Avalanche (AVAX) Tries Comeback, Unfazed By $2-B Market Cap Loss In Last 2 Weeks

August 27 2022 - 3:10AM

NEWSBTC

Avalanche (AVAX) has pushed forward with its its ascent, despite

market obstacles and negative circumstances over the past few

weeks. Analysis of the Avalanche price reveals a bearish trend AVAX

market sentiment remains bullish AVAX/USD trading at $20.57 as of

this writing Due to the unfavorable market conditions, its market

cap dropped by almost $2 billion over the last two weeks, but it is

now trying to recover. At the time of writing, Avalanche’s market

cap – at $5.8 billion – was below its monthly high but above its

monthly low. But with the market still trying to recover from last

week’s fall, will more value permeate the blockchain network now?

Related Reading: Polkadot Dev’t Activity Up In Last 7 Days, Despite

Steady Drop In DOT Price Avalanche Price Circling Support Line It

should be noted that for the past five days, AVAX has been circling

above its support line. Its rising range, during which it has been

oscillating for the last nine weeks, has the same support line. As

the cryptocurrency declines approaching the $22.62 level, Avalanche

price research reveals a bearish trend in the market. The $23.63

level is now acting as resistance for the AVAX/USD pair, and it

must be broken in order for the pair to go higher. But it’s likely

that the bears will take over the market and drive the price down

to the $22.52 support level. The one-day Avalanche price analysis

has verified a negative trend, and the price is now declining once

more. The AVAX/USD pair has been declining since last week and is

currently trading at $20.58. The price movement continues to be

contained by the two parallel trendlines, and the market is moving

in a descending channel formation. If the selling pressure

persists, the price is predicted to continue falling and may

potentially breach the $22.52 support level. Chart: TradingView.com

AVAX Price Experiences High Level Of Uncertainty The current price

level of AVAX underlines the high degree of uncertainty. The

fact that the price has repeatedly tested the same support line is

what causes the doubt. Therefore, there is a chance of support

weakness. Despite the market’s uncertainties, AVAX’s market

sentiment is currently shifting in favor of the bulls. This was

made clear by the weighted sentiment indicator on August 21 after

it had previously declined during the bearish performance the

previous week. The market is clearly in a negative trend, as

evidenced by the 4-hour price chart for Avalanche price analysis.

Related Reading: Shiba Inu Burn Events Spark A Rally In Altcoin

Over The Past Weeks The market is losing momentum and is

anticipated to move lower in the near future, and the declining

volume is another sign of this. On the other hand, the bulls may

force the price up to retest the $23.63 resistance level if they

can seize control of the market. The signal line is going above the

histogram, which is a negative indication, according to the Moving

Average Convergence Divergence (MACD) indicator. Another sign that

the market is bearish is that the Relative Strength Index (RSI)

indicator is below the 50 level. $21.15 and $22.06 are the 50-day

and 200-day moving averages, respectively. AVAX total market cap at

$5.82 billion on the daily chart | Source: TradingView.com Featured

image from The Daily Hodl, chart from TradingView.com

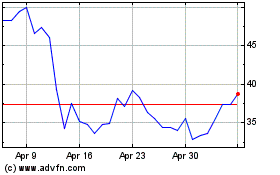

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

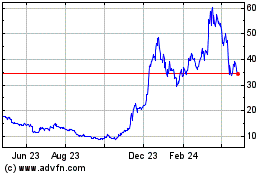

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024