Ripple CLO Exposes How SEC Ignores Law And Brags About It

May 15 2023 - 4:50AM

NEWSBTC

The legal battle between Ripple Labs and the US Securities and

Exchange Commission (SEC) in the US District Court of Southern New

York is still awaiting a ruling from Judge Analisa Torres. Just

last week, Ripple CEO Brad Garlinghouse downgraded expectations,

stating that a ruling would likely come in “two to six months”

rather than the first half of 2023. However, this is not stopping

Ripple’s Chief Legal Officer (CLO) Stuart Alderoty from continuing

to attack the SEC and expose its unlawful legal practices. Via

Twitter, Alderoty shared a court decision over the weekend that

shows just that. Ripple CLO Exposes Unlawful Guidance By SEC

Specifically, it concerns the “common enterprise” issue that is a

component of the Howey test. The Ripple CLO writes that in the 1946

Supreme Court case “Howey”, the SEC unsuccessfully tried to pull

off a trick that it is unpacking again today. At the time, the SEC

wanted to enforce that an investment in a “common enterprise” was

not required as long as there was a “common interest”. Related

Reading: Ripple CTO Labels BEN Coin As Scam, Bitboy Reacts “The SEC

was wrong then and it is wrong now. Common Interest ≠ Common

Enterprise,” wrote Alderoty, who also shared the text of the writ.

XRP community attorney John E. Deaton added that the SEC’s

framework for digital assets ignores just that: The SEC is so

arrogant that it ignores the law and brags about it. The SEC’s

website, where the “Framework for Investment Contract Analysis of

Digital Assets” can be found, states that in order to satisfy the

“common enterprise” aspect of the Howey test, federal courts

require that there be either “horizontal commonality” or “vertical

commonality” (Revak v. SEC Realty Corp.). Related Reading: XRP

Holds Above Key Support As Ripple CEO Predicts Delay Of Verdict The

Commission, on the other hand, does not require vertical or

horizontal commonality per se, nor does it consider a “common

enterprise” to be a distinct element of the term “investment

contract”. On that basis, Alderoty said in a follow-up tweet: The

Revak case exposes yet another SEC sleight of hand. Without a

‘common enterprise’ it matters not whether ‘the fortunes of

investors’ are tied to the efforts of others. The Howey test is not

‘so easily satisfied.’ Whether Judge Torres will agree and rule in

Ripple’s favour remains to be seen. The pressure on the judge is

likely to be intense, especially in light of the US Democrats’

attack on crypto. XRP Price Above Key Support At press time, XRP

was trading at $0.4280, holding above the key support level of

$0.4131 over the past few days. This support is crucial as a break

below it would send the XRP price back into the early November 2022

to mid-March 2023 trading range, a signal the bulls should avoid at

all costs. Featured image from FinanceFeeds, chart from

TradingView.com

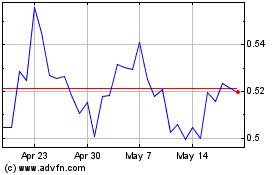

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024