Press Release Related to a Proposed Public Buy-Out Offer Followed

by a Squeeze-Out Concerning Tarkett’s Shares

This press release does not constitute an

offer to purchase securities. The offer described

hereafter can only be opened once it has been declared compliant by

the Financial Markets Authority.

Translation for information purposes

only – In case of discrepancy between the French and English

version, the French version shall prevail

PRESS RELEASE RELATED TO A PROPOSED

PUBLIC BUY-OUT OFFER FOLLOWED BY A SQUEEZE-OUT CONCERNING THE

COMPANY’S SHARES

TARKETT

INITIATED BY

TARKETT PARTICIPATION

PRESENTED BY

ROTHSCHILD MARTIN MAUREL

PRESENTING BANK

AND

PORTZAMPARC BNP PARIBAS GROUP - CREDIT

AGRICOLE CORPORATE & INVESTMENT BANK - SOCIETE GENERALE -

CREDIT AGRICOLE MIDCAP ADVISORS

PRESENTING AND GUARANTEEING

BANKS

OFFER PRICE

16 euros per Tarkett ordinary share

|

DURATION OF THE PUBLIC BUY-OUT OFFER

10 trading days

The timetable for the offer will be determined by the French

Financial Markets Authority (the “AMF”) in

accordance with its general regulation. |

This press release was prepared by Tarkett Participation and issued

in accordance with the provisions of Article 231-16 of the AMF’s

general regulation.

This offer and the draft offer document remain subject to

review by the AMF. |

IMPORTANT DISCLOSURE

Subject to a clearance decision from the AMF, at the end of the

public buy-out offer to which the draft offer document relates, the

squeeze-out procedure described in Article L. 433-4 II of the

French Monetary and Financial Code will be implemented. Subject to

the exceptions set out in the draft offer document, the Tarkett

shares concerned by the public buy-out offer that have not been

tendered to the offer will be transferred to Tarkett Participation

in return for compensation in cash equal to the offer price, net of

all costs.

The draft offer document should be read in conjunction with the

other documents published in relation to the draft offer. In

particular, in accordance with Article 231-28 of the AMF’s general

regulation, a description of the legal, financial and accounting

information relating to Tarkett Participation will be provided to

the public no later than the day before the public buy-out offer

opens. A press release will be published to inform the public about

how these documents may be obtained. |

The draft offer document prepared by Tarkett

Participation (the “Draft Offer Document”) is

available on the Tarkett website (www.tarkett-group.com) and the

AMF website (www.amf-france.org) and can be obtained free of charge

on request from:

Tarkett Participation

Tour Initiale - 1, Terrasse Bellini

92919 Paris La Défense Cedex

|

Rothschild & Co Martin Maurel

29 Avenue de Messine

75008 Paris |

Portzamparc BNP Paribas

1 Boulevard Haussmann

75009 Paris

Société Générale

GLBA/IBD/ECM/SEG

75886 Paris Cedex 18

|

Crédit Agricole Corporate and Investment Bank

12, place des Etats-Unis

CS 70052

92547 Montrouge Cedex

|

1. Presentation

of the Offer

1.1. Presentation

of the Offer and identity of the Offeror

In accordance with Title III of Book II, and

more specifically Articles 236-3 and 237-1 et seq. of the

AMF’s general regulation, Tarkett Participation, a société par

actions simplifiée with its registered office at Tour Initiale

- 1, Terrasse Bellini, 92919 Paris La Défense Cedex, registered

with the Nanterre Trade and Companies Register under number 898 347

877 (the “Offeror”)1 makes an

irrevocable offer to the shareholders of Tarkett, a société

anonyme with a supervisory board and management board, whose

registered office is located at Tour Initiale - 1, Terrasse

Bellini, 92919 Paris La Défense Cedex, registered with the Nanterre

Trade and Companies Register under number 352 849 327,

(“Tarkett” or the “Company”, and

together with its direct or indirect subsidiaries, the

“Group”) to buy in cash all of the Company’s

shares held by them (the “Shares”) within the

framework of a Public Buy-out Offer (the “Public Buy-out

Offer”), which will be immediately followed by a

squeeze-out (the “Squeeze-Out” and, with the

Public Buy-out Offer, the “Offer”) at a price of

€16 per share (the “Offer Price”) payable entirely

in cash, subject to the conditions described below.

The Shares are admitted for trading on

compartment B of the Euronext Paris regulated market

(“Euronext Paris”) under Code ISIN FR0004188670

(ticker: TKTT).

As of the date of the Draft Offer Document, the

Offeror holds:

- directly:

59,207,028 shares and 117,187,257 voting rights in the Company

representing 90.32% of the share capital and 94.66% of theoretical

voting rights of the Company; and

- indirectly:

- 18,559 shares

held in treasury by Tarkett;

- 4,000 Shares

held by members of the Deconinck family, acting in concert with the

Offeror; and

- 27,768 Free

Shares Under Retention (as defined in Section 2.4.1 and covered by

the Liquidity Mechanism with Mr Fabrice Barthélemy) held by Mr

Fabrice Barthélemy and 4,441 Free Shares Under Retention (as

defined in Section 2.4.1 and covered by the Liquidity Mechanism

with Mr Raphael Bauer) held by Mr Raphael Bauer.

It is specified that the Offer does not

include:

- the 18,559

shares held in treasury by Tarkett; and

- the 32,209 Free

Shares Under Retention (these Shares being legally and technically

unavailable and cannot be tendered in the Offer), (together, the

“Excluded Shares”).

In total, the Offeror directly and indirectly

holds, alone and in concert, 59,261,796 Shares representing, as of

the date of the Draft Offer Document, 90.41% of the share capital

and 94.72% of the theoretical voting rights of the

Company2.

The Public Buy-out Offer concerns all Shares not

held directly or indirectly by the Offeror that are already in

issue (except Excluded Shares) representing, to the Offeror’s

knowledge, a maximum of 6,292,485 Shares3, or 9.60% of

the share capital and 5.29% of theoretical voting rights of Tarkett

as of the date of this Draft Offer Document, calculated in

accordance with Article 233-11 of the AMF’s general regulation.

The duration of the Public Buy-out Offer will be

10 trading days, in accordance with Article 236-7 of the AMF’s

general regulation.

Subject to a clearance decision from the AMF, at

the end of the Public Buy-out Offer, the Squeeze-Out described in

Article L. 433-4, II of the French Monetary and Financial Code and

Article 237-1 et seq. of the AMF’s general regulations

will be implemented. The Shares concerned that are not tendered to

the Public Buy-out Offer will be transferred to the Offeror in

return for payment in cash equal to the Offer Price of €16 per

Share, net of all costs.

To the Offeror’s knowledge, there are no equity

securities or any financial instruments issued by the Company or

rights granted by the Company that could give access, either

immediately or in the future, to the Company’s share capital or

voting rights other than the Shares. There are no current stock

option plans or free share award plans within the Company that

could give access, either immediately or in the future, to the

Company’s share capital or voting rights.

In accordance with Article 231-13 of the AMF’s

general regulation, Rothschild & Co Martin Maurel, Portzamparc

BNP Paribas, Crédit Agricole Corporate and Investment Bank («

CACIB ») and Société Générale (the

“Presenting Banks”) filed the draft Offer and the

Draft Offer Document with the AMF on 24 February 2025 on behalf of

the Offeror.

It is specified that only Portzamparc BNP

Paribas, CACIB and Société Générale guarantee, in accordance with

Article 231-13 of the AMF’s general regulation, the content and

irrevocable nature of the undertakings made by the Offeror in

connection with the Offer.

1.2. Background

and reasons for the Offer

1.2.1. Background

of the Offer

Tarkett is a worldwide leader in innovative

flooring and sports surface solutions. With its experienced staff

and sales in more than 100 countries, the Group has gained in-depth

knowledge and an excellent understanding of customers’ cultures,

tastes and requirements, regulations and customs regarding floor

coverings in each country.

In the year ended 31 December 2024, Tarkett

generated consolidated revenue of €3,331.9 million.

The Group was formed through the 1997

combination between Société française Sommer Allibert

S.A., listed in Paris, and Tarkett AG, listed in

Frankfurt. Tarkett’s shares were admitted to trading on the Paris

stock exchange in 2013.

On 26 April 2021, the Offeror filed a draft

simplified public tender offer with the AMF for all Tarkett shares

not held by the Offeror (the “Previous

Offer”).

The Previous Offer, which was cleared by the AMF

on 8 June 2021, was opened on 10 June 2021 and closed on 9 July

2021.

After the Previous Offer, as announced in a

press release dated 15 July 2021, the Offeror directly held

56,300,463 shares, representing, as of this date, 85.89% of the

share capital and 84.98% of the voting rights of Tarkett, and in

total 56,548,018 shares representing 86.27% of the share capital

and 85.36% of the voting rights of Tarkett, including the 247,555

shares held in treasury by Tarkett and therefore indirectly held by

the Offeror.

As a result of various acquisitions on the

market and off-market following the close of the Previous Offer,

Tarkett announced in a press release dated 28 October 2021 that the

Offeror directly and indirectly held 90.41% of the Company’s share

capital and that Tarkett’s minority shareholders now held less than

10% of the share capital and voting rights.

For the purposes of simplification and

organisational efficiency, the Offeror decided to explore the

possibility of delisting Tarkett in order to allow the Company to

implement its strategy in a calmer environment.

As declared on 20 February 2025 in a joint press

release from the Company and the Offeror, the draft Offer was

welcomed by the Company’s Supervisory Board, which set up an ad hoc

committee consisting mainly of independent members, in charge of

overseeing the work done by the independent appraiser and making

recommendations to the Company’s Supervisory Board regarding the

Offer. In the context of the preparation of the draft Offer, and on

the recommendation of the ad hoc committee, the Supervisory Board

appointed Finexsi – Expert & Conseil Financier, represented by

Mr Olivier Peronnet and Mr Olivier Courau, as independent appraiser

with the task of preparing a report on the financial terms of the

Offer and the possible Squeeze-Out in accordance with Article

261-1(I)(1), (2) and (4) and Article 261-1(II) of the AMF’s general

regulation (the “Independent Appraiser”).

1.2.2. Presentation

of the Offeror

The Offeror is a simplified joint-stock

corporation incorporated under French law, created by SID on 16

April 2021 for the purposes of the Previous Offer.

As of the date of this Draft Offer Document, the

Offeror’s share capital and voting rights are held as follows:

|

Shareholder |

Number of shares |

Number of theoretical voting rights |

% of share capital |

% of voting rights |

|

SID |

381,188,474 |

381,188,474 |

72.74% |

72.74% |

|

Investor |

134,667,415 |

134,667,415 |

25.70% |

25.70% |

|

Management |

7,287,766 |

7,287,766 |

1.39% |

1.39% |

|

Treasury |

902,737 |

902,737 |

0.17% |

0.17% |

|

Total |

524,046,392 |

524,046,392 |

100% |

100% |

1.2.3. Ownership

of the Company’s share capital and voting rights

To the Offeror’s knowledge, as of the Draft

Offer Document, the Company’s share capital totals €327,751,405,

divided into 65,550,281 shares with par value of €5 each.

The table below shows, to the Offeror’s

knowledge, the ownership of Tarkett’s share capital and theoretical

voting rights as of the date of the Draft Offer Document:

|

Shareholder |

Number of shares |

Number of theoretical voting rights |

% of share capital |

% of voting rights |

|

Offeror |

59,207,028 |

117,187,257 |

90.32% |

94.66% |

|

Other shareholders |

6,324,694 |

6,593,198 |

9.65% |

5.33% |

|

Treasury |

18,559 |

18,559 |

0.03% |

0.01% |

|

Total |

65,550,281 |

123,799,014 |

100% |

100% |

1.2.4. Acquisitions

of Shares in the last 12 months

The Offeror did not acquire any shares in

Tarkett in the 12 months before the draft Offer was filed.

1.2.5. Reasons

for the Offer

As the Offeror holds more than 90% of the share

capital and voting rights of Tarkett, pursuant to Articles 236-3

and 237-1 et seq. of the AMF’s general regulation, it has filed

with the AMF the draft Public Buy-out Offer, which will be

immediately followed by a Squeeze-Out, in order to acquire all of

the shares in Tarkett with the exception of Excluded Shares not

covered by the Public Buy-out Offer and delist the Company’s

shares.

The Offer is for the purpose of simplification

and organisational efficiency. The Offeror believes that delisting

the Company’s shares will simplify its operation and remove the

regulatory and legislative constraints (including financial

communications) and the costs associated with its listing on

Euronext Paris.

Furthermore, the listing is of limited use to

the Company. Recent acquisitions have shown the Company to be

capable of financing its development without turning to the capital

markets. In addition, maintaining the listing no longer seems

justified given the Company’s current shareholding structure and

the shares’ low trading volume.

The Company’s minority shareholders, which

represent 9.65% of the Company’s share capital, will therefore

receive immediate payment in cash for all their shares, on the

basis of the Offer Price, while the shares currently have limited

liquidity.

Rothschild & Co Martin Maurel, Portzamparc

BNP Paribas, Crédit Agricole Midcap Advisors (a wholly-owned

subsidiary of CACIB) and Société Générale have performed a

valuation of Tarkett shares, a summary of which is reproduced in

Section 3 below.

Furthermore, the fairness of the financial terms

of the Offer will be the object of a fairness opinion by the

Independent Appraiser.

1.3. Intentions

of the Offeror over the next 12 months

1.3.1.

Industrial, business and financial strategy and future

activity

The Offeror, with the help of the Company’s

current management team, intends to pursue the main strategies

implemented by the Company and to continue to develop the

Company.

1.3.2.

Intentions regarding employment

The Offer forms part of a plan in which the

Company’s business activities and development are to continue. As a

result, it should not result in any particular impact on the

Company’s workforce, wage policy or human resource management

policy.

1.3.3.

Intentions of the Offeror regarding the composition of the

Company’s corporate bodies and management

After the Squeeze-Out is implemented following

the Public Buy-out Offer, it is planned that the Company will be

turned into a simplified joint-stock corporation for the purpose of

simplification.

1.3.4.

Dividend distribution policy

The Company did not pay any dividends in respect

of the financial years ended 31 December 2023, 2022 and 2021.

After the Offer, the Company’s dividend policy

and any changes to this policy will continue to be determined by

its corporate bodies in accordance with the law and the Company’s

articles of association, and on the basis of the Company’s ability

to make distributions, financial position and funding needs.

1.3.5.

Synergies

The Offeror is a holding company that was

incorporated on 16 April 2021 and its purpose is to own an equity

stake in and manage the Company. As a result, the Offeror does not

anticipate any cost or revenue synergies with the Company, other

than savings resulting from delisting the Company.

1.3.6.

Intentions regarding merging or

integration

There are no plans for the Offeror to merge with

the Company.

1.3.7.

Advantages for the Company and the

shareholders

The Offeror is offering the Company’s

shareholders who tender their Shares to the Offer the opportunity

to obtain immediate liquidity for all of their interest at an

attractive price.

The Offer Price represents a premium of 32,3%

and 37,5% to the daily volume-weighted average closing price in the

20 and 60 stock exchange trading sessions preceding the Offer

announcement respectively, and a 18,1% premium to the closing price

preceding the Offer announcement.

Information for assessing the Offer Price is

presented in Section 3 of the Draft Offer Document.

1.3.8.

Squeeze-out

As the conditions set out in Article L. 433-4 II

of the French Monetary and Financial Code and Articles

237-1 et seq. of the AMF’s general regulation have

already been met, the Public Buy-out Offer will be followed

immediately by a Squeeze-Out concerning all Shares not tendered to

the Public Buy-out Offer, in return for compensation equal to the

Offer Price of €16 per share, net of all costs.

It is specified that this procedure will result

in the delisting of Tarkett shares from compartment B of Euronext

Paris on the day the Squeeze-Out becomes effective.

1.4. Agreements

that may materially affect the assessment of the Offer or its

outcome

To the Offeror’s knowledge, no agreements that

may materially affect the assessment of the Offer or its outcome

were entered into apart from the liquidity mechanism described

in Section 1.4.1 of the Draft Offer Document (the

“Liquidity Mechanism”).

As a reminder, the following agreements entered

into within the framework of the Previous Offer remain in

force:

- the

shareholders’ agreement formed between SID and the Investor on 23

April 2021, as described in Section 1.4.2 of the Draft Offer

Document; and

- the investment

and performance share allotment plan implemented after the Previous

Offer by SID and the Investor involving the Offeror for certain

executives and senior managers of the Company, as described in

Section 1.4.2 of the Draft Offer Document (the

“Plan”).

2. Details of

the Offer

2.1. Arrangements

of the Offer

In accordance with Articles 231-13, 236-3 and

237-1 of the AMF’s general regulation, the Presenting Banks, acting

on behalf of the Offeror as presenting institutions, filed the

draft Offer with the AMF on 24 February 2025 in the form of a

Public Buy-out Offer followed by a Squeeze-Out concerning the

Shares in Tarkett not held by the Offeror, as well as the Draft

Offer Document.

Portzamparc BNP Paribas, CACIB and Société

Générale guarantee, in accordance with Article 231-13 of the AMF’s

general regulation, the content and irrevocable nature of the

undertakings made by the Offeror in connection with the Offer.

In accordance with Articles 236-1 et

seq. of the AMF’s general regulation, the Offeror makes the

irrevocable undertaking for a period of ten (10) trading days to

offer the Company’s shareholders the option of tendering their

shares to the Public Buy-out Offer in return for cash of €16 per

Share.

Within the framework of the Squeeze-Out, shares

not held by the Offeror that are not tendered to the Public Buy-out

Offer (apart from the Excluded Shares) will be transferred to it in

return for compensation equal to the Offer Price, net of all costs,

of €16 per Share.

The draft Offer and the Draft Offer Document

remain subject to review by the AMF.

In accordance with Article 231-16 of the AMF’s

general regulation, a press release setting out the main details of

the Offer and how the Draft Offer Document may be obtained will be

made public on the Tarkett website (www.tarkett-group.com).

The Draft Offer Document is available to the

public free of charge from Tarkett’s registered office and from the

registered office of the Presenting Banks, and will be posted on

the AMF website (www.amf-france.org) and the Tarkett website

(www.tarkett-group.com).

The AMF will clear the Offer after it has

ensured that it complies with applicable legal and regulatory

requirements and will publish its clearance decision on its website

(www.amf-france.org). This clearance decision will represent the

AMF’s approval of the offer document and can only be given after

the Company files a draft response document to the Draft Offer

Document.

The offer document approved by the AMF and the

document containing “Other Information” relating in particular to

the legal, financial and accounting characteristics of the Offeror

will be available to the public, in accordance with Articles 231-27

and 231-28 of the AMF’s general regulation, from the Tarkett’s

registered office and from the registered office of the Presenting

Banks, no later than the day preceding the opening of the Offer.

These documents will also be posted on the AMF website

(www.amf-france.org) and the Tarkett website

(www.tarkett-group.com).

A press release indicating how these documents

may be obtained will be published no later than the day preceding

the opening of the Offer in accordance with Articles 231-27 and

231-28 of the AMF’s general regulation.

Prior to the opening of the Public Buy-out

Offer, the AMF will publish a notice announcing the opening and

timetable of the Public Buy-out Offer, and Euronext Paris will

publish a notice announcing the arrangements and timetable of the

Public Buy-out Offer.

2.2. Number

and type of shares covered by the Offer

As of the date of the Draft Offer Document, to

the Offeror’s knowledge, there are a total of 65,550,281 Tarkett

Shares, representing 123,799,014 theoretical voting rights,

calculated in accordance with Article 223-11 of the AMF’s general

regulation.

It is specified that as of the date of the Draft

Offer Document, the Offeror holds:

- directly:

59,207,028 shares and 117,187,257 voting rights in the Company

representing 90.32% of the share capital and 94.66% of theoretical

voting rights of the Company; and

- indirectly:

- 18,559 shares

held in treasury by Tarkett;

- 4,000 Shares

held by members of the Deconinck family, acting in concert with the

Offeror; and

- 27,768 Free

Shares Under Retention (as defined in Section 2.4.1 and covered by

the Liquidity Mechanism with Mr Fabrice Barthélemy) held by Mr

Fabrice Barthélemy and 4,441 Free Shares Under Retention (as

defined in Section 2.4.1 and covered by the Liquidity Mechanism

with Mr Raphael Bauer) held by Mr Raphael Bauer.

It is specified that the Offer does not

include:

- the 18,559

shares held in treasury by Tarkett; and

- the 32,209 Free

Shares Under Retention (these Shares being legally and technically

unavailable and cannot be tendered in the Offer).

In total, the Offeror directly and indirectly

holds, alone and in concert, 59,261,796 Shares representing, as of

the date of the Draft Offer Document, 90.41% of the share capital

and 94.72% of the theoretical voting rights of the Company.

The Public Buy-out Offer concerns all Shares not

held directly or indirectly by the Offeror that are already in

issue (except Excluded Shares) representing, to the Offeror’s

knowledge, a maximum of 6,292,485 Shares4, or 9.60% of

the share capital and 5.29% of theoretical voting rights of Tarkett

as of the date of the Draft Offer Document, calculated in

accordance with Article 233-11 of the AMF’s general regulation.

Within the framework of the Squeeze-Out, shares

not held by the Offeror will be transferred to the Offeror in

return for compensation equal to the Offer Price, net of all costs,

apart from shares held in treasury by the Company on the date of

the Squeeze-Out and Free Shares Under Retention (6,292,485 shares

on the date of the Draft Offer Document).

To the Offeror’s knowledge, there are no equity

securities or any financial instruments issued by the Company or

rights granted by the Company that could give access, either

immediately or in the future, to the Company’s share capital or

voting rights other than the Company’s existing shares. There are

no current stock option plans or free share award plans within the

Company that could give access, either immediately or in the

future, to the Company’s share capital or voting rights.

2.3. Conditions

that apply to the Offer

The Offer is not subject to any requirement to

obtain regulatory approval.

2.4. Position

of the beneficiaries of free shares and liquidity

mechanism

2.4.1. Position

of the beneficiaries of free shares

To the Offeror’s knowledge, there are no free

share plans implemented by the Company as of the date of the Draft

Offer Document.

In addition, some Shares currently held by

beneficiaries of certain previous free share plans are locked up as

of the date of the Draft Offer Document and will remain so until

the estimated closing date of the Offer (the “Free Shares

Under Retention”), including some Shares whose vesting

period has ended as of the date of the Draft Offer Document.

The Free Shares Under Retention correspond to a

maximum of 32,209 Shares under retention in accordance with Article

L. 225-197-1 II of the French Commercial Code, under which

Tarkett’s Supervisory Board has required Tarkett’s corporate

officers to retain their Shares until the end of their terms of

office (the “Additional Retention Period”);

To the Offeror’s knowledge, as of the filing

date of the Draft Offer Document and subject to cases of early

transferability provided for by law, the Free Shares Under

Retention will not be capable of being tendered to the Offer to the

extent that the Additional Retention Period has not ended before

the closing of the Offer.

2.4.2. Liquidity

Mechanism

The Liquidity Mechanism that will be proposed to

holders of Free Shares Under Retention is described more fully

in Section 1.4.1 of the Draft Offer Document.

2.5. Terms of

the Offer

The Offeror makes the irrevocable undertaking to

acquire from the Company’s shareholders, other than the Offeror and

excluding the Excluded Shares, all the Shares concerned by the

Public Buy-out Offer that are tendered to the Public Buy-out Offer,

at the Offer Price of €16 per share, payable only in cash, for a

period of ten (10) trading days.

Apart from the Shares held in treasury and the

Free Shares Under Retention, the Shares covered by the Offer that

are not tendered to the Public Buy-out Offer will be transferred to

the Offeror within the framework of the Squeeze-Out following the

Public Buy-out Offer, in return for compensation equal to the Offer

Price of €16 per share.

2.6. Adjustment

of the Offer terms

Any distribution of a dividend, interim

dividend, reserve, issue premium or any other distribution (in cash

or in kind) decided by the Company where the ex-date or any capital

reduction would take place before the Public Buy-out Offer closes

will give rise to a reduction, on a euro-for-euro basis, in the

price per share offered in the Offer.

2.7. Procedure

for tendering shares to the Public Buy-out Offer

The Public Buy-out Offer will be open for ten

(10) trading days, in accordance with Article 236-7 of the AMF’s

general regulation.

Shares tendered to the Public Buy-out Offer must

be freely negotiable and free of any lien, charge, pledge, other

guarantee or any restriction on the free transfer of their

ownership. The Offeror reserves the right to reject any shares that

do not comply with this condition.

Shares held in registered form must be converted

into bearer form in order to be tendered to the Public Buy-out

Offer. As a result, shareholders whose Shares are in registered

form and who wish to tender them to the Public Buy-out Offer must

request their conversion into bearer form at the earliest

opportunity in order to tender them to the Public Buy-out Offer.

Orders to tender shares to the Public Buy-out Offer are

irrevocable. It is specified that the conversion of registered

shares to bearer shares will result in these shareholders losing

the benefits associated with ownership of these shares in

registered form.

Shareholders whose Shares are registered in an

account managed by a financial intermediary and who wish to tender

them to the Public Buy-out Offer must send to the financial

intermediary that is the custodian of their Shares an irrevocable

order to tender or sell the Shares at the Offer Price, using the

template provided by that intermediary in good time to allow their

order to be executed and no later than the day on which the Public

Buy-out Offer closes, subject to the processing times of the

financial intermediary concerned..

The Public Buy-out Offer will be carried out

solely by means of acquisitions on the market in accordance with

Article 233-2 of the AMF’s general regulation. Tarkett shareholders

wishing to tender their Shares to the Public Buy-out Offer must

send back their sale order by the last day of the Public Buy-out

Offer and settlement will take place as and when orders are

executed, two (2) trading days after the execution of each order,

it being stipulated that trading fees (including related brokerage

fees and VAT) will remain payable by the shareholder selling the

Shares in the market.

Portzamparc BNP Paribas, an investment service

provider authorised as a market member, will buy the Shares sold in

the market on behalf of the Offeror, in accordance with applicable

regulations.

The transfer of ownership of Shares tendered to

the Public Buy-out Offer and all associated rights (including the

right to dividends) will take place on the date of registration in

the Offeror’s account, in accordance with Article L. 211-17 of the

French Monetary and Financial Code.

2.8. Squeeze-Out

In accordance with Artiles L.433-4 II of the

French Monetary and Financial Code and 237-1 and 237-7 of the AMF’s

general regulation, after the Public Buy-out Offer, the Shares in

the Company that have not been tendered to the Public Buy-out Offer

(apart from Excluded Shares) will be transferred to the Offeror

(regardless of the country of residence of the holder of said

Shares) in return for compensation of €16 per Share in the

Company.

The AMF will publish a notice of implementation

of the Squeeze-Out and Euronext Paris will publish a notice

announcing the timetable for implementation of the Squeeze-Out.

A notice informing the public of the Squeeze-Out

will be published by the Offeror in a legal announcements bulletin

in the place of the Company’s registered office in accordance with

Article 237-5 of the AMF’s general regulation.

The amount of compensation equal to the Offer

Price of €16 will be paid, net of all costs, after the Public

Buy-out Offer, into a blocked account opened for this purpose with

Uptevia, the centralising agent in charge of compensation

payments.

In accordance with Article 237-8 of the AMF’s

general regulation, unallocated funds corresponding to compensation

for the Company’s shares for which the beneficial owners are

unknown (i.e. unclaimed or similar shares, in particular those of

shareholders whose contact details are not known) will be held in

custody (and, if applicable, upon request for payment of

compensation from the beneficial owners during this period, paid

net of all costs by Uptevia on behalf of the Offeror) for a period

of ten (10) years from the date of the Squeeze-Out and paid to

Caisse des Dépôts et Consignations at the end of this period. These

funds will be available to beneficial owners subject to the 30-year

limitation period, after which they are transferred to the French

government.

It is specified that this procedure will result

in the Tarkett shares being delisted from compartment B of Euronext

Paris on the day the Squeeze-Out becomes effective.

2.9. Applicable

law

This Offer and all related documents are

governed by French law. Any dispute or conflict of any kind

relating to this Offer will be brought before the competent

courts.

2.10. Indicative

timetable of the Offer

Prior to the opening of the Offer, the AMF will

publish a notice stating the opening and timetable of the Offer,

and Euronext Paris will publish a notice announcing the

arrangements and opening of the Offer.

An indicative timetable is provided below, which

is still subject to review by the AMF:

|

Date |

Main stages of the Offer |

|

24 February 2025 |

-

Draft offer and Draft Offer Document filed with the AMF

-

Draft Offer Document made available to the public at the registered

offices of the Offeror and the Presenting Banks and published on

the AMF website (www.amf-france.org) and the Company’s website

(www.tarkett-group.com)

-

Publication of the press release on the filing and availability of

the Draft Offer Document

|

|

18 March 2025 |

-

Filing of the Company’s draft response document with the AMF,

including the reasoned opinion of the Company’s Supervisory Board

and the report of the Independent Appraiser

-

Company’s draft response document made available to the public at

the registered office of the Company and posted on the AMF website

(www.amf-france.org) and the Company’s website

(www.tarkett-group.com)

-

Publication of the press release relating to the filing and

availability of the Company’s draft response document

|

|

8 April 2025 |

-

Publication of the AMF’s clearance decision relating to the Offer,

signifying approval of the Offeror’s offer document and the

Company’s response document.

-

Approved offer document made available to the public at the

registered offices of the Offeror and the Presenting Banks and

posted on the AMF website (www.amf-france.org) and the Company’s

website (www.tarkett-group.com)

-

Approved response document made available to the public at the

registered offices of the Offeror and the Presenting Banks and

posted on the AMF website (www.amf-france.org) and the Company’s

website (www.tarkett-group.com)

|

|

9 April 2025 |

-

Filing by the Offeror with the AMF of the document “Other

information relating to the legal, financial and accounting

characteristics” of the Offeror

-

Document “Other information relating in particular to the legal,

financial and accounting characteristics” of the Offeror made

available to the public at the registered offices of the Offeror

and the Presenting Banks and posted on the AMF website

(www.amf-france.org) and the Company’s website

(www.tarkett-group.com)

-

Publication of a press release from the Offeror relating to the

offer document and the document “Other information relating in

particular to the legal, financial and accounting characteristics”

of the Offeror being available

-

Filing by the Company with the AMF of the document “Other

information relating to the legal, financial and accounting

characteristics” of the Company

-

Document “Other information relating in particular to the legal,

financial and accounting characteristics” of the Company made

available to the public at the registered office of the Company and

posted on the AMF website (www.amf-france.org) and the Company’s

website (www.tarkett-group.com)

-

Publication of a press release from the Company relating to the

reply document and the document “Other information relating in

particular to the legal, financial and accounting characteristics”

of the Company being available

|

|

10 April 2025 |

-

Opening of the Public Buy-out Offer

|

|

25 April 2025 |

-

Close of the Public Buy-out Offer

|

|

28 April 2025 |

-

Publication by the AMF and Euronext Paris of the notice stating the

result of the Public Buy-out Offer

|

|

As soon as possible after the publication of the notice

announcing the results of the Public Buy-out Offer |

-

Implementation of the Squeeze-Out

-

Delisting of Tarkett shares from compartment B of Euronext

Paris

|

2.11. Financing

of the Offer

2.11.1.

Expenses relating to the Offer

The overall amount of all expenses, costs and

disbursements incurred by the Offeror solely in connection with the

Offer, including the fees and other expenses of its external

financial, legal and accounting advisors, along with those of

appraisers and other consultants, and publicity and communication

expenses, is estimated at approximately €2 million (excluding

VAT).

2.11.2.

Arrangements for financing the Offer

On the basis of the Offer Price, the acquisition

by the Offeror of all the Shares concerned by the Offer represents

a maximum of €100,679,760.00 (excluding commission and associated

fees).

The Offeror has sufficient equity capital and

credit lines, particularly under its existing credit facilities, to

finance the Offer and may also carry out additional financing

rounds on the market without these being necessary for the

financing of the Offer.

2.11.3.

Reimbursement of brokerage fees

No expenses will be reimbursed and no commission

will be paid by the Offeror to a shareholder tendering their Shares

to the Offer, or to any intermediary or any person soliciting the

tendering of Shares to the Offer.

2.12. Restrictions

on the Offer outside France

No request to register the Offer or to obtain

approval has been made to a financial market supervisory authority

other than the AMF and no such request will be made.

As a result, the Offer is made to shareholders

of the Company located in France and outside France, provided that

the local laws to which they are subject allow them to take part in

the Offer without the Offeror being required to complete any

additional formalities.

The publication of the Draft Offer Document, the

Offer, the acceptance of the Offer and the delivery of the Shares

may in some countries be subject to specific regulations or

restrictions. As a result, the Offer is not addressed to persons

subject to such restrictions, either directly or indirectly, and is

not capable of being accepted in a country in which the Offer is

subject to restrictions.

Neither the Draft Offer Document nor any other

document relating to the Offer constitutes an offer to buy or sell

financial instruments or a solicitation of an offer in any country

in which such offer or solicitation would be illegal, could not be

legally made or would require the publication of a prospectus of

any other formality in accordance with local financial laws. The

holders of Securities located outside of France may participate in

the Offer only to the extent that such participation is authorised

by the local laws to which they are subject.

As a result, persons in possession of the Draft

Offer Document are required to inform themselves about any

applicable local restrictions and to comply with them. A failure to

comply with these restrictions may constitute a violation of

applicable stock exchange laws and regulations.

The Offeror will not be liable for the violation

of applicable legal or regulatory restrictions by any person.

United States of America

No document relating to the Offer, including the

Draft Offer Document, constitutes an extension of the Offer to the

United States and the Offer is not being made, directly or

indirectly, in the United States, to persons resident in the United

States or “US persons” (within the meaning of Regulation S under

the U.S. Securities Act of 1933, as amended) by means of postal

services or any other means of communication or instrument of trade

(including, without limitation, sending by fax, telex, telephone or

email) in the United States or by means of the services of a stock

exchange in the United States. As a result, no copies of the Draft

Offer Document, and no other documents relating to the Draft Offer

Document or to the Offer, can be sent by post, or communicated and

disseminated via an intermediary or any other person in the United

States in any way. No shareholders of the Company will be able to

tender their shares to the Offer if they are not able to certify

that (i) they are not a US Person; (ii) they have not received in

the United States a copy of the Draft Offer Document or any other

document relating to the Offer, and that they have not sent such

documents in the United States; (iii) they have not used, directly

or indirectly, postal services, telecommunications or other

instruments of trade or the services of a stock exchange in the

United States in connection with the Offer; (iv) they were not in

the United States when they accepted the terms of the Offer, or

sent their order to transfer shares; and (v) they are not an agent

or representative acting on behalf of a principal that sent their

instructions outside the United States. Approved intermediaries may

not accept orders to tender shares that have not been made in

accordance with the above requirements, unless there is any

authorisation or instruction on the contrary from or for the

Offeror, at the Offeror’s discretion. Any acceptance of the Offer

that may be assumed to result from a breach of these restrictions

will be deemed invalid.

The Draft Offer Document does not constitute an

offer to buy or sell or a solicitation for an order to buy or sell

securities in the United States, and has not been filed with the

United States Securities and Exchange Commission.

For the purposes of the above two paragraphs,

the United States refers to the United States of America, their

territories and possessions, or any of these States and the

District of Columbia.

3. Summary of

the Assessment of the Offer Price

The Offer Price proposed by the Offeror is €16.00.

Based on the valuation work described in Section 3 of the Draft

Offer Document, the Offer Price presents the following

premiums:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Value per share1 (€) |

|

|

Premium / (discount) induced by the Offer Price

(%) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Offer price per share (€) |

|

|

16,0 |

|

|

- |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Principal methods used |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Stock

market references |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Closing price prior to project

annoncement2 |

|

|

13,6 |

|

|

+18,1% |

|

|

|

| |

|

|

VWAP - 20 days |

|

|

12,1 |

|

|

+32,3% |

|

|

|

| |

|

|

VWAP - 60 days |

|

|

11,6 |

|

|

+37,5% |

|

|

|

| |

|

|

VWAP - 120 days |

|

|

11,1 |

|

|

+44,6% |

|

|

|

| |

|

|

VWAP - 250 days |

|

|

10,7 |

|

|

+49,5% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

DCF |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Mid-range of the company’s business

plan |

|

|

12,5 |

|

|

+28,3% |

|

|

|

| |

|

|

Top of the range of the company’s

business plan |

|

|

13,5 |

|

|

+18,4% |

|

|

|

| |

|

|

Bottom of the range of the company’s

business plan |

|

|

11,5 |

|

|

+39,0% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Indicative methods |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

CIC

Target prices |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Target price |

|

|

10,0 |

|

|

+60,0% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Stock

market comparables |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

EV / EBIT 2025 |

|

|

15,6 |

|

|

+2,9% |

|

|

|

| |

|

|

EV / EBIT 2026 |

|

|

13,8 |

|

|

+15,9% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

1 Value per Share based on 65,531,722

Shares, excluding the 18,889 Shares held in treasury.

2 20 February 2025

Important Notice

This press release has been prepared for information purposes only.

This press release does not constitute a public offer (offre au

public). Dissemination of this press release, the Offer and

its acceptance may be subject to specific regulations or

restrictions in some countries.

The Offer is not addressed to persons directly or indirectly

subject to such restrictions and may not be accepted in any way

from a country in which the Offer is subject to such restrictions.

This press release shall not be distributed in these countries.

Therefore, persons in possession of this press release must inform

themselves about and comply with any local restrictions that may

apply.

Tarkett Participation declines any responsibility resulting from

any breach of these restrictions by any person.

|

1

It is specified

that the Offeror, controlled by Société Investissement Deconinck, a

société par actions simplifiée with its registered office at Tour

Initiale - 1 Terrasse Bellini, 92919 Paris La Défense Cedex, and

registered in the Nanterre Trade and Companies Register under

number 421 199 274, controlled by the Deconinck Family

(“SID”), is acting in concert with Expansion 17

S.C. A., a reserved alternative investment fund in the form of a

société en commandite par actions, “Tarkett” compartment, with its

registered office at 11-15, avenue Emile Reuter, L - 2420

Luxembourg and registered with the Luxembourg Trade and Companies

Register under number B180975 and Global Performance 17 S.C. A., a

reserved alternative investment fund in the form of a société en

commandite par actions, “Millésime 3” compartment, with its

registered office at 11-15, avenue Emile Reuter, L - 2420

Luxembourg and registered with the Luxembourg Trade and Companies

Register under number B180980 (both of which are part of the Wendel

group) (the “Investor”), Mr. Fabrice Barthélemy,

Chairman of the Company’s Management Board and Chairman of the

Offeror, and members of the Deconinck family who directly own

shares in the Company.

2

Based on 65,550,281

shares representing 123,799,014 theoretical voting rights as at 31

January 2025 in accordance with Article 223-11 of the AMF’s general

regulation.

3

It is specified

that the 4,000 Shares held directly by members of the Deconinck

family, which are deemed to be held indirectly by the Offeror

within the meaning of Article L. 233-9 of the French Commercial

Code, are included in the 6,292,485 Shares concerned by the Public

Buy-out Offer and will be tendered to the offer.

4

It is specified

that the 4,000 Shares held directly by members of the Deconinck

family, which are deemed to be held indirectly by the Offeror

within the meaning of Article L. 233-9 of the French Commercial

Code, are included in the 6,292,485 Shares concerned by the Public

Buy-out Offer and will be tendered to the offer.

- Press release related to a proposed public buy-out offer

followed by a squeeze-out-Tarkett Participation-Tarkett

24.2.25

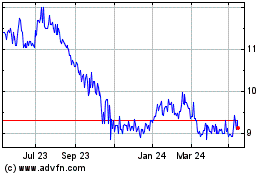

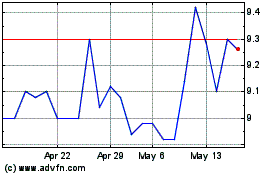

Tarkett (EU:TKTT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tarkett (EU:TKTT)

Historical Stock Chart

From Feb 2024 to Feb 2025