XRP Ledger On Fire: Daily Transactions Skyrocket 10.7% In Q1 2023

May 19 2023 - 11:59AM

NEWSBTC

According to the latest report by the research firm, Messari, the

XRP Ledger (XRPL) saw a significant surge in activity during the

first quarter of 2023. The daily active addresses and daily

transactions increased by 13.9% and 10.7% QoQ, respectively. XRP’s

price also showed an impressive increase of 56%

quarter-over-quarter (QoQ), from $0.35 to $0.54. This price

increase outpaced the total crypto market cap in the same period,

largely due to positive news regarding the ongoing case between

Ripple and the Securities and Exchange Commission (SEC). Related

Reading: Shiba Inu Sees Juicy Capital Inflows – An Imminent Rebound

in Sight? XRP Ledger Network Activity Soars The XRP Ledger is

a blockchain network operational for over a decade. It is known for

its fast and energy-efficient cross-border payment capabilities,

among other features. It offers a variety of native capabilities,

including Issued Currencies, a decentralized exchange, escrow

functionality, and token management. These features allow the XRPL

to execute many of the same functions as other networks, even

though it does not support smart contracts. The chart above shows

that the XRPL has seen a significant increase in overall network

activity metrics in Q1. Daily active addresses and transactions

increased by 13.9% and 10.7%, respectively. The increase in total

active addresses was largely due to receiving addresses growing by

17.1% from 47,000 to 55,000. However, sending addresses decreased

by 7.2% QoQ, further separating the metric from receiving

addresses. Despite 141,000 accounts being deleted in Q1, the total

addresses increased. This is because, unlike many other blockchain

networks, the XRPL allows accounts to be deleted to reclaim the

deposit of XRP escrowed during account creation. This escrow

incentivizes to delete of accounts, and the total address metric

has more significance. According to the report, the XRPL applies

deflationary pressure to the total supply of 100 billion XRP

through transaction fee burning. However, only around 10 million

XRP have been burned since the XRPL’s inception. To counteract this

burn rate, 1 billion XRP vests to Ripple per month. Any XRP not

spent or distributed by Ripple in that month is returned to escrow.

This system will continue until the remaining 48 billion XRP become

liquid. Unlike many other cryptocurrency networks, the XRPL does

not distribute rewards or transaction fees to validators. Instead,

validators are incentivized by supporting the decentralization of

the network. This is similar to a full node for Ethereum/Bitcoin

rather than a validator/miner. NFT Market Adapts To XLS-20

Standard The XRPL standardized NFTs on its network with the XLS-20

standard, enabled in October 2022. Five new transaction types were

created to track all NFT activity on the network accurately.

However, NFT mints declined 40.4% QoQ, from 732,000 in Q4 to

436,000 in Q1, while NFT offers accepted declined 25.1% QoQ, from

370,000 in Q4 to 277,000 in Q1. Furthermore, in NFT sales volume,

XPUNKS remained the all-time leader with 15.7 million XRP ($8.5

million as of Q1). However, Core Apes Club and RipplePunks rivaled

XPUNKS in sales volume in Q1, with each collection doing

400,000-500,000 XRP in quarterly volume. RipplePunks averaged

141,000 XRP ($76,000) in monthly sales volume and 960 monthly sales

in Q1. Related Reading: Lido’s ETH Deposits Reach Record High Amid

Stagnant stETH Withdrawals Overall, the XRPL’s deflationary

mechanism of burned transaction fees and focus on decentralization

and trust between nodes through unique node lists are key factors

in its success. As the network continues to grow and evolve,

further developments and innovations in the platform’s native

capabilities are likely seen. Featured image from iStock,

chart from TradingView.com

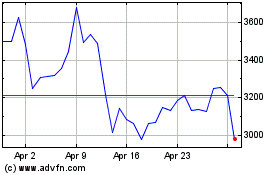

stETH (COIN:STETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024