Luna Classic Faces Strong Resistance At This Level – Can Bulls Barrel Through?

February 09 2023 - 8:14AM

NEWSBTC

Altcoins in the crypto space have been seeing a lot of volatility

lately as major cryptocurrencies Bitcoin and Ethereum face

resistances which hindered their growth. Luna Classic, the revival

attempt of the Terra Luna ecosystem, is one of those tokens that is

facing losses in the short term. According to CoinGecko, the

token has depreciated by 4% in the daily time frame which might be

a sign that things might get bleaker for investors. Previously

known as Terra Classic, the old chain’s native coin is now known as

Luna Classic (LUNC). Released in May 28 last year, it followed the

establishment of the genesis block on the new chain that resulted

from the fork. LUNC, which was formerly known as LUNA, is a

stablecoin that serves the same purpose as the original Terra Luna

coin and maintains the value of the Terra Classic stablecoin,

TerraUSD (UST). Related Reading: This Little-Known Crypto Erupts

1,300% In Last 24 Hours – Find Out Here Positive Developments

Contradict Bears The Twitter space for LUNC has been particularly

bullish lately. KuCoin, one of the biggest exchanges in the market,

has recently entered the Luna Classic chain as a validator. This is

a complete turnaround in sentiment in Luna Classic. One of

the largest centralized exchanges #KuCoin has now entered the $LUNC

chain once again as a validator 👀 pic.twitter.com/kAqtr4ANma —

Classy 🔮 (@ClassyCrypto_) February 8, 2023 Due to the massive

staking of KuCoin on-chain, LUNC has reached almost 14% of the

total supply being staked. This could signal a positive sentiment

built around the ecosystem. Santiment is noting a strong

development force supporting the LUNC bulls. GM #LUNC👋 HUGE

STAKING EVENT!🚀 KuCoin is BACK With 47.8 BILLION $LUNC Delegated

Taking the #5 Spot & Pushes the Total #LUNACLASSIC Staked to

940B at 13.69%🔥 Next Goal: 1 TRILLION #LUNC Staked!

pic.twitter.com/wR69BtMCyw — The Millennial Market (@TMMcryptos)

February 8, 2023 Since October 2022, the ecosystem has been

experiencing strong development activity, reaching a peak last

month, January 15th. UST, Terra Luna’s stablecoin that made

the crypto industry lose billions, is also being planned to be

re-pegged to $1. If this re-peg of the stablecoin is successful, it

might help bring more bullishness on LUNC. The burning of the token

should also give a boost as it nears 40 billion LUNC burnt.

Chart: TradingView Rejection At $0.0002091 Drives LUNC Downwards

Bearish or not, the token’s current rejection certainly had an

effect on LUNC’s ability to break through the current

resistance level at $0.00020916. However, the token’s support at

$0.00016897 might hold even as the bearish momentum

continues. For the token to continue its climb, LUNC should

close above $0.00016897 support as a break on this support might

make the token revert to $0.00015115. Investors and traders should

also monitor the token’s correlation with major

cryptocurrencies. LUNC total market cap at $1 billion on the

daily chart | Chart: TradingView.com Related Reading: Shibarium

Hype Hits Its Peak As 1.3 Million Wallets Hold SHIB At the time of

writing, it has a strong correlation with Ethereum which has

currently entered a consolidation period above $1.6k. If ETH bears

break through this support, we might see LUNC follow the top

altcoin. LUNC bulls should watch internal and external

developments as this could either give confidence or spark

skepticism for token’s price movement. For now, investors and

traders should focus on strengthening the token’s current support

with a possible target above $0.00020916. But LUNC bulls should

brace for short to medium term pain as the token has a chance to

decline in the coming days. -Featured image from Telegaon

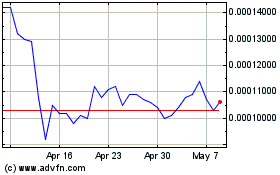

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024