Ethereum Shapella Upgrade Expected To Boost Liquid Staking Protocols

April 06 2023 - 12:32PM

NEWSBTC

In decentralized finance (DeFi), Ethereum (ETH) liquid staking has

become a significant market valued at over $15 billion. This market

is set to see a significant boost with the upcoming Shapella

upgrade, which is expected to unlock the entire liquid staking

market in less than a week, according to DeFi researcher Thor

Hartvigsen. Liquid staking allows users to earn staking rewards

while maintaining the flexibility to use their stakes assets for

other purposes. It’s a win-win situation for both the protocol and

the user, as it helps to secure Ethereum’s network while generating

additional revenue for the user. With this said, what protocols are

better positioned to benefit from the next Ethereum Shapella

upgrade? Related Reading: Can Dogecoin Rally Further? Here’s What

On-Chain-Data Says 3 Protocols To Watch Ahead Of Ethereum Shapella

Upgrade Liquid staking has become an increasingly popular way for

investors to earn rewards on their Ethereum holdings while

maintaining flexibility in their usage. According to Hartvigsen,

since the start of the year, the total amount of ETH staked via

liquid staking has increased by a significant 21%, from 6.8 million

to over 8 million ETH. However, despite the benefits of

liquid staking, there has been a lingering concern among investors

regarding the risk of being unable to unstaked or redeem their

liquid-staked assets at their true value. Fortunately, the upcoming

Shapella upgrade is set to address these issues. According to

Hartvigsen, few protocols have gained market share and are well

positioned to continue the increasing trend of liquid staking

post-Shapella. These protocols include: Rocket Pool is a DeFi

staking network that allows users to stake any amount of ETH,

regardless of the size of their holdings. The platform has been

gaining traction in the market, as evidenced by its recent Q1

stats. In the first quarter of the year, Rocket Pool saw an

inflow of 90,000 ETH staked on the protocol, a significant increase

from the previous quarter and indicative of the growing demand for

liquid staking services. Rocket Pool’s market share increased from

4.9% to 5.3% in the first quarter. Lido Finance is a liquid

staking protocol that allows users to stake their ETH and receive a

tokenized representation of their staked ETH, known as stETH. The

platform has been gaining momentum in the market. In the

first months of the year, Lido Finance saw an inflow of 1.09

million ETH staked on the protocol, representing a significant

increase of over 22% from the previous quarter. Despite a slight

decrease in market share from 74% to 72%, Lido Finance remains a

dominant player in the liquid staking market, according to

Hartvigsen. In addition, Lido Finance’s native token, LDOUSD,

has seen a significant increase in value. It has risen by 152% in

the first quarter. StakeWise is also well-positioned ahead of

the upcoming Shapella upgrade. StakeWise is a prominent DeFi

staking platform that allows users to stake ETH and receive a fixed

interest rate. The platform has been steadily gaining popularity in

the market. In Q1, StakeWise saw an inflow of 10,000 ETH staked on

the protocol, according to Hartvigsen, representing a solid

increase of 12% from the end of 2023. Furthermore, the platform

generated $1.68 million in fees during the first quarter. In

addition to its strong market performance, StakeWise’s native

token, SWISEUSD, has seen a significant increase in value, which

has risen 128% in the first quarter of 2023. According to

Hartvigsen, as the Ethereum liquid staking market expands, each

protocol has arguments for future growth. According to the

researcher, the ETH liquid staking market is set to experience

significant growth in the coming months and years. Related

Reading: BNB Remains Under Pressure As Regulators Crack Down On

Binance

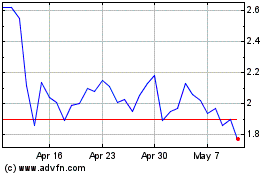

Lido DAO Token (COIN:LDOUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lido DAO Token (COIN:LDOUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024