U.S. Dollar Falls On Hopes Of Easing Lockdown Restrictions

April 22 2020 - 1:07AM

RTTF2

The U.S. dollar drifted lower against its major counterparts in

the European session on Wednesday on improved risk sentiment, as

some countries in Europe are considering to relax COVID-19

restrictions.

Italian Prime Minister Giuseppe Conte has convened a taskforce

comprised of leading economists and health experts to weigh all the

pros and cons of easing restrictions.

"I would like to be able to say, let's open everything. Right

away," Conte wrote on Facebook. "But such a decision would be

irresponsible."

Elsewhere, Spain aims to begin winding down its coronavirus

lockdown in the second half of May, Prime Minister Pedro Sanchez

said today.

"We will be going back-and-forth depending on how the pandemic

evolves," he said.

In France, the government has said restrictions will be

gradually lifted from May 11.

The greenback edged down to 0.9683 against the franc, from a

high of 0.9705 seen at 12:30 am ET. The greenback is seen finding

support around the 0.94 mark.

The greenback weakened to 107.51 against the yen, from

yesterday's closing value of 107.75. If the greenback falls

further, 106.00 is likely seen as its next support level. The

greenback dropped to 1.0874 against the euro, after rising to

1.0845 at 12:30 am ET. The greenback is seen locating support

around the 1.10 mark.

The greenback slipped to 1.2344 against the pound, reversing

from a high of 1.2275 logged at 12:30 am ET. Further drop in the

greenback may face support around the 1.26 area.

Data from the Office for National Statistics showed that UK

inflation slowed to a three-month low in March.

Consumer price inflation eased to 1.5 percent in March from 1.7

percent in February. This was the lowest rate since last December,

when prices were up 1.3 percent. The rate came in line with

expectations.

After gaining to 1.4238 against the loonie and 0.5948 against

the kiwi in early deals, the greenback declined to 1.4139 and

0.5999, respectively. The next possible support for the greenback

is seen around 1.33 against the loonie and 0.64 against the

kiwi.

The greenback fell back to 0.6347 against the aussie, heading to

pierce its Asian session's 2-day low of 0.6350. The greenback may

face support around the 0.70 region, if it falls again.

Looking ahead, Canada CPI for March and U.S. FHFA's house price

index for February are due out in the New York session.

At 10:00 am ET, Eurozone consumer sentiment for April will be

featured.

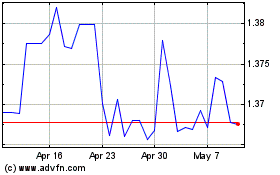

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024