Canadian Dollar Rises Amid Higher Oil Prices

May 26 2022 - 6:59AM

RTTF2

The Canadian dollar climbed against its major rivals in the New

York session on Thursday, amid a rally in oil prices on concerns

over tight supply as the U.S. summer driving season is set to

begin.

Crude for August delivery rose $2.22 to 113.34 per barrel.

Data from the Energy Information Administration showed that U.S.

oil stockpiles fell more than expected last week.

Crude oil inventories fell by 1.019 million barrels last week,

higher than expectations for a drop of 0.737 million barrels.

Data from Statistics Canada showed that Canada retail sales were

virtually unchanged in March.

On a seasonally adjusted monthly basis, retail sales were flat

in March following the downwardly revised 0.2 percent rise in

February. Economists were looking for a gain of 1.4 percent.

The loonie rebounded to 1.3690 against the euro, from a low of

1.3749 logged at 6:45 am ET. On the upside, 1.34 is possibly seen

as the next resistance level.

The loonie was up against the yen, at a 2-day high of 99.64. The

loonie is likely to challenge resistance around the 103.00

level.

The loonie touched 2-day highs of 1.2777 against the greenback

and 0.9042 against the aussie, rising from its prior lows of 1.2849

and 0.9103, respectively. If the loonie rises further, 1.25 and

0.89 are likely seen as its next resistance levels against the

greenback and the aussie, respectively.

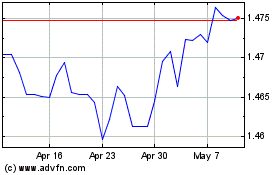

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024