NZ Dollar Rises After RBNZ's Expected 50 Bps Rate Cut

November 26 2024 - 8:45PM

RTTF2

The New Zealand dollar strengthened against other major

currencies in the Asian session on Wednesday, as the Reserve Bank

of New Zealand (RBNZ) announced its policy decision.

The Reserve Bank of New Zealand reduced its benchmark interest

rate by 50 basis points, as inflation moved close to the midpoint

of the target range and economic output remains below its

potential.

The Monetary Policy Committee governed by Adrian Orr decided to

reduce the Official Cash Rate to 4.25 percent from 4.75

percent.

Policymakers expect economic growth to recover next year, as

lower interest rates boost investment and other spending. However,

employment growth is forecast to remain weak until mid-2025.

The MPC cautioned that exact speed and timing of the recovery is

subject to uncertainty. Traders remain cautious ahead of the

release of a key U.S. inflation measure, the Thanksgiving holiday

in the U.S. and uncertainty over Trump's tariff plans. Markets were

positive after Israel approved a US-brokered ceasefire agreement

with Lebanon's Hezbollah.

Traders also react to the minutes of the US Fed's latest

monetary policy meeting that revealed officials believe it will be

appropriate to "gradually" lower interest rates. They also await a

slew of US economic data, including the Fed's preferred readings on

consumer price inflation for clues on the interest rate

outlook.

In economics news, data from the National Bureau of Statistics

showed that China's industrial profits declined at a slower pace in

October. Industrial profits posted an annual decline of 10 percent

on a yearly basis in October. This follows a sharp 27.1 percent

decrease in September.

The improvement in October was partly due to the low base of

comparison.

In the Asian trading now, the NZ dollar rose to a 9-day high of

1.1013 against the Australian dollar, a 6-day high of 0.5882

against the U.S. dollar and a 2-day high of 1.7834 against the

euro, from yesterday's closing quotes of 1.1092, 0.5834 and 1.7973,

respectively. If the kiwi extends its uptrend, it is likely to find

resistance around 1.09 against the aussie, 0.60 against the

greenback and 1.76 against the euro.

Against the yen, the kiwi edged up to 89.89 from an early more

than a 2-month low of 89.10. The kiwi may test resistance around

the 93.00 region.

Looking ahead, the market research group GfK releases Germany's

consumer confidence survey data for December at 4:30 am ET. The

forward-looking consumer sentiment index is expected to fall to

-18.8 in December from -18.3 in November.

In the New York session, U.S. weekly mortgage approvals data,

U.S. Core PCE price index for October, personal income and spending

for October, durable goods orders for October, pending home sales

for October, U.S. Chicago PMI for November, U.S. EIA crude oil data

and U.S. Baker Hughes oil rig count data are slated for

release.

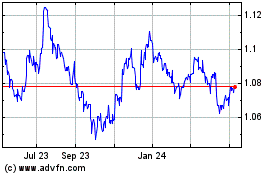

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Oct 2024 to Nov 2024

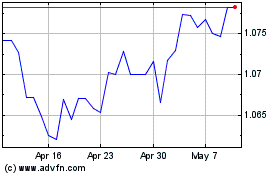

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Nov 2023 to Nov 2024