Vista Gold Corp. Announces Favorable Changes to the Northern Territory, Australia Mineral Royalties Regime

June 11 2024 - 5:45AM

Business Wire

Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the

“Company”) today announced that the Northern Territory, Australia

(the “NT”) has passed legislation to enact the Mineral Royalties

Act 2024 (“Royalties Act”) effective July 1, 2024. The Royalties

Act will replace the prior net profits royalty regime with an ad

valorem royalty regime for new mines. The new effective royalty

rate is expected to positively impact project economics for the

Company’s Mt Todd gold project in the NT. All dollar amounts in

this press release are in U.S. dollars.

The Royalties Act is aimed at encouraging present and future

exploration and development of mining projects by simplifying the

NT’s royalty system and making it more competitive with other Tier

1 jurisdictions. Pursuant to the Royalties Act, the royalty rate

applicable to gold doré from Mt Todd will be 3.5% of the value of

gold produced.

Frederick H. Earnest, President and CEO of Vista Gold, stated,

“We are pleased with the successful efforts of the NT Government to

encourage new mining development in the Territory. The 3.5% royalty

to be applied to the production from Mt Todd represents a

meaningful opportunity for improved project economics and earlier

shareholder returns compared to our 2024 updated feasibility study,

which included NT royalties equivalent to nearly a 7% ad valorem

rate. Under the previous net profits royalty regime, our base case

economic analysis at an $1,800 gold price estimated the payment of

$765 million in NT royalties over the life of the mine. The new

royalty rate will represent nearly a 50% reduction in payable

royalties and underscores the NT’s commitment to growing a viable

mining sector through new development.”

The Chief Minister and Treasurer of the Northern Territory, Eva

Lawler, recently commented, “Mining is a key driver of the

Territory economy. An ad valorem scheme is simple, competitive, and

delivers investment certainty, allowing new mines to commence

operations in the Territory, creating significant economic benefit,

higher employment, and more royalties for Territorians. Right now

we are in a position to set our course for a mining industry that

is not only profitable to the Northern Territory, but also supports

the energy transition to renewables.”1

John Rozelle, a “qualified person” as defined by Canadian

National Instrument 43-101 Standards of Disclosure for Mineral

Projects, has verified the data underlying the information

contained in and has approved this press release.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset

is Mt Todd, located in the mining friendly jurisdiction of Northern

Territory, Australia. Situated approximately 250 km southeast of

Darwin, Mt Todd is one of the largest development stage

opportunities in Australia and demonstrates compelling economics.

All major environmental and operating permits necessary to initiate

development of Mt Todd are in place.

Mt Todd benefits from its location in a leading mining

jurisdiction and offers opportunities to add value through growth

of mineral reserves, alternative development strategies, and other

de-risking activities.

For further information about Vista or Mt Todd, please contact

Pamela Solly, Vice President of Investor Relations, at (720)

981-1185 or visit the Company’s website at www.vistagold.com.

1

Lawler, Eva Dina and Australian Labor

Party. (2024, May 21) Securing the best value for our Territory

resources. Northern Territory Government.

Forward Looking Statements

This news release contains forward-looking statements within the

meaning of the U.S. Securities Act of 1933, as amended, and U.S.

Securities Exchange Act of 1934, as amended, and forward-looking

information within the meaning of Canadian securities laws. All

statements, other than statements of historical facts, including

our belief that the Mineral Royalties Act 2024 (“Royalties Act”)

will be effective July 1, 2024; our belief that the Royalties Act

will replace the prior net profits royalty regime with an ad

valorem regime for new mines; our belief that the new effective

royalty rate is expected to positively impact project economics for

the Company’s Mt Todd gold project; our belief that the Royalty Act

is aimed at encouraging present and future exploration and

development of mining projects by simplifying the NT’s royalty

system and making it more competitive with other Tier 1

jurisdictions; our belief that the royalty rate applicable to gold

doré from Mt Todd will be 3.5% of the value of gold produced; our

belief that the 3.5% royalty to be applied to the production from

Mt Todd represents a meaningful opportunity for improved project

economics and earlier shareholder returns compared to our 2024

updated feasibility study, which included NT royalties equivalent

to nearly a 7% ad valorem rate; under the previous net profits

royalty regime, our base case economic analysis at an $1,800 gold

price estimated the payment of $765 million in NT royalties over

the life of the mine; our belief that the new royalty rate will

represent nearly a 50% reduction in payable royalties and

underscores the NT’s commitment to growing a viable mining sector

through new development; our belief that Mt Todd is one of the

largest development stage opportunities in Australia and

demonstrates compelling economics; our belief that Mt Todd offers

opportunities to add value through growth of mineral reserves,

alternative development opportunities, and other de-risking

activities are forward-looking statements and forward-looking

information. The material factors and assumptions used to develop

the forward-looking statements and forward-looking information

contained in this news release include the following: our forecasts

and expected cash flows; our projected capital and operating costs;

our expectations regarding mining and metallurgical recoveries;

mine life and production rates; that laws or regulations impacting

mine development or mining activities will remain consistent; our

approved business plans, our mineral resource and reserve estimates

and results of preliminary economic assessments; preliminary

feasibility studies and feasibility studies on our projects, if

any; our experience with regulators; political and social support

of the mining industry in Australia; our experience and knowledge

of the Australian mining industry and our expectations of economic

conditions and the price of gold. When used in this news release,

the words “optimistic,” “potential,” “indicate,” “expect,”

“intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and

similar expressions are intended to identify forward-looking

statements and forward-looking information. These statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

statements. Such factors include, among others, uncertainty of

resource and reserve estimates, uncertainty as to the Company’s

future operating costs and ability to raise capital; risks relating

to cost increases for capital and operating costs; risks of

shortages and fluctuating costs of equipment or supplies; risks

relating to fluctuations in the price of gold; the inherently

hazardous nature of mining-related activities; potential effects on

our operations of environmental regulations in the countries in

which it operates; risks due to legal proceedings; risks relating

to political and economic instability in certain countries in which

it operates; uncertainty as to the results of bulk metallurgical

test work; and uncertainty as to completion of critical milestones

for Mt Todd; as well as those factors discussed under the headings

“Note Regarding Forward-Looking Statements” and “Risk Factors” in

the Company’s latest Annual Report on Form 10-K as filed in March

2024, subsequent Quarterly Reports on Form 10-Q, and other

documents filed with the U.S. Securities and Exchange Commission

and Canadian securities regulatory authorities. Although we have

attempted to identify important factors that could cause actual

results to differ materially from those described in

forward-looking statements and forward-looking information, there

may be other factors that cause results not to be as anticipated,

estimated or intended. Except as required by law, we assume no

obligation to publicly update any forward-looking statements or

forward-looking information; whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240607564698/en/

Pamela Solly, Vice President of Investor Relations, (720)

981-1185

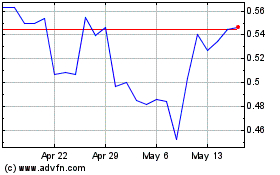

Vista Gold (AMEX:VGZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vista Gold (AMEX:VGZ)

Historical Stock Chart

From Dec 2023 to Dec 2024