Halfords Group PLC (HFD) Halfords Group PLC: Acquisition of

National 01-Dec-2021 / 16:35 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information according to

REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION (EU) NO 596/2014 AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018

For immediate release

1 December 2021

Halfords Group PLC

("Halfords" or the "Company" and together with its subsidiaries,

the "Group")

Acquisition of National

Halfords secures position as the UK's largest vehicle service,

maintenance and repair business

Introduction

Halfords, the UK's largest provider of Motoring and Cycling

products and services, today announces that it has signed a sale

and purchase agreement (the "SPA") to purchase the entire issued

share capital of Axle Group Holdings Ltd ("National") (the

"Acquisition") on a cash free, debt free basis, for total

consideration of GBP62 million (the "Consideration"), subject to

adjustment for normalised working capital. The Consideration will

be paid in cash on the date of completion, which is expected to be

9 December 2021. A further investment of c.GBP17 million will be

made post acquisition on associated capital expenditure and c.GBP2

million on integration costs.

National is a well-established business in the tyre and

automotive servicing, maintenance and repair ("SMR") market,

operating under the following brands: National Tyres and Autocare

("NTA"), Viking Wholesale Tyres ("Viking") and Tyre Shopper. On

completion of the Acquisition, National will be integrated into

Halfords' Autocentres business.

The directors of the Company (the "Directors") believe that the

Acquisition is both strategically and financially compelling,

delivering on Halfords' objective of evolving into a business more

heavily weighted towards Motoring Services.

Highlights of the Acquisition include:

-- the Acquisition accelerates Halfords' Motoring Services

strategy surpassing its current target of 550garages and 200

consumer vans;

-- post-completion, Halfords will have approximately 604

garages, 234 consumer vans and 190 commercial vans.Including retail

stores this will mean a combined total of over 1,400 fixed or

mobile Motoring Services locations;

-- the Acquisition means the majority of UK motorists will be

within a 20-minute drive of a Halfords garage;

-- supports progress towards Halfords' new target of 800+

garages, 300+ consumer vans and 500+ commercialvans and further

enhances the Group's commercial and business-to-business ("B2B")

offering;

-- post-Acquisition, Motoring revenue is expected to represent

more than 70% of the Group's revenue(calculated on a pro-forma

basis), an increase from 67% (in H1 of FY22), and Services revenue

is expected torepresent more than 40% of the Group's revenue

(calculated on a pro-forma basis), up from 33% (in H1 of

FY22)1;

-- the Acquisition presents significant synergy opportunities -

expected to deliver incremental EBITDA2 ofc.GBP18 million per annum

by year 5, with a third of that expected to be achieved in year

1;

-- the Consideration is expected to be broadly equivalent to the

'per site' cost of an organic roll-outalternative;

-- the Acquisition is financially compelling, and is expected to

deliver2,3:? Return on Investment ("ROI") greater than the

Company's weighted average cost of capital ("WACC") inthe first

full financial year (FY23); ? Single digit EPS accretion in the

first full financial year (FY23) and double digit EPS accretion

inFY24; and ? ROI at maturity4 expected to be more than 20% with an

expected project internal rate of return("IRR") greater than

30%.

The Company intends to part-fund the Acquisition and maintain

balance sheet flexibility for future opportunities by undertaking a

non-pre-emptive placing, together with a management subscription

and retail offer, to raise up to c.GBP64 million, that will be the

subject of separate announcements today.

Graham Stapleton, Chief Executive Officer of Halfords,

commented:

"This acquisition helps cement our position as the UK's largest

vehicle service, maintenance and repair business. It will also see

us deliver on our established strategy of evolving Halfords to

become a Motoring Services focused business, with Motoring revenue

set to represent more than 70% of our pro-forma revenue following

the acquisition.

National has a high quality, UK-wide network of garages and

mobile tyre fitting vans, and 1,400 highly skilled colleagues,

providing a complementary fit with Halfords' existing operations.

Post-acquisition, Halfords will have over 1,400 fixed or mobile

Motoring Services locations, servicing a broad range of vehicles

and delivering 7.5 million motoring jobs a year. This increased

scale will bring the majority of UK-mainland motorists within a

20-minute drive of a Halfords garage, with even more vans available

to provide mobile services at their home or work.

Given our recent track record of successfully acquiring and

integrating businesses, and the potential we see to further grow

our Motoring Services business in other areas of the country, I am

very excited about our future growth prospects, and I look forward

to welcoming the new teams to the business."

National overview

National is a well-established business in the tyre and

automotive SMR market. It employs c.1,400 people and operates under

three brands:

-- NTA operates 239 tyre and SMR garages and 60 mobile tyre

fitting vans, providing national coverage acrossGreat Britain.

Tyres, which are predominantly sourced through Viking, represent

over 80% of its sales mix withc.1.3 million tyres fitted per annum.

MOT and service represent c.5% of NTA's sales mix. Headquartered

inStockport, NTA has approximately 1,200 FTE across its garage

estate (equivalent to c.4-5 FTEs per garage) alongwith a database

of 1.1 million customers. NTA's central support people costs

(across all the National brands) isc.GBP7m per annum.

-- Viking is a wholesaler of tyres and related consumables to

B2B customers, including NTA. Headquartered inGlasgow, Viking has 8

warehouses5 strategically located close to the motorway

network.

-- Tyre Shopper is a UK based online tyre retailer, where users

purchase tyres online and have them fittedat NTA centres or

remotely using the mobile fitting service. Currently, 'online'

represents just under a third ofNational's sales mix.

National's garage network is structurally similar to Halfords'

Autocentres business and adds further complementary capabilities in

the tyre market with Viking and Tyre Shopper. National's CEO, Tony

Neill will also join the Group post-Acquisition.

In the COVID-19 impacted year to 31 December 2020, National

generated GBP157.7 million revenue and delivered GBP3.0 million

EBITDA2. The Company estimates that National's base case year 1

EBITDA2, assuming the tyre market returns to normal but margin

headwinds and cost inflation are sustained, is c.GBP5.9 million

pre-synergies.

Acquisition rationale

The Directors believe that the Acquisition will expedite

Halfords' strategic growth plans in Motoring Services:

-- National builds on Halfords' existing capability - Halfords

is already the largest vehicle 'Service,Maintenance and Repair'

business in the UK, having grown share through a superior operating

model and bettercustomer service. This Acquisition will build on an

existing position of strength.

-- National helps exceed the target of 550 garages - Halfords

previously communicated a medium-term ambitionto grow the garage

estate to 550 and the number of consumer facing mobile vans to 200.

The Acquisition will seeHalfords comfortably exceed these targets

and, given that the market opportunity remains significant,

supportsprogress towards Halfords' new target of 800+ garages, 300+

consumer vans and 500+ commercial vans.

-- National can be successfully integrated - Halfords has

acquired and integrated three similar businessesin the past two

years, McConechy's, Tyres on the Drive and Universal, and is

confident that it will be able tosuccessfully integrate National

and extract significant synergies.

-- National contributes towards growing the Services business -

Halfords' strategy to grow its MotoringServices business is not

only focussed on scaling the physical estate. Other key

initiatives, such as ProjectFusion, Loyalty and Cross-Shop are

important drivers of demand into Autocentres. Additionally, the

increase infixed and mobile servicing locations will allow Halfords

to offer its customers greater convenience; for consumers,through

reducing the distance from their home to a garage and, for B2B

customers, offering a more convenient,national network and the

ability to partner with just one services provider, rather than

many.

-- Add to a more consistent, higher quality revenue stream - The

Motoring Services business is moreresilient to economic volatility,

has more repeat business and yields higher returns on capital.

Post-completion, Halfords will have approximately 604 garages,

234 consumer vans, 190 commercial van and 8 warehouses.

(MORE TO FOLLOW) Dow Jones Newswires

December 01, 2021 11:35 ET (16:35 GMT)

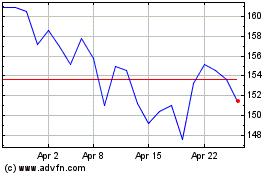

Halfords (LSE:HFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halfords (LSE:HFD)

Historical Stock Chart

From Apr 2023 to Apr 2024