Latest Findings Show A Reduction In Sell Off, Is A Bitcoin Rally Ahead?

October 17 2022 - 7:18AM

NEWSBTC

Bitcoin and the broader crypto market surprisingly performed over

the past week. At the beginning of the week, the market saw more

movements to the south in most crypto asset prices. A few hours

following the release of the US CPI data for September saw the

entrance of the bears into the market. However, almost all the

tokens had a reversal in the direction of the trend. The bull

suddenly appeared and forced massive volatility pushing the assets

to the north. Related Reading: Elrond (EGLD) Price May Break Past

$56 Hurdle – Here’s How The performance of the primary crypto

asset, Bitcoin, was calm throughout the weekend. Bitcoin sustained

its anchor at around $19,200 through the period. But some

participants in the industry are wondering about a possible turn

for the leading cryptocurrency. Possible Price Spike With Present

Indicators According to indicators from on-chain platforms, BTC

might record a more bullish trend soon. The sentiment is drawn from

the indication of the Bitcoin futures market. An analyst at

CryptoQuant, Dan Lim, gave some supporting explanations for this

positive trend expectation. According to him, the token currently

has low selling pressure in the futures market. Lim says there’s

been a drastic decline in the BTC amount transferred from spot

exchange to derivatives since October. He recalled that since the

fall in June, the volume continued to rise, but Bitcoin retained

its June low of $17,600. Currently, the volume is dropping sharply,

negating any occurrence of intense selling pressure. But, the

funding rates of Bitcoin futures have become negative in the

market. This was due to the decline in the price of BTC from

$22,000 to the $19K level. Comparing these occurrences with the

2019-2021 period shows a drop in the metrics showing a low activity

and demand in BTC futures market. According to Greatest_Tracker, a

CryptoQuant analyst, the indicator usually leads to a consolidation

and range phase period. However, the analyst noted that extreme

negative values might result in a short squeeze triggering a price

reversal for Bitcoin. Volatility Through Bitcoin Futures’ Stance

With the present condition of the Bitcoin futures, many predictions

revolve around the price of BTC. But some traders are anticipating

increased volatility following the market situation. Michael Van de

Poppe, a notable crypto trader, expected a price surge. However, he

wrote that following four months of consolidation in prices; it’s

possible to get massive market volatility. Van de Poppe noted that

some people still expect a more bearish trend, but an increased

northward move could be the odds. Related Reading: Algorand Social

Activity Reaches 13 Million – Time To Buy ALGO? But the worsening

global macroeconomic conditions bring contrary opinions for some

traders. Nicholas Merten, the founder of DataDash, indicated

concerns with macro factors. He reported that the Nasdaq Composite

went below its average performance for the first time in 14 years.

It recorded a weekly close below the 200-week moving average. The

trader noted that the crypto market, especially BTC, will face more

bearish trends in the future with such conditions. Featured image

from Pixabay and chart from TradingView.com

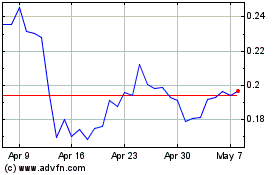

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024