

N. Brown, Director

J. E. Kelly, Non-Executive Director

Accounting policies

Goodwin PLC (the "Company") is incorporated in England and

Wales.

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the "Group") and

equity account the Group's interest in associates.

The Group's financial statements have been approved by the

Directors and prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 and international financial reporting standards adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union.

The Accounting Policies are included in Note 1 of the Accounts

to be published shortly.

New IFRS standards and interpretations adopted during 2021

In 2021 the following amendments had been endorsed by the EU,

became effective and were, therefore, mandated to be adopted by the

Group:

-- Amendments to IFRS 9, IAS39 and IFRS 7 - Interest rate

benchmark reform phase 1 (effective for annual periods beginning on

or after 1st January 2020)

-- Amendments to IFRS 3 - Definition of a business (effective

for annual periods beginning on or after 1st January 2020)

-- Amendments to IAS 1 and IAS 8 - Definition of material

(effective for annual periods beginning on or after 1st January

2020)

-- Amendments to References to the Conceptual Framework in IFRS

Standards (effective for annual periods beginning on or after 1st

January 2020)

The implementation of these standards and amendments has not had

a material impact on the Group's financial statements.

The financial information previously set out does not constitute

the Company's statutory accounts for the years ended 30th April,

2021 or 2020 but is derived from those accounts. Statutory accounts

for 2020 have been delivered to the Registrar of Companies, and

those for 2021 will be delivered in due course. The auditors have

reported on those accounts; their report was:

i. unqualified;

ii. did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report; and

iii. did not contain a statement under Section 498(2) or (3) of the Companies Act 2006.

Copies of the 2021 accounts are expected to be posted to

shareholders within the next 10 days and will also be available on

the Company's website: www.goodwin.co.uk and from the Company's

Registered Office: Ivy House Foundry, Hanley, Stoke-on-Trent ST1

3NR.

Note 1

Segmental Information

Products and services from which reportable segments derive

their revenues

For the purposes of management reporting to the chief operating

decision maker, the Board of Directors, the Group is organised into

two reportable operating divisions: mechanical engineering and

refractory engineering. Segment assets and liabilities include

items directly attributable to segments as well as those that can

be allocated on a reasonable basis. Associates are included in

Refractory Engineering.

In accordance with the requirements of IFRS 8 i nformation

regarding the Group's operating segments is reported below.

Mechanical Engineering Refractory Engineering Sub Total

Year ended 30th April 2021 2020 2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External sales 86,616 100,078 44,615 44,434 131,231 144,512

Inter-segment sales 20,871 25,821 11,526 8,361 32,397 34,182

Total revenue 107,487 125,899 56,141 52,795 163,628 178,694

Reconciliation to consolidated

revenue:

Inter-segment sales (32,397) (34,182)

Consolidated revenue

for the year 131,231 144,512

Mechanical Engineering Refractory Engineering Sub Total

Year ended 30th April 2021 2020 2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Profits

Operating profit including

share of associates 10,823 8,065 9,340 7,034 20,163 15,099

% of total operating

profit including share

of associates 54% 53% 46% 47% 100% 100%

Group centre (3,009) (2,175)

Group finance expenses (640) (809)

Consolidated profit

before tax for the

year 16,514 12,115

Tax (3,508) (3,775)

Consolidated profit after tax for the

year 13,006 8,340

Segmental total Segmental total Segmental net

assets liabilities assets

Year ended 30th April 2021 2020 2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental net assets

Mechanical Engineering 92,929 95,193 66,909 72,207 26,020 22,986

Refractory Engineering 44,114 41,962 20,591 22,850 23,523 19,112

Sub total reportable

segment 137,043 137,155 87,500 95,057 49,543 42,098

Goodwin PLC net assets 83,998 83,415

Elimination of Goodwin PLC

investments (25,392) (25,801)

Goodwill 9,879 9,890

Consolidated total net assets 118,028 109,602

Segmental capital expenditure

Property, Right-of-use Intangible Total

plant and assets assets

equipment

Year ended 2021 2020 2021 2020 2021 2020 2021 2020

30th April

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Goodwin PLC 5,315 2,824 1,180 - 151 2,333 6,646 5,157

Mechanical

Engineering 4,952 2,511 1,146 156 1,123 613 7,221 3,280

Refractory

Engineering 1,570 633 74 1,033 456 633 2,100 2,299

1 3,573,5799

11,837 5,968 2,400 1,189 1,730 3,579 15,967 10,736

2021 2020

Segmental depreciation, amortisation and impairment

Depreciation Amortisation and Total

impairment

Year ended 30th April 2021 2020 2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Goodwin PLC 2,970 2,934 1,106 708 4,076 3,642

Mechanical Engineering 2,346 2,369 20 97 2,366 2,466

Refractory Engineering 1,352 1,398 440 523 1,792 1,921

6,668 6,701 1,566 1,328 8,234 8,029

Geographical segments

The Group operates in the following principal locations.

In presenting the information on geographical segments, revenue

is based on the location of its customers and assets on the

location of the assets.

Year ended 30th April, Year ended 30th April, 2020

2021

Operational Non-current Capital Operational Non-current Capital

Revenue net assets assets expenditure Revenue net assets assets expenditure

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

UK 39,755 81,982 89,944 13,634 39,609 76,467 84,198 8,681

Rest of

Europe 21,473 8,309 3,264 279 20,004 8,346 3,439 207

USA 8,027 - - - 12,749 - - -

Pacific

Basin 28,255 13,708 6,499 719 34,844 13,513 7,132 1,248

Rest of

World 33,721 14,029 6,880 1,335 37,306 11,276 6,712 600

Total 131,231 118,028 106,587 15,967 144,512 109,602 101,481 10,736

Of the GBP21,473,000 (April 2020 : GBP20,004,000 ) sales to the

rest of Europe, GBP8,366,000 (April 2020 : GBP5,975,000 ), relate

to the European sales of our German-domiciled subsidiary, Noreva

GmbH.

The following tables provide an analysis of revenue by

geographical market and by product line.

Geographical market

Year ended 30th April, Year ended 30th April, 2020

2021

Mechanical Refractory Mechanical Refractory

Engineering Engineering Total Engineering Engineering Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

UK 28,258 11,497 39,755 29,187 10,422 39,609

Rest of Europe 15,123 6,350 21,473 13,088 6,916 20,004

USA 7,596 431 8,027 12,664 85 12,749

Pacific Basin 10,899 17,356 28,255 16,361 18,483 34,844

Rest of World 24,740 8,981 33,721 28,778 8,528 37,306

Total 86,616 44,615 131,231 100,078 44,434 144,512

Product lines

Year ended 30th April, Year ended 30th April, 2020

2021

Mechanical Refractory Mechanical Refractory

Engineering Engineering Total Engineering Engineering Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Standard products

and consumables 10,630 44,615 55,245 9,545 44,434 53,979

Bespoke products

- point in time 11,203 - 11,203 25,427 - 25,427

Point in time revenue 21,833 44,615 66,448 34,972 44,434 79,406

Minimum period

contracts 3,306 - 3,306 4,143 - 4,143

Bespoke products

- over time 61,477 - 61,477 60,963 - 60,963

Over time revenue 64,783 - 64,783 65,106 - 65,106

Total revenue 86,616 44,615 131,231 100,078 44,434 144,512

Note 2

Dividends

The Directors propose the payment of an ordinary dividend of

102.24p per share (2020: ordinary dividend of 81.71p ). If approved

by shareholders, the ordinary dividend will be paid on 8th October,

2021 to shareholders on the register at the close of business on

17(th) September, 2021.

Note 3

Earnings per share

Number of ordinary

shares

2021 2020

Ordinary shares in issue

Balance at 1st May, 2020 (1st May, 2019 ) 7,363,200 7,200,000

Shares issued in the year 163,200 163,200

7,526,400 7,363,200

Outstanding ordinary share options 163,200 326,400

Total ordinary shares (issued and options) 7,689,600 7,689,600

Weighted average number of ordinary shares in issue 7,445,024 7,288,289

Weighted average number of outstanding ordinary share

options 162,651 325,365

Denominator used for diluted earnings per share calculation 7,607,675 7,613,654

2021 2020

GBP'000 GBP'000

Relevant profits attributable to ordinary shareholders 12,494 7,866

Note 4

Going concern

The Directors, after having reviewed the projections and

possible challenges that may lie ahead, believe that, there is a

reasonable expectation that the Group has adequate resources to

continue in operational existence for at least twelve months from

the date of approval of these financial statements, and have

continued to adopt the going concern basis in preparing the

financial statements.

During April 2021, the Company repaid in full the GBP30 million

drawn down from the Bank of England's CCFF scheme and having

completed the refinancing of GBP10 million referred to within 30th

April, 2020 accounts, currently has at its disposal GBP50.5 million

of Bank facilities, GBP44.5 million of which are vested in long

term committed facilities.

The Directors have, as part of this going concern assessment,

considered the ongoing impact of Covid-19 on the Group's

operations. We are now more than 18 months on from the onset of

Covid-19 and whilst we experienced a slow down in the Refractory

Engineering segment of the business during March 2020 to August

2020, since then most of the entities in this division are seeing

record levels of activity. As predicted when writing within the

30th April, 2020 going concern assessment, there has been little

Covid-19 impact on the Mechanical Engineering segment of the

business. Whilst we have and are still seeing temporary impacts on

our overseas pump company operations, we are thankfully seeing

minimal impact on Group activities as a result of the virus

pandemic.

Within our severe but plausible downside model, it is

demonstrable that the Group has sufficient funds to cover the

Group's and the Company's financial commitments during the forecast

period whilst remaining compliant with its financial covenants. The

downside model factors in adverse circumstances such as the loss of

a major customer and a new Covid-19 impact on our Refractory

Engineering segment.

Since the end of the financial year, the Company has entered

into a ten year interest rate swap agreement which fixes our

variable interest rate on borrowings at less than 1% for the entire

period. The Directors see no shortage of investment opportunities

in the coming years and so, given the historical low level of

interest rates, we deemed it prudent to remove the impact of higher

interest rates from our risk modelling.

Whilst our carrying values of trade debtors and contract assets

are significant, we see little risk here in terms of recovery. We

credit insure our debtors and pre credit risk (work in progress)

and for significant contracts where credit insurance is not

available, we ensure, where possible, that these contracts are

backed by letters of credit or cash positive milestone

payments.

As discussed elsewhere within these accounts, the Mechanical

Engineering order book remains very high and the Refractory

Engineering segment is buoyant.

The Directors are confident that the Group and Company will have

sufficient funds to continue to meet their liabilities as they fall

due for at least twelve months from the date of approval of the

financial statements and therefore have prepared the financial

statements on a going concern basis.

Note 5

Annual General Meeting

The Annual General Meeting will be held at 10.30 a.m. on 6th

October, 2021 at Crewe Hall, Weston Road, Crewe, Cheshire CW1

6UZ.

Note 6

Alternative performance measures

Measure 2021 2020

Gross profit (GBP'000) 39,001 34,769

Revenue (GBP'000) 131,231 144,512

Gross profit as percentage

of revenue (%) 29.7 24.1

Operating profit (GBP'000) 17,094 12,858

Capital employed (GBP'000) 130,572 123,834

Return on capital employed

(%) 13.1 10.4

Net debt (GBP'000) 17,431 18,817

Net assets attributable

to equity holders of

the parent(GBP'000) 113,141 105,017

Gearing (%) 15.4 17.9

Net profit attributable

to equity holders of

the parent (GBP'000) 12,494 7,866

Net assets attributable

to equity holders of

the parent(GBP'000) 113,141 105,017

Return on investment

(%) 11.0 7.5

Revenue (GBP'000) 131,231 144,512

Average number of employees 1,129 1,190

Sales per employee (GBP'000) 116 121

Annual post tax profit

(GBP'000) 13,006 8,340

Depreciation owned assets

(GBP'000) 5,696 5,874

Depreciation right-of-use

assets (GBP'000) 972 827

Amortisation and impairment

(GBP'000) 1,566 1,328

Exclude operating lease

depreciation (GBP'000) (550) (537)

Annual post tax profit

+ depreciation +

amortisation (GBP'000) 20,690 15,832

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FFFVVTLIILIL

(END) Dow Jones Newswires

August 11, 2021 02:00 ET (06:00 GMT)

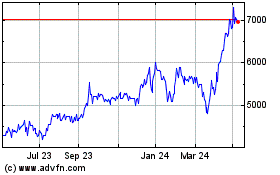

Goodwin (LSE:GDWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

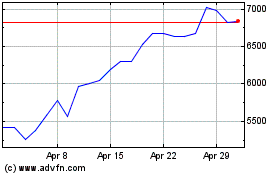

Goodwin (LSE:GDWN)

Historical Stock Chart

From Apr 2023 to Apr 2024