Too Late to Buy the Philippines ETF? - ETF News And Commentary

April 10 2013 - 3:00AM

Zacks

While most of the developed economies are in the doldrums, the

Philippines is one of the few nations that has not only managed to

perform well, but has also been able to surge past broad emerging

market indexes as well. A number of trends have been responsible

for this continued move higher in the market, both from a domestic

perspective and in terms of exports.

Thanks to its large, young population that can speak English,

the Philippines has been growing in popularity as an outsourcing

destination and has emerged as a tough competitor to India. This

has provided the country with a fresh source of employment, and

helped to diversify the nation’s economy (read: India ETFs Slump on

Weak GDP Forecast).

This has allowed the Philippines, which is still pretty

undeveloped, to become a favorite destination for most investors

seeking high returns in emerging markets. This is evidenced by the

only ETF focused on the nation the iShares MSCI Philippines

Investable Market Index Fund

(EPHE).

The product has managed to amass a respectable $420 million in

AUM with a solid volume of nearly 300,000 shares per day on

average. So, bid/ask spread looks relatively tight for the fund,

suggesting that total costs will not be much more than the fund’s

expense ratio of 60 bps.

The gains in AUM and volume have undoubtedly been in part due to

the country’s low levels of correlation to both developed markets

as well as many emerging nations (read: Philippines ETF: A Rising

Star in Emerging Market Investing).

EPHE in Focus

The ETF tracks the MSCI Philippines Investable Market Index,

which looks to offer investors a broad exposure to equities listed

in the Philippines. The product has 42 securities in its basket and

focuses more on large caps. It does not spread well across

individual securities, investing 59% of the assets in top ten

holdings.

SM Investments Corp, Ayala Land and SM Prime Holdings take the

top three positions with 10.54%, 8.12% and 6.27%, respectively, of

EPHE’s assets.

From the sector perspective, the fund is tilted towards

financials (41.8%) followed by industrial (24.5%) and utilities

(10.1%). Other sectors make up a nice mix in the portfolio,

although sector risk is clearly an issue.

Yet, despite the heavy financial exposure, the product has not

been hampered by the unresolved European crisis, suggesting that it

could be an interesting choice for those looking for financials

that aren’t heavily correlated to the euro zone (read: Financial

ETFs Set to Rally in Earnings Season).

Performance of EPHE

EPHE has been crushing competition since its inception in

September 2010, greatly outpacing broad emerging market ETFs like

the MSCI Emerging Markets index (EEM) and Vanguard Emerging Market

ETF (VWO). The fund is up more than 13% while EEM and VWO both have

lost around 5% so far in the year.

In fact, EPHE has delivered outstanding returns of 45.5% in 2012

and 58% since inception, implying that the product has a solid

history of outperformance (read: A Trio of Top Emerging Market ETFs

for 2013).

The fund currently has a Zacks ETF Rank #1 or ‘Strong Buy’,

suggesting that it would continue to outperform its peers over the

next year. This is because the long-term fundamentals for the

nation look good in view of the political stability and popularity

of the government, which stems from its commitment to accelerate

the pace of reforms in the country.

According to the International Monetary Fund (IMF), the economy

is expected to grow at a rate of 6% this year, up from

the previous projection of 4.8%. While an improving fiscal

situation (fiscal deficit is 2% of GDP), comfortable foreign

exchange reserves position (up five-fold since 2005), and booming

exports will spur the economy, the country faces some significant

risks from poor infrastructure and corruption.

Additionally, the threat of rising inflation might put pressure

on the future growth of the Philippines and the ETF given higher

food prices and fast, above-average economic growth rates (see more

ETFs in the Zacks ETF Center).

Bottom Line

However, we aren’t too concerned about these issues, as EPHE

remains a best-in-class ETF. Furthermore, the country’s

fundamentals and quickly diversifying economy should help to

mitigate some of these concerns, especially in the long run.

Overall, EPHE continues to be a solid pick for emerging market

ETF investors as long as inflation stays under control and the

country’s economic condition continues to improve. The fund remains

a star performer, seemingly no matter what is happening in broad

markets, and is definitely worth a closer look by investors seeking

more Asia-Pacific ETF exposure.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS PH IM (EPHE): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

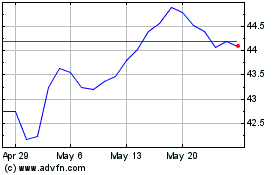

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Oct 2024 to Nov 2024

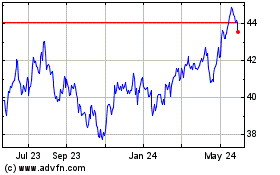

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2023 to Nov 2024