Stacks (STX) Rockets 26% Higher In A Single Week: The Factors At Play

October 21 2023 - 2:46AM

NEWSBTC

The price of Stacks (STX) experienced a sustained rebound, driven

by a prevailing sentiment of positivity within the cryptocurrency

sector. STX had a significant increase, reaching a peak of $0.680,

which represents the highest value observed since July 14th. Stacks

is a layer-1 blockchain solution aiming to enable smart contracts

and decentralized applications on the Bitcoin network without

altering its core features, like security and stability. It

operates through the Stacks token (STX), which powers smart

contract execution, transaction processing, and asset registration

on the Stacks 2.0 blockchain. This enhances Bitcoin’s capabilities

without requiring a fork or changes to its original blockchain.

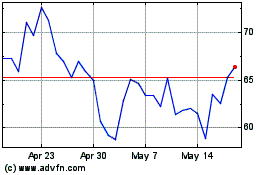

Stacks (STX) Racks Up 26% Gain At the time of writing, STX was

trading at $0.640, up 1.5% in the last 24 hours, and registering a

solid 26% increase in the last seven days, data from crypto market

tracker Coingecko shows. STX price action today. Source: Coingecko

The surge in STX is attributed to the prevailing optimism among

investors on the potential acceptance of a spot Bitcoin ETF by the

US Securities and Exchange Commission. Related Reading: Bulls

Thrust Solana To $25 – What Traders Should Expect Next In a recent

statement, Gary Gensler affirmed that the agency is currently

engaged in an ongoing examination of the various proposals for

exchange-traded funds (ETFs). It is widely anticipated by analysts

that the commission is likely to provide approval to proposals put

up by established ETF companies such as Blackrock, Invesco,

Infidelity and Franklin Templeton. STXUSD trading at $0.636 on the

weekend chart on TradingView.com This expectation is influenced by

their considerable knowledge and experience in the exchange-traded

fund (ETF) sector. Given its previous setbacks in lawsuits against

Grayscale and Ripple Labs, the SEC also hopes to head off any

prospective legal challenges. Meanwhile, Peter Schiff tweeted this

week that the price of bitcoin might rise ahead of the ETF

approval, only to fall afterward. Buying rumors and then selling

them as news is a common practice. How many times can #Bitcoin

rally on the same ETF rumor? Once a U.S. Bitcoin EFT is approved,

or $GBTC is able to convert into an ETF, there will be no more

“good” news for Bitcoin to rally on. After years of buying the

rumor, everyone will finally be able to sell the news. — Peter

Schiff (@PeterSchiff) October 16, 2023 Analysts’ Outlook For STX A

significant number of cryptocurrency traders utilizing platform X

exhibit a favorable perspective towards STX. DaanCrypto expresses a

positive outlook regarding the possibility of a substantial

increase in the STX price, contingent upon its ability to surpass

the resistance level of $0.52. $STX Not looking bad on the higher

timeframe. Had this huge run up early in the year and has since

come down to test the high timeframe support area. Needs to break

above $0.52 to break out of this consolidation. Below $0.44 is the

danger zone. pic.twitter.com/tGI6AeZZWN — Daan Crypto Trades

(@DaanCrypto) October 14, 2023 Nevertheless, the author cautions

that a negative trajectory might potentially emerge in the event

that the price descends below the threshold of $0.42. Related

Reading: Why Is Bitcoin SV (BSV) Up 63% Today? Find Out Here Crypto

Tony holds a positive outlook for the cryptocurrency, but his

approach differs from the previous trader. He emphasizes a bullish

ascending triangle pattern for the altcoin instead of placing the

same emphasis on horizontal long-term levels. $STX / $USD – Update

Break above 0.53c would be a trigger for a long position legends.

Love the structure we are forming so far pic.twitter.com/Gd4xBYptGi

— Crypto Tony (@CryptoTony__) October 8, 2023 This indicates his

expectation for potential upward price movement, as ascending

triangles are typically seen as bullish patterns with the potential

for a breakout to higher price levels. This analysis showcases the

diversity of trading strategies and technical indicators in the

cryptocurrency market. (This site’s content should not be construed

as investment advice. Investing involves risk. When you invest,

your capital is subject to risk). Featured image from Cute

Wallpapers

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024