TIDMKASH

Kasei Holdings plc

(`Kasei' or the `Company')

Posting of Annual Report and Notice of AGM

Kasei Holdings PLC (AQSE: KASH), a digital asset and web 3.0 investment company,

is pleased to confirm that the Annual Report & Accounts for the year ended 31

July 2023, together with the Notice of Annual General Meeting ("AGM") and a Form

of Proxy, will be posted to shareholders shortly.

The Annual Report & Accounts and the Notice of AGM are available on the

Company's website at https://kaseiholdings.com/

The Company's AGM will be held at Park House, 16-18 Finsbury Circus, London,

EC2M 7EB on 25 January 2024 at 4pm. For further information please contact:

+-------------------------------------------------+---------------------------+

|Kasei Holdings PLC |Jai.patel@kaseiholdings.com|

| | |

|Jai Patel | |

| | |

|Chief Investment Officer | |

+-------------------------------------------------+---------------------------+

|VSA Capital Limited (AQSE Corporate Adviser) |+44 (0)203 005 5000 |

| | |

|Simon Barton / Thomas Jackson (Corporate Finance)| |

+-------------------------------------------------+---------------------------+

About Kasei Holdings

Kasei is a team of experienced financial experts who came together through a

shared interest in the digital asset ecosystem and the belief that blockchain

technology will transform industries and have significant global economic

impact.

Kasei's cumulative 100 years plus experience in navigating traditional financial

markets, in particular highly volatile asset classes, provides the Company with

a solid grounding to build a balanced portfolio positioned to take advantage of

the disruptive innovation in this space.

Despite Kasei's belief that these assets are positioned for highly significant

long-term gains, the Company employ a balanced risk-and-reward strategy. This

provides shareholders with an actively managed portfolio of crypto assets, as

well as exposure to investments in blockchain enabled companies and technology,

all in the form of one listed security.

LinkedIn: Kasei Holdings PLC: Overview |

LinkedIn (https://www.linkedin.com/company/kasei-holdings

-plc/?originalSubdomain=uk)

For the Period Ended 31 July 2023

Introduction

Kasei Holdings PLC (AQSE: KASH) is a digital asset and Web 3.0 investment

company established in July 2021 to provide investors with broad based exposure

to the digital asset ecosystem.

Business review

Over the past 12 months, Kasei Holdings PLC. has navigated successfully the

volatile and dynamic landscape of the blockchain digital asset industry. The

company has strategically positioned itself during this period of uncertainty to

capitalise on emerging trends, regulatory developments, and technological

advancements in the blockchain space. This report provides a brief analysis of

Kasei Holdings performance, key investment decisions, market insights,

challenges faced, and future strategic directions in the blockchain digital

asset space.

The last 12 months has seen huge uncertainty within the crypto industry and has

seen a fall in the company's NAV which is down 12% on the previous year. However

during the year the company grew its income significantly from staking and

option writing during the period which accounted for £33k of the company's

turnover which was up significantly on the year previous. The management

acknowledges there is still a significant amount of ground to recover from, the

company is satisfied with its performance as it managed its costs and

investments during this volatile period in the industry. Kasei has strategically

positioned itself in key segments of the blockchain digital asset industry to be

able to capitalise on the implementation of blockchain technology in this

rapidly evolving sector.

Navigating the regulatory landscape has been a constant challenge waiting for

guidelines to ensure compliance with evolving legal frameworks. We believe this

proactive approach will pay off in the long term and will enhance the company's

credibility in the eyes of investors.

Looking ahead, as the industry continues to mature Kasei Holdings and its

management team remains confident in its focus on blockchain technology and

digital assets and aims to capitalise on market conditions and improving

sentiment around the approval of a Bitcoin ETF and the upcoming Bitcoin halving

which is anticipated to occur in April 2024 including the increased integration

of blockchain in traditional financial systems, further expansion into global

markets and many other industries.

Since the end of the financial year the company's NAV has seen a steady increase

and as of the 31st October 2023 it was up 8%.

Our portfolio as of 31st July 2023 was as follows:

Asset Quantity Price (£) Valuation (£)

BTC 27.73 22,740.09 630,582.66

BTC 258.31 1,444.03 373,004.39

ETHW 3.99 1.36 5.44

LINK 4,990.00 5.87 29,288.98

SOL 770.60 18.45 14,220.13

AR 2,502.45 4.24 10,611.97

USDT 40,032.39 0.78 31,153.26

USDC 15,080.00 0.78 11,731.76

ALGO 13,061.58 0.09 1,115.73

AVAX 1,026.71 9.98 10,247.96

QNT 2,500.00 85.04 212,599.19

HBAR 249,890.00 0.04 10,165.51

HNT 2,500.00 1.34 3,348.57

LUNA 30.20 0.45 13.66

LUNC 5,000.00 0.00 0.31

DAG 2,500,000.92 0.03 78,321.95

LTX 50,000.03 0.08 4,006.54

ADS 275,000.00 0.05 13,591.68

GBTC 6,000.00 14.86 89,156.28

Principal risks and uncertainties

The digital asset industry is in an early stage of growth and adoption and as

such carries significant risk. Asset prices are highly volatile and many of the

protocols may ultimately fail. As such it is imperative for a diversified

approach to be adopted as currently the winners are unclear. In addition, a

stringent risk management framework is essential. We believe that the board's

expertise in managing volatile asset classes stands us in good stead to navigate

the volatile landscape. The company continues to believe that significant growth

and adoption lies ahead and intends to navigate the many pitfalls diligently.

Security of holding digital assets also remains challenging. However, more and

more institutional grade custody solutions are appearing and the company

continues to monitor the landscape in order to ensure all measures are taken to

maximise security and custody of its assets using trusted partners and regulated

entities.

Bear markets and crypto winters are the perfect time for protocols to

concentrate on building and for investors to analyse which projects have been

battle tested and yet remain. As such we see the current malaise as an

opportunity to concentrate resources and focus on the opportunities that will

arise.

Financial key performance indicators

The company's business objective is to provide investors with broad based access

to the digital asset ecosystem. Holding assets in a diversified manner and using

yield generating strategies and stringent risk management has led to

outperformance vs a core strategy of holding BTC or ETH. The price performance

of Quant network (QNT), the company's largest altcoin position has been a key

highlight and has enhanced the company's commitment to focus on utility within

the asset class.

Directors' statement of compliance with duty to promote the success of the Group

This statement is intended by the Board of Directors to set out how they have

approached and met their responsibilities under s172(1)(a) to (f) of the

Companies Act 2006 in the year ending 31 July 2023.

Stakeholders of the Company include employees, shareholders, suppliers,

creditors of the business and the community in which it operates.

The Directors, both collectively and individually, consider that they have acted

in good faith to promote the success of the Company for the benefit of its

stakeholders as a whole (having regard to the matters set out in s172 of the

Act) in the decisions taken during the period. In particular:

To ensure that the Board take account of the likely consequences of their

decisions in the long-term, they receive regular and timely information on all

the key areas of the business including financial performance, operational

matters, health and safety, environmental reports, risks and opportunities. The

Company's performance and progress is also reviewed regularly at Board meetings.

The Directors' intentions are to behave responsibly towards all stakeholders and

treat them fairly and equally, so that they all benefit from the long-term

success of the Company.

The Directors have overall responsibility for determining the Company's purpose,

values and strategy and for ensuring high standards of governance. The primary

aim of the Directors is to promote the long-term sustainable success of the

Company, generating value for stakeholders and contributing to the wider

society. In the future, the Board will continue to review and challenge how the

Company can improve its engagement with its stakeholders.

This report was approved by the board and signed on its behalf.

Brendan Kearns Director

20th December 2023

Directors' Report

For the Period Ended 31 July 2023

The directors present their report and the financial statements for the year

ended 31 July 2023.

Directors' responsibilities statement

The directors are responsible for preparing the Group Strategic Report, the

Directors' Report and the consolidated financial statements in accordance with

applicable law and regulations.

Company law requires the directors to prepare financial statements for each

financial year. Under that law the directors have elected to prepare the

financial statements in accordance with applicable law and United Kingdom

Accounting Standards (United Kingdom Generally Accepted Accounting Practice),

including Financial Reporting Standard 102 `The Financial Reporting Standard

applicable in the UK and Republic of Ireland'. Under company law the directors

must not approve the financial statements unless they are satisfied that they

give a true and fair view of the state of affairs of the Company and the Group

and of the profit or loss of the Group for that period.

In preparing these financial statements, the directors are required to:

· select suitable accounting policies for the Group's financial statements and

then apply them consistently;

· make judgments and accounting estimates that are reasonable and prudent;

· state whether applicable UK Accounting Standards have been followed, subject

to any material departures disclosed and explained in the financial statements;

· prepare the financial statements on the going concern basis unless it is

inappropriate to presume that the Group will continue in business.

The directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy at any time the financial position of the Company and the

Group and to enable them to ensure that the financial statements comply with the

Companies Act 2006. They are also responsible for safeguarding the assets of the

Company and the Group and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

Principal activity

The principal activity of the Company in the year under review was that of an

investment company providing investors with broad based exposure to the digital

asset ecosystem.

Results and dividends

The loss for the year, after taxation, amounted to £283,744 (2022 - loss

£1,513,470). The Directors do not propose a dividend in respect of the year

ended 31st July 2023. Directors

The directors who served during the year were:

Bryan Coyne (appointed 9 July 2021)

Steven Davis (appointed 5 August 2021)

Brendan Kearns (appointed 28 July 2021)

Jai Patel (appointed 9 July 2021)

Jane Thomason (appointed 4 August 2021)

Future developments

The company intends to continue to leverage the Board's expertise to identify

compelling investments within the digital asset ecosystem.

Disclosure of information to auditors

Each of the persons who are directors at the time when this Directors' Report is

approved has confirmed that:

· so far as the director is aware, there is no relevant audit information of

which the Company and the Group's auditors are unaware, and

· the director has taken all the steps that ought to have been taken as a

director in order to be aware of any relevant audit information and to establish

that the Company and the Group's auditors are aware of that information.

Auditors

Under section 487(2) of the Companies Act 2006, Brindley Goldstein LTD will be

deemed to have been reappointed as auditors 28 days after these financial

statements were sent to members or 28 days after the latest date prescribed for

filing the accounts with the registrar, whichever is earlier.

This report was approved by the board and signed on its behalf.

Brendan Kearns Director

20th December 2023

Independent Auditors' Report to the Members of KASEI HOLDINGS PLC

Opinion

We have audited the financial statements of KASEI HOLDINGS PLC (the 'parent

Company') and its subsidiaries (the 'Group') for the year ended 31 July 2023,

which comprise the Consolidated Statement of Comprehensive Income, the

Consolidated Balance Sheet, the Company Balance Sheet, the Consolidated

Statement of Cash Flows, the Consolidated Statement of Changes in Equity, the

Company Statement of Changes in Equity and the related notes, including a

summary of significant accounting policies. The financial reporting framework

that has been applied in their preparation is applicable law and United Kingdom

Accounting Standards, including Financial Reporting Standard 102 `The Financial

Reporting Standard applicable in the UK and Republic of Ireland' (United Kingdom

Generally Accepted Accounting Practice).

In our opinion the financial statements:

· give a true and fair view of the state of the Group's and of the parent

Company's affairs as at 31 July 2023 and of the Group's loss for the year then

ended;

· have been properly prepared in accordance with United Kingdom Generally

Accepted Accounting Practice; and

· have been prepared in accordance with the requirements of the Companies Act

2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing

(UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards

are further described in the Auditors' responsibilities for the audit of the

financial statements section of our report. We are independent of the Group in

accordance with the ethical requirements that are relevant to our audit of the

financial statements in the United Kingdom, including the Financial Reporting

Council's Ethical Standard and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe that the

audit evidence we have obtained is sufficient and appropriate to provide a basis

for our opinion.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the directors' use

of the going concern basis of accounting in the preparation of the financial

statements is appropriate.

Based on the work we have performed, we have not identified any material

uncertainties relating to events or conditions that, individually or

collectively, may cast significant doubt on the Group's or the parent Company's

ability to continue as a going concern for a period of at least twelve months

from when the financial statements are authorised for issue.

Our responsibilities and the responsibilities of the directors with respect to

going concern are described in the relevant sections of this report.

Other information

The other information comprises the information included in the Annual Report

other than the financial statements and our Auditors' Report thereon. The

directors are responsible for the other information contained within the Annual

Report. Our opinion on the financial statements does not cover the other

information and, except to the extent otherwise explicitly stated in our report,

we do not express any form of assurance conclusion thereon. Our responsibility

is to read the other information and, in doing so, consider whether the other

information is materially inconsistent with the financial statements or our

knowledge obtained in the course of the audit, or otherwise appears to be

materially misstated. If we identify such material inconsistencies or apparent

material misstatements, we are required to determine whether this gives rise to

a material misstatement in the financial statements themselves. If, based on the

work we have performed, we conclude that there is a material misstatement of

this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinion on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

· the information given in the Group Strategic Report and the Directors'

Report for the financial year for which the financial statements are prepared is

consistent with the financial statements; and

· the Group Strategic Report and the Directors' Report have been prepared in

accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the Group and the parent

Company and its environment obtained in the course of the audit, we have not

identified material misstatements in the Group Strategic Report or the

Directors' Report.

We have nothing to report in respect of the following matters in relation to

which the Companies Act 2006 requires us to report to you if, in our opinion:

· adequate accounting records have not been kept by the parent Company, or

returns adequate for our audit have not been received from branches not visited

by us; or

· the parent Company financial statements are not in agreement with the

accounting records and returns; or

· certain disclosures of directors' remuneration specified by law are not

made; or

· we have not received all the information and explanations we require for our

audit.

Responsibilities of directors

As explained more fully in the Directors' Responsibilities Statement set out on

page 6, the directors are responsible for the preparation of the financial

statements and for being satisfied that they give a true and fair view, and for

such internal control as the directors determine is necessary to enable the

preparation of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are responsible for

assessing the Group's and the parent Company's ability to continue as a going

concern, disclosing, as applicable, matters related to going concern and using

the going concern basis of accounting unless the directors either intend to

liquidate the Group or the parent Company or to cease operations, or have no

realistic alternative but to do so.

Auditors' responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial

statements as a whole are free from material misstatement, whether due to fraud

or error, and to issue an Auditors' Report that includes our opinion. Reasonable

assurance is a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a material

misstatement when it exists. Misstatements can arise from fraud or error and are

considered material if, individually or in the aggregate, they could reasonably

be expected to influence the economic decisions of users taken on the basis of

these Group financial statements.

Irregularities, including fraud, are instances of non-compliance with laws and

regulations. We design procedures in line with our responsibilities, outlined

above, to detect material misstatements in respect of irregularities, including

fraud. The extent to which our procedures are capable of detecting

irregularities, including fraud is detailed below:

The objectives of our audit are to identify and assess the risks of material

misstatement of the financial statements due to fraud or error; to obtain

sufficient appropriate audit evidence regarding the assessed risks of material

misstatement due to fraud or error; and to respond appropriately to those risks.

Owing to the inherent limitations of an audit, there is an unavoidable risk that

material misstatements in the financial statements may not be detected, even

though the audit is properly planned and performed in accordance with the ISAs

(UK).

· In identifying and assessing risks of material misstatement in respect of

irregularities, including fraud and non- compliance with laws and regulations,

our procedures included the following:

· We obtained an understanding of the legal and regulatory frameworks

applicable to the Group and the industry

in which it operates. We determined that the following laws and regulations were

most significant: FRS 102 and the Companies Act 2006.

· We obtained an understanding of how the Group is complying with those legal

and regulatory frameworks by making enquiries of management.

· We challenged assumptions and judgments made by management in its significant

accounting estimates. We did not identify any key audit matters relating to

irregularities, including fraud.

A further description of our responsibilities for the audit of the financial

statements is located on the Financial Reporting Council's website at:

www.frc.org.uk/auditorsresponsibilities. This description forms part of our

Auditors' Report.

Use of our report

This report is made solely to the Company's members, as a body, in accordance

with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been

undertaken so that we might state to the Company's members those matters we are

required to state to them in an Auditors' Report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company and the Company's members, as a body, for our

audit work, for this report, or for the opinions we have formed.

Charles Goldstein (Senior Statutory Auditor) for and on behalf of

Brindley Goldstein LTD

Charted Accountants and Statutory Auditors Registered Auditors

103 High Street Waltham Cross London

EN8 7AN

Date:

[image]

The financial statements were approved and authorised for issue by the board and

were signed on its behalf on B Kearns

Director 20/12/2022

The notes on pages 22 to 34 form part of these financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 JULY 2023

Called Share Treasury Profit and Total

up premium shares

equity

account Otherloss

share £ £

capita £ reserveaccount

£ ££

At 1 August 290,617 3,796,753 - 157,500(1,513,470)

2,731,400

2022

Loss for the - - - -(283,744)

(283,744)

year

Other - - -14,153-

14,153

comprehensive

income

Unsubscribed - - (27,992)

(27,992)

shares --

Shares issued 41,667 150,424 ---

192,091

during the

year

At 31 July 332,284 3,947,177 (27,992) 171,653(1,797,214)

2,625,908

2023

The notes on pages 22 to 34 form part of these financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 JULY 2022

Called Share Other Profit and Total

up premium reserve equity

account loss

share account

capital

£ { £ £ £

Comprehensive

income for

the

year

Loss for the (1,513,470) (1,513,470)

year

Shares issued 290,617 3,796,753 4,087,370

during the

year

Other reserve 157,500 157,500

movement

At 31 July 290,617 3,796,753 157,500 (1,513,470) 2,731,400

2022

The notes on pages 22 to 34 form part of these financial statements.

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 JULY 2023

Called Share Treasury Other Profit

and

up premium shares

account reserve loss

share account

capital

£ £ £ £ £

At 1 August 2022 290,617 3,639,253

(1,513,023)

Loss for the year

(283,744)

Othercomprehensive 14,153

income

Unsubscribed (27,992)

shares

Shares issued 41,667 150,424

during the year

At 31July 2023 332,284 3,789,677 (27,992) 14,153

(1,796,767)

Total equity

£

At 1 August 2022 2,416,847

Loss for the year (283,744)

Other comprehensive income 14,153

Unsubscribed shares (27,992)

Shares issued during the year 192,091

At 31July 2023 2,311,355

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 22, 2023 09:56 ET (14:56 GMT)

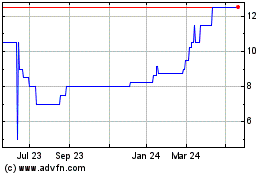

Kasei (AQSE:KASH)

Historical Stock Chart

From Nov 2024 to Dec 2024

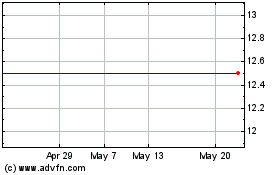

Kasei (AQSE:KASH)

Historical Stock Chart

From Dec 2023 to Dec 2024