Ethereum Sports Bearish Signals As Crypto Market Shifts Back Into Fear

March 03 2022 - 5:00PM

NEWSBTC

Ethereum has mostly mirrored bitcoin’s run in the recent rally.

This has seen the digital asset break as high as $3,000 once again

for the year. This point which has proved elusive for the

cryptocurrency has continued to give it a hard time. In previous

times, Ethereum has had a had time staying above this level. Such

has been the case this time around as it fails to secure its spot

above e$3K. Ethereum On The Decline Like all other

cryptocurrencies, Ethereum is a highly volatile asset and as such

is subject to wild fluctuations in its price. For the last few

months, it has fluctuated but remained mostly around the $2,600 to

$ 2,800=0 level. With the recent rally, it was finally able to

break out of this trend and begin a whole new one, one which saw it

rise above the coveted $3K level. Related Reading | TA:

Ethereum Prints Bearish Pattern, Why It Could Correct To $2.8K

Nevertheless, this recovery would prove to be short-lived given

that ETH could not maintain this position. Meeting fierce

resistance from the bears at the $3,000 point, the digital asset

was unable to form any meaningful support above it. This meant that

the price crumbled below it but it would prove to be a continuous

downward trend given the current indicators. The fall below $3k saw

the digital asset trading below its 50-day moving average. Now,

this is an incredibly important point for cryptocurrencies in

general given their high volatility. Since buyers are unwilling to

purchase the digital asset at prices they did over the past few

weeks, it indicates that Ethereum is still a seller’s market. Thus,

it is expected that there will be a continuous downtrend as more

coins are dumped on the market. ETH falls below $3k | Source:

ETHUSD on TradingView.com This however does not spell bad news all

around though. A market like ETH’s can quickly switch up and turn

into a buyer’s market, especially when prices are as low as they

are right now. If this happens, then Ethereum could very well see

another 10% bounce that will cement its position above the $3k

resistance point. Market Sentiments Falls To Fear The Fear &

Greed Index had moved out of the fear territory back into a neutral

point at the start of the week but this new wave of positive

sentiment did not hold. The index has now moved back into fear at a

current score of 39 as at the time of this writing, showing that

despite recent rallies, investor sentiments are still more negative

than anything. Related Reading | Terra (LUNA) Outperforms

Popular Cryptos Ether, Dogecoin In The Past 24 Hours Ethereum and

the crypto market are directly affected by investor sentiment as

they show when investors are likely to put money in the market.

Currently, with the index in fear, it shows that investors are very

wary of putting money in the market. However, this does not

necessarily spell bad news for ETH. Market sentiments drop to fear

| Source: Alternative.me Usually, when most investors are fearful,

it can present a good buying opportunity. In the past, whales have

been known to take advantage of moments like these to fill their

bags. If so, then ETH can kickstart another rally. But only a large

absorption of current supply can start the digital asset on this

path. Featured image from CNBC, chart from TradingView.com

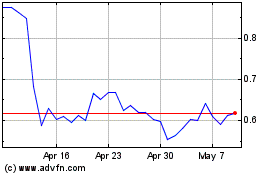

Terra (COIN:LUNAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Terra (COIN:LUNAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024