Flash Crashes On The Rise: Understanding The Recent $300 Billion Crypto Drop

February 26 2025 - 9:00PM

NEWSBTC

The crypto market is experiencing a significant upheaval, with a

staggering $300 billion erased in just 24 hours. This massive

sell-off has raised concerns among investors, prompting analysts to

explore the underlying causes of this dramatic decline. Bitcoin And

Ethereum Plummet According to insights from the Kobelsi Letter, a

global commentator on capital markets, the frequency of “flash

crashes” in the crypto sector has surged since January. These rapid

price declines can occur without major bearish news, leaving

investors puzzled about the sudden volatility. The recent downturn

began with Bitcoin (BTC), which initially fell below $95,000.

However, a sharp drop from $95,000 to $90,000 within just 30

minutes early in the morning served as a wake-up call for

traders. Ethereum (ETH) has fared even worse, experiencing a

staggering 37% drop over 60 hours on February 2nd, despite trade

war headlines that had already been priced into the market. Related

Reading: Why Ethereum Is A Must-Watch: Expert Analysis Highlights 4

Strong Bullish Indicators One of the critical factors contributing

to this crypto volatility, according to the analysts, is the

drastic shift in liquidity and short positioning in Ethereum. In a

single week, short positions surged by 40%, and since November

2024, they have skyrocketed by 500%. This unprecedented level

of shorting by Wall Street hedge funds has created a precarious

situation for Ethereum, which is now valued at approximately $300

billion. As institutional investors increasingly short Ethereum,

many have turned their attention to Bitcoin, creating a stark

contrast in market dynamics. While retail interest in Bitcoin has

waned, driven partly by a surge in memecoins, institutional capital

continues to flow into Bitcoin, exacerbating the volatility in

altcoins like Solana. Retail Vs Institutional Investors Amid Crypto

Volatility Kobelsi further highlights that the current market

environment is characterized by a polarization between retail and

institutional investors. As liquidity decreases, price movements

become increasingly erratic. This has resulted in significant

“air pockets,” where sentiment can shift dramatically, leading to

rapid price changes. Recent sentiment analysis reveals that the

crypto market is experiencing its lowest levels of enthusiasm for

2024. The Crypto Fear and Greed Index, which previously indicated a

state of greed, has now dropped to a fear level of 29%. Such shifts

in sentiment often precede flash crashes, as traders react to the

changing landscape. Related Reading: XRP Price Continuation After

Crash Below $2.4? New Targets Emerge Adding to the complexity of

the situation, public figures like Eric Trump have been vocal about

their views on the largest crypto assets, Bitcoin and Ethereum.

Trump has suggested that these price dips present buying

opportunities, a perspective that may influence retail investors’

behavior. Furthermore, companies like MicroStrategy have also

impacted the crypto market dynamics. Despite a 45% drop in its

stock since its November 20th peak, MicroStrategy continues to

accumulate Bitcoin through convertible note offerings, reinforcing

its commitment to the crypto and potentially influencing market

sentiment. So far, Ethereum has managed to regain the $2,500 level

after falling below $2,300 on Tuesday, recording losses of 7% in

the 24-hour time frame. Featured image from DALL-E, chart from

TradingView.com

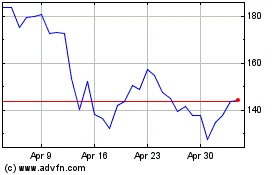

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025