Getlink Successfully Prices Green Debt Refinancing at Eurotunnel Level

April 21 2022 - 1:02PM

Business Wire

Regulatory News:

Getlink (Paris:GET):

As part of its ongoing strategy to optimise the structure and

cost of its debt, the Group has today successfully priced and

placed the refinancing of its EUR 425m fixed-to-floating Tranche

C2A loan issued in May 2017 at the Eurotunnel level1, which will

become callable in June 20222. The new loan (at the Eurotunnel

level) will have a fixed rate of 3.531% until 2031, resulting in a

9-year expected economic maturity3 and total cash savings of c.

€100m over these 9 years compared to the post June 2022

pre-refinancing terms of the existing Tranche C2A loan.4.

The new loan is being financed through notes1, which are being

issued to investors under a private placement arranged by Goldman

Sachs Bank Europe SE and BNP Paribas as Joint Placement Agents.

The new notes are being issued under Getlink’s new Green Finance

Framework, published here:

https://www.getlinkgroup.com/content/uploads/2022/04/Getlink-Green-Finance-Framework-April-2022.pdf

and are expected to be rated BBB by S&P Global Ratings UK

Limited, BBB by Fitch Ratings Limited and Baa2 by Moody’s Investors

Service Ltd.

To account for the new debt’s initial 9-year fixed rate coupon

period, the Group has partially unwound its interest rate hedges in

place since 2007 over the corresponding 9-year maturity. The

related hedge break costs of €118million and other transaction

costs will be paid separately using the Group’s cash resources.

Geraldine Perichon, CFO of Getlink SE, said: “This

transaction demonstrates the continued investor confidence on our

strategy and their appetite for Eurotunnel debt despite current

market volatility. The attractive pricing conditions achieved will

enable the Group to further improve cash flow and optimize its

financing structure.”

The settlement date of the new notes is expected to be on 12

May 2022.

Important disclaimers:

This information is an inside information under article 7 of EU

regulation 596/2014. The securities referred to in this release

have not been and will not be registered under the US Securities

Act and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

requirements.

___________________________ 1 Loan financed through notes issued

by a debt securitisation vehicle created for the purpose by the

lenders - Channel Link Enterprises Finance Plc (CLEF). 2 As of June

2022, the debt switches to a floating rate of Euribor + 5.55%. 3

The debt will switch to a floating rate in June 2031 of Euribor +

6.00% and will become callable at that time. 4 Including the net

effect of the associated interest rate hedge unwinding detailed

thereafter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220421006032/en/

For UK media enquiries contact John Keefe on + 44

(0) 1303 284491 Email: press@getlinkgroup.com

For other media enquiries contact Romain Dufour on

+33(0)1 4098 0464

For investor enquiries contact: Jean-Baptiste Roussille

on +33 (0)1 40 98 04 81 Email:

jean-baptiste.roussille@getlinkgroup.com

Michael Schuller on +44 (0) 1303 288749 Email:

Michael.schuller@getlinkgroup.com

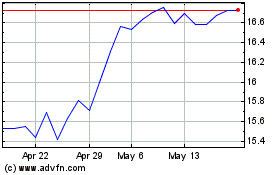

Getlink (EU:GET)

Historical Stock Chart

From Oct 2024 to Nov 2024

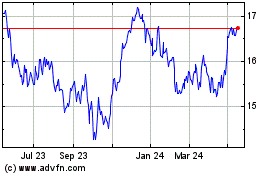

Getlink (EU:GET)

Historical Stock Chart

From Nov 2023 to Nov 2024