Lagardère Travel Retail Completes the Acquisition of International Duty Free (IDF), Belgium’s Leading Travel Retail Operator

September 19 2019 - 10:45AM

Business Wire

Regulatory News:

Lagardère (Paris:MMB):

Lagardère Travel Retail today announced that it had completed

the acquisition of International Duty Free, Belgium’s leading

Travel Retail operator also present in Luxembourg and

Kenya.

Announced on 25 July, this acquisition cements Lagardère Travel

Retail’s position as the world’s third-largest operator of Duty

Free airport points of sale and as the European leader in Travel

Retail, bringing its annual revenue to a total of €5.3 billion1.

The acquisition also enables Lagardère Travel Retail to extend its

presence to an additional leading European Hub, Brussels, with

high-quality operations, while consolidating its positions in

Luxembourg and in Africa with entry into Kenya. Lagardère Travel

Retail will also be able to leverage IDF’s experience in the

fast‑growing Belgian premium chocolate segment to strengthen its

operations in this market at the international level.

The close affinity between IDF and Lagardère Travel Retail in

terms of culture and strategy will help to ensure a successful

integration, led by Nicolas Van Brandt as CEO, while the companies’

combined operating and sales expertise will help boost sales and

unlock recurring operating synergies.

IDF revenue for 2019 is expected to be between €185 million and

€190 million. The company will be consolidated in Lagardère’s

financial statements with effect from 1 October 2019.

The acquisition has been valued at €250 million2, or around 8x

IDF’s pro forma EBITDA3 for 2020, factoring in €7 million in

recurring synergies expected to be unlocked through to 2022. It is

expected to deliver solid cash generation and be accretive to

Lagardère Travel Retail’s recurring EBIT, as well as extending the

average life of the Group’s concession agreements.

This value-creating transaction is an important step in

Lagardère Travel Retail’s global growth strategy, marking its entry

into the Duty Free space in a further two countries, including

Belgium, where it will benefit from a long-standing leadership

position and long-term concessions in both of the country’s main

airports.

***

Until recently, the Lagardère group was structured into four

business divisions: Lagardère Publishing, Lagardère Travel Retail,

Lagardère Sports and Entertainment and Lagardère Active. In 2018,

the Group launched its strategic refocusing around two priority

divisions: Lagardère Publishing and Lagardère Travel Retail.

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

1 Based on 100% of 2018 revenue, including the pro forma

contribution of HBF on a full-year basis, which would translate

into consolidated pro forma revenue of €4.1 billion. 2 Enterprise

value based on zero cash and debt. 3 Pro forma EBITDA corresponds

to estimated budgeted EBITDA for 2020 (first year of operation),

plus recurring run-rate synergies of €7 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190919005611/en/

Press Contact Lagardère Travel

Retail Vanessa MIREMONT Tel. +33 1 42 99 07 14

v.miremont@lagardere-tr.com

Press Thierry FUNCK-BRENTANO

Tel: +33 1 40 69 16 34 tfb@lagardere.fr

Ramzi KHIROUN Tel: +33 1 40 69 16 33 rk@lagardere.fr

Investor Relations Florence

LONIS Tel. +33 1 40 69 18 02 flonis@lagardere.fr

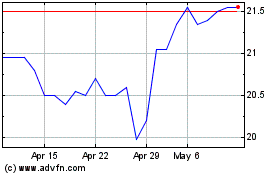

Lagardere (EU:MMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

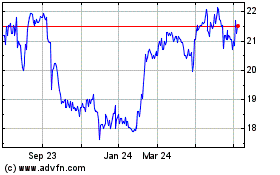

Lagardere (EU:MMB)

Historical Stock Chart

From Apr 2023 to Apr 2024