Cboe’s New Cash-Settled Bitcoin ETF Options: Could This Spark A Move Beyond $100,000?

November 23 2024 - 5:00AM

NEWSBTC

Cboe, the derivatives exchange for digital assets and securities

trading, is set to make a big addition to the crypto landscape by

launching the first cash-settled index options linked to Bitcoin’s

(BTC) spot price movements. Scheduled to debut on December 2, these

options will be based on the Cboe Bitcoin ETF Index, which tracks a

selection of US-listed spot Bitcoin exchange-traded funds.

What This Means For Traders The introduction of these options

follows closely on the heels of Nasdaq’s recent listing of spot

Bitcoin ETF options. This move allows US investors to utilize

derivatives to speculate on or hedge against BTC’s price

movements. Related Reading: XRP Price Outlook Brightens:

Expert Predicts $2 Target Post-Gensler Era Alex Thorn, head of

firmwide research at Galaxy Digital, emphasized that reducing

Bitcoin’s volatility could significantly alter investor

perceptions. The availability of cash-settled options will provide

institutions with effective tools to hedge their positions,

potentially increasing overall market liquidity. This influx

of options trading could also influence retail trading behavior,

especially during bullish market conditions. Notably, the current

surge in Bitcoin’s price, which reached an all-time high of

$99,300, has been partly attributed to increased trading activity

and market optimism. Therefore, introducing cash-settled

options could further push Bitcoin over the $100,000 mark,

especially given the increased buying pressure seen in recent

days. Cboe’s options on the Bitcoin ETF Index will also

enable market participants to gain exposure to spot Bitcoin ETFs

and, by extension, to Bitcoin itself. The cash-settled nature of

these options is said to simplify the process, as positions will be

resolved in cash at expiration. Additionally, the options

will feature a “European-style exercise,” meaning they can only be

exercised on the expiration date, thus minimizing the risks

associated with early assignment. Cboe Mini Bitcoin ETF Options In

conjunction with the standard-sized index options, Cboe plans to

launch Cboe Mini Bitcoin ETF Index options (Ticker: MBTX), valued

at one-tenth the notional value of the standard options.

Moreover, Cboe will also offer cash-settled FLEX options on both

the standard and mini index options. FLEX options enable traders to

customize key contract terms such as exercise price, exercise

style, and expiration date, providing further flexibility in

trading strategies and allowing for larger positions than typically

permitted with standard options contracts. Related Reading:

Dogecoin Price Set To Skyrocket By Saturday, Warns Crypto Analyst

Rob Hocking, Cboe’s Global Head of Product Innovation, highlighted

the benefits of cash settlement and the variety of index sizes

available, which are expected to attract institutional and retail

participants looking to hedge or capitalize on Bitcoin’s price

movements without directly holding the asset. The exchange already

lists cash-settled Bitcoin and Ether margin futures on Cboe Digital

Exchange, with plans to transition these products to the Cboe

Futures Exchange in the first half of 2025, pending regulatory

approval. Cboe’s BZX Equities Exchange also holds a leading

position in the US market for spot crypto ETFs, having captured a

majority market share of available Bitcoin and Ethereum ETFs. When

writing, the market’s leading cryptocurrency is trading at

$99,240. Featured image from DALL-E, chart from

TradingView.com

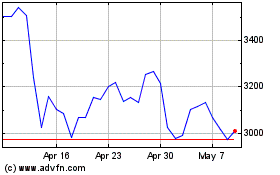

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024