TIDMBSRT

RNS Number : 5169K

Baker Steel Resources Trust Ltd

06 May 2022

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

6 May 2022

29 April 2022 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 29 April 2022:

Net asset value per Ordinary Share: 91.9 pence.

The NAV per share has decreased by 5.7% against the unaudited

NAV at 31 March 2022 largely due to falls in the share prices of

the listed portion of the portfolio, in particular that of Tungsten

West Plc, which outweighed an increase in the carrying value of

Futura due to the conversion of a bridging loan into an additional

royalty interest.

The Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 29 April

2022.

Investment Update

The Company's top 10 investments were as follows as a percentage

of NAV:

29 April 2022 31 December 2021

Futura Resources Ltd 23.7% 18.1%

Cemos Group plc 19.6% 18.6%

Bilboes Gold Limited 15.1% 13.1%

Tungsten West Plc 9.3% 14.7%

First Tin plc 7.3% 7.7%

Kanga Potash 4.7% 4.1%

Polar Acquisition Ltd 4.3% 7.5%

Nussir ASA 3.9% 3.6%

Silver X Mining Corporation 3.6% 2.8%

Azarga Metals Corp 1.5% 2.1%

Listed Precious Metal Shares 2.8% 3.2%

Other Investments 3.8% 3.3%

Net Cash, Equivalents and

Accruals 0.4% 1.1%

Tungsten West PLC ("Tungsten West")

On 21 April 2022, Tungsten West announced that it is pausing the

redevelopment of its Hemerdon tungsten project to evaluate

alternative lower cost approaches due to significant recent

inflation in key consumables in particular steel, cement, ammonium

nitrate (explosives), electricity and diesel. Although the tungsten

price has increased modestly over the past year this has not been

to the same extent as the rise in input prices, and we have seen

other tungsten projects facing similar challenges.

Although clearly a setback, Tungsten West is in the fortunate

position that it hadn't yet committed to the major part of the cost

of the redevelopment so is able to adjust its plans whilst it still

retains GBP28 million from its IPO in October 2021 and has not

drawn down on its debt facility with Orion. In addition, it has

taken delivery of 7 Tomra ore sorters which are a key capital item

and were ordered mid 2021, before recent inflationary impacts.

It is expected Tungsten West will now look to restart the

Hemerdon mine on a smaller scale based on lower capital and

operating costs whist retaining the optionality to move back to the

larger scale operation should market conditions warrant it. A

revised development plan on this basis is expected in the third

quarter this year.

The reduction in the share price of Tungsten West on the AIM

market of the London Stock Exchange has reduced the NAV by

approximately 8.9% from 31 March 2022, albeit the quoted share

price remains at an approximate 85% premium to the Company's cost

price.

Futura Resources Ltd ("Futura")

During April 2022, the Company exercised its option to convert

the A$2.2 million bridging loan it had provided to Futura into a

further 0.5% gross revenue royalty ("GRR") over Futura's Wilton and

Fairhill coking coal projects in Australia. The Company had this

option as Futura had been unable to complete its development

financing by 31 March 2022. Futura is currently in advanced

discussions with a number of potential financiers and is hoped that

they can agree a satisfactory finance package this quarter.

The 0.5% GRR is in addition to the Company's existing 1% GRR

which is valued at A$16 million. Conversion of the bridging loan

has therefore added GBP3.1 million (approximately 3%) to the

Company's NAV.

First Tin PLC ("First Tin")

As discussed in the Company's 31 March 2022 NAV update, First

Tin successfully completed its IPO and listing on the London Stock

Exchange on 8 April 2022, raising GBP20m before expenses. As the

Company's shares are subject to a one-year lock-up the shares are

being carried at a 23.4% discount to the closing bid price on 29

April 2022, in a similar way to the holding in Tungsten West

Plc.

The proceeds of the IPO will be used primarily to complete

Definitive Feasibility Studies on First Tin's Tellerhauser tin

project in Germany and its Taronga tin project in Australia.

Azarga Metals Ltd ("Azarga")

During April 2022 the Company agreed to convert its US$3.5

million loan to Azarga into equity at a conversion price of C$0.10

per share. In exchange for BSRT converting the loan Azarga has also

agreed to grant BSRT the option to acquire Azarga's Unkur copper

silver project in far east Russia until 31 December 2023, whilst

Azarga concentrates on its copper-rich VMS Marg project in the

Yukon. Azarga will use its best efforts (while recognising that

sanctions and other force majeure circumstances may hinder these

efforts), to maintain the corporate existence of its subsidiaries

and its licences, including the Unkur project, on a care and

maintenance basis during the option period.

The transaction is subject to definitive agreements and

regulatory approvals including, if necessary, Azarga shareholder

approval. Upon completion the Company will hold approximately 36%

of Azarga. The effect of the transaction is not material to the

Company's NAV.

Silver X Resources Ltd ("Silver X")

During April 2022 the Company agreed to convert the US$4.2

million of capital and interest due under its convertible debenture

to Silver X into common shares of Silver X at a deemed price of

C$0.30 per share (approximately 48% discount to the original

conversion price). The conversion (subject to final TSX approval)

will result in the Company becoming Silver X's largest shareholder

with 13.9% of the enlarged share capital and the Company will have

the right to appoint a director. The effect of the conversion is

not material to the Company's NAV.

During 2022 Silver X has made significant progress towards

becoming one of the few listed producing silver juniors. The recent

completion of the Nueva Recuperada processing plant expansion and

continued positive mine development results have built a strong

foundation for the future.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVZZGGKKKMGZZM

(END) Dow Jones Newswires

May 06, 2022 02:01 ET (06:01 GMT)

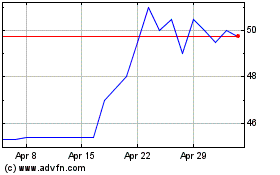

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Apr 2023 to Apr 2024