Amended Current Report Filing (8-k/a)

January 13 2021 - 3:22PM

Edgar (US Regulatory)

0000088121false00000881212020-12-022020-12-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

|

|

|

Date of Report (Date of earliest event reported)

|

|

Seaboard Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-3390

|

|

04-2260388

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

|

|

|

|

|

|

|

|

|

9000 West 67th Street, Merriam, Kansas

|

66202

|

(Address of principal executive offices)

|

|

|

|

|

Registrant’s telephone number including area code

|

|

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock $1.00 Par Value

|

SEB

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 to Current Report on Form 8-K (this “Form 8-K/A”) amends the Current Report on Form 8-K of Seaboard Corporation (the “Company”) filed with the Securities and Exchange Commission on December 8, 2020 (the “Original Form 8-K”), which reported the appointment of David H. Rankin to serve as Executive Vice President and Chief Financial Officer (“CFO”) of the Company. Pursuant to Instruction 2 to Item 5.02 of Form 8-K, this Form 8-K/A is being filed solely to provide information called for in Item 5.02(c)(3) of Form 8-K that had not been determined at the time of filing of the Original Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On December 2, 2020, the Company announced that the Board of Directors (the “Board”) appointed David H. Rankin, the Company’s then-serving Senior Vice President, Taxation and Business Development to the office of Executive Vice President and CFO effective on the same date. On January 12, 2021, the Company and Mr. Rankin entered into a Restated Employment Agreement (the “Employment Agreement”), which restates and replaces the Employment Agreement between the parties dated as of June 2013.

Pursuant to the Employment Agreement, Mr. Rankin agrees to serve as Executive Vice President and CFO of the Company for an initial term ending on December 31, 2021, which will renew automatically for additional one (1) year terms unless a notice of non-renewal is given by the Company. The term will not extend beyond December 31, 2033 unless otherwise agreed by the Company and Mr. Rankin. The Employment Agreement provides that Mr. Rankin will receive an annual base salary of $425,000, effective December 3, 2020, subject to annual increases at the discretion of the Board. The Employment Agreement also provides that Mr. Rankin is eligible for an annual target bonus of 131.25% of his base salary and a maximum bonus of 175% of his base salary and provides Mr. Rankin a guaranteed minimum bonus of $300,000 for any calendar year during his employment period. In the event Mr. Rankin’s salary and bonus for a year totals in excess of $1,000,000, the amount of Mr. Rankin’s bonus, if any, in excess of $300,000 may be deferred at the option of the Company pursuant to the Company’s Post-2018 Nonqualified Deferred Compensation Plan (the “Deferred Compensation Plan”). Any amounts deferred pursuant to the Deferred Compensation Plan may be invested in various investment options and, upon Mr. Rankin’s retirement or termination of employment, such deferred amounts will be paid to him in installments of up to $1,000,000 per year for up to five (5) years, with any remaining balance due thereafter to be paid in full in the sixth year thereafter. Mr. Rankin will also receive a car allowance and gasoline charge privileges in accordance with the Company’s car allowance policy. Mr. Rankin is subject to certain non-competition, non-solicitation and confidentiality restrictive covenants in the Employment Agreement. The Employment Agreement provides for the payment of severance payments and benefits to Mr. Rankin upon the termination of his employment in certain circumstances, subject to his compliance with certain restrictive covenants. In connection with Mr. Rankin’s appointment, the Board approved Mr. Rankin’s personal use of the Company’s airplane for up to 10 hours of flight time per year. The Company will also pay for incidental fees and expenses incurred related to the flights, including ground transportation, and a “tax gross-up” of the estimated federal and state income taxes Mr. Rankin will incur as a consequence of this benefit.

The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by the provisions of the Employment Agreement, a copy of which will be filed by the Company as an exhibit to its Annual Report on Form 10-K for the year ended December 31, 2020.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: January 13, 2021

|

|

|

|

|

|

|

|

|

|

|

Seaboard Corporation

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert L. Steer

|

|

|

|

|

|

Robert L. Steer

President, Chief Executive Officer

|

|

|

|

|

|

|

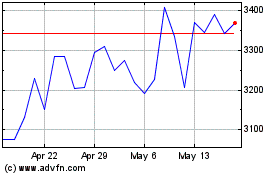

Seaboard (AMEX:SEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

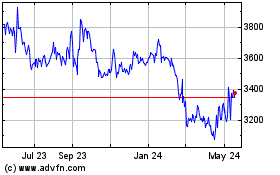

Seaboard (AMEX:SEB)

Historical Stock Chart

From Apr 2023 to Apr 2024