The Association of Southeast Asian Nations, or ASEAN for short,

and their economies have had a long tradition of enticing investors

from all over the globe. This is because the market is an

attractive destination for domestic and foreign investors thanks to

solid growth rates, booming populations and generally good

governance when compared to other emerging regions of the

globe.

The region has recovered nicely from the shocks of 1998 and many

countries have developed significant capital stocks in order to

buffer themselves from future issues, a trend that could reduce

risk going forward.

Thanks to this and weak performances in some BRIC markets, many

countries have seen a substantial amount of inflow in the recent

past, sparking new developments in both the manufacturing and

natural resource industries (Three Country ETFs Struggling in

2013).

The high growth rates expected in these economies

also beats out their developed market counterparts by leaps

and bounds. The increase in per capita income and consumption in

the burgeoning middle class in these markets ensures that the rates

are sustainable.

These countries are also somewhat immune to Western shocks and

are an interesting option to invest in. However, there are certain

risks like liquidity risk, geopolitical problems, and currency

issues which can hurt the region (Top Performing ETFs of the First

Quarter).

Still we believe that these markets are tremendous options for

many investors and definitely worth a closer look. Below we have

highlighted some of the Southeast Asia ETFs that could make for

interesting picks for an investor, given the strong returns and

bright outlooks both in the near and long term:

Indonesia

The Indonesian economy, the biggest in Southeast Asia, appears

to be poised for good growth in 2013. This is largely attributable

to healthy domestic consumption, a favorable investment climate and

increased infrastructure development.

Low inflation and interest rates should also support economic

growth, helping the country to surge higher in the years ahead.

This, along with strong domestic consumption, has enabled the

economy to maintain a mid-single digit GDP growth rate for the past

eight years, suggesting impressive resilience for the Indonesian

economy.

Funds tracking the Indonesian economy have proved to be strong

performers in 2013 after a disappointing performance in 2012

(Indonesia ETFs: Can the Run Continue?).

Market Vectors Indonesia Small-Cap ETF

(IDXJ)

Among the top performers in the ETF world, Indonesian ETFs put

up a remarkable show in the first quarter. The fund has now

recorded an impressive year-to-date gain of 29.4%, easily crushing

pretty much every other ETF in the market.

As the name suggests, the recently launched IDXJ offers a

targeted exposure to the small-cap segment of the Indonesian market

thereby providing a better opportunity to tap domestic growth.

IDXJ manages an asset base of $10.4 million and provides

exposure to 27 small-cap securities of Indonesia. The fund charges

an expense ratio of 61 basis points annually.

The ETF appears to be concentrated in the top ten holdings to

which it allocates a hefty 58.04% of the asset base. Among sector

allocations, Financials dominates the list with a 42.1% share while

Industrials and Energy get the next two positions with allocations

of 24.8% and 11.7% of the asset base, respectively.

Other Indonesia ETFs

Among the ETFs providing exposure to the Indonesian economy,

performance of IDXJ has been the most striking in the new year.

However, the other two ETFs tracking the market, The Market

Vectors Indonesia ETF

(IDX) and the

iShares MSCI Indonesia Investable Market Index Fund

(EIDO), have also put up

a remarkable show in 2013.

In the year-to-date period, EIDO has returned 16% to investors

while IDX recorded a return of 12.6% (Can Indonesia ETFs Rebound in

2013?).

Thailand

Thailand seems to have recovered quite well and is expanding

rapidly after the strong flood that had hit the nation in 2011.

This is well evidenced by its fourth quarter GDP growth rate which

came in at a robust 18.9%, well above the consensus estimate.

Higher government spending and strong domestic demand helped to

mitigate the negative impact from lower exports. Additionally,

recovery in China and the U.S. will assist the nation to regain its

export business. The economy is expected to post growth of 4.5% to

5.5% in 2013.

In such a scenario, a look at the iShares MSCI Thailand

Investable Market Index ETF (THD) could

be a good idea. Attributable to the strong fundamentals of the

economy, THD has been able to perform really well in 2013 and post

significant returns in the year-to-date period (Top Ranked Thailand

ETF in Focus).

THD which holds 92 stocks in its basket has recorded a gain of

14.1% year to date. However, the fund appears to be concentrated

from both a sector and an individual security perspective.

While 49.5% of the asset base comprises of the top ten holdings,

among sector allocation, Banks comprise roughly one-third of the

total assets while Energy companies make up another fifth. Among

other sectors, the fund doesn’t invest more than 9.8%. The fund

charges a fee of 60 basis points on an annual basis.

Philippines

The Philippines has shown incredible resilience to the global

turmoil, posting a solid GDP growth rate. For the full year, the

region is expected to deliver a sharp growth rate of 6% as compared

to the earlier forecast of 5%.

Rating agencies have taken note as well, as in early 2012

S&P bumped the country's long-term foreign currency-denominated

debt to BB+ from BB, the highest rating since 2003. This does not

end here with Moody’s lifting its outlook on the economy to

positive and Fitch recently upgrading the region's rating to

investment grade (Philippines ETF Surges on Fitch Upgrade).

Additionally, the Philippines is supported by strong domestic

demand, low level of inflation and low credit-to-GDP and

loan-to-deposit ratios. However, a high unemployment rate may pose

an obstacle to the economy's growth path.

Clearly, the trends are continuing to be positive for the

country, suggesting that some might want to consider the area for

investment. One way to do this in basket form is via the

MSCI Philippines Investable Market Index Fund

(EPHE).

The return offered by EPHE is an ample proof of the strong

fundamentals of the economy. The fund has returned a robust 20.84%

in the year-to-date period.

The fund trades with an asset base of $221.4 million and

currently has just over 42 securities in its basket. Investors

should note that the fund is concentrated in the top 10 holdings

with more than 55% of investment.

Among sector allocation as well, the fund appears to have a

concentrated exposure. The maximum sector exposure is to Financials

(42.9%) and Industrials (25.48%).

Among others the fund does not invest more than 9.08%. The fund

charges a fee of 60 basis points on an annual basis (Too late to

Buy the Philippines ETF?).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS INDON (EIDO): ETF Research Reports

ISHARS-MS PH IM (EPHE): ETF Research Reports

MKT VEC-INDONES (IDX): ETF Research Reports

MKT VEC-INDO SC (IDXJ): ETF Research Reports

ISHRS-MSCI THAI (THD): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

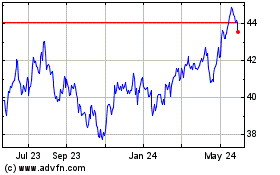

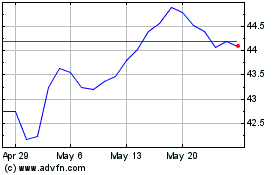

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2023 to Nov 2024