Revenue up 4.5% like for like(1) for the

target scope and recurring EBIT(1) for the target scope(2) up

5.6%(3) to €361 million

Sharp rise in free cash flow generation(1)

for the target scope: up 20% to €250 million (excluding changes in

working capital), and by 13% to €278 million including changes in

working capital

Proposed ordinary dividend stable at €1.30

per share

2020 recurring EBIT growth target: between

4% and 6%(4), excluding the impact of the

coronavirus

Action plan in progress at Lagardère Travel

Retail to mitigate the impact of the coronavirus on 2020(5)

Regulatory News:

With the sale of Lagardère Sports and of numerous media

assets, in 2019, the Lagardère group (Paris:MMB) completed the bulk

of its strategic refocusing plan.

In 2019, the Group continued to see strong growth in revenue

and in recurring EBIT based on the target scope(2), driven by

impressive momentum at Lagardère Publishing and Lagardère Travel

Retail as the two divisions took full advantage of the

opportunities resulting from their diverse geographic and business

profiles.

Free cash flow for the target scope (excluding changes in

working capital) totalled €250 million, a rise of 20% year on year

led by strong margin growth in the Group’s two businesses.

The Group also continued to develop its two pillars, with the

acquisitions of Gigamic, Short Books and Blackrock Games at

Lagardère Publishing, and of the International Duty Free group

(IDF) at Lagardère Travel Retail. These acquisitions were mainly

financed out of proceeds from the sale of media assets.

Continued growth

momentum

- The target scope reported revenue of €6,936 million in 2019, up

4.5% like for like. This growth momentum was powered by a solid

performance at Lagardère Travel Retail, which delivered 6.3%

growth, and by a good year at Lagardère Publishing, which advanced

by 2.8%.

Continued rise in recurring

EBIT

- Recurring EBIT was 5.6% higher than in 2018, meeting the

recurring EBIT target for the target scope as confirmed on 7

November 2019 (“Restated for the impact of IFRS 16 on concession

agreements at Lagardère Travel Retail, at constant exchange rates

and excluding Lagardère Travel Retail’s acquisitions of Hojeij

Branded Foods (HBF) and International Duty Free (IDF)”).

- Recurring EBIT for the target scope came in at €361 million

versus €310 million in 2018, buoyed by good performances from

Lagardère Travel Retail and Lagardère Publishing, and by the

consolidation of HBF.

- Profit before finance costs and tax was €411 million in 2019,

compared with €451 million in 2018 which had included the one-off

capital gain on the sale of the office building located in rue

François 1er (Paris, France).

- Profit for the period was €11 million, down from €199 million

in 2018 owing to the adverse impact of discontinued operations.

Restated for non-recurring/non-operating items, adjusted profit

- Group share was €200 million, stable year on year.

Solid financial position

At end-December 2019, net debt stood at €1,461 million. The

leverage ratio (net debt (1)/recurring EBITDA(1)) at both end-2019

and end-2018 was 2.1.

Consolidated data

At 31 December 2019, Lagardère Sports is classified within

“Assets held for sale and associated liabilities” in the

consolidated balance sheet. In accordance with IFRS 5, the

contribution of Lagardère Sports is presented as a single amount on

the face of the 2019 consolidated income statement and consolidated

statement of cash flows, within “Profit (loss) from discontinued

operations” and “Net cash from (used in) discontinued operations”,

respectively. Data for 2018 have been restated for the purposes of

comparability.

- REVENUE AND RECURRING

EBIT(6)

Revenue

Revenue for the Lagardère group came in at €7,211 million for

2019, up 5% on a consolidated basis and up 4.1% like for like.

The difference between

consolidated and like-for-like revenue is essentially attributable

to a €92 million positive foreign exchange effect resulting mainly

from the appreciation of the US dollar. The €18 million negative

scope effect reflects the disposals of media assets, chiefly offset

by the two acquisitions carried out at Lagardère Travel Retail (HBF

and IDF).

Revenue (€m)

Change

2018

2019

on a consolidated

basis

on a like-for-like

basis

Lagardère Publishing

2,252

2,384

+5.9%

+2.8%

Lagardère Travel Retail

3,673

4,264

+16.1%

+6.3%

Other Activities*

301

288

-4.3%

-4.2%

Target scope

6,226

6,936

+11.4%

+4.5%

Non-retained scope**

642

275

-57.2%

-4.6%

LAGARDÈRE

6,868

7,211

+5.0%

+4.1%

* Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1,

Virgin Radio, RFM and the Elle brand licence), the Entertainment

businesses, the Group Corporate function, and the Lagardère Active

Corporate function, whose costs are being wound down by 2020. **

Operations disposed of/disposals pending completion (Lagardère

Active), excluding Lagardère Sports, classified as a discontinued

operation in accordance with IFRS 5.

GROUP RECURRING EBIT

Group recurring EBIT

(€m)

Change (€m)

2018*

2019

Lagardère Publishing

200

220

+20

Lagardère Travel Retail

121

152

+31

Other Activities**

(11)

(11)

0

Target scope

310

361

+51

Non-retained scope***

75

17

-58

LAGARDÈRE

385

378

-7

* Restated for IFRS 16. See appendices at

the end of the press release.

** Lagardère News (Paris Match, Le Journal du Dimanche, Europe

1, Virgin Radio, RFM and the Elle brand licence), the Entertainment

businesses, the Group Corporate function, and the Lagardère Active

Corporate function, whose costs are being wound down by 2020. ***

Operations disposed of/disposals pending completion (Lagardère

Active), excluding Lagardère Sports, classified as a discontinued

operation in accordance with IFRS 5.

Group recurring EBIT totalled €378 million, down €7 million

on 2018.

Recurring EBIT based on the target scope rose by €51 million

year on year, to €361 million. The scope effect resulting from

the acquisitions of HBF and IDF added €27 million, while changes in

exchange rates added €7 million to the recurring EBIT figure.

Excluding these scope and foreign exchange effects, recurring EBIT

for the target scope climbed 5.6% or €17 million, lifted by a

strong year at Lagardère Publishing in both Illustrated Books and

Education, as well as improved profitability for US operations, and

by Lagardère Travel Retail thanks to a good showing in EMEA and

North America.

Recurring EBIT for the non-retained scope amounted to €17

million, down €58 million year on year owing mainly to the various

disposals at Lagardère Active during the year.

Revenue

Lagardère Publishing revenue was €677 million in

fourth-quarter 2019, up 5.0% on a consolidated basis and up 1.7%

like for like, thanks notably to the publication of a new Asterix

album in late October 2019.

Full-year 2019:

Revenue totalled €2,384 million for the year, up 5.9% on a

consolidated basis and up 2.8% like for like.

Revenue growth in 2019 was chiefly driven by a good performance

in Education – particularly in France and Spain, the success of the

new Asterix album, and sustained growth in Partworks and Mobile

Games.

Revenue for France was up 6.3%, spurred by a sharp rise in

Education on the back of the reform of two French high school

levels, and by a solid increase in Illustrated Books thanks to the

international success of the new Asterix album, La Fille de

Vercingétorix, along with a good performance at Hachette Pratique,

Hachette Jeunesse Licences and Larousse. General Literature also

had a good year, buoyed by the publication of the large-format

version of Guillaume Musso’s La Vie secrète des écrivains, and by

growth in Le Livre de Poche paperbacks led by the publication of

Musso’s La Jeune Fille et la Nuit, and Valérie Perrin’s Changer

l’eau des fleurs. Lastly, Mobile Games also continued to generate

good momentum.

The United Kingdom fell 1.4%, as a good performance for the

backlist and for digital sales at Bookouture and the success of

Billy Connolly’s Tall Tales and Wee Stories late in the year failed

to offset an unfavourable comparison effect resulting from the

success of Michael Wolff’s Fire and Fury in 2018 and of the J.K.

Rowling/Robert Galbraith titles published in the last quarter of

that year.

The United States slipped 1.0%. A sharp rise in revenue from

digital audiobooks led by Malcolm Gladwell’s Talking to Strangers,

as well as the success of Andrzej Sapkowski’s The Witcher at Orbit

late in the year, only partially offset the unfavourable comparison

effect with 2018, which had been boosted by the remarkable success

of James Patterson and Bill Clinton’s The President is Missing and

by the publication of Nicholas Sparks’ Every Breath.

Spain/Latin America posted 10.3% revenue growth, spurred by

curriculum reform in Spain (concerning all primary school levels in

Andalusia) and by the launch of the new Asterix album at Bruño.

Partworks delivered revenue growth of 4.9%, reflecting the good

performance of first-half launches (particularly models and leisure

crafts) in Japan, Germany and France.

E-books accounted for 7.7% of total Lagardère Publishing revenue

in 2019 versus 7.9% in 2018, while digital audiobooks represented

3.4% of revenue versus 2.7% in 2018.

Recurring EBIT

Lagardère Publishing reported €220 million in recurring EBIT, up

€20 million on 2018.

Recurring EBIT growth was led mainly by France, with Illustrated

Books buoyed by publication of a new Asterix album and Education by

high school reform, as well as by Spain (new primary school

textbooks) and the United States (growth in audiobooks and

operating cost efficiency plan). Recurring EBIT for the division

also benefited from a positive foreign exchange effect resulting

from the appreciation of the US dollar.

Revenue

Revenue for fourth-quarter 2019 totalled €1,117 million, up

17.8% on a consolidated basis and up 5.8% like for like. The

fourth-quarter performance was driven mainly by dynamic trading for

the EMEA scope (excluding France) and for continental China.

Platforms in North America also performed well in the fourth

quarter. However, social incidents in France and Hong Kong dampened

these gains.

Full-year 2019:

Revenue totalled €4,264 million for the year, up 16.1% on a

consolidated basis and up 6.3% like for like.

Despite the slowdown towards the end of the year owing to the

strikes, France reported a sharp 7.6% rise in revenue, buoyed by

good Duty Free trading at regional platforms (Nice, Marseille and

Nantes), growth in the Foodservice network (Toulouse) and the

success of the new Relay concept at Travel Essentials.

The EMEA region (excluding France) enjoyed robust momentum (up

6.9%), attributable to a good performance in Italy for Duty Free

operations (Rome, Venice and regional airports) and Travel

Essentials (favourable network impact), as well as in Romania,

Spain and Portugal. The Middle East also reported solid revenue

growth, with the opening of the new Dubai Foodcourt and ongoing

business expansion in Africa.

In North America, business grew by 2.9% (by 3.6% on a same-store

basis), reflecting a dynamic performance at Travel Essentials

driven by sales initiatives and Foodservice operations, despite the

adverse impact of US-China trade tensions on Canadian airport

traffic.

Asia-Pacific advanced 7.2%, spurred by growth in China

(continental China and Hong Kong) which benefited from the new

openings and modernisation initiatives carried out in 2018 and

2019. Business contracted in the Pacific region due to the economic

slowdown in Australia and an unfavourable network effect, despite

the full-year impact of new outlets opened in Christchurch, New

Zealand.

Recurring EBIT

Recurring EBIT moved up €31 million to €152 million.

This impressive increase mainly reflects the impact of the

acquisitions of HBF in November 2018 and of IDF in the final

quarter of 2019, and bullish performances from North America and

Italy. France also had a very good year in 2019, despite the impact

of the strikes. Business continued to ramp up despite events in

Hong Kong, the collapse of the Icelandic airline WOW Air and the

weak Australian economy.

Revenue

Revenue for 2019 totalled €288 million, down 4.2% like for

like and down 4.3% on a consolidated basis.

The revenue decline for Other Activities is chiefly the result

of a 12.5% fall in Radio revenue owing to lower audience figures

for Europe 1. Revenue also contracted for Lagardère News (down

6.9%), as upbeat advertising revenues failed to fully counter the

drop in circulation revenues, which accelerated towards the end of

the year owing to the strikes in France.

Recurring EBIT

Recurring EBIT for Other Activities in 2019 remained stable

year on year, at a negative €11 million.

The gradual reduction in overheads linked to the disappearance

of the former Lagardère Active Corporate function, whose costs are

being fully wound down in 2020, was offset by the combined impact

of a decline in Europe 1 advertising revenues and in the

circulation of press titles.

Revenue for the non-retained scope in 2019 was down 57.2% on a

consolidated basis, at €275 million. Recurring EBIT amounted to €17

million for the year.

- MAIN INCOME STATEMENT

ITEMS

(€m)

2018*

2019

Revenue

6,868

7,211

Group recurring EBIT

385

378

Income from equity-accounted

companies**

3

6

Non-recurring/non-operating items

22

(33)

Impact of IFRS 16 on concession

agreements

41

60

Profit before finance costs and

tax

451

411

Interest expense on lease liabilities

(76)

(85)

Finance costs, net

(57)

(53)

Profit before tax

318

273

Income tax expense

(124)

(55)

Profit (loss) from discontinued

operations

5

(207)

Profit for the period

199

11

Minority interests

22

26

Profit (loss) - Group share

177

(15)

* Restated for IFRS 16. See appendices at

the end of the press release.

** Before impairment losses.

- Income from equity-accounted companies

Income from equity-accounted companies (before impairment

losses) came in at €6 million in 2019, versus €3

million one year earlier, buoyed by good performances from the

joint operations at Lagardère Travel Retail.

- Non-recurring/non-operating items

Non-recurring/non-operating items represented a net negative

amount of €33 million, compared with a net positive amount of €22

million in 2018, and mainly included:

- €134 million in net disposal gains, chiefly relating to the

sale of TV channels in September 2019 (€99 million), BilletReduc in

February 2019 (€18 million) and South African Radio operations (€13

million) in January 2019. In 2018, net disposal gains amounted to

€205 million, including a gain of €245 million on the sale of the

rue François 1er office building in Paris (France) and a loss of

€40 million on the sale of the interest in Marie Claire group;

- €34 million in impairment losses against property, plant and

equipment and intangible assets, including €6 million attributable

to Lagardère Travel Retail and €26 attributable to the non-retained

scope;

- €42 million in restructuring costs, a sharp €29 million

decrease on 2018, including €15 million at Other Activities

resulting from the late-2019 redundancy plan for the Group

Corporate function, €14 million at Lagardère Travel Retail

including HBF integration costs, and €12 million at Lagardère

Publishing relating to the streamlining of distribution centres in

the United Kingdom;

- €91 million in amortisation of intangible assets and costs

relating to the acquisition of consolidated companies, including

€82 million for Lagardère Travel Retail and €8 million for

Lagardère Publishing.

- Impact of IFRS 16 on concession agreements

The impact of applying IFRS 16 on concession agreements amounted

to a positive €60 million in 2019, versus a positive €41 million in

2018.

- Interest expense on lease liabilities

Interest expense on lease liabilities represented €85 million

in 2019, versus €76 million

in 2018. The €9 million rise in this item results from the

consolidation of HBF and IDF.

Net finance costs amounted to €53 million in

2019, a slight improvement on

the prior year.

Income tax expense totalled €55 million, down €69 million

year on year. Income tax expense in 2018 notably included €83

million in one-off tax payable on the sale by Lagardère Active of

the rue François 1er office building in Paris (France) and €14

million in tax savings resulting from the Lagardère Active

restructuring plan.

- Profit (loss) from discontinued operations

Discontinued operations relate

to Lagardère Sports, which generated a total loss of €207 million

in 2019 (the purchase offer received in December 2019 led the Group

to recognize a €234 million impairment loss against the

business).

Taking account of all these items, profit for the year came

out at €11 million, including a loss of €15 million attributable to

the Group. Profit attributable to minority interests in 2019

was €26 million, versus €22 million attributable to minority

interests in 2018, reflecting the performance of Le Livre de Poche

paperbacks at Lagardère Publishing and North American and Italian

operations at Lagardère Travel Retail.

ADJUSTED PROFIT - GROUP

SHARE

Adjusted profit - Group share (excluding

non-recurring/non-operating items) totalled €200 million in

2019, in line with the 2018 figure.

(€m)

2018*

2019

Group recurring EBIT**

385

378

Income from equity-accounted

companies***

+3

+6

Interest expense on lease liabilities –

buildings and other leases

-17

-19

Finance costs, net

-57

-53

Tax effects****

-85

-77

o/w attributable to minority interests

-29

-35

Adjusted profit - Group share**

200

200

* Restated for IFRS 16. See appendices at

the end of the press release.

** Alternative performance measure, see

definition at the end of the press release.

*** Before impairment losses.

**** Excluding tax on

non-recurring/non-operating items.

EARNINGS PER SHARE

Earnings per share - Group share represented a negative €0.12,

versus a positive €1.36 in 2018. Adjusted earnings per share -

Group share was €1.55, versus €1.54 in 2018. The number of shares

comprising the share capital was unchanged from the previous

year.

- OTHER FINANCIAL

INFORMATION

Cash flow from operations and investing activities

(€m)

2018*

2019

Cash flow from operations before

changes in working capital and income taxes paid**

439

495

Changes in working capital

18

34

Income taxes paid excluding taxes on

property disposals

(30)

(52)

Cash flow from operations**

427

477

Purchases/disposals of property, plant and

equipment and intangible assets***

(186)

(197)

Free cash flow excluding property

disposals

241

280

Property disposals net of tax paid and

related refitting costs

183

14

Free cash flow****

424

294

Purchases of investments

(339)

(287)

Disposals of financial investments

148

323

Cash flow from operations and investing

activities

233

330

* Restated for IFRS 16. See appendices at the end of the press

release. ** Before taxes on property disposals. *** Excluding

property disposals and refitting costs. **** Alternative

performance measure.

- Cash flow from operations

Cash flow from operations before changes in working capital

amounted to €495 million in 2019 compared to €439 million in

2018. This increase chiefly results from the favourable impact

of business at Lagardère Publishing (€32 million) and Lagardère

Travel Retail (€49 million), only partly offset by the €32 million

decline for the non-retained scope.

Changes in working capital represented an inflow of €34

million over the year, compared to an inflow of €18 million in

2018. This €16 million increase reflects (i) a rise of €49

million for Lagardère Publishing resulting from lower author

advances at the end of the year and a year-on-year reduction in

Partworks inventories, which had been affected by a busy launch

schedule at the end of 2017, and (ii) a rise of €26 million for the

non-retained scope, including a €22 million inflow relating to the

collection of a portion of the proceeds from the sale of most of

the magazine publishing titles to Czech Media Invest (CMI). The

increase is offset by a €73 million decline for Lagardère Travel

Retail (2018 had been boosted by a favourable one-off impact linked

to the working capital optimisation drive).

Income taxes paid (excluding tax on property disposals)

totalled €52 million in 2019 compared to €30 million in 2018.

The increase in this item reflects adverse changes in tax

settlements in connection with tax consolidation in France and the

impact of higher taxation on cross-border trade in the United

States.

- Purchases/disposals of property, plant and equipment and

intangible assets

Net purchases and disposals of property, plant and equipment

and intangible assets (excluding property disposals) represented an

outflow of €197 million in 2019, chiefly relating to Lagardère

Travel Retail (€156 million), with a significant portion

corresponding to the opening of new stores. The balance (€35

million) results essentially from Lagardère Publishing and is

mainly attributable to the end of investments in logistics projects

in the United Kingdom and in new information systems projects in

France.

Further to the implementation of the strategic refocusing plan,

free cash flow for the target scope excluding changes in working

capital is presented in the following table: - illustrating the

generation of free cash flow for the Group's new scope, stripping

out the volatility of changes in working capital, which should be

neutral over the long term; and - presenting separately the

contribution of non-retained assets together with the costs

associated with the refocusing plan.

2018*

2019

Cash flow from operations before changes

in working capital and income taxes paid**

402

491

Income taxes paid excluding taxes on

property disposals

-14

-46

Purchases/disposals of property, plant and

equipment and intangible assets***

-180

-195

Free cash flow excluding changes in

working capital for the target scope

+208

+250

Changes in working capital for the target

scope

+38

+28

Free cash flow for the target

scope

+246

+278

Property disposals net of tax paid and

related refitting costs

+183

+14

Restructuring costs relating to the

Group’s strategic refocusing

-

-19

Other cash flow from operations –

non-retained scope****

-5

+21

Free cash flow for the non-retained

scope

+178

+16

Free cash flow**

424

294

* Restated for IFRS 16. See appendices at

the end of the press release.

** Alternative performance measure.

*** Excluding property disposals and

refitting costs.

**** Operations disposed of/disposals

pending completion (Lagardère Active), excluding Lagardère Sports,

classified as a discontinued operation in accordance with IFRS

5.

The Group’s free cash flow totalled €294 million in 2019

versus €424 million in 2018. The €130 million decrease reflects the

sharp decrease in free cash flow for the non-retained scope

(negative €162 million impact), partly offset by a significant €32

million improvement in free cash flow for the target scope.

Excluding changes in working capital, free cash flow for the

target scope was €250 million, up €42 million on 2018 thanks to

a sharp rise for the Group’s two businesses (cash flow from

operations before changes in working capital up €89 million),

tempered by a rise in income taxes paid (€32 million negative

impact) and in purchases of property, plant and equipment and

intangible assets (€15 million negative impact) related mainly to

the consolidation of HBF.

Changes in working capital represented a positive €28 million

impact, €10 million lower than in 2018.

As a result, free cash flow for the target scope was €278

million, up €32 million year on year.

Free cash flow for the non-retained scope totalled €16 million

in 2019, down by €162 million versus 2018, driven by:

- the €169 million decrease in property disposals, with 2018

including the sale of the rue François 1er office building in Paris

(France);

- outflows relating to restructuring costs for the former

Lagardère Active Corporate function;

- partly offset by a higher contribution from divested

activities, including an inflow of €22 million relating to the

collection of a portion of the proceeds from the sale of most of

the magazine publishing titles to Czech Media Invest (CMI).

- Purchases/disposals of investments

Purchases of investments represented an outflow of €287

million and mainly related to the acquisition of the IDF group

in Belgium, and to a lesser extent the acquisition of Autogrill Cz

in the Czech Republic by Lagardère Travel Retail. Purchases of

investments also include Lagardère Publishing’s acquisitions of

Gigamic and Blackrock Games in France, and of Short Books in the

United Kingdom.

Disposals of financial investments represented an inflow of

€323 million (including €7 million in interest received) in

2019, with €316 million of this amount corresponding mainly to

disposals at Lagardère Active as part of the strategic refocusing

plan, including the sale of the TV channels in September 2019, of

BilletReduc and most of the magazine publishing titles in France in

February 2019, and of South African Radio operations in January

2019.

Cash flow from operations and investing activities

In all, cash flow from operations and investing activities

represented a net inflow of €330 million in 2019, compared with a

net inflow of €233 million in 2018.

FINANCIAL POSITION

At end-December 2019, net debt stood at €1,461 million compared

to €1,367 million one year earlier. Acquisitions were primarily

financed out of proceeds from disposals carried out in 2019.

- The Group's liquidity position remains very solid, with

€2,163 million in available liquidity (available cash and

short-term investments reported on the balance sheet totalling €913

million and an undrawn amount on the syndicated credit line of

€1,250 million).

- The Group continues to enjoy a healthy financial position,

with a stable leverage ratio (net debt(1)/recurring EBITDA(1)) of

2.1.

- KEY EVENTS SINCE 7 NOVEMBER

2019

- Chairmanship of the Supervisory Board of Lagardère

SCA

At its meeting on 4 December 2019, the Supervisory Board, acting

on the recommendation of the Appointments, Remuneration and

Governance Committee, decided to appoint Patrick Valroff as its

Chairman and as Chairman of the Audit Committee of Lagardère SCA,

further to the resignation of Xavier de Sarrau for personal

reasons.

- Sale of Lagardère Sports to H.I.G. Capital

On 16 December 2019, the Lagardère group announced that it had

received an offer from H.I.G. Capital to acquire 75% of the capital

of Lagardère Sports. The preliminary sale agreement was signed on

20 February 2020. The transaction is targeted to close before the

end of the first quarter of 2020 and is subject to clearance from

the competition authorities.

2020 RECURRING EBIT(1) GROWTH TARGET

BASED ON TARGET SCOPE

The Lagardère group expects 2020 recurring EBIT(1) growth

to be between 4% and 6% at constant exchange rates, excluding the

acquisition of IDF and the impact of the coronavirus.

The COVID-19 epidemic has had

a marked impact on business levels at Lagardère Travel Retail since

the middle of January, chiefly in the Asia-Pacific zone as well as

at its international hubs (notably as regards Chinese tourist

spending at European destinations). In view of the change in

business levels observed to date, Lagardère estimates that COVID-19

will have an adverse impact on recurring EBIT, excluding the impact

of the Group’s action plan, of around €20 million in the first

quarter of 2020.

Around half of this impact is

expected to be offset over the course of the year by the

progressive ramp-up of various initiatives that are already being

implemented in all geographies (e.g., optimisation of site opening

hours and rents in agreement with landlords, optimisation of

operating costs).

Obviously, it is not currently

possible to foresee how the epidemic will develop going forward.

The Group is continuing to monitor the situation very carefully,

with a view to implementing any additional measures across all of

its geographies as and when appropriate.

DIVIDEND

As for 2018, shareholders at the Annual General Meeting will be

asked to approve a €1.30 per share dividend for the 2019 fiscal

year. Shareholders will be given the option of receiving the

dividend payment in shares, allowing the Group to strengthen its

financial flexibility in supporting the development of its two

pillars while maintaining shareholder return.

- Supervisory Board meeting The Supervisory Board meeting was held on 27

February 2020 to review the parent company and consolidated

financial statements for 2019.

- Lagardère Investor Day The Group's Investor Day will be held on 25

March 2020 at 2:00 p.m.

- First-quarter 2020 revenue First-quarter 2020 revenue will be released

on 30 April 2020 at 8:00 a.m. A conference call will be held at

10:00 a.m. on the same day.

- General Meeting – Fiscal year 2019 The General Meeting

of Shareholders will be held on 5 May 2020 at 10:00 a.m. at the

Carrousel du Louvre in Paris.

- Ordinary dividend The

ex-dividend date for the ordinary dividend (proposed at €1.30 per

share) for 2019 is expected to be 7 May 2020, with a payment date

as from 28 May 2020.

- First-half 2020 results First-half 2020 results will be released on

30 July 2020 at 5:35 p.m. A conference call will be held at 5:45

p.m. on the same day.

- Third-quarter 2020 revenue Third-quarter 2020 revenue will be released

on 5 November 2020 at 8:00 a.m. A conference call will be held at

10:00 a.m. on the same day.

***

FOURTH-QUARTER 2019

REVENUE:

Revenue (€m)

Change

Q4 2018

Q4 2019

on a consolidated

basis

on a like-for-like

basis

Lagardère Publishing

645

677

+5.0%

+1.7%

Lagardère Travel Retail

948

1,117

+17.8%

+5.8%

Other Activities*

91

80

-12.1%

-10.1%

Target scope

1,684

1,874

+11.3%

+3.4%

Non-retained scope**

196

88

-55.1%

+8.0%

LAGARDÈRE

1,880

1,962

+4.4%

+3.6%

* Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1,

Virgin Radio, RFM and the Elle brand licence), the Entertainment

businesses, the Group Corporate function, and the Lagardère Active

Corporate function, whose costs are being wound down by 2020. **

Operations disposed of/disposals pending completion (Lagardère

Active), excluding Lagardère Sports, classified as a discontinued

operation in accordance with IFRS 5.

CHANGES IN SCOPE OF CONSOLIDATION AND

EXCHANGE RATES

Full-year 2019:

The difference between consolidated and like-for-like revenue

data is attributable to a €92 million positive foreign exchange

effect resulting chiefly from fluctuations in the US dollar, and to

an €18 million negative scope effect, breaking down as:

- a €359 million negative impact resulting from disposals carried

out in 2018 and 2019 at Lagardère Active as part of the strategic

refocusing plan, including €248 million relating to the sale of

most of the magazine publishing titles to Czech Media Invest in

January 2019, €51 million relating to the sale of the TV channels

in September 2019 and €30 million relating to the sale of Radio

operations in Eastern Europe;

- a €314 million positive impact chiefly resulting from Lagardère

Travel Retail’s acquisitions of HBF in late November 2018 and of

IDF at the end of September 2019;

- a €23 million positive impact at Lagardère Publishing, mainly

reflecting the February 2019 acquisition of Gigamic.

OPERATIONS DISPOSED OF OR IN EXCLUSIVE

SALE NEGOTIATIONS

Disposals to date

2018 recurring EBIT*

2019 recurring EBIT

Estimated sale value

(€m)

Date of sale

LARI – Eastern Europe

7

-

73

July 2018

Marie Claire

-

-

14

June 2018

MonDocteur

(4)

-

55

July 2018

Doctissimo

October 2018

Boursier

3

41

January 2019

BilletReduc

-

February 2019

Plurimédia

February 2019

Doctipharma

February 2019

LARI - Africa (Jacaranda, Mediamark, Vibe

Radio [Senegal and Côte d'Ivoire])

1

18

Jacaranda and Vibe Radio:

transactions closed in February 2019

-

Mediamark: closing subject to

regulatory clearance

Magazine publishing titles (excluding

Paris Match, Le Journal du Dimanche and the Elle brand licence)

22

-

52

February 2019

Mezzo

3

1

12 at 60%, and 20 at 100%

July 2019

DHP, other

1

0

1

July-October 2019

TV channels, excluding Mezzo

23

2

215

September 2019

Total

56

3

* Restated for IFRS 16. See appendices at

the end of the press release.

Disposals pending completion

2018 recurring

EBIT*

2019 recurring EBIT

Estimated sale value

(€m)

Date of sale

Lagardère Sports

32

64

110

Closed 20 February 2020

Not yet sold

Lagardère Studios

19

15

Total

51

79

* Restated for IFRS 16. See

appendices at the end of the press release

Lagardère uses alternative performance measures which serve as

key indicators of the Group’s operating and financial performance.

These indicators are tracked by the Executive Committee in order to

assess performance and manage the business, as well as by investors

in order to monitor the Group’s operating performance, along with

the financial metrics defined by the IASB. These indicators are

calculated based on accounting items taken from the consolidated

financial statements prepared under IFRS and a reconciliation with

those items is provided in this press release, in the full-year

2019 results presentation, or in the notes to the consolidated

financial statements.

Like-for-like revenue is used by the Group to analyse revenue

trends excluding the impact of changes in the scope of

consolidation and in exchange rates.

The like-for-like change in revenue is calculated by comparing:

- revenue for the period adjusted for companies consolidated for

the first time during the period and revenue for the prior-year

period adjusted for consolidated companies divested during the

period; - revenue for the prior-year period and revenue for the

current period adjusted based on the exchange rates applicable in

the prior-year period.

The scope of consolidation comprises all fully-consolidated

entities. Additions to the scope of consolidation correspond to

business combinations (acquired investments and businesses), and

deconsolidations correspond to entities over which the Group has

relinquished control (full or partial disposals of investments and

businesses, such that the entities concerned are no longer included

in the Group’s financial statements using the full consolidation

method). The difference between consolidated and like-for-like

figures is explained in section VII - Appendices of this press

release.

The Group's main performance indicator is recurring operating

profit of fully consolidated companies (recurring EBIT), which is

calculated as follows:

Profit before finance costs and tax

Excluding:

- Income from equity-accounted companies before impairment

losses

- Gains (losses) on disposals of assets

- Impairment losses on goodwill, property, plant and equipment,

intangible assets and investments in equity-accounted

companies

- Items related to business combinations: - Acquisition-related

expenses - Gains and losses resulting from purchase price

adjustments and fair value adjustments due to changes in control -

Amortisation of acquisition-related intangible assets

- Specific major disputes unrelated to the Group’s operating

performance

- Items related to leases and finance lease arrangements: -

Cancellation of fixed rental expense* on concession agreements -

Depreciation of right-of-use assets on concession agreements -

Gains and losses on lease modifications under concession

agreements

* Cancellation of fixed rental expense on concession agreements

is equal to the repayment of the lease liability, the associated

change in working capital and interest paid in the statement of

cash flows.

The reconciliation between recurring operating profit of fully

consolidated companies (recurring EBIT) and profit before finance

costs and tax is set out in the full-year 2019 results

presentation, on slide 18.

Operating margin is calculated by dividing recurring operating

profit of fully consolidated companies (recurring EBIT) by

revenue.

- Recurring EBITDA over a rolling

12-month period

Recurring EBITDA is calculated as recurring operating profit of

fully consolidated companies (Group recurring EBIT) plus dividends

received from equity-accounted companies, less depreciation and

amortisation charged against property, plant and equipment and

intangible assets, amortisation of the cost of obtaining contracts,

and the cancellation of fixed rental expense* on property and other

leases, plus recurring EBITDA from discontinued operations.

* Cancellation of fixed rental expense on concession agreements

is equal to the repayment of the lease liability, the associated

change in working capital and interest paid in the statement of

cash flows.

The reconciliation between recurring EBITDA and recurring

operating profit of fully consolidated companies (recurring EBIT)

is set out in the full-year 2019 results presentation, on slide

39.

- Adjusted profit - Group

share

Adjusted profit - Group share is calculated on the basis of

profit for the period, excluding non-recurring/non-operating items,

net of the related tax and of minority interests, as follows:

Profit for the period

Excluding:

- Gains (losses) on disposals of assets

- Impairment losses on goodwill, property, plant and equipment,

intangible assets and investments in equity-accounted

companies

- Items related to business combinations: - Acquisition-related

expenses - Gains and losses resulting from purchase price

adjustments and fair value adjustments due to changes in control -

Amortisation of acquisition-related intangible assets

- Specific major disputes unrelated to the Group’s operating

performance

- Non-recurring changes in deferred taxes

- Items related to leases and finance lease arrangements: -

Cancellation of fixed rental expense* on concession agreements -

Depreciation of right-of-use assets on concession agreements -

Interest expense on lease liabilities under concession agreements -

Gains and losses on lease modifications under concession

agreements

- Tax effects of the above items

- Profit (loss) from discontinued operations

- Adjusted profit attributable to minority interests: profit

attributable to minority interests adjusted for minorities' share

in the above items

= Adjusted profit - Group share

* Cancellation of fixed rental expense on concession agreements

is equal to the repayment of the lease liability, the associated

change in working capital and interest paid in the statement of

cash flows.

The reconciliation between profit and adjusted profit - Group

share is set out in the full-year 2019 results presentation, on

slide 34.

Free cash flow is calculated as cash flow from operations before

changes in working capital, the repayment of lease liabilities and

related interest paid, changes in working capital and interest paid

plus net cash flow relating to acquisitions and disposals of

property, plant and equipment and intangible assets.

The reconciliation between cash flow from operations and free

cash flow is set out in the full-year 2019 results presentation, on

slide 32.

Net debt is calculated as the sum of the following items:

- Short-term investments and cash and cash equivalents

- Financial instruments designated as hedges of debt

- Non-current debt

- Current debt

= Net debt

The reconciliation between balance sheet items and net debt is

set out in the full-year 2019 results presentation, on slide

38.

***

A live webcast of the presentation of the

full-year 2019 results will be available today at 5:45 p.m. (CET)

on the Group’s website (www.lagardere.com).

The presentation slides will be made

available at the start of the webcast.

A replay of the webcast will be available

online later in the evening.

***

Created in 1992, Lagardère is an international group with

operations in more than 40 countries worldwide. It employs over

30,000 people and generated revenue of €7,211 million in 2019. In

2018, the Group launched its strategic refocusing around two

priority divisions: Lagardère Publishing (Book and e-Publishing,

Mobile and Board games) and Lagardère Travel Retail (Travel

Essentials, Duty Free & Fashion, Foodservice). The Group’s

operating assets also include Lagardère News and Lagardère Live

Entertainment. Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Important Notice: Some of the statements contained in

this document are not historical facts but rather are statements of

future expectations and other forward-looking statements that are

based on management’s beliefs. These statements reflect such views

and assumptions prevailing as of the date of the statements and

involve known and unknown risks and uncertainties that could cause

future results, performance or future events to differ materially

from those expressed or implied in such statements. Please refer to

the most recent Universal Registration Document filed by Lagardère

SCA with the French Autorité des marchés financiers for additional

information in relation to such factors, risks and uncertainties.

Lagardère SCA has no intention and is under no obligation to update

or review the forward-looking statements referred to above.

Consequently Lagardère SCA accepts no liability for any

consequences arising from the use of any of the above

statements.

1 Aternative performance measure, see definition at the end of

the press release. 2 Lagardère Publishing, Lagardère Travel Retail,

Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1,

Virgin Radio, RFM, the Elle brand licence), the Entertainment

business, the Group Corporate function and the Lagardère Active

Corporate function, whose costs are being wound down by 2020. 3

Restated for the impact of IFRS 16 on concession agreements at

Lagardère Travel Retail, at constant exchange rates and excluding

Lagardère Travel Retail’s acquisition of HBF and IDF. 4 At constant

exchange rates, excluding the impact of Lagardère Travel Retail’s

acquisition of IDF. 5 The adverse impact to date and action plans

are described on page 10 in the “Outlook” section. 6 The Group's

consolidated financial statements have been audited. The audit

report will be signed off once the specific verifications have been

completed. 7 Dates may be susceptible to change

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200227005770/en/

Press Contacts Thierry

Funck-Brentano Tel. +33 1 40 69 16 34 tfb@lagardere.fr

Ramzi Khiroun Tel. +33 1 40 69 16 33 rk@lagardere.fr

Investor Relations Contact

Emmanuel Rapin Tel. +33 1 40 69 17 45 erapin@lagardere.fr

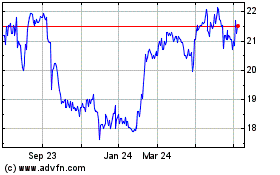

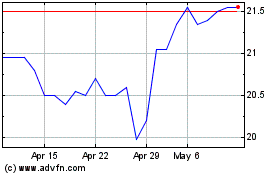

Lagardere (EU:MMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lagardere (EU:MMB)

Historical Stock Chart

From Apr 2023 to Apr 2024