Ellsworth Growth and Income Fund Ltd. Declares Distribution of $0.13 Per Share

February 17 2023 - 7:15AM

Business Wire

The Board of Trustees of Ellsworth Growth and Income Fund Ltd.

(NYSE American: ECF) (the “Fund”) declared a $0.13 per share cash

distribution payable on March 24, 2023 to common shareholders of

record on March 17, 2023.

The Fund intends to pay the greater of either an annual

distribution of 5% of the Fund’s trailing 12-month average

month-end market price or an amount that meets the minimum

distribution requirement of the Internal Revenue Code for regulated

investment companies.

Each quarter, the Board of Trustees reviews the amount of any

potential distribution from the income, realized capital gain, or

capital available. The Board of Trustees will continue to monitor

the Fund’s distribution level, taking into consideration the Fund’s

net asset value and the financial market environment. If necessary,

the Fund pays an adjusting distribution in December, which includes

any additional income and net realized capital gains in excess of

the quarterly distributions. The Fund’s distribution policy is

subject to modification or termination by the Board of Trustees at

any time, and there can be no guarantee that the policy will

continue. The distribution rate should not be considered the

dividend yield or total return on an investment in the Fund.

All or part of the distribution may be treated as long-term

capital gain or qualified dividend income (or a combination of

both) for individuals, each subject to the maximum federal income

tax rate for long term capital gains, which is currently 20% in

taxable accounts for individuals (or less depending on an

individual’s tax bracket). In addition, certain U.S. shareholders

who are individuals, estates or trusts and with income that exceeds

certain thresholds will be required to pay a 3.8% Medicare

surcharge on their "net investment income", which includes

dividends received from the Fund and capital gains from the sale or

other disposition of shares of the Fund.

If the Fund does not generate sufficient earnings (dividends and

interest income, less expenses, and realized net capital gain)

equal to or in excess of the aggregate distributions paid by the

Fund in a given year, then the amount distributed in excess of the

Fund’s earnings would be deemed a return of capital. Since this

would be considered a return of a portion of a share-holder’s

original investment, it is generally not taxable and would be

treated as a reduction in the shareholder’s cost basis.

Long-term capital gains, qualified dividend income, investment

company taxable income and return of capital, if any, will be

allocated on a pro-rata basis to all distributions to common

shareholders for the year. Based on the accounting records of the

Fund currently available, the current distribution paid in 2023 to

common shareholders with respect to the Fund’s fiscal year ending

September 30, 2023 would include approximately 30% from net

investment income and 70% from net capital gains on a book basis.

This information does not represent information for tax reporting

purposes. The estimated components of each distribution are updated

and provided to shareholders of record in a notice accompanying the

distribution and are available on our website. The final

determination of the sources of all distributions in 2023 will be

made after year end and can vary from the quarterly estimates.

Shareholders should not draw any conclusions about the Fund’s

investment performance from the amount of the current distribution.

All individual shareholders with taxable accounts will receive

written notification regarding the components and tax treatment for

all 2023 distributions in early 2024 via Form 1099-DIV.

Investors should carefully consider the investment objectives,

risks, charges, and expenses of the Fund before investing. For more

information regarding the Fund’s distribution policy and other

information about the Fund, call:

Bethany Uhlein (914) 921-5546

About Ellsworth Growth and Income Fund

Ellsworth Growth and Income Fund Ltd. is a diversified,

closed-end management investment company with $193 million in total

net assets. ECF invests primarily in convertible securities and

common stock with the objectives of providing income and the

potential for capital appreciation, objectives the Fund considers

to be relatively equal over the long-term due to the nature of the

securities in which it invests. The Fund is managed by Gabelli

Funds, LLC, a subsidiary of GAMCO Investors, Inc. (OTCQX:

GAMI).

NYSE American: ECF CUSIP – 289074106

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230217005205/en/

Investor Relations Contact: Bethany Uhlein 914.921.5546

buhlein@gabelli.com

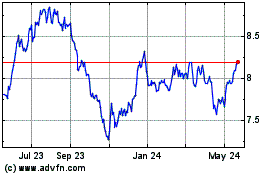

Ellsworth Growth and Inc... (AMEX:ECF)

Historical Stock Chart

From Jan 2025 to Feb 2025

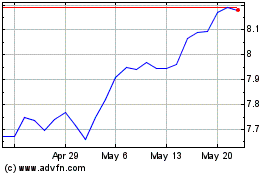

Ellsworth Growth and Inc... (AMEX:ECF)

Historical Stock Chart

From Feb 2024 to Feb 2025