TIDMAGL

RNS Number : 6193J

Angle PLC

28 April 2022

For Immediate Release 28 April 2022

ANGLE plc

("ANGLE" or "the Company")

Preliminary Results for the year ended 31 December 2021

FDA REVIEW PROGRESSING WITH RESPONSE AWAITED

CLINICAL LABORATORIES ESTABLISHED AND GLOBAL PHARMA SERVICES

BUSINESS LAUNCHED

OVARIAN CANCER CLINICAL VERIFICATION STUDY ENROLMENT COMPLETED

AND ANALYSIS IN PROCESS

ANGLE plc (AIM: AGL OTCQX: ANPCY), a world-leading liquid biopsy

company, today announces audited preliminary results for the year

ended 31 December 2021.

Operational Highlights

-- US Food and Drug Administration (FDA) substantive review made

good progress in the year with a comprehensive response made to

FDA's Additional Information Request and continued constructive and

supportive dialogue with the Agency throughout

-- Clinical laboratories opened in the UK and United States and

global pharma services business launched

- contracts in place with three pharma and biotech customers,

with two new customers onboarded post year end

- discussions continue with multiple other potential customers,

including large global pharma companies

- Clinical Laboratory Improvement Amendments (CLIA) and UKAS

accreditation submissions initiated in the United States and UK

and, post year end, CLIA Registration Certificate awarded to United

States clinical laboratory

-- Ovarian cancer clinical verification study with leading

United States cancer centre nearing completion

- patient enrolment completed during the year but sample

analysis was delayed due to COVID-19 related disruption to supplies

of key reagents

-- Prostate cancer study design completed and discussions

progressed with a major group of United States urology clinics,

with a view to partnering in studies and providing access to a

significant patient base

-- Over 26,000 samples processed during the year and a further

17 peer-reviewed publications from internationally recognised

cancer centres with key developments in breast, ovarian, head and

neck, non-small cell lung and prostate cancers

Financial Highlights

-- Revenue GBP1.0 million (2020: GBP0.8 million)

-- Loss for the year GBP15.0 million reflecting planned investment (2020: loss GBP11.6 million)

-- Fundraising from institutional investors, including existing

and new US institutional investors, raising gross proceeds of

GBP20.0 million (GBP18.9 million net of expenses)

-- Cash and cash equivalents and short-term deposits combined

balance at 31 December 2021 of GBP31.8 million (2020: GBP28.6

million)

Outlook

-- Regular constructive dialogue continues with FDA and a regulatory response is awaited

-- Reagents required to complete the ovarian cancer study

analysis have been received and are being validated so that

analysis of ovarian samples can be resumed and headline results

from the study are anticipated mid-year ahead of potential launch

of the ovarian cancer test as ANGLE's first laboratory developed

test (LDT)

-- The pharma services business continues to build with a total

of five independent customers onboarded. Deployment of the

Parsortix system in the first contracts with these customers is

progressing well and two early customers have already agreed

additional contracts for further clinical trials

Garth Selvey, Non-Executive Chairman of ANGLE plc,

commented:

"With the help of our staff, external researchers and investors,

in 2021 we made good progress on all our major initiatives. We

maintained the momentum on our FDA submission with additional

analytical studies, launched our clinical laboratories in the

United States and UK and secured our first pharma services

contracts, added a further 17 peer-reviewed publications, outlined

a new prostate cancer study and completed enrolment on our ovarian

cancer clinical verification study.

The strong operational momentum seen in 2021 has continued into

2022. Since the start of the year, we have maintained regular and

constructive dialogue with FDA on our De Novo application and our

United States laboratory has been registered with CLIA and is

progressing towards full accreditation. We look forward to a

successful year ahead."

Details of webcast

A meeting for analysts will be held at 10:00 am BST today at the

offices of Berenberg, 60 Threadneedle Street, London EC2R 8HP. A

live webcast of the analyst meeting can be accessed via ANGLE's

Investor Centre page,

https://angleplc.com/investor-relations/regulatory-news/ , with

Q&A participation reserved for analysts only. Please register

in advance and log on to the webcast approximately 5 minutes before

10:00 am on the day of the results. A recording of the webcast will

be made available on ANGLE's website following the results

meeting.

For further information:

ANGLE plc +44 (0) 1483 343434

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

Andrew Holder, Head of Investor Relations

Berenberg (NOMAD and Joint Broker)

Toby Flaux, Ciaran Walsh, Milo Bonser +44 (0) 20 3207 7800

Jefferies (Joint Broker)

Max Jones, Thomas Bective +44 (0) 20 7029 8000

FTI Consulting

Simon Conway, Ciara Martin +44 (0) 203 727 1000

Matthew Ventimiglia (US) +1 (212) 850 5624

For Frequently Used Terms, please see the Company's website on

https://angleplc.com/investor-relations/glossary/

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the EU Market Abuse Regulation (596/2014). Upon the publication of

this announcement via a regulatory information service, this

information is considered to be in the public domain.

These Preliminary Results may contain forward-looking

statements. These statements reflect the Board's current view, are

subject to a number of material risks and uncertainties and could

change in the future. Factors that could cause or contribute to

such changes include, but are not limited to, the impact of the

COVID-19 pandemic, the general economic climate and market

conditions, as well as specific factors including the success of

the Group's research and development, commercialisation strategies,

the uncertainties related to clinical study outcomes and regulatory

clearance, obtaining reimbursement and payor coverage, acceptance

into national guidelines and the acceptance of the Group's products

by customers.

CHAIRMAN'S STATEMENT

Following the De Novo submission to FDA in September 2020, FDA's

progress in reviewing ANGLE's submission was encouraging despite

the well-publicised pressures on FDA resources due to the COVID-19

pandemic. ANGLE completed the additional analytical work required

to provide a comprehensive response in June 2021 to the Additional

Information Request from FDA.

ANGLE made excellent progress in establishing clinical

laboratories in the UK and United States. They are being used as

accelerators and demonstrators in support of the Company's product

sales of Parsortix instruments and cassettes and to provide

services to pharmaceutical and biotech customers running cancer

drug trials. The laboratories are already offering pharma services

and, once accreditation is in place, will be able to offer

validated clinical tests. First submissions have been made in

relation to CLIA and UKAS accreditation of the laboratories and, in

the United States, a CLIA registration certificate was awarded post

year end, an important step towards accreditation allowing samples

to be processed for patient management.

Initial demand for pharma services has been encouraging and

contracts are now in progress with five different customers, after

two new customers were onboarded post year end. Discussions are

ongoing with a number of other potential customers, and we are

pleased with the level of interest being generated by the

commercial teams in the UK and United States.

Patient enrolment for the Company's ovarian cancer assay

clinical verification study was completed during the year but

sample analysis was hindered by a shortage of key reagents due to

COVID-19 related supply chain issues. These issues have been

addressed and the required reagents have been received and are

being validated before resuming sample analysis, with headline

results anticipated mid-year. A laboratory developed test is

scheduled for launch pending the results of the study and once the

clinical laboratories have received accreditation.

In line with its strategy, ANGLE continues to explore potential

new clinical applications for the Parsortix system and identify

opportunities to develop additional assays for specific high-risk

groups. To this end, ANGLE initiated discussions with a large-scale

group of urology clinics in the United States and completed the

design of a new study in prostate cancer, which is scheduled to

start as soon as terms have been finalised.

Overview of Financial Results

Revenue of GBP1.0 million in the year ( 2020: GBP0.8 million)

came mainly from research use sales of the Parsortix system with a

small initial contribution from the newly established pharma

services business. Research sales continued to be impacted by the

COVID-19 pandemic but there was an encouraging improvement towards

the end of the year as these pressures began to be alleviated.

Importantly, both pharma services and research use product sales

are expected to accelerate should the Company receive FDA clearance

of the Parsortix system. ANGLE continued its investment in studies

to develop and validate the clinical application and commercial use

of the Parsortix system and to launch its new clinical laboratories

and pharma services business, resulting in operating costs of

GBP18.0 million (2020: GBP14.4 million) and a loss for the year of

GBP15.0 million (2020: loss GBP11.6 million).

The cash and cash equivalents and short-term deposits combined

balance was GBP31.8 million at 31 December 2021 (2020: GBP28.6

million) with R&D Tax Credits due at 31 December 2021 of GBP4.5

million (2020: GBP2.1 million).

Strategy

ANGLE has continued with its sustained focus on its four-pronged

strategy for achieving widespread adoption of its Parsortix system

in the emerging multi-US$ billion liquid biopsy market:

1) Completion of rigorous large-scale clinical studies run by

leading cancer centres, demonstrating the effectiveness of

different applications of the system in cancer patient care

2) Securing regulatory approvals with the emphasis on FDA

clearances as the de facto global gold standard. ANGLE is seeking

to become the first ever company to gain FDA product clearance for

a system which harvests circulating tumour cells (CTCs) from

patient blood for subsequent analysis and will look to build on the

initial metastatic breast cancer clearance for specific clinical

assays and, where appropriate, for additional cancer types,

additional products and additional geographies through further

regulatory submissions

3) Building a body of published evidence from leading cancer

centres showing the utility of the system through peer-reviewed

publications, scientific data and clinical research evidence,

highlighting a wide range of potential applications

4) Establishing a significant pharma services business and

building partnerships with large healthcare companies for market

deployment and development of multiple clinical applications

utilising the Parsortix system, including our own laboratory

developed tests from our clinical laboratories, once accredited, in

the United States and the UK

FDA response awaited

ANGLE is seeking to become the first ever company to receive FDA

product clearance for a medical device that harvests intact

circulating tumour cells from the blood of metastatic breast cancer

(MBC) patients for subsequent analysis. A full De Novo FDA

Submission for its Parsortix PC1 system seeking FDA clearance for

use with MBC patients was submitted in September 2020.

Following substantive review, FDA provided a written response in

the form of an Additional Information Request (AIR). Receipt of an

AIR was expected and is in line with typical De Novo clearance

processes. Some of the technical information requested necessitated

some targeted additional analytical studies. These studies did not

require patient samples and were completed as planned and a

comprehensive response to the AIR was announced in early June 2021.

Regular and constructive dialogue with FDA continues and a

regulatory response is awaited.

Clinical laboratories

ANGLE made excellent progress in establishing clinical

laboratories in the UK and United States that will have the

capability of offering validated clinical tests. The laboratories,

in Guildford, UK and Plymouth Meeting, Pennsylvania, United States

were completed ahead of schedule in Q1 2021 and are engaged in

processing clinical samples. In line with the Company's strategy,

the laboratories are being used as accelerators and demonstrators

in support of the Company's established plan for product sales of

Parsortix instruments and cassettes and to provide services to

pharmaceutical and biotech customers running clinical trials.

Processing of patient samples for clinical purposes (treating

patients) requires the laboratories to be accredited under the

appropriate local regulatory regimes. During the year, first

submissions were made in relation to accreditation of the Company's

United States and UK clinical laboratories respectively. Post year

end, the Centers for Medicare and Medicaid Services (CMS) issued a

Certificate of Registration, under the CLIA process, to the

Company's United States clinical laboratory. This is a key step

towards achieving CLIA accreditation of the laboratory. Following

CMS audit, including an inspection of the facilities and

documentation on the validation of assays to be performed together

with associated quality control procedures, a Certificate of

Compliance will be issued. This will complete the accreditation

process that permits the Laboratory to process samples for patient

management from the majority of the United States, with a small

number of States requiring additional procedures which will be

progressed separately.

Global pharma services business

The Parsortix liquid biopsy has particular advantages in

capturing intact cancer cells including mesenchymal cells and CTC

clusters and provides an opportunity for longitudinal testing

(before, during and after drug intervention) in a clinical setting,

which is not possible with tissue biopsy. ANGLE believes that

longitudinal monitoring of CTCs will prove highly attractive to the

pharma industry looking for new insights in cancer drug trials.

Despite lengthy initial sales processes (detailing the analysis

capability, evidencing the laboratory quality systems, and agreeing

the sampling handling and reporting requirements), ANGLE has

already successfully secured pharma services contracts with five

pharma and biotech companies including a Phase III prostate cancer

trial for one customer and the development of bespoke

immunofluorescence (IF) assays to detect specific target proteins

for another.

The incorporation of bespoke assay development as a first phase

in pharma services is a major development and is expected to

significantly increase the attractiveness of the Parsortix CTC

analysis offering, as pharma clients can look at proteins on CTCs

which directly align with the mechanism of operation of their drug

under investigation.

Once developed, the new assays will remain in the ownership of

ANGLE and be added to ANGLE's menu of pre-developed tests that can

be offered to other pharma customers. Pharma companies are commonly

interested in investigating protein markers on actual cancer cells.

These cannot be investigated using the alternative liquid biopsy

approach ctDNA (fragments of dead cancer cells) since protein

cannot be measured on ctDNA. Tissue biopsies provide cancer cells

but cannot be used for longitudinal monitoring since only a single

time point is usually possible with tissue biopsy. Consequently,

pharma companies are unable to access this analysis without

analysing CTCs.

The pharma services business continues to build with a total of

five independent customers now onboarded. Deployment of the

Parsortix system in the first contracts with these customers is

progressing well and two early customers have already agreed

additional contracts for further clinical trials.

Clinical applications

Patient enrolment for ANGLE's ovarian cancer clinical

verification study, which is being undertaken by the University of

Rochester Medical Center (URMC) Wilmot Cancer Institute, New York,

USA was completed during the year. The study is designed to

evaluate the use of ANGLE's combined Parsortix(R) and HyCEAD(TM)

platforms as a simple blood test to detect the presence of ovarian

cancer in women with an abnormal pelvic mass.

A positive outcome from the study will support ANGLE's plans to

launch a clinical assay for the detection of ovarian cancer in

women with an abnormal pelvic mass, with both high sensitivity

(correctly detecting cancer) and high specificity (correctly

detecting no cancer with a low false positive rate). Once the new

performance data is available and, assuming positive results, ANGLE

intends to establish this test as a laboratory developed test (LDT)

in its accredited clinical laboratories. The test has the potential

to significantly improve patient outcomes whilst also reducing

overall healthcare costs.

While good progress was made in many areas of the study, towards

the year end there were some third-party supply chain difficulties

attributed to COVID-19 with a key supplier unable to deliver

certain reagents as scheduled. Post year end, the reagents required

to complete the ovarian cancer study analysis have been received

and are being validated so that analysis of ovarian samples can be

resumed and headline results from the study are anticipated

mid-year.

Discussions regarding the initiation of a new study in prostate

cancer with one of the largest groups of specialist urology clinics

in the United States are well advanced and it is anticipated the

study will start promptly once final terms for the collaboration

have been agreed. ANGLE believes that compelling data from this

study could form the basis for a further LDT to be offered from

ANGLE's clinical laboratories and that the urology group concerned

would provide the first route to market in the United States.

Building a body of published evidence

The Company continues to build momentum around the research use

adoption of the Parsortix system by leading cancer research

centres, in line with its strategy to drive independent third

parties to use Parsortix for the development of new clinical

applications.

Over 141,000 samples have been processed using the Parsortix

system as at 31 December 2021, with some 26,000 samples in the

year. There were 54 peer-reviewed publications as at 31 December

2021 with 17 new publications

announced during 2021 (see https://angleplc.com/library/publications/ ) .

-- Western University and Lawson Health Research Institute,

Ontario, Canada demonstrating the performance of the Parsortix

system in a head-to-head comparison with the leading antibody-based

CTC system

-- CANCER-ID Consortium, the Europe-wide

Public-Private-Partnership aimed at standardising protocols and

driving wide adoption of liquid biopsy in clinical practice,

establishing the performance and technical capabilities of five CTC

isolation platforms, in which key advantages of the Parsortix

system were identified

-- National and Kapodistrian University of Athens, Greece,

demonstrating the utility of the Parsortix system for minimally

invasive, longitudinal monitoring of changes in CTC gene expression

in non-small cell lung cancer patients with an EGFR mutation being

treated with the tyrosine kinase inhibitor (TKI), Osimertinib

(AstraZeneca's Tagrisso(R) )

-- University Medical Centre Hamburg-Eppendorf, Germany,

demonstrating the ability of the Parsortix system to harvest CTCs

with a mesenchymal phenotype, which can be used to detect the

metastatic biomarker cysteine-rich angiogenetic inducer 61 (Cyr61)

in breast cancer patients

-- Istituto Nazionale dei Tumori, Milan, Italy, utilising the

Parsortix system together with whole genome sequencing to uncover

therapeutic targets in patients with triple negative breast

cancer

-- University Hospital Ghent, Belgium, demonstrating the use of

the Parsortix system in oesophageal cancer for the first time,

consistently harvesting high-quality CTCs and validating a

workstream that could enable targeted treatment in this

hard-to-treat cancer

-- Washington University, St Louis, Missouri, United States,

supporting the potential use of the Parsortix system in the

prevention of relapse of breast cancer patients in remission. The

Parsortix system was successfully used to harvest cancer cells

"hibernating" in the bone marrow

-- National and Kapodistrian University of Athens, Greece,

highlighting differences in EGFR mutations between ctDNA and CTCs

in matched liquid biopsies from non-small cell lung cancer patients

and supporting the view that CTCs can provide perspective insight

into a patient's cancer, which may not be possible with ctDNA

alone

-- University Medical Centre Hamburg-Eppendorf, Germany, using

the Parsortix system to successfully harvest CTCs for analysis from

patients with brain metastasis, potentially enabling more

personalised care where traditional tissue biopsy is not

possible

-- Institute of Oncology, Ljubljana, Slovenia, highlighting the

ease of use and superior performance of the Parsortix system in

harvesting CTCs from metastatic breast cancer patients compared to

an alternative antibody-based approach

-- University College London, UK, demonstrating the use of the

Parsortix system to enable whole-genome sequencing of single CTCs

from neuroendocrine neoplasms

-- Medical University of Innsbruck, Austria, demonstrating the

use of the Parsortix system to enable gene expression analysis of

metastatic prostate cancer patients where longitudinal patient

monitoring showed reduction in CTCs with patient drug response

-- Health Research Institute of Santiago, Santiago de

Compostela, Spain, demonstrating the use of the Parsortix system to

assess PD-L1 status of CTCs in non-small cell lung cancer

patients

-- University of Birmingham, UK, exploring the use of the

Parsortix system in harvesting CTCs for gene expression analysis,

potentially providing markers of disease and prognosis in head and

neck squamous cell carcinoma patients

-- Medical University of Vienna, Austria, showing the Parsortix

system as key in demonstrating RNA analysis of CTCs as a prognostic

tool in non-small cell lung cancer patients. Multi-marker

transcriptomic analysis of CTCs revealed multiple subtypes with

different prognostic significance

-- National and Kapodistrian University of Athens, Greece,

supporting the analysis of CTCs captured using the Parsortix

system, together with ctDNA, from serial liquid biopsies to provide

information on disease progression and drug resistance in non-small

cell lung cancer patients

-- Edith Cowan University, Perth, Australia, using CTCs isolated

with the Parsortix system to highlight the relationship between

PD-L1 expression and epithelial to mesenchymal transition in

ovarian cancer patients

Following the year end, there have been eight further

publications, including the following of note:

-- University of Southern California Norris Cancer Center,

United States, a breakthrough study demonstrating, for the first

time, concordance of a Parsortix liquid biopsy test with invasive

tissue biopsy of the metastatic site and the potential for a

Parsortix blood test to be used as an alternative to tissue biopsy

in metastatic breast cancer

-- IRCCS Istituto Nazionale dei Tumori, Milano, Italy, published

their work in early-stage triple negative breast cancer,

demonstrating how longitudinal monitoring of CTCs isolated by the

Parsortix system can provide information on tumour evolution and

identify actionable genes that could help determine future

treatment options for patients with chemo-resistant disease

-- Marlene and Stewart Greenebaum NCI Comprehensive Cancer

Center, University of Maryland, Baltimore, United States, used the

Parsortix system to isolate CTCs in a preclinical model of

metastasis. The authors demonstrated how drug treatment with an

approved therapeutic could significantly reduce the metastatic

potential of CTCs. As metastasis is the leading cause of cancer

deaths, drugs reducing or preventing metastatic spread could

significantly improve patient survival

-- University of Basel and University Hospital Basel,

Switzerland, published ground-breaking research into the use of

CRISPR to identify genes required for metastatic invasion of CTCs

and CTC clusters isolated by the Parsortix system. The team were

able to identify actionable gene pathways which could be targeted

by novel or existing drugs to reduce metastatic spread

As at 31 December 2021, 29 separate cancer centres from around

the world have published positive reports on their use of the

Parsortix system. Using the Parsortix system, leading independent

cancer centres across Europe, North America and elsewhere have

undertaken research in 24 different cancer types.

Outlook

ANGLE gathered significant momentum in 2021 and this has carried

through into the start of 2022. We look forward to a busy year

ahead with the prospect of the first ever FDA product clearance for

a system to harvest cancer cells for subsequent analysis,

laboratory accreditation in both the United States and the UK,

major expansion of our pharma services business, clinical data in

ovarian cancer and the initiation of a new study in prostate cancer

as well as the deployment of our sample-to-answer solutions within

our clinical laboratories and directly with customers.

Globally, operating costs are rising with inflationary pressures

and some areas are experiencing supply chain constraints. In

addition, there is considerable competition in the sector for

talent and some cancer centres are facing a lack of availability of

grant funding for cancer research. ANGLE is taking the necessary

steps to address these challenges and does not anticipate any

significant impact on its growth trajectory. The Company is

strongly positioned in a large, fast growing market with a highly

differentiated product that has the potential to improve cancer

patient care and at the same time reduce healthcare costs and we

expect to see the Company grow significantly as this product

becomes widely adopted.

Clinical adoption of liquid biopsy solutions for cancer

diagnosis is building in all major markets and drug developers are

increasingly looking for new tools to improve clinical trial

efficiency and support market acceptance for novel cancer

treatments. The commercialisation of our unique liquid biopsy

platform to support personalised cancer care is underway and we

look forward to significant growth in the coming year and

beyond.

Garth Selvey

Chairman

27 April 2022

ANGLE PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2021

2021 2020

Note GBP'000 GBP'000

Revenue 1,013 762

Cost of sales (302) (165)

--------- ---------

Gross profit 711 597

Other operating income 41 79

Operating costs (17,987) (14,407)

--------- ---------

Operating profit/(loss) (17,235) (13,731)

Finance income 29 78

Finance costs (157) (92)

--------- ---------

Profit/(loss) before tax (17,363) (13,745)

Tax (charge)/credit 5 2,351 2,139

--------- ---------

Profit/(loss) for the year (15,012) (11,606)

Other comprehensive income/(loss)

Items that may be subsequently reclassified to profit

or loss:

Exchange differences on translating

foreign operations (175) 562

--------- ---------

Other comprehensive income/(loss) (175) 562

Total comprehensive income/(loss)

for the year (15,187) (11,044)

========= =========

Earnings/(loss) per share attributable

to owners of the parent

Basic and Diluted (pence per share) 6 (6.67) (6.52)

All activity arose from continuing

operations.

ANGLE PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

2021 2020

Note GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 3,573 3,710

Property, plant and equipment 2,172 1,176

Right-of-use assets 2,204 1,233

----------- ------------

Total non-current assets 7,949 6,119

----------- ------------

Current assets

Inventories 1,748 742

Trade and other receivables 1,269 1,443

Taxation 4,510 2,127

Short-term deposits - 16,538

Cash and cash equivalents 31,839 12,080

----------- ------------

Total current assets 39,366 32,930

----------- ------------

Total assets 47,315 39,049

----------- ------------

Liabilities

Non-current liabilities

Lease liabilities (1,816) (928)

Trade and other payables (257) -

----------- ------------

Total non-current liabilities (2,073) (928)

----------- ------------

Current liabilities

Lease liabilities (522) (434)

Trade and other payables (4,390) (3,343)

----------- ------------

Total current liabilities (4,912) (3,777)

----------- ------------

Total liabilities (6,985) (4,705)

----------- ------------

Net assets 40,330 34,344

=========== ============

Equity

Share capital 7 23,514 21,540

Share premium 99,406 81,532

Share-based payments reserve 2,727 1,745

Other reserve 2,553 2,553

Translation reserve (3,960) (3,785)

Accumulated losses (83,808) (69,139)

ESOT shares (102) (102)

----------- ------------

Total equity 40,330 34,344

=========== ============

ANGLE PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2021

2021 2020

GBP'000 GBP'000

Operating activities

Profit/(loss) before tax (17,363) (13,745)

Adjustments for:

Depreciation of property, plant

and equipment 701 661

Depreciation and impairment of

right-of-use assets 532 421

(Profit)/loss on disposal of property,

plant and equipment 4 2

Amortisation and impairment of

intangible assets 254 337

Share-based payments 1,325 268

Exchange differences (170) 565

Net finance (income)/costs 128 14

--------- -----------

Operating cash flows before movements

in working capital (14,589) (11,477)

(Increase)/decrease in inventories (1,015) 14

(Increase)/decrease in trade and

other receivables 204 (658)

Increase/(decrease) in trade and

other payables 1,417 872

--------- -----------

Operating cash flows (13,983) (11,249)

Research and development tax credits

received - 3,410

Overseas tax payments (27) (9)

--------- -----------

Net cash from/(used in) operating

activities (14,010) (7,848)

Investing activities

Purchase of property, plant and

equipment (1,666) (412)

Purchase of intangible assets (122) (94)

Transfer to short-term deposits 16,538 (1,530)

Interest received 24 70

--------- -----------

Net cash from/(used in) investing

activities 14,774 (1,966)

Financing activities

Net proceeds from issue of share

capital - placing 18,765 18,627

Proceeds from issue of share capital

- share option exercises 925 23

Principal elements of lease payments (614) (463)

Interest elements of lease payments (85) (44)

--------- -----------

Net cash from/(used in) financing

activities 18,991 18,143

Net increase/(decrease) in cash

and cash equivalents 19,755 8,329

Cash and cash equivalents at start

of year 12,080 3,757

Effect of exchange rate fluctuations 4 (6)

Cash and cash equivalents at 31

December 31,839 12,080

========= ===========

Cash and cash equivalents 31,839 12,080

Short-term deposits - 16,538

------- -------

Cash and cash equivalents and short-term

deposits

at 31 December 31,839 28,618

======= =======

ANGLE PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2021

------------------------------ Equity attributable

to owners of the parent -------------------------------

Share-based

Share Share payments Other Translation Accumulated ESOT Total

capital premium reserve reserve reserve losses shares equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2020 17,277 67,272 1,518 2,553 (4,347) (57,574) (102) 26,597

For the year

to 31 December

2020

Consolidated

profit/(loss) (11,606) (11,606)

Other comprehensive

income/(loss):

Exchange differences

on translating

foreign operations 562 562

------------------------ -------- -------- ------------ ------- --------- ----------- -------- ----------

Total comprehensive

income/(loss) 562 (11,606) (11,044)

Issue of shares

(net of costs) 4,263 14,260 18,523

Share-based payments 268 268

Released on exercise (4) 4 -

Released on forfeiture (37) 37 -

_______ _______ ___________ ______ ________ __________ _______ _________

At 31 December

2020 21,540 81,532 1,745 2,553 (3,785) (69,139) (102) 34,344

For the year

to 31 December

2021

Consolidated

profit/(loss) (15,012) (15,012)

Other comprehensive

income/(loss):

Exchange differences

on translating

foreign operations (175) (175)

------------------------ -------- -------- ------------ ------- --------- ----------- -------- ----------

Total comprehensive

income/(loss) (175) (15,012) (15,187)

Issue of shares

(net of costs) 1,974 17,874 19,848

Share-based payments 1,325 1,325

Released on exercise (295) 295 -

Released on forfeiture (48) 48 -

______ _______ ___________ ______ ________ __________ _______ _________

At 31 December

2021 23,514 99,406 2,727 2,553 (3,960) (83,808) (102) 40,330

====== ====== ========== ===== ======= ========= ======= ========

ANGLE PLC

NOTES TO THE PRELIMINARY ANNOUNCEMENT

FOR THE YEAR ENDED 31 DECEMBER 2021

1 Preliminary announcement

The preliminary results for the year ended 31 December 2021 were

approved by the Board of Directors on 27 April 2022.

The preliminary announcement set out above does not constitute

ANGLE plc's statutory Financial Statements for the years ended 31

December 2021 or 31 December 2020 within the meaning of section 434

of the Companies Act 2006 but is derived from those audited

Financial Statements.

The auditor's report on the Consolidated Financial Statements

for the years ended 31 December 2021 and 31 December 2020 is

unqualified and does not contain statements under s498(2) or (3) of

the Companies Act 2006.

The accounting policies used for the year ended 31 December 2021

are unchanged from those used for the statutory Financial

Statements for the year ended 31 December 2020. The 31 December

2021 statutory accounts will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

2 Compliance with accounting standards

While the financial information included in this preliminary

announcement has been computed in accordance with the measurement

principles of UK-adopted international accounting standards, this

announcement does not itself contain sufficient information to

comply with these accounting standards.

Accounting standards adopted in the year

No new accounting standards that have become effective and

adopted in the year have had a significant effect on the Group's

Financial Statements.

Accounting standards issued but not yet effective

At the date of authorisation of the Financial Statements, there

were a number of other Standards and Interpretations (International

Financial Reporting Interpretation Committee - IFRIC) which were in

issue but not yet effective, and therefore have not been applied in

these Financial Statements. The Directors have not yet assessed the

impact of the adoption of these standards and interpretations for

future periods.

3 Going concern

The Financial Statements have been prepared on a going concern

basis which assumes that the Group will be able to continue its

operations for the foreseeable future

The Group's business activities, together with the factors

likely to affect its future development, performance and financial

position are set out in the Chairman's Statement.

The Directors have considered the uncertainties, risks and

potential impact on the business associated with potential negative

trading scenarios, market and geopolitical uncertainty

(Ukraine-Russia conflict), Brexit friction and residual COVID-19

impacts. Discretionary expenditure within the business provides

flexibility to scale back operations to address adverse events if

required. Mitigation measures to reduce costs could be taken if

needed and other potential sources of funding exist such as grants,

exclusivity and/or milestone payments for corporate partnerships

being developed and equity proceeds.

The Directors have prepared and reviewed the financial

projections for the 12 month period from the date of approval of

these Financial Statements with discretionary expenditure carefully

controlled in line with available resources, as certain projects

may be deferred until additional resources are available. Based on

the level of existing cash and expected R&D tax credits, the

projected income and expenditure (the quantum and timing of some of

which is at the Group's discretion) and other potential sources of

funding, the Directors have a reasonable expectation that the

Company and Group have adequate resources to continue in business

for the foreseeable future. Accordingly, the going concern basis

has been used in preparing the Financial Statements.

4 Critical accounting estimates and judgements

The preparation of the Financial Statements requires the use of

estimates, assumptions and judgements that affect the reported

amounts of assets and liabilities at the date of the Financial

Statements and the reported amounts of revenues and expenses during

the reporting year. Although these estimates, assumptions and

judgements are based on the Directors' best knowledge of the

amounts, events or actions, and are believed to be reasonable,

actual results ultimately may differ from those estimates.

The estimates, assumptions and judgements that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities are described below.

Share-based payments

In calculating the fair value of equity-settled share-based

payments the Group uses options pricing models. The Directors are

required to exercise their judgement in choosing an appropriate

options pricing model and determining input parameters that may

have a material effect on the fair value calculated. These key

input parameters are expected volatility, expected life of the

options and the number of options expected to vest.

5 Tax

The Group undertakes R&D activities. In the UK these

activities qualify for tax relief and result in R&D tax

credits.

6 Earnings/(loss) per share attributable to owners of the parent

The basic and diluted earnings/(loss) per share is calculated by

dividing the after tax loss for the year attributable to the owners

of the parent of GBP15.0 million (2020: GBP11.6 million) by the

weighted average number of shares in the year.

In accordance with IAS 33 Earnings per share, 1) the "basic"

weighted average number of Ordinary shares calculation excludes

shares held by the Employee Share Ownership Trust (ESOT) as these

are treated as treasury shares and 2) the "diluted" weighted

average number of Ordinary shares calculation considers potentially

dilutive Ordinary shares from instruments that could be converted.

Share options are potentially dilutive where the exercise price is

less than the average market price during the year. Due to losses

in the 2021 and 2020 reporting years, share options are

non-dilutive for those years as adding them would have the effect

of reducing the loss per share and therefore the diluted loss per

share is equal to the basic loss per share.

The basic and diluted earnings/(loss) per share are based on

225,073,380 weighted average ordinary GBP0.10 shares for the year

(2020: 178,036,093).

7 Share capital

The Company has one class of Ordinary shares which carry no

right to fixed income and at 31 December 2021 had 235,143,050

Ordinary shares of GBP0.10 each allotted, called up and fully paid

(2020: 215,405,178).

The Company issued 17,241,380 new Ordinary shares with a nominal

value of GBP0.10 at an issue price of GBP1.16 per share in a

placing of shares realising gross proceeds of GBP20.0 million.

Associated costs of GBP1.1 million were incurred. Shares were

admitted to trading on AIM in July 2021.

The Company issued 2,496,492 new Ordinary shares with a nominal

value of GBP0.10 at exercise prices between GBP0.10 to GBP0.8625

per share as a result of the exercise of share options by employees

realising gross proceeds of GBP0.9 million. Shares were admitted to

trading on AIM at various dates across the year.

8 Shareholder communications

Copies of this announcement are posted on the Company's website

www.ANGLEplc.com .

The Annual General Meeting (AGM) of the Company will be held at

2:00 pm on Wednesday 29 June 2022 at the Holiday Inn Guildford,

Egerton Road, Guildford, GU2 7XZ. The Board is looking forward to

once again welcoming shareholders to the Meeting in person. As has

been the case in recent years, the Board is pleased to be able to

continue to offer shareholders the opportunity to follow

proceedings online via a live webcast. Details will be included in

the notice of AGM. The Company will continue to monitor the ongoing

situation with regard to COVID-19 and any changes to the format of

the meeting, including the ability for Shareholders to no longer

attend in person, will be notified through a regulatory news

service (RNS).

Notice of the meeting will be enclosed with the audited

Statutory Financial Statements.

The audited Statutory Financial Statements for the year ended 31

December 2021 are expected to be distributed to shareholders no

later than 1 June 2022 and will subsequently be available on the

Company's website or from the registered office, 10 Nugent Road,

Surrey Research Park, Guildford, GU2 7AF.

This preliminary announcement was approved by the Board of

Directors on 27 April 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUPACUPPPPM

(END) Dow Jones Newswires

April 28, 2022 02:02 ET (06:02 GMT)

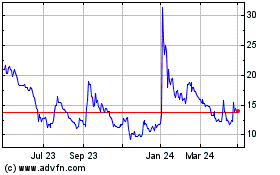

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

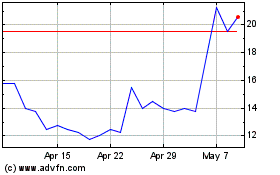

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024