Bitcoin Confidence Grows As Binance Data Highlights Surprising Market Trends

December 14 2024 - 4:30AM

NEWSBTC

A recent report by a CryptoQuant analyst, known as Crazzyblockk has

explored the implications of Bitcoin inflow metrics at Binance and

their potential impact on market sentiment. The analysis offers

insights into how short-term and long-term participants view the

current state of the market. The analysis also comes as BTC’s price

maintains its price above $100,000, after reclaiming it few days

ago. Related Reading: Key Indicators Signal Bitcoin’s Next Move:

Should Investors Brace For A Market Shift? BTC Market Sees Optimism

Amid Binance Inflow Trends Binance, recognized as one of the

largest cryptocurrency exchanges globally, remains pivotal in

shaping Bitcoin’s trading landscape. According to Crazzyblockk, the

average realized price for Bitcoin deposits into Binance currently

stands at $63,000. Despite this high historical price level, the

Inflow CDD (Coin Days Destroyed) metric remains low. This data

indicates a notable pattern among Bitcoin investors, showcasing a

“nuanced interplay” between market confidence and trading activity.

Crazzyblockk revealed that the low Inflow CDD metric reveals that

Bitcoin deposits into Binance primarily come from short-term

holders or new market entrants rather than long-held coins. This

trend suggests that long-term investors continue to adopt a “hodl”

strategy, refraining from liquidating their assets despite

Bitcoin’s price volatility. The analyst added that this reluctance

of seasoned investors to sell their holdings points to a sustained

belief in Bitcoin’s long-term potential. Crazzyblockk wrote: Such

trends reflect a reduction in selling pressure and growing optimism

in the market. Binance’s ability to attract substantial inflows

further cements its reputation as a trusted exchange, making it a

critical hub for both institutional and retail investors in the

evolving cryptocurrency landscape. Bitcoin Market Performance And

Outlook Bitcoin so far continues to maintain its price above the

$100,000 price mark. Although it recently attempted to renew its

all-time high (ATH) of $103,679 after trading above $102,00 earlier

this week, it has again faced correction now trading for $101,090.

This trading price puts BTC to 2.7% decrease away from its peak and

a 0.5% decline in the past day. Regardless of these corrections, a

recent analysis by a CryptoQuant analyst known as Datascope has

revealed that the Bitcoin Bull-Bear Market Cycle Indicator is

currently within the bull market. Related Reading: Sell Bitcoin

When This Happens, Warns Analyst—Here’s What to Watch For The

analyst also added: As long as the 30-day Bull-Bear Market Cycle

Indicator moving average remains above the 365-day Bull-Bear Market

Cycle Indicator moving average, the long-term outlook will stay

positive. Meanwhile, VanEck, one of the largest investment

management firms in American, has recently predicted an ambitious

$180,000 price target for BTC should the US eventually launch a BTC

reserve. JUST IN: $118 billion VanEck predicts $180,000 #Bitcoin

and the U.S. will embrace a Strategic BTC Reserve in 2025 🇺🇸

pic.twitter.com/s7lnNgkyhn — Bitcoin Magazine (@BitcoinMagazine)

December 13, 2024 Featured image created with DALL-E, Chart from

TradingView

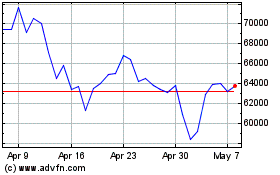

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024