State Street Plans Ex-BRIC Emerging Market ETF - ETF News And Commentary

September 13 2013 - 9:05AM

Zacks

Emerging markets have seen unfavorable performances this year due

to feeble demand and sluggish currencies. Consequently, investors

have pulled huge amounts of capital out of this market over the

past couple of months.

In fact, the two ultra-popular funds –

Vanguard FTSE

Emerging Market ETF

(VWO) and

iShares MSCI Emerging Markets Index Fund

(EEM) – have seen

combined outflows of over $3.3 billion in the last three

months.

State Street, the second-largest ETF provider globally, however,

seems unperturbed by fading investor confidence in emerging

markets. In fact, it even plans to bring in some more ETFs in the

emerging market space.

According to the latest filing with SEC, the firm offered up plans

for a new

SPDR MSCI Beyond BRIC ETF (EMBB) that

could give investors a fresh way to tackle emerging market

securities outside the BRIC countries (read: Are BRIC ETFs in

Trouble?).

A great deal of key information – such as expense ratio and the

individual holdings breakdown – was not available in the initial

SEC document, but other important points were released in the

filing. We have highlighted those below for investors interested in

a new emerging equity play from State Street should it clear

regulatory hurdles:

Proposed ETF in Focus

The proposed ETF looks to follow the MSCI Beyond BRIC Index using

sampling strategy. The index focuses on 17 developing countries

(excluding BRIC) including Chile, Colombia, the Czech Republic,

Egypt, Hungary, Indonesia, Malaysia, Mexico, Morocco, Peru, the

Philippines, Poland, South Africa, South Korea, Taiwan, Thailand

and Turkey (see more in the Zacks ETF Center).

This will give the ETF broad exposure to a number of countries

which are important emerging markets, but which are usually

overlooked in many other emerging market funds. After all, in both

EEM and VWO, holdings in the four BRIC countries make up at least

38% of assets, suggesting this proposed EMBB could have a very

different risk-return profile.

How does it fit in a portfolio?

This new fund, if approved, could be an interesting option for

investors seeking diversified exposure in the global ex-developed

market. This product would allow investors to tap the still beaten

down emerging economies that are showing clear signs of a quick

recovery (read: 3 Emerging Market ETFs Surviving the Slump).

These nations could be interesting plays in the future as their

valuations are quite favorable at current levels and growth rates

are still quite high compared to many of the developed nations.

The IMF recently lowered its growth forecast for the emerging

nations to 5% for this year and 5.4% for the next. According to the

agency, the worst performers would include the BRICS (Brazil,

Russia, India, China and South Africa) nations. The IMF slashed

2013 economic growth outlook by 0.5% to 2.5% for Brazil, 0.9% to

2.5% for Russia, 0.2% to 5.6% for India, 0.3% to 7.8% for China,

and 0.8% to 2% for South Africa (read: Avoid These 3 Emerging

Market ETFs).

As the proposed ETF looks to avoid the BRIC nations, the State

Street’s potential offering could make a splash in the space.

Can it succeed?

Fortunately for State Street, there is only one ETF provider that

offers exposure to the emerging markets excluding the BRIC

countries. This includes the

EGShares Beyond BRICs ETF

(BBRC) that has accumulated $10.3 million since its debut

a year ago (see: all the Emerging Market ETFs here). The fund holds

50 securities in its basket and charges 85 bps in fees a year from

investors. The ETF is down nearly 13% so far this year.

So the proposed State Street fund, if approved, could give

investors a second alternative to play the emerging markets beyond

BRIC. But given the low level of interest and negative returns so

far in the recent emerging market slump, it is hard to say how EMBB

will perform should it pass regulatory hurdles, though continued

interest and diversification in the space should be welcomed by

long term investors seeking new options.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

EGS-BEYOND BRIC (BBRC): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

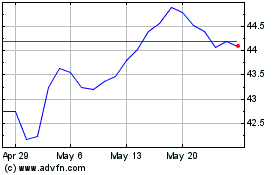

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Oct 2024 to Nov 2024

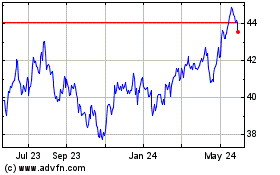

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2023 to Nov 2024