Current Report Filing (8-k)

January 06 2022 - 6:20AM

Edgar (US Regulatory)

0001051470false00010514702022-01-062022-01-060001051470exch:XNYS2022-01-062022-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 6, 2022

Crown Castle International Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-16441

|

|

76-0470458

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

8020 Katy Freeway, Houston, Texas 77024-1908

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (713) 570-3000

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

CCI

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01—REGULATION FD DISCLOSURE

On January 6, 2022, Crown Castle International Corp. ("Crown Castle") and T-Mobile US, Inc. ("T-Mobile") announced that they entered into a long-term agreement ("Agreement"). The following are additional details regarding the Agreement:

•The 12-year Agreement includes contracted new tower leasing activity and a base escalator that is consistent with historical levels for Crown Castle’s Towers segment. As a result, Crown Castle expects to recognize approximately $250 million of additional straight-lined site rental revenues for full year 2022 for its Towers segment when compared to the Full Year 2022 Outlook issued on October 20, 2021.

•The Agreement also includes a contractual commitment by T-Mobile for 35,000 new small cell nodes, including specific commitments in each of the next five years to enter into contracts associated with identified small cell locations. The majority of the committed small cell nodes are expected to be collocated on existing Crown Castle fiber.

•Crown Castle anticipates the T-Mobile and Sprint network consolidation contemplated in the Agreement will result in tower non-renewals in 2025 which are expected to reduce site rental revenues by approximately $200 million. Except for full year 2025, Crown Castle expects consolidated annual tower non-renewals to remain in line with the Company’s historical range of 1% to 2% of annual site rental revenues.

•Crown Castle also anticipates the T-Mobile and Sprint network consolidation will result in small cell non-renewals which are expected to reduce site rental revenues by approximately $45 million, with the majority occurring in 2023. The financial impact of the anticipated non-renewals is expected to be offset by approximately $10 million per year during the corresponding small cell contract term from the amortization of anticipated upfront payments to be made by T-Mobile associated with certain of those non-renewals. Except for full year 2023, Crown Castle expects consolidated annual small cell non-renewals to remain in line with the Company’s historical range of 1% to 2% of annual site rental revenues.

•Crown Castle’s long-term annual growth target for its common stock dividend remains 7% to 8%. Due to the network consolidation non-renewals in 2025 mentioned above, the Company expects its dividend growth in 2025 to be below its long-term annual target.

The January 6, 2022 press release announcing the Agreement is furnished herewith as Exhibit 99.1. The above disclosure does not purport to be a complete statement of the parties’ rights and obligations under the Agreement.

ITEM 9.01—FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Index

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

The information in Item 7.01 of this Current Report on Form 8-K ("Form 8-K") and Exhibit 99.1 attached hereto are furnished as part of this Form 8-K and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended ("Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information or exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Cautionary Language Regarding Forward Looking Statements

This Form 8-K, including Exhibit 99.1 furnished herewith, contain forward-looking statements that are based on management's current expectations. Such statements include plans, projections, expectations and estimates regarding (1) the Agreement, including any benefits to be derived therefrom, (2) site rental revenues and the impacts thereon from the Agreement, (3) T-Mobile and Sprint network consolidation and the impacts thereof, including tower and small cell non-renewals, (4) collocation on existing Crown Castle fiber, (5) amortization of upfront payments and (6) our dividends, dividend targets and dividend growth rate. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including prevailing market conditions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. More information about potential risks that could affect

Crown Castle and its results is included in Crown Castle's filings with the Securities and Exchange Commission. The term "including," and any variation thereof, means "including, without limitation."

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CROWN CASTLE INTERNATIONAL CORP.

|

|

|

|

By:

|

/s/ Kenneth J. Simon

|

|

|

|

|

Name:

|

Kenneth J. Simon

|

|

|

|

|

Title:

|

Executive Vice President

and General Counsel

|

|

Date: January 6, 2022

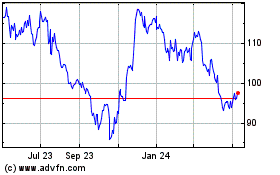

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

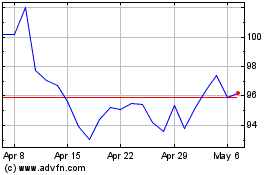

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024