OHM Holders Wake Up To Blood, How This OlympusDAO Whale Sank Its Price by 44%

January 17 2022 - 12:00PM

NEWSBTC

In 2021, Ethereum based OlympusDAO and its native token OHM

exploded as the protocol onboarded new users seeking to leverage

its high annual percentage yield (APY). At its peak, the price of

OHM went from $330 to an all time high of $1,639, but the asset

seems to be on a downward trend since October last year. Related

Reading | Why This Token Thrives With A 38% Profit While

Bitcoin And Ethereum Bleed According to Wu Blockchain, a OlympusDAO

Whale triggered a cascade of liquidations on the protocol during

today’s trading session. This led to a 44% crash in OHM’s price

within an hour. At this time, the APY offered to OHM holders stood

at around 190,000%. As reported by NewsBTC, OlympusDAO is an

algorithmic currency protocol that was classified in 2021 as high

risk, but with the potential to display a “countercyclical” price

behavior by research firm Delphi Digital. In other words, OHM’s

price could move against the general sentiment in the market.

However, OHM seems to have been unable to meet its potential or at

least seems to have failed at appreciating as the crypto market

trends to the downside. OHM’s price action has been driven by early

investors taking profits on their gains. User Freddie Raynolds

identified the Ethereum transaction used by a “savage” OlympusDAO

user to dump $11 million in OHM. The transaction caused a 25%

slippage and $5 million in liquidations for this asset, as Raynolds

reported via his Twitter account. Recorded on the Ethereum

blockchain 12 hours ago, the OHM holder used decentralizaed

exchange SushiSwap to swap over 82,526 OHM tokens for $11 million

in DAI. The transaction was tracked down to a pseudonym holder

called “el sk”, @shotta_sk, on social network Twitter. The OHM

whale apparently sold part of his funds to “survive” the current

crypto market conditions. Via Twitter, he claimed the following:

Derisked some of my OHM to ensure my family can weather any

economic outcome. Remaining risk on with the rest indefinitely.

Perfect Time To Get Into OlympusDAO? OlympusDAO experienced an

increase in its number of users, its treasury assets, and total

value locked (TVL) during 2021. Thus, some users claimed that

today’s OHM crash should be leverage as a buying opportunity. The

protocol and its team behind have set out to create “the reserve

currency for DeFi” with their 3,3 mechanism and the introduction of

new features, including an incubator and a pro version of the

platform. However, the protocol has seen a lot of criticism.

Related Reading | Why this OlympusDAO’s product could be

amongst DeFi most lucrative The CIO of Selini Capital Jordi

Alexander published a two-part article on OlympusDAO, OHM, and its

3,3 mechanism. Therein, Alexander refers to the protocol as a

“ponzi”. Addressing the possibility that his article affected OHM’s

performance, he said: Only selling affects price, there’s no

shorting so only whale holders can sell lots. So, you can ask them

if they cared, but I imagine they were looking for an exit anyway-

Price has been in a big downtrend for weeks.

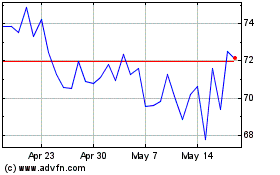

Olympus (COIN:OHMUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

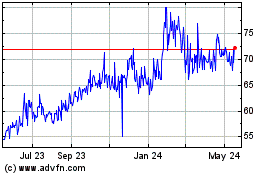

Olympus (COIN:OHMUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Olympus (Cryptocurrency): 0 recent articles

More Olympus News Articles