$99K And Climbing: Bitcoin Reacts To Gensler’s SEC Departure Announcement

November 22 2024 - 11:00AM

NEWSBTC

Bitcoin (BTC) jumped beyond $99,000 on Thursday, setting a new

milestone before easing slightly. The milestone comes on the heels

of substantial political and market events that have increased

investor trust in digital assets. Related Reading: Bitcoin Barrels

Close To $98,000—Is The $100K Barrier Next? Rumors of Securities

and Exchange Commission (SEC) Chair Gary Gensler’s departure, as

well as Donald Trump’s prospective crypto-friendly policies, have

fueled the crypto space’s excitement. Inspired by hope for a

possible change in US financial policy, Bitcoin surged to $99,126

from a dismal beginning of the session. Investors still think

$100,000 is in the cards particularly considering the rise in

cryptocurrencies approximately 40% following Trump’s anticipated

re-election win earlier this month. A Pro-Crypto Administration?

Reports show that the government of Trump is considering the

creation of the first crypto policy job, which may turn around how

regulations are taken. Many think that the SEC will become more

open-minded after Gensler leaves, which has been a bone of

contention for long among the crypto community. On January 20, 2025

I will be stepping down as @SECGov Chair. A thread 🧵⬇️ — Gary

Gensler (@GaryGensler) November 21, 2024 Galaxy Digital’s CEO, Mike

Novogratz, expressed hope about this change, noting that the Trump

team’s energy is very different, that they are pro-crypto,

pro-blockchain, and sees the promise Bitcoin brings. He claimed the

government’s desire in building a national Bitcoin stockpile and

giving blockchain innovation top priority will help to empower the

market even more. Corporate Moves Add Fuel The Financial Times has

reported that Trump Media & Technology Group (DJT) is in talks

to acquire Bakkt, a cryptocurrency exchange. This possible

collaboration might bring cryptocurrency into a larger

technological framework, making it more accessible and widespread.

Such developments add to the larger story of institutional

adoption, which was a crucial driver in prior bull cycles. The

market’s reaction shows a rising view that Bitcoin is prepared to

play a larger role in both the private and public sectors under

favorable regulations. #Bitcoin looks like it did in December 2020.

Even the RSI is nearly identical. If true, $BTC will go to

$108,000, drop to $99,000, and bounce to $135,000!

pic.twitter.com/hsIBWBVGnl — Ali (@ali_charts) November 20, 2024

Analysts Predict New Highs Meanwhile, crypto expert Ali Martinez

said the current rise of Bitcoin has strong similarities with its

rise in late 2020. Research from this analyst postulates that

Bitcoin will increase up to $108,000 before dropping down to

$99,000 and then increase to $135,000. Related Reading: XRP On

Fire: Over 90% Weekly Growth Catapults Altcoin To Fresh 2-Year High

Important data including daily active addresses—which topped

475K—and higher social volumes of 380K support this projection.

These trends mirror the 2020 breakout when Bitcoin more than

doubled within a few weeks. Following Gensler’s resignation,

Bitcoin’s course may be determined by the position taken by his

successor. A pro-crypto leader may encourage uptake and propel

Bitcoin above $100,000, paving the way for a prolonged bull run.

However, changes in regulations and market attitude will be

important factors. Featured image from DALL-E, chart from

TradingView

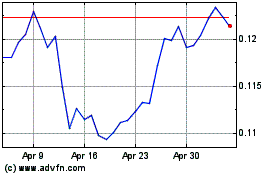

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024