Revenue at €1,361 million, down 12.5% like

for like(1) in the wider context of the Covid-19 health

crisis

Lagardère Publishing reports revenue growth

in the United States

Lagardère Travel Retail down 18% like for

like

The Group is taking firm corrective action

to mitigate the impacts of the crisis

Regulatory News:

LAGARDERE SCA (Paris:MMB):

Revenue fell 12.5% in first-quarter 2020, mainly as a result

of the impacts of the Covid-19 crisis on Lagardère Travel Retail’s

operations from mid-February, and despite a good performance at

Lagardère Publishing for the first two months of the

quarter.

Target scope highlights(2) (like-for-like basis):

- Lagardère Publishing: the drop in revenue (down 3.3%) is

mainly attributable to France following the closure of most points

of sale in the second half of March owing to the health crisis.

However, the business delivered growth in the United States, buoyed

by good momentum in digital formats and by the success of The

Witcher series.

- Lagardère Travel Retail: the decrease in revenue (down

18.0%) for the first quarter was attributable to the impacts of the

Covid-19 pandemic as from mid-February. These were initially felt

in China, where the virus first emerged, and Asia-Pacific, before

spreading to its operations around the world and leading to strict

confinement measures and the gradual closure of many airports and

railway stations, along with an unprecedented collapse in passenger

traffic.

Group revenue totalled €1,361 million versus €1,520

million in first-half 2019, representing a decrease of 10.4% on

a consolidated basis and of 12.5% like for like.

The difference between consolidated and like-for-like revenue is

attributable to a €13 million favourable foreign exchange effect

resulting chiefly from the appreciation of the US dollar and pound

sterling. The €14 million positive scope effect is mainly due to

the acquisition of International Duty Free in Belgium, partly

countered by the disposal of TV channels and digital activities as

part of the Lagardère group’s strategic refocusing.

I. REVENUE AND ACTIVITY BY

DIVISION

Revenue (€m)

Change

Q1 2019

Q1 2020

on a

consolidated

basis

on a like-for-like

basis

Lagardère Publishing

460

457

-0.8%

-3.3%

Lagardère Travel Retail

930

804

-13.5%

-18.0%

Other Activities*

65

60

-7.7%

-6.3%

Target scope

1,455

1,321

-9.2%

-12.8%

Non-retained scope**

65

40

-38.5%

+0.8%

LAGARDÈRE

1,520

1,361

-10.4%

-12.5%

* Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1,

Virgin Radio, RFM and the Elle brand licence), the Entertainment

businesses, the Group Corporate function, and the Lagardère Active

Corporate function, whose costs are being wound down by end

2020.

** Operations disposed of/disposals pending completion

(Lagardère Active), excluding Lagardère Sports, classified as a

discontinued operation in accordance with IFRS 5.

Revenue for first-quarter 2020 totalled €457 million, down

0.8% on a consolidated basis and down 3.3% like for like.

The difference between consolidated and like-for-like revenue is

attributable to a €7 million positive foreign exchange effect

resulting primarily from the appreciation of the US dollar and

pound sterling and, to a lesser extent, a €5 million positive scope

effect linked to the acquisitions of Gigamic and Short Books in

2019.

The figures below are presented on a like-for-like basis.

The 9.4% revenue decline in France

reflects the confinement measures introduced by the French

government in March amid the health crisis. Trade segments

accounted for most of the decline. Distribution activities were

also disrupted, with the moderate proportion of digital operations

failing to offset the sales downturn at brick-and-mortar

stores.

In the United States, the

significant 6.8% increase in business was led by the success of

Andrzej Sapkowski’s The Witcher series (both print and e-book

formats) and by the sharp rise in downloadable audiobooks fuelled

by the success of Malcolm Gladwell’s Talking to Strangers and The

Witcher series. E-books accounted for 16.8% of total US revenue in

first-quarter 2020 versus 17.4% in first-quarter 2019. Downloadable

audiobooks as a percentage of total US revenue increased by almost

4.5 percentage points, to 14.4% in first-quarter 2020 from 10.0%

one year earlier.

Revenue in the United Kingdom

contracted 5.5% owing to a more subdued literary release schedule,

although this was partly countered by the success in all formats of

The Witcher series at Orion. E-books accounted for 17.8% of total

UK revenue in first-quarter 2020 versus 16.8% in first-quarter

2019, while downloadable audiobooks accounted for 6.2% versus 3.8%

in first-quarter 2019.

Revenue in the Spain/Latin America

region slipped 2.3%, as March figures were affected by the state of

emergency and confinement measures introduced in Spain. Mexico saw

slight growth.

Partworks fell 6.1%, hit by a

combination of fewer launches in the quarter, a strong performance

in the comparative first-quarter 2019 period – with successful

titles in Japan and France – and the impacts of the health crisis

in March, which primarily affected sales at newsstands, especially

in France.

E-books accounted for 9.7% of total Lagardère Publishing revenue

in the first quarter of 2020, versus 9.1% in first-half 2019, while

downloadable audiobooks represented 5.9% of revenue compared to

3.8% one year earlier.

Lagardère Travel Retail revenue for first-quarter 2020

totalled €804 million, down 13.5% on a consolidated basis and down

18.0% like for like.

The difference between consolidated and like-for-like data is

attributable to a €6 million positive foreign exchange effect

primarily resulting from the appreciation of the US dollar, and to

a €35 million positive scope effect, due mainly to the acquisition

of International Duty Free in Belgium.

The figures below are presented on a like-for-like

basis.

France saw a 20.7% decline in

business, prompted both by the strikes which continued into the

first few months of 2020, and then by the impacts of the Covid-19

pandemic, with the containment measures introduced by the French

government leading to the rapid shutdown of virtually the entire

network.

The EMEA region (excluding France)

retreated 14.7%, affected by travel restrictions and border

closures introduced as from March in every country in order to halt

the spread of Covid-19.

Revenue was also down in North

America, contracting 15.2% on account of the repercussions

from the Covid-19 pandemic in North America, even though lockdowns

and travel restrictions were introduced later than in the ASPAC and

EMEA regions.

Asia-Pacific, the epicentre of the

pandemic, was the hardest hit geographic area with revenue down

28.0%, the biggest regional decline over the quarter.

First-quarter 2020 revenue for Other Activities came in at

€60 million, down 7.7% on a consolidated basis and down 6.3% like

for like.

The figures below are presented on a like-for-like basis.

Despite a good performance from both press and radio advertising

in the first two months of the year, Lagardère News(3) revenue was down 3.5% over the

quarter, with the impacts of the Covid-19 pandemic taking a heavy

toll on the radio (down 1.5%), press (down 2.8%), and licensing

(down 8.5%) businesses.

First-quarter 2020 revenue for the non-retained scope came in

at €40 million, down 38.5% on a consolidated basis and up 0.8% like

for like.

Lagardère Studios saw a slight 0.8% rise in the first quarter,

buoyed by a good delivery schedule in France and an upbeat start to

the year in distribution, partly offset by an unfavourable

catalogue effect at international subsidiaries.

II. KEY EVENTS SINCE 27 FEBRUARY

2020

13 March: following the new measures taken by the French

government limiting public gatherings and events, the Group

postponed its Investor Day initially planned for 25 March

2020.

25 March: the Group suspended its market guidance and changed

the dividend to be proposed to the Annual General Meeting of 5 May

2020 in light of the Covid-19 pandemic.

7 April: Lagardère cancelled the dividend to be proposed to

the Annual General Meeting of 5 May 2020 and created a Covid

Solidarity Fund for employees.

22 April: Lagardère finalised the sale of Lagardère Sports to

H.I.G. Capital.

III. COVID-19: OUTLOOK AND

LIQUIDITY

Over the first quarter of 2020, the Group experienced a gradual

deterioration in its businesses as the Covid-19 pandemic took hold

and governments across the globe introduced restrictions. Owing to

its exposure to the Asia-Pacific region, the Travel Retail business

was the first to feel the impact and was the hardest hit. Revenue

growth for Lagardère Travel Retail initially slowed to 1.3% over

January-February 2020, with the epidemic mainly affecting the

Asia-Pacific region, before falling 54% in March as the virus

gradually spread across Europe and North America.

Lagardère Publishing was primarily affected as from the second

half of March 2020, when its brick-and-mortar points of sale closed

in Europe and North America following government-imposed

restrictions. After a very good start to the year in

January-February 2020 with 5.6% growth, Lagardère Publishing

revenue fell 19% in March.

Revenue for the Group’s Other Activities edged up 1.4% in the

first two months of the year, but contracted 19% in March due to

the impacts of the health crisis on the advertising market and the

enforced closure of performance venues on the Lagardère Live

Entertainment business.

Lagardère Studios (non-retained scope) was also heavily impacted

from mid-March due to the virtual standstill in production since

confinement measures were introduced in France and Spain.

April 2020 is the first month in which the impacts of the

measures taken by governments to halt the spread of the Covid-19

pandemic will be felt across all of the Lagardère group’s

businesses and over the entire month. Compared to the same period

in 2019, the Group expects April 2020 revenue to be down in the

region of 45% for Lagardère Publishing, 90% for Lagardère Travel

Retail and 40% for Other Activities.

In this context, the Group is continuing to put in place

corrective measures in all of its businesses and at the corporate

level to mitigate the impacts of the Covid-19 pandemic as far as

possible. These include:

- protecting the health of employees, customers and

partners;

- adapting sales and pricing wherever possible;

- systematically reducing costs across all of the Group’s

business in order to curb the impact of the decline in revenue on

operating profit;

- adjusting investment programs and optimising working capital in

order to preserve the Group’s cash resources;

- cancelling the proposed 2019 dividend to be paid in 2020, on

the initiative of Arnaud Lagardère and unanimously approved by the

Supervisory Board;

- reducing the remuneration payable to the Executive Committee by

20% until the summer and for as long as the situation continues, on

the initiative of its members;

- creating a Covid-19 Solidarity Fund to finance the Group’s

initiatives in support of its employees and partners worldwide. The

fund is to be endowed with (i) €5 million deducted from the cash

initially set aside to pay the dividend, (ii) the full amount of

the reduction in Executive Committee remuneration, and (iii)

additional sums voluntarily contributed by Supervisory Board

members.

In view of the uncertainty over the duration and scale of the

epidemic and the government lockdowns and closures, the Group is

currently unable to assess the impacts of the crisis accurately and

reliably in terms of the decrease in revenue and operating profit

of fully-consolidated companies (recurring EBIT).

However, taking these corrective measures into account, the

Lagardère group estimates that the adverse impact on the full-year

2020 recurring EBIT of Lagardère Travel Retail could be in the

region of 20% to 25% of the decrease in its revenue. For Lagardère

Publishing, the Group estimates that the adverse impact on

full-year 2020 recurring EBIT could be in the region of 35% to 40%

of the decrease in its revenue.

At 31 March 2020, the Group’s liquidity stood at €1,940 million,

comprising €690 million in cash and cash equivalents and a

renewable credit facility for €1,250 million granted by a syndicate

of the Group’s banking partners and available in full. To

consolidate its liquidity, the Lagardère group has reached an

agreement with the banking syndicate granting the €1,250 million

renewable credit line to waive the covenant for June 2020 and

December 2020. The Group considers that it has sufficient liquidity

for full-year 2020, including in a pessimistic scenario as

simulated by Lagardère using the following main assumptions:

- Lagardère Travel Retail: operations remaining severely

disrupted for the rest of 2020, in line with the April 2020

situation;

- Lagardère Publishing and Other Activities: gradual return to

2019 business levels starting early in the second half of

2020;

- repayment of debt (with no refinancing) falling due over the

next 12 months, representing €681 million at 31 March 2020, of

which 78% corresponds to commercial paper.

The Group remains confident in its business model as refocused

on Lagardère Publishing and Lagardère Travel Retail. Thanks to its

liquidity position and to the corrective measures taken, the

Lagardère group expects to weather the Covid-19 crisis and to be

well placed to proactively benefit from the upturn in its

markets.

IV. INVESTOR CALENDAR(4)

2020 Annual General Meeting The 2020 Annual General Meeting will be held

on 5 May 2020 at 10:00 a.m.

First-half 2020 results First-half 2020 results will be released on

30 July 2020 at 5:35 p.m.

Third-quarter 2020 revenue Third-quarter 2020 revenue will be released

on 5 November 2020 at 8:00 a.m.

***

V. APPENDICES

CHANGES IN SCOPE OF CONSOLIDATION AND EXCHANGE RATES

First-quarter 2020

The difference between consolidated and like-for-like data is

mainly attributable to a €13 million positive foreign exchange

effect resulting chiefly from the appreciation of the US dollar and

pound sterling, and to a €14 million positive scope effect breaking

down as:

- a €26 million negative impact from disposals, essentially TV

channels and digital activities within the scope of the Group’s

strategic refocusing;

- a €40 million positive impact from acquisitions, carried out

mainly at Lagardère Travel Retail (acquisition of IDF representing

a positive €32 million and of Smullers representing a positive €2

million) and at Lagardère Publishing (acquisition of Gigamic

representing a positive €4 million and of Short Books representing

a positive €1 million).

VI. GLOSSARY

Lagardère uses alternative performance measures which serve as

key indicators of the Group’s operating and financial performance.

These indicators are tracked by the Executive Committee in order to

assess performance and manage the business, as well as by investors

in order to monitor the Group’s operating performance, along with

the financial metrics defined by the IASB. These indicators are

calculated based on accounting items taken from the consolidated

financial statements prepared under IFRS and a reconciliation with

those items is provided in this press release, in the full-year

2019 results presentation, or in the notes to the consolidated

financial statements.

Like-for-like revenue is used by the Group to analyse revenue

trends excluding the impact of changes in the scope of

consolidation and in exchange rates.

The like-for-like change in revenue is calculated by

comparing:

- revenue for the period adjusted for

companies consolidated for the first time during the period and

revenue for the prior-year period adjusted for consolidated

companies divested during the period; - revenue for the prior-year

period and revenue for the current period adjusted based on the

exchange rates applicable in the prior-year period.

The scope of consolidation comprises all fully-consolidated

entities. Additions to the scope of consolidation correspond to

business combinations (acquired investments and businesses), and

deconsolidations correspond to entities over which the Group has

relinquished control (full or partial disposals of investments and

businesses, such that the entities concerned are no longer included

in the Group’s financial statements using the full consolidation

method).

The difference between consolidated and like-for-like figures is

explained in section V - Appendices of this press release.

The Group’s main performance indicator is recurring operating

profit of fully consolidated companies (recurring EBIT),

which is calculated as follows:

Profit before finance costs and tax

Excluding:

- Income from equity-accounted companies before impairment

losses

- Gains (losses) on disposals of assets

- Impairment losses on goodwill, property, plant and equipment,

intangible assets and investments in equity-accounted

companies

- Net restructuring costs

- Items related to business combinations:

- Specific major disputes unrelated to the Group’s operating

performance

- Items related to leases and finance lease arrangements:

* Cancellation of fixed rental expense on concession agreements

is equal to the repayment of the lease liability, the associated

change in working capital and interest paid in the statement of

cash flows.

***

A live webcast of the first-quarter 2020

revenue presentation will be available today at 10:00 a.m. (CET) on

the Group’s website (www.lagardere.com).

The presentation slides will be made

available at the start of the webcast.

A replay of the webcast will be available

online later in the afternoon.

***

Created in 1992, Lagardère is an international group with

operations in more than 40 countries worldwide. It employs over

30,000 people and generated revenue of €7,211 million in 2019.

In 2018, the Group launched its strategic refocusing around two

priority divisions: Lagardère Publishing (Book and e-Publishing,

Mobile and Board games) and Lagardère Travel Retail (Travel

Essentials, Duty Free & Fashion, Foodservice).

The Group’s operating assets also include Lagardère News and

Lagardère Live Entertainment.

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Important notice:

Some of the statements contained in this document are not

historical facts but rather are statements of future expectations

and other forward-looking statements that are based on management’s

beliefs. These statements reflect such views and assumptions

prevailing as of the date of the statements and involve known and

unknown risks and uncertainties that could cause future results,

performance or future events to differ materially from those

expressed or implied in such statements.

Please refer to the most recent Universal Registration Document

(Document d’enregistrement universel) filed in French by Lagardère

SCA with the Autorité des marchés financiers for additional

information in relation to such factors, risks and

uncertainties.

Lagardère SCA has no intention and is under no obligation to

update or review the forward-looking statements referred to above.

Consequently Lagardère SCA accepts no liability for any

consequences arising from the use of any of the above

statements.

1 Alternative performance indicators. See the glossary at the

end of this press release. 2 Lagardère Publishing, Lagardère Travel

Retail, Lagardère News (Paris Match, Le Journal du Dimanche, Europe

1, Virgin Radio, RFM, the Elle brand licence), the Entertainment

business, the Group Corporate function and the Lagardère Active

Corporate function, whose costs are being wound down by end 2020.

3Paris Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM

and the Elle brand licence. 4 These dates may be susceptible to

change.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200429005965/en/

Press Contacts Thierry

Funck-Brentano Tel. +33 1 40 69 16 34 tfb@lagardere.fr

Ramzi Khiroun Tel. +33 1 40 69 16 33 rk@lagardere.fr

Investor Relations Contact

Emmanuel Rapin Tel. +33 1 40 69 17 45 erapin@lagardere.fr

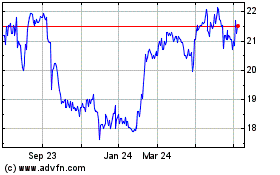

Lagardere (EU:MMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

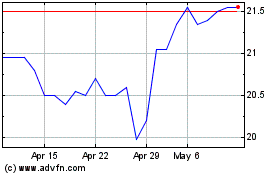

Lagardere (EU:MMB)

Historical Stock Chart

From Apr 2023 to Apr 2024