On-Chain Data Reveals Binance’s Strategy Behind Massive Ethereum And Solana Sell-Off

February 26 2025 - 4:30PM

NEWSBTC

As the broader cryptocurrency market grapples with significant

downturns, Ethereum (ETH) and Solana (SOL) have emerged as some of

the hardest-hit assets among the top ten digital currencies.

On top of that, recent allegations by market experts on social

media suggest potential market manipulation by major players in the

space, raising further concerns for investors. Ethereum Falls Below

$2,600: Potential End To Altseason Over the past few days, on-chain

data has surfaced, indicating large-scale selling of Ethereum and

Solana tokens primarily by Binance (BNB), the world’s largest

cryptocurrency exchange. Market expert Crypto Rover

highlighted that these sales, which occurred over a span of just 48

hours, have contributed to a staggering 7% drop in Ethereum and a

12% decline in Solana’s value. Related Reading: Bitcoin Crashes:

Experts Warn Of 6-Month Slump To $73,000 Ethereum has now breached

its critical support level of $2,600, a point that analysts like

Ali Martinez caution could signal the end of the altcoin season if

confirmed on higher time frames. Martinez notes that the next

significant threshold for the Ethereum holders is set at $2,300;

falling below this level could jeopardize the psychologically

crucial $2,000 mark. For Solana, the situation is similarly dire.

The asset has retraced below its major support level at $150,

settling around $140. This decline represents a considerable 51%

gap from its all-time high of $293 reached in January. The bearish

sentiment surrounding Solana is further underscored by a stark drop

in network activity. Martinez pointed out that Solana’s active

addresses have plummeted by 60%, falling from an impressive

all-time high of 18.5 million in October to just 7.3 million.

Market Manipulation Allegations Arise Amidst these troubling

developments, voices within the crypto community are suggesting

that the market turbulence may not be coincidental. Experts

like Marty Party have expressed concerns about the role of Binance,

asserting that the exchange may have offloaded its holdings in

Solana and Ethereum to cover fines imposed by the Department of

Justice (DOJ) while also profiting from liquidating leveraged

futures positions. Such actions have been characterized as

“manipulative,” with Marty noting the timing of these sales. Doctor

Profit, another market expert, also suggests that platforms like

Bybit may have engaged in similar practices to recover “lost

Ethereum” after its recent hack, fueling further speculation about

the integrity of these exchanges. Critics argue that these “market

maneuvers” are indicative of a broader pattern of manipulation,

particularly aimed at triggering mass liquidations among long

positions. Related Reading: Ethereum Price Crash To $2,000

Could Happen As Smaller Timeframes Turn Bearish Doctor Profit

remarked on the apparent transparency of these manipulations,

suggesting that market players are exploiting the naivety of

average crypto investors. Given the current climate, there is a

growing call within the crypto community to shift away from

centralized exchanges and traditional financial structures.

Advocates like Doctor Profit are urging investors to embrace

decentralized finance (DeFi) and monolithic networks, emphasizing

the importance of self-custody and minimizing reliance on

institutions that may be susceptible to manipulation. For now,

Ethereum has managed to stabilize at $2,390, which is nearly 50%

below the record high of $4,878 reached during the 2021 bull

market. Featured image from DALL-E, chart from TradingView.com

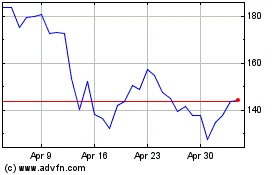

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025