Euro Higher As European Shares Advance

March 16 2021 - 3:07AM

RTTF2

The euro appreciated against its major counterparts in the

European session on Tuesday, as investors awaited the Fed meeting

beginning today for clues about the future outlook for the

economy.

The meeting will conclude on Wednesday at 2 pm ET.

The Fed is widely expected to leave interest rates unchanged,

but traders will be paying close attention to any changes in the

accompanying statement.

Investors will closely watch the Fed's reaction to the recent

spike in bond yields, which has led to considerable volatility in

Wall Street in recent sessions.

European stocks rose, tracking a rally in Asia and on Wall

Street, amid optimism over the global economic recovery.

Survey data from the ZEW - Leibniz Centre for European Economic

Research showed that German economic confidence improved in

March.

The ZEW Indicator of Economic Sentiment rose 5.4 points to 76.6

points in March. The reading was above economists' forecast of

74.0.

The euro edged higher to 1.1946 against the greenback and 130.40

against the yen, off its early lows of 1.1914 and 130.08,

respectively. The euro is seen finding resistance around 1.22

against the greenback and 132.00 against the yen.

The euro that closed yesterday's deals at 0.8575 against the

pound climbed to near a 2-week high of 0.8640. Against the aussie,

the euro hit a 6-day high of 1.5473, up from Asian session's 4-day

low of 1.5371. The next possible resistance for the euro is seen

around 0.88 against the pound and 1.56 against the aussie.

The European currency gained to 1.6646 against the kiwi, after

falling to 1.6551 at 5 pm ET. Versus the loonie, the euro remained

higher at 1.4896. If the euro rises further, it may find resistance

around 1.70 against the kiwi and 1.51 against the loonie.

In contrast, the euro weakened to a 6-day low of 1.1041 against

the franc, following a high of 1.1076 seen at 5:30 am ET. Next key

support for the euro is likely seen around the 1.07 level.

Looking ahead, U.S. import and export prices, retail sales and

industrial production, all for February, business inventories data

for January and NAHB housing market index for March are scheduled

for release in the New York session.

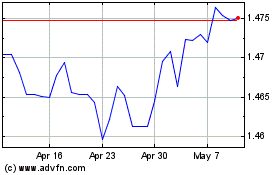

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024