Bitcoin Leverage: Lack Of Liquidations Could Indicate Another Wave Of Selling

January 26 2022 - 5:00PM

NEWSBTC

Bitcoin finally broke below the $40K point this past weekend. This

had sent the cryptocurrency back towards six-month lows. One thing

though was that liquidations or the digital asset remained lower

than expected. The current liquidation volumes lay well below the

volumes that have accompanied previous crashes like this one. This

could be a very important indicator for the market. Bitcoin

Liquidations Remain Low In Shakeout Previously, whenever the price

of bitcoin had dumped this hard, liquidation volumes have quickly

risen. This is due to the massive sell-offs that follow such

crashes as investors try to get out of a bleeding market. This time

around, bitcoin liquidation volumes have not jumped. They remain

really low, indicating that maybe investors were not done selling

their holdings. Related Reading | Has Bitcoin Reached Its

Bottom? Analyst Says It Still Has A Long Way To Go If this is the

case, then there may be more downside coming as the week runs

toward the end. Massive sell-offs have already sent the digital

asset to lows not seen since mid-last year. Another round of

sell-offs could end up pushing the cryptocurrency’s value down

below $30K. Last Friday, when the price of BTC had successfully

broken below $40,000, the bitcoin futures and perpetual markets

were rocked by liquidation. By the time the beginning of the

weekend rolled around, over $854 million in long liquidations were

already recorded. This may seem like a lot but compared to previous

iterations of this type of shakeout, liquidations have fallen

short. BTC liquidation volumes fall short of expectations | Source:

Arcane Research May 2021 was the last time that BTC’s price had

taken a similar plunge. In total, the market saw $4.8 billion worth

of liquidated longs across the market. Indicating that the sell-off

in May was more intense than those recorded in January of 2022. One

explanation for the low liquidation volumes is that traders were

able to re-allocate and add collateral to underwater trades, given

that they’ve had more time to reassess their positions. Where Are

The Liquidations Happening? Another reason for the low liquidation

volumes could be the data available for analysis. Back in May 2021,

crypto exchanges like Binance and ByBit had their bitcoin

liquidation data out for anyone who wanted to have a look. Since

then, there has been a change by both exchanges where they now

restrict their liquidation. Now, analysts are having to guesstimate

liquidation volumes using historical data from the exchanges. BTC

price begins uptrend | Source: BTCUSD on TradingView.com Binance

still retains dominance of the market, thus, not having access to

the crypto exchange’s bitcoin liquidation data could severely

affect the volumes of liquidations being reported. The crypto

exchange’s dominance in the market has risen since before its data

was restricted, suggesting an even larger pool of liquidations that

are not being reported correctly. Related Reading | Bitcoin

Whales Take Advantage Of Market Crash To Gobble Up Millions In BTC

Nevertheless, the liquidations have spilled into other spaces in

the industry. Decentralized finance (DeFi) did not escape the

onslaught in the least as it was also rocked by liquidations.

Featured image from Bitcoin News, charts from Arcane Research and

TradingView.com

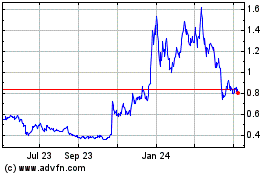

Mina (COIN:MINAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024