TIDMBMN

RNS Number : 2839X

Bushveld Minerals Limited

19 December 2023

Market Abuse Regulation ("MAR") Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

19 December 2023

Bushveld Minerals Limited

("Bushveld Minerals" or the "Company")

Confirmed Acquisition of Minority Interests in Vametco

Bushveld Minerals (AIM: BMN), the AIM quoted, integrated primary

vanadium producer, is pleased to announce that, further to its

announcement of 30 October 2023, the Company has met all the

necessary conditions and received final approval from the South

African Reserve Bank ("SARB"), allowing the Company to increase its

ownership to 100% of the Vametco vanadium mine and production

facility ("Vametco") (collectively the "Transaction") .

Highlights

-- All of the conditions precedent to the Transaction as

outlined in the 30 October 2023 announcement, " Conditional

acquisition of minority interests in Vametco", have been met,

including receipt of SARB's approval of the Transaction.

-- Bushveld has accordingly acquired the 26% minority interest

in Bushveld Vametco Holdings Proprietary Limited ("BVH") from the

Black Economic Empowerment ("BEE") consortium in return for,

inter-alia, the issue of 232,836,255 new ordinary shares of 1 pence

each in the Company (the "Consideration Shares"), representing 13%

of the issued share capital on admission of the Consideration

Shares to trading on AIM.

-- The Transaction:

-- results in Bushveld owning 100% of the Vametco mine and

vanadium plant, thereby acquiring full operational, management and

financial control of Vametco;

-- gives the Group complete control over Vametco's cash flows

previously restricted by the minority interest;

-- is immediately value accretive to Bushveld Shareholders and

is expected to enhance earnings per share going forward; and

-- 70% of the Consideration Shares are subject to a 6 month lock-in period.

-- Completion of the Transaction also secures fulfilment of a

key condition precedent to the Orion Convertible Loan Note

Refinancing agreement, announced on 27 November 2023.

-- In addition to the anti-dilution provisions of the lock-in

agreement, the BEE consortium has now been granted the right to

subscribe for up to 39,682,540 new Ordinary Shares at the issue

price of 3 pence at any time during the period commencing on the

date of Admission and expiring on 28 February 2024.

Further approvals and requirements

Following the completion of the Transaction, BVH will apply to

the Minister of Mineral Resources and Energy (in terms of section

102 of the Mineral and Petroleum Resources Development Act, 2002)

to amend and update the BVH Mining Right to reflect the updated

ownership structure.

Admission, Settlement and Total Voting Rights

Application has been made to the London Stock Exchange for the

232,836,255 Consideration Shares to be admitted to trading on AIM,

("Admission"). It is expected that Admission will take effect by 21

December 202 3.

Following Admission, there will be a total of 1,791,048,114

Ordinary Shares in issue, 670,000 of which are held in treasury.

Shareholders should use the figure of 1,790,378,114 as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the Company, under the FCA's Disclosure and

Transparency Rules.

Craig Coltman, CEO of Bushveld Minerals Limited, commented :

"The approval of this important transaction by SARB strengthens

and confirms the direction of our Company strategy. This allows us

to consolidate the ownership of a valuable vanadium-producing

asset, solely under one entity - Bushveld Minerals."

Enquiries : info@Bushveldminerals.com

Bushveld Minerals Limited +27 (0) 11 268 6555

Craig Coltman, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance Nominated Adviser,

LLP Joint Broker +44 (0) 20 3470 0470

Richard Morrison / Charlie

Bouverat

Grant Barker / Richard Parlons

Hannam & Partners Joint Broker +44 (0) 20 7907 8500

Andrew Chubb / Matt Hasson

/

Jay Ashfield

Tavistock Financial PR +44 (0) 207 920 3150

Gareth Tredway / Tara Vivian-Neal

/ James Whitaker

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a vertically integrated primary vanadium

producer, it is one of only three operating primary vanadium

producers. In 2022, the Company produced 3,842 mtV, representing

more than 3% of the global vanadium market. With a diversified

vanadium product portfolio serving the needs of the steel, energy

and chemical sectors.

Detailed information on the Company and progress to date can be

accessed on the website www.Bushveldminerals.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDKLBFXLLLFBV

(END) Dow Jones Newswires

December 19, 2023 02:32 ET (07:32 GMT)

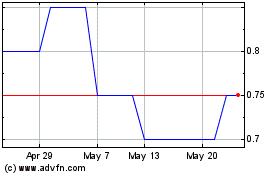

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024