Cardano Whales Buy The Dip – Metrics Show Increasing Demand

November 27 2024 - 1:00PM

NEWSBTC

Cardano (ADA) has captured investors’ attention after surging to

multi-year highs at $1.15, marking an impressive 245% gain since

November 5. This remarkable rally has solidified its position as

one of the top-performing altcoins in the current market cycle. As

the broader cryptocurrency market undergoes consolidation, Cardano

continues to stand out with bullish momentum that could signal

further upward movement in the coming days. Related Reading:

Bitcoin Leverage Remains High – Data Reveals Selling Pressure Above

$93K Top analyst and investor Ali Martinez recently shared a

technical analysis on X, highlighting a significant accumulation of

ADA by whales. According to Martinez, large investors have been

aggressively buying Cardano, particularly during the weekend’s

price dip, a move that underscores growing confidence in the

asset’s potential. The next few days will be critical for ADA as it

navigates a consolidating altcoin market poised for its next major

move. Investors are closely watching Cardano’s ability to maintain

its bullish structure and capitalize on the heightened interest

from whales. Should the market turn favorable, ADA could set its

sights on new highs, reinforcing its status as a key player in the

altcoin space. With whales accumulating and market conditions

aligning, Cardano’s future remains one of the most exciting

narratives in the crypto landscape. Cardano Large Holders

Accumulating Cardano is showing strong signs of bullish momentum as

large holders, commonly referred to as whales, increase their

buying activity. According to data from blockchain analytics firm

Santiment, these whales, defined as entities holding over 100

million ADA, accumulated more than 130 million tokens during the

recent price dip. Top analyst Ali Martinez brought attention

to these metrics on X, emphasizing the importance of whale activity

in shaping ADA’s market trajectory. Martinez notes that this level

of accumulation is a clear signal of confidence from large-scale

investors, suggesting that the current rally still has room to

grow. Cardano’s price, which recently hit a multi-year high of

$1.15, could see continued surges as whales add buying pressure to

the market. Despite the bullish outlook, some analysts believe a

retracement below the $1 mark could provide a healthier foundation

for ADA’s next major move. Such a pullback would allow the market

to consolidate and shake out weaker hands, creating stronger demand

zones for the next rally. Related Reading: Ethereum Analyst

Predicts $3,700 Once ETH Breaks Through Resistance With whales

leading the charge and metrics indicating rising demand, Cardano’s

bullish trend appears well-supported. The coming days will likely

determine whether ADA can maintain its upward trajectory or if a

temporary correction will pave the way for its next leg up.

Investors are closely watching key levels, with optimism that

Cardano will continue to outperform as the altcoin market remains

in focus. ADA Testing Liquidity Around $1 Cardano is trading at

$0.99, marking a 24% retrace from its recent local highs of $1.15.

Despite this dip, the price action suggests ADA is testing a

crucial supply zone near the $1 mark, a key psychological and

technical level. Reclaiming and holding above this level in the

coming days would confirm the continuation of the broader bullish

breakout, signaling renewed strength for Cardano. If ADA

successfully maintains support above $1, it could pave the way for

a swift move back toward $1.15 and potentially beyond as the

bullish trend regains momentum. This level is being closely

monitored by traders and investors as a marker of resilience, with

further upward price action expected if ADA demonstrates strength.

Related Reading: Bitcoin Realized Profit Hits ATH At $443 Million –

Local Top Or Continuation? However, a temporary consolidation below

$1 should not be seen as a bearish indicator. Instead, such a move

could allow the market to establish stronger demand zones and

provide a healthier base for ADA’s next rally. Consolidation phases

are often vital in sustaining long-term price trends and shaking

out weaker hands. As the market evaluates these critical levels,

ADA’s price trajectory will likely depend on whether it can break

and hold above $1 or consolidate before the next major move.

Featured image from Dall-E, chart from TradingView

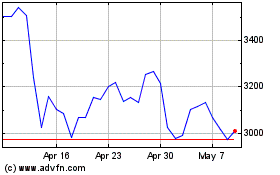

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024