German Ifo Business Confidence Deteriorates In November

November 23 2021 - 11:42PM

RTTF2

Germany's business sentiment weakened in November as the fourth

wave of pandemic caused expectations to fall especially in the

service sector, survey results from the ifo Institute showed on

Wednesday.

The business confidence index fell to 96.5 in November from 97.7

in October. The reading was forecast to drop to 96.6.

Companies were less satisfied with their current business

situation, and expectations became more pessimistic.

The current conditions indicator came in at 99.0, in line with

expectations, and down from 100.2 a month ago. At the same time,

the business expectations index posted 94.2 in November. The score

was expected to fall to 95.0 from October's 95.4.

Supply bottlenecks and the fourth wave of the coronavirus are

challenging German companies, Clemens Fuest, ifo President,

said.

The survey suggested that the German economy was struggling even

before the recent tightening of Covid restrictions, Andrew

Kenningham, an economist at Capital Economics, said. Things will be

much worse in December as coronavirus restrictions are tightened

further.

In the manufacturing sector, the ifo business climate index fell

as companies assessed their current business as considerably worse.

By contrast, their expectations brightened somewhat, especially due

to developments in the automotive industry.

According to ifo, supply bottlenecks in intermediate products

and raw materials still have a grip on the manufacturing sector and

a majority of companies plan to raise prices.

Sentiment in the service sector deteriorated noticeably in

November. Skepticism grew substantially, especially as regards

expectations. Service providers were less satisfied with their

current situation as well.

The business climate index weakened in trade reflecting greater

pessimism in companies' expectations, although they rated their

current situation as somewhat improved. The mood in retail

continues to suffer due to supply problems and prices are more

likely to increase over the coming months, the survey showed.

The business climate in the construction industry worsened

slightly in November. Following the continuous upswing of recent

months, expectations have turned more pessimistic. Companies judged

their current situation to be somewhat better.

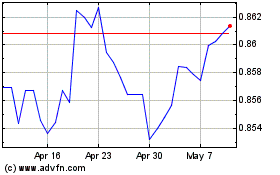

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

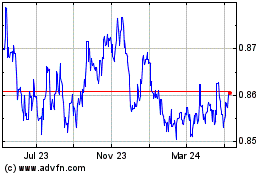

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024