U.S. Dollar Strengthens On Trade Optimism

January 09 2019 - 1:34AM

RTTF2

The U.S. dollar advanced against its major counterparts in the

European session on Wednesday, erasing its early losses, as U.S.

treasury yields spiked up after the U.S. and China wrapped up trade

talks amid signs of progress on key issues.

Sentiment lifted up after talks have been extended for an

unexpected third day, with US President Donald Trump saying on

Twitter that "Talks with China are going very well!"

Ted McKinney, US under secretary of agriculture for trade and

foreign agricultural affairs, said that the talks went fine but he

didn't give further details.

Signs of progress in US-China trade talks triggered speculation

that a trade deal can be struck ahead of a March 1 deadline

established by Trump and Chinese President Xi Jinping last month at

the G-20 summit in Argentina.

Investors await the Fed minutes from December meeting, when it

raised rates for the fourth time in 2018.

The minutes will be scrutinized for clues on future rate hikes,

although the information is of little relevance since Fed Chairman

Powell softened his tone on future rate hikes last week.

The U.S. treasury yields rose with the benchmark yield on 2-year

note higher by 2.6 percent, while that of 10-year equivalent was up

by 2.7 percent. Yields move inversely to bond prices.

The currency fell against its major counterparts in the Asian

session, with the exception of the yen.

The greenback recovered to 1.2716 against the pound, from a low

of 1.2777 hit at 3:45 am ET. The greenback is seen finding

resistance around the 1.25 level. The greenback bounced off to

0.9814 against the Swiss franc, from a low of 0.9791 touched at

4:30 am ET. The next possible resistance for the greenback is seen

around the 0.995 mark.

Figures from the Federal Statistical Office showed that

Switzerland's consumer price inflation slowed in December to its

lowest level in 10 months.

The consumer price index rose 0.7 percent year-on-year following

a 0.9 percent increase in November. Economists had expected a 0.8

percent climb.

After falling to 1.1479 against the euro at 2:45 am ET, the

greenback reversed direction with the pair trading at 1.1439. The

greenback is poised to challenge resistance around the 1.12

mark.

Preliminary data from the Federal Statistical Office showed that

Germany's merchandise trade surplus grew in November to its biggest

level in five months as imports fell unexpectedly, and exports

decreased, giving further evidence of a slowdown in the biggest

euro area economy.

The non-adjusted trade surplus grew to EUR 20.5 billion from EUR

18.9 billion in October.

The greenback held steady against the yen, after having advanced

to 109.00 early in the Asian session. At yesterday's close, the

pair was worth 108.74.

On the flip side, the greenback dropped to a 3-week low of

0.7171 against the aussie, near 3-week low of 0.6779 against the

kiwi and a new 5-week low of 1.3223 against the loonie, from its

early highs of 0.7134, 0.6721 and 1.3278, respectively. If the

greenback falls further, 0.73, 0.69 and 1.31 are possibly seen as

its support levels against the loonie, the aussie and the kiwi,

respectively.

Looking ahead, at 8:15 am ET, Canada housing starts for December

are set for release.

In the New York session, U.S. advance goods trade data for

December will be out.

The Bank of Canada announces its interest rate decision at 10:00

am ET. Economist widely expect the benchmark rate to remain

unchanged at 1.75 percent.

At 2:00 pm ET, the Fed releases minutes from the December 18-19

meeting.

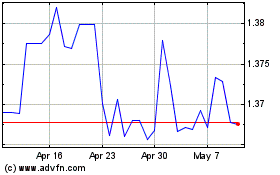

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024