Form 8-K - Current report

October 17 2024 - 3:35PM

Edgar (US Regulatory)

0001065059False00010650592024-10-162024-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_________________

Date of Report (Date of earliest event reported): October 16, 2024

Centrus Energy Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-14287 | 52-2107911 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

6901 Rockledge Drive, Suite 800

Bethesda, MD 20817

(301) 564-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Class A Common Stock, par value $0.10 per share | LEU | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

Centrus Energy Corp. announced today that its subsidiary, American Centrifuge Operating, LLC (“ACO”), has won an award from the U.S. Department of Energy (the "Department") aimed at expanding domestic commercial production of High-Assay, Low-Enriched Uranium ("HALEU"), which is needed to fuel many of the next-generation nuclear reactor designs currently under development. ACO is one of four awardees. The award has a minimum contract value of $2.0 million and a maximum contract value of $2.7 billion over a ten-year period. The ultimate dollar amount associated with this award will depend upon which task orders ACO is subsequently issued and their value.

Separate from this award, ACO was also one of the awardees selected by the Department on October 8, 2024, to deconvert HALEU from uranium hexafluoride ("UF6") to uranium oxide and/or uranium metal forms, a key step in the nuclear fuel production process which is separate from, and subsequent to, production of HALEU via uranium enrichment.

A copy of the press release is being furnished as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to this Item 8.01, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | Centrus Energy Corp. | |

| | | | | |

| | | | | |

| Date: | October 17, 2024 | By: | /s/ Kevin J. Harrill | |

| | | | Kevin J. Harrill | |

| | | Senior Vice President, Chief Financial Officer, | |

| | | and Treasurer | |

FOR IMMEDIATE RELEASE: October 17, 2024 Centrus Wins HALEU Enrichment Award from U.S. Department of Energy BETHESDA, Md. – Centrus Energy (NYSE American: LEU) announced today that its subsidiary, American Centrifuge Operating, LLC (“ACO”), has won an award from the U.S. Department of Energy aimed at expanding domestic commercial production of High-Assay, Low-Enriched Uranium (HALEU), which is needed to fuel many next-generation nuclear reactor designs currently under development. “This award could facilitate the potential expansion of Centrus’ first-of-a-kind HALEU production capacity to help meet the needs of the advanced nuclear industry and the nation,” said Centrus President and CEO Amir Vexler. “It represents a critical piece of the public-private partnership we are working to build so that we can restore a robust, American-owned uranium enrichment capability to power the future of nuclear energy.” ACO is one of four awardees being announced today for HALEU production, with a minimum contract value of $2 million and a maximum value for all awardees of $2.7 billion over a ten- year period. The ultimate dollar amount associated with this award – and the potential scale of the expansion supported -- will depend upon task orders subsequently issued by the U.S. Department of Energy to Centrus. ACO will manufacture the centrifuges and supporting equipment exclusively in the United States, relying upon domestic engineering and a domestic supply chain that currently spans 14 major, American-owned suppliers in 13 states and is expected to grow. Separate from this award, ACO was also one of the awardees selected by the Department on October 8th to deconvert HALEU from uranium hexafluoride (UF6) to uranium oxide and/or uranium metal forms, a key step in the nuclear fuel production process which is separate from, and subsequent to, production of HALEU via uranium enrichment. About Centrus Energy Centrus Energy is a trusted supplier of nuclear fuel and services for the nuclear power industry. Centrus provides value to its utility customers through the reliability and diversity of its supply sources – helping them meet the growing need for clean, affordable, carbon-free electricity. Since 1998, the Company has provided its utility customers with more than 1,750 reactor years of fuel, which is equivalent to 7 billion tons of coal. With world-class technical and engineering capabilities, Centrus is also advancing the next generation of centrifuge technologies so that

America can restore its domestic uranium enrichment capability in the future. Find out more at www.centrusenergy.com. ### Forward Looking Statements This news release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. In this context, forward-looking statements mean statements related to future events, which may impact our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will”, “should”, “could”, “would” or “may” and other words of similar meaning. These forward-looking statements are based on information available to us as of the date of this news release and represent management’s current views and assumptions with respect to future events and operational, economic and financial performance. Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control. For Centrus Energy Corp., particular risks and uncertainties (hereinafter “risks”) that could cause our actual future results to differ materially from those expressed in our forward-looking statements and which are, and may be, exacerbated by any worsening of the global business and economic environment include but are not limited to the following: risks related to the U.S. Department of Energy (“DOE”) not issuing any task orders to any awardee under this award or any task orders to the Company under this award; risks related to the Company not winning a task order under this award to expand its HALEU plant; risks related to DOE not providing adequate share of the appropriated funding under this award; risks related to our ability to secure financing to expand our plant; risks related to our ability to increase capacity in a timely manner to meet market demand or our contractual obligations; risks related to DOE not awarding any contracts to the Company in response to the Company’s remaining proposals; risks related to whether or when government funding or demand for high-assay low-enriched uranium (“HALEU”) for government or commercial uses will materialize and at what level; risks related to (i) our ability to perform under our agreement with the DOE to deploy and operate a cascade of centrifuges to demonstrate production of HALEU for advanced reactors (the “HALEU Operation Contract”), (ii) our ability to obtain new contracts and funding to be able to continue operations and (iii) our ability to obtain and/or perform under other agreements; risks that (i) we may not obtain the full benefit of the HALEU Operation Contract and may not be able or allowed to operate the HALEU enrichment facility to produce HALEU after the completion of the HALEU Operation Contract or (ii) the output from the HALEU enrichment facility may not be available to us as a future source of supply; risks related to the fact that we face significant competition from major enrichers who may be less cost sensitive or are wholly or partially government owned; risks related to the potential for demobilization or termination of the HALEU Operation Contract; risks related to DOE delaying, modifying or terminating any contracts under this award; risks related to laws that ban (i) imports of Russian LEU into the United States, including the “Prohibiting Russian Uranium Imports Act” (“Import Ban Act”) or (ii) transactions with the Russian State Atomic Energy Corporation (“Rosatom”) or its subsidiaries, which includes TENEX; risks related to our potential inability to secure additional waivers or other exceptions from the Import Ban Act or sanctions in a timely manner or at all in order to allow us to continue importing Russian LEU under the TENEX Supply Contract or otherwise doing business with TENEX or implementing the TENEX Supply Contract; risks related to TENEX’s refusal or inability to deliver LEU to us for any reason including because (i) U.S. or foreign government sanctions or bans are imposed on LEU from Russia or on TENEX, (ii) TENEX is unable or unwilling to deliver LEU, receive payments, receive the return of natural uranium hexafluoride, or conduct other activities related to the TENEX Supply Contract, or (iii) TENEX elects, or is directed (including by its owner or the Russian government ), to limit or stop transactions with us or with the United States or other countries; risks related to the increasing quantities of LEU being imported into the U.S. from China and the impact on our ability to make future LEU or SWU sales or ability to finance any buildout of our enrichment capacities; risks related to reliance on the only firm that has the necessary permits and capability to transport LEU from Russia to the United States and that firm’s ability to maintain those permits and capabilities or secure additional permits.

Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this news release. These factors may not constitute all factors that could cause actual results to differ from those discussed in any forward-looking statement. Accordingly, forward-looking statements should not be relied upon as a predictor of actual results. Readers are urged to carefully review and consider the various disclosures made in this news release and in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2023, under Part II, Item 1A - “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and in our filings with the SEC that attempt to advise interested parties of the risks and factors that may affect our business. We do not undertake to update our forward-looking statements to reflect events or circumstances that may arise after the date of this news release, except as required by law. Contacts: Investors: Dan Leistikow at LeistikowD@centrusenergy.com Media: Lindsey Geisler at GeislerLR@centrusenergy.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

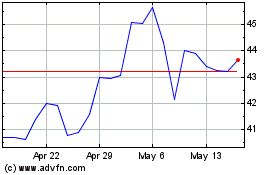

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Oct 2024 to Nov 2024

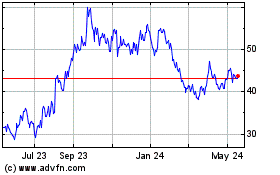

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Nov 2023 to Nov 2024