Bitcoin Surge Towards $24k As CPI Report Show Inflation Cooling

August 10 2022 - 5:56PM

NEWSBTC

Bitcoin surged after July’s CPI data showed that inflation has

started to decline after several months of record-breaking rates.

Similar to earlier instances, the price of bitcoin climbed close to

$24,000. CPI Report Boost Bitcoin Price According to the Consumer

Price Index report (CPI) that the U.S. Bureau of Labor and

Statistics released on Wednesday, consumer costs remained

unchanged, putting inflation at 8.5%. Prior to this, analysts

anticipated that the index, which analyzes price changes across a

wide range of products and services, would increase by 0.2% to

reveal inflation to be 8.7% on an annual basis. After the U.S.

Bureau of Labor Statistics released its data on inflation for July,

the value of the Dow Jones Industrial Average, Nasdaq, S&P 500,

and NYSE indexes all sharply increased. Moreover, the value of

precious metals and cryptocurrencies rose on Wednesday. The value

of bitcoin surged by nearly 4%, that of gold by 0.35%, and that of

silver by 1.43% in relation to the dollar. BTC/USD trades close to

$24k. Source: TradingView Inflation as measured by headline

CPI increased 0.0 percent month-over-month in July, well below its

elevated June monthly rate of 1.3 percent. Monthly core inflation

in July fell to 0.3 percent. 1/ pic.twitter.com/6bVTZq7m1W —

Council of Economic Advisers (@WhiteHouseCEA) August 10, 2022

According to the Consumer Price Index (CPI) report for July 2022,

the Consumer Price Index for All Urban Consumers (CPI-U) increased

by 1.3 percent in June but remained steady in July. Before seasonal

adjustment, the all items index rose 8.5 percent over the previous

12 months. The report on inflation adds: “The gasoline index fell

7.7 percent in July and offset increases in the food and shelter

indexes, resulting in the all items index being unchanged over the

month.” President of the United States Joe Biden talked about the

CPI figures as well and said that new legislation and domestic

semiconductor production had increased the nation’s economic

activity. According to Biden, the lack of semiconductors resulted

in high pricing for autos last year, which accounted for one-third

of core inflation. “America is back leading the way with the CHIPS

and Science Law boosting our efforts to make semiconductors right

here at home.” Related Reading: Billionaire Mike Novogratz Says

Bitcoin At $30,000 Is Unlikely Focus Turns To FOMC Meeting In

September Analysts anticipate that core inflation will rise from

5.9% to 6.1%, pushing the Fed to raise interest rates further in

September. The CPI data, however, indicates that recent rate hikes

are having a cooling effect on the economy. Nevertheless, Citigroup

economists predicted another 75 basis point increase, fueled by

strong job data and faster pay growth than anticipated. But if core

inflation comes in higher than anticipated, there is also a chance

for a 100 basis point rise. Federal Funds Effective Rate (Source:

FRED) The current CPI rate is 9%, and investor Stanley

Druckenmiller said that “Inflation has never come down from above

5% without Fed funds rising above CPI.” The Fed won’t need to raise

rates as much as they have thus far this year if inflation has

peaked. In response to rising interest rates that slow growth,

institutional investors have moved away from more speculative

assets like tech stocks and cryptocurrencies and toward investments

that are more comparatively stable, such corporate bonds and U.S.

Treasuries. Related Reading: TA- Bitcoin Bounced off Key Support

After CPI Announcement Featured image from Getty Image, charts from

FRED and TradingView.com

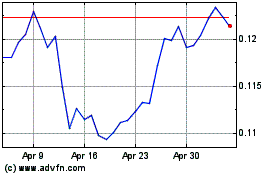

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024