EDENRED : First-quarter 2022 revenue - Excellent start to the year

with continued strong momentum in sales and digital innovation

First-quarter 2022 revenue

Excellent start to the year with continued

strong momentum in sales and digital innovation

Edenred recorded sustained

revenue growth in the first quarter, attesting to the

relevance of its digital innovation

strategy and its commercial success:

- Operating revenue up 17.3% as reported

(+15.3% like-for-like) versus first-quarter 2021, totaling €426

million

- Double-digit like-for-like revenue

growth in all regions and in both main business lines

- Driven by strong business volume and

higher interest rates in some regions, other revenue increased by

nearly 30%, from €10 million to €13 million

- Total revenue of €439 million, up 17.6%

as reported (+15.7% like-for-like)

Edenred leveraged its unique digital platform

following the transformation of its business model:

- A value proposition broadened by the

extension of its Beyond Food and Beyond Fuel portfolio of

solutions

- A recognized user experience supported

by technological leadership and continued substantial

investment

- Further strong sales momentum, both

with key accounts and in the SME segment

- Recognized ESG leadership as

sustainable development becomes embedded in the Group’s DNA

- An inflationary environment further

enhancing the appeal of the Group’s solutions as tools for

increasing employees’ purchasing power and improving the efficiency

of fleet management

Confirmation for 2022 of the annual targets set in

the Group’s Next Frontier strategic plan (2019-2022):

- Like-for-like operating revenue growth

of more than 8%

- Like-for-like EBITDA growth of more

than 10%

- Free cash flow/EBITDA conversion rate

of more than 65%1

***

Bertrand Dumazy, Chairman

and Chief Executive Officer of Edenred, said: “After our

historic results in 2021, Edenred has recorded an excellent first

quarter thanks to the exemplary commitment shown by Edenred’s teams

again at the start of this year. Edenred is thus confirming its

sustainable and profitable growth trajectory. All regions delivered

double-digit growth, driven by a remarkable performance from our

Employee Benefits and Fleet & Mobility Solutions. Thanks to its

unique digital platform, Edenred is asserting itself quarter after

quarter as the innovation leader in its markets. Our value

proposition is constantly being broadened with new solutions in

line with our clients’ expectations, as well as new features that

improve and streamline the user experience.We are therefore

confident in our ability to maintain a sustained pace of growth for

the rest of the year, driven by favorable post-Covid trends and a

macroeconomic environment that strengthens the appeal of our

solutions.” |

FIRST-QUARTER 2022 TOTAL

REVENUE

|

(in € millions) |

First-quarter 2022 |

First-quarter 2021 |

% change (reported) |

% change (like-for-like) |

| Operating

revenue |

426 |

363 |

+17.3% |

+15.3% |

|

Other revenue |

13 |

10 |

+28.9% |

+29.7% |

|

Total revenue |

439 |

373 |

+17.6% |

+15.7% |

Total revenue for the first quarter of 2022 came

to €439 million, up 17.6% year on year as reported, including a

favorable currency effect (+2.4%) and a slightly negative scope

effect (-0.5%). On a like-for-like basis, total revenue was up

15.7%.

Operating revenue came to €426 million in the

first three months of 2022, up 17.3% as reported, including a

favorable currency effect (+2.5%) and a negative scope effect

(-0.5%). On a like-for-like basis, operating revenue rose by 15.3%

year on year.

This very good performance follows on from the

positive trends already observed in 2021. Operating revenue growth

was notably driven by continued strong sales momentum, both in the

very buoyant SME segment and in key accounts, with contract wins

with iconic clients such as Google in France and FedEx in Brazil

and Mexico.

During the first quarter, the Group also

continued to develop new services as part of its Beyond Food and

Beyond Fuel strategy. The partnership in Europe with ChargePoint, a

leading global electric vehicle charging network provider, is just

one example. This partnership provides Edenred clients in Europe

with access to more than 240,000 public electric charge points

across 32 countries, enabling Edenred to support fleet managers in

their transition to electric mobility.

The Group’s performance also benefited from a

macroeconomic environment that further strengthened the appeal of

Edenred’s solutions. With governments and companies looking to

protect employees’ purchasing power, introducing new benefits or

increasing the face value of existing benefits have emerged as

effective responses. In Fleet & Mobility Solutions, the

increase in fuel prices at the pump has encouraged fleet managers

to exercise even tighter control over costs.

- Operating revenue by

business line

|

(in € millions) |

First-quarter 2022 |

First-quarter 2021 |

% change (reported) |

% change (like-for-like) |

|

Employee Benefits |

256 |

223 |

+15.1% |

+14.2% |

| Fleet &

Mobility Solutions |

117 |

90 |

+29.6% |

+24.3% |

|

Complementary Solutions |

53 |

50 |

+5.0% |

+3.9% |

|

Total |

426 |

363 |

+17.3% |

+15.3% |

Operating revenue for the Employee

Benefits business line, which accounts for 60% of the

Group’s total operating revenue, was €256 million in

first-quarter 2022, a 15.1% year-on-year increase as reported

(+14.2% like-for-like).

This growth was once again driven by strong

sales momentum, reflected in the ever-increasing penetration of the

SME segment, as well as the success of the Group’s solutions with

key accounts. With the world of work undergoing a radical

transformation, Edenred continued to roll out its Beyond Food

offering, designed notably to support clients looking to enhance

their appeal and boost staff engagement. The multi-product offering

of employee benefits in Brazil (Ticket Superflex), for example, met

with major commercial success, as did platforms to equip employees

for remote working in France and Mexico. Lastly, the first-quarter

performance also benefited from a favorable basis of comparison due

to the impact of Covid-related restrictions, notably in Europe, in

the first quarter of 2021.

In the Fleet & Mobility

Solutions business line, which accounts for 27% of

the Group’s total operating revenue, operating revenue for

first-quarter 2022 amounted to €117 million, up 29.6% year on

year as reported (+24.3% like-for-like).

This strong growth reflects the continued

rollout of the Beyond Fuel strategy, notably through the

maintenance and toll offering, which is proving highly successful

in Europe and Latin America. The February acquisition of Greenpass,

an issuer of e-toll solutions in Brazil, is fully in line with this

strategy. The business also enjoyed strong sales momentum once

again, driven by the relevance of its digital and multi-product

offering for fleet managers. In addition, high oil prices in the

first three months of the year contributed to greater business

volumes compared with the first quarter of 2021.

The Complementary Solutions

business line, which includes Corporate Payment Services, Incentive

& Rewards and Public Social Programs, generated revenue of €53

million in first-quarter 2022, representing 13% of the Group total.

This figure was up 5.0% as reported (+3.9% like-for-like) compared

with the first quarter of 2021.

Corporate Payment Services in North America,

operated through CSI, recorded a solid performance, driven by new

contract wins and the steady improvement in volumes generated by

clients in the media and hospitality segments.

The growth posted in this business line was

impacted by a high basis of comparison as a result of the

implementation in first-quarter 2021 of several specific earmarked

funds programs for people hard hit by the health crisis, notably in

Romania and the United Kingdom.

- Operating revenue by

region

|

(in € millions) |

First-quarter 2022 |

First-quarter 2021 |

% change (reported) |

% change (like-for-like) |

| Europe |

270 |

237 |

+13.8% |

+13.4% |

| Latin

America |

123 |

97 |

+26.5% |

+16.5% |

|

Rest of the World |

33 |

29 |

+14.3% |

+26.0% |

|

Total |

426 |

363 |

+17.3% |

+15.3% |

In Europe, operating revenue

amounted to €270 million in the first quarter, a year-on-year

increase of 13.8% as reported (+13.4% like-for-like). Europe

accounted for 63% of total consolidated operating revenue in

first-quarter 2022.

In France, operating revenue

came in at €76 million for the first quarter, up 10.3% as

reported and like-for-like. This performance notably reflects the

commercial success of Ticket Restaurant®, the market’s number one

name and digital leader, offering a simple and flexible solution

for clients and a constantly improving experience based on

innovative new features for users. Solutions rolled out as part of

the Beyond Food strategy (such as Ticket Mobilité® and the remote

working platform) and the Fleet & Mobility Solutions offering

also contributed to sharp growth in the first quarter.

Operating revenue in Europe excluding

France totaled €194 million in first-quarter 2022, an

increase of 15.3% as reported (+14.8% like-for-like) versus the

prior-year period. Employee Benefits recorded a solid performance,

driven by robust growth in Ticket Restaurant®. In Fleet &

Mobility Solutions, continued rollout of the Beyond Fuel strategy

also contributed to the significant growth recorded in the first

quarter.

Operating revenue in Latin

America came to €123 million for the first quarter, a

rise of 26.5% as reported (+16.5% like-for-like) compared with the

same period in 2021.

In Brazil, operating revenue

rose by 29.1% as reported (+16.5% like-for-like) in first-quarter

2022 versus first-quarter 2021. This significant increase reflects

strong momentum in Fleet & Mobility Solutions, driven notably

by the ongoing deployment of maintenance and toll management

solutions, along with the growing contribution of the partnership

with Itaú Unibanco to sales performance in Employee Benefits.

In Hispanic Latin America,

operating revenue was up 21.0% as reported (+16.6% like-for-like)

in first-quarter 2022 versus the same period in 2021. Employee

Benefits business in the region is recovering as the health crisis

subsides. In Fleet & Mobility Solutions, Edenred continued to

gradually roll out its Beyond Fuel offering (tolls and

maintenance).

In the Rest of the World,

operating revenue came to €33 million for the first quarter,

up 14.3% as reported and up 26.0% like-for-like. This performance

was notably spurred by the success of paperless and plasticless

digital solutions in Taiwan. In North America, CSI’s Corporate

Payment Services maintained the good momentum seen in late 2021,

fueled notably by the distribution partnerships entered into with

several banks, including the Commercial Cards division of

international bank Citi one year ago.

Other revenue for the first quarter of 2022

totaled €13 million, up 28.9% as reported (+29.7% like-for-like).

This rise reflects the increase in float2 resulting from the high

level of business in the first quarter, as well as higher interest

rates in European countries outside the euro zone and in Latin

America.

OUTLOOK

Following on from historic results in 2021, the

solid performance recorded in the first quarter of 2022 reflects

Edenred’s ability to leverage its unique digital platform to

continue along a sustainable and profitable growth trajectory. The

Group’s commercial momentum continues to be driven by the addition

of new digital, multi-product solutions adapted to the needs and

expectations of clients in its three business lines. Building on

these innovative and relevant solutions, Edenred will continue to

penetrate its markets and thereby support changing behaviors and

structural trends, such as remote working as a permanent feature in

the workplace, green commuting, the consumption of eco-friendly

products and the transition of fleets to electric or plug-in hybrid

vehicles.

Edenred also expects to continue benefiting from

a favorable macroeconomic environment, and in particular from the

inflationary context, which is encouraging public authorities and

companies to increase the face value of Employee Benefits solutions

and prompting fleet managers to prioritize expense management

solutions.

Edenred is therefore reaffirming its confidence

for 2022, and intends to maintain a sustained pace of growth in all

regions where the Group operates and in each business line.

As a result, for 2022, the Group is confirming

the annual targets set in its Next Frontier strategic plan:

- like-for-like operating revenue

growth of more than 8%;

- like-for-like EBITDA growth of more

than 10%;

- free cash flow/EBITDA conversion

rate of more than 65%3.

SIGNIFICANT EVENT IN THE FIRST

QUARTER

- Edenred strengthens its

toll offering in Brazil with the acquisition of

Greenpass

On February 22, Edenred announced that it

had acquired a 51% controlling interest in Greenpass, an issuer of

electronic toll solutions in Brazil. The deal strengthens Edenred’s

position in this business as well as its technology and sales

capabilities in an attractive market offering significant

cross-selling potential with its client base. It is fully in line

with the Group’s Beyond Fuel strategy to develop new non-fuel fleet

and mobility services, enhancing its value proposition for fleet

managers and expanding its addressable market.

SUBSEQUENT EVENT

- UTA Edenred partners with

ChargePoint

On April 5, Edenred announced a partnership with

ChargePoint, a leading electric vehicle charging network provider

in Europe and in the USA. This partnership enables customers of UTA

Edenred, a leading mobility service provider in Europe, to access

over 240,000 public electric charge points across 32 European

countries. Edenred supports fleet managers in the transition

towards electric vehicle usage, notably through the introduction of

an all-in-one, fully integrated solution that combines an electric

vehicle charging solution with UTA Edenred’s proven energy, toll

and maintenance services.

UPCOMING EVENTS

May 11, 2022: General MeetingJuly 26, 2022:

First-half 2022 resultsOctober 21, 2022: Third-quarter 2022

revenueOctober 25, 2022: Capital Markets Day in London (initially

scheduled for October 26, 2022)

▬▬

About Edenred

Edenred the everyday companion

for people at work, is a leading digital platform for services and

payments which connects over 50 million users and 2 million partner

merchants in 46 countries via approximately 900,000 corporate

clients.

Edenred offers specific-purpose payment

solutions for food (such as meal benefits), incentives (such as

gift cards, employee engagement platforms), mobility (such as

multi-energy, maintenance, toll, parking and commuter solutions)

and corporate payments (such as virtual cards).

True to the Group’s purpose, “Enrich

connections. For good.”, these solutions enhance users’

well-being and purchasing power. They improve companies’

attractiveness and efficiency, and vitalize the employment market

and the local economy. They also foster access to healthier food,

more environmentally friendly products and softer mobility.

Edenred’s 10,000 employees are committed to

making the world of work a connected ecosystem that is safer, more

efficient and more responsible every day.

In 2021, thanks to its global technology assets,

the Group managed close to €30 billion in business volume,

primarily carried out via mobile applications, online platforms and

cards.

Edenred is listed on the Euronext Paris stock

exchange and included in the following indices: CAC Next 20,

CAC Large 60, Euronext 100, FTSE4Good and MSCI Europe.

The logos and other trademarks mentioned and

featured in this press release are registered trademarks of

Edenred S.E., its subsidiaries or third parties. They may not

be used for commercial purposes without prior written consent from

their owners.

▬▬

CONTACTS

|

Communications Department

Emmanuelle Châtelain +33 (0)1 86 67 24 36

emmanuelle.chatelain@edenred.com Media

Relations Matthieu Santalucia+33 (0)1 86 67 22

63matthieu.santalucia@edenred.com |

Investor

Relations Cédric Appert+33 (0)1 86 67 24

99cedric.appert@edenred.com Baptiste Fournier +33 (0)1

86 67 20 73 baptiste.fournier@edenred.com

|

APPENDICES

Operating revenue

| |

Q1 |

|

|

2022 |

2021 |

|

In €

millions |

|

|

|

|

|

|

|

Europe |

270 |

237 |

|

France |

76 |

69 |

|

Rest of Europe |

194 |

168 |

|

Latin America |

123 |

97 |

|

Rest of the world |

33 |

29 |

|

|

|

|

|

Total |

426 |

363 |

| |

|

|

| |

Q1 |

|

|

Change reported

|

Change L/L |

|

In % |

|

|

|

|

|

|

|

Europe |

+13.8% |

+13.4% |

|

France |

+10.3% |

+10.3% |

|

Rest of Europe |

+15.3% |

+14.8% |

|

Latin America |

+26.5% |

+16.5% |

|

Rest of the world |

+14.3% |

+26.0% |

|

|

|

|

|

Total |

+17.3% |

+15.3% |

Other revenue

| |

Q1 |

|

In € millions |

2022 |

2021 |

|

|

|

|

|

Europe |

5 |

3 |

|

France |

2 |

1 |

|

Rest of Europe |

3 |

2 |

|

Latin America |

7 |

6 |

|

Rest of the world |

1 |

1 |

|

|

|

|

|

Total |

13 |

10 |

| |

|

|

| |

Q1 |

|

|

Changereported |

Change L/L |

|

In % |

|

|

|

|

|

|

|

Europe |

+40.5% |

+39.1% |

|

France |

+5.6% |

+5.6% |

|

Rest of Europe |

+66.0% |

+63.5% |

|

Latin America |

+33.5% |

+22.8% |

|

Rest of the world |

-18.9% |

+35.3% |

|

|

|

|

|

Total |

+28.9% |

+29.7% |

| |

Q1 |

|

In € millions |

2022 |

2021 |

|

|

|

|

|

Europe |

275 |

240 |

|

France |

78 |

70 |

|

Rest of Europe |

197 |

170 |

|

Latin America |

130 |

103 |

|

Rest of the world |

34 |

30 |

|

|

|

|

|

Total |

439 |

373 |

| |

|

|

| |

Q1 |

|

|

Change reported

|

Change L/L |

|

In % |

|

|

|

|

|

|

|

Europe |

+14.2% |

+13.8% |

|

France |

+10.2% |

+10.2% |

|

Rest of Europe |

+15.9% |

+15.3% |

|

Latin America |

+26.9% |

+16.8% |

|

Rest of the world |

+12.9% |

+26.5% |

|

|

|

|

|

Total |

+17.6% |

+15.7% |

Total revenue

1 Based on constant regulations and methods.2 The float

corresponds to a portion of the operating working capital from the

preloading of funds by corporate clients.3 Based on constant

regulations and methods.

- 2022 04 21 - Edenred PR Q1 2022 PR EN

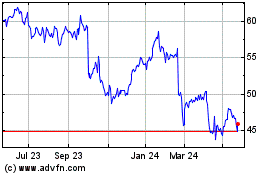

Edenred (EU:EDEN)

Historical Stock Chart

From Jan 2025 to Feb 2025

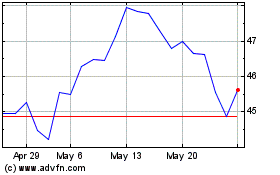

Edenred (EU:EDEN)

Historical Stock Chart

From Feb 2024 to Feb 2025