U.S. Dollar Falls On Improved Risk Sentiment, Fed Statement

April 30 2020 - 1:03AM

RTTF2

The U.S. dollar lost ground against its major opponents on

Thursday, as the U.S. Federal Reserve reiterated its commitment to

use its full range of tools to support the economy and promising

trial results of Gilead Sciences' potential coronavirus treatment

remdesivir underpinned sentiment.

The Federal Reserve kept interest rates unchanged on Wednesday,

leaving it in a range between zero and 0.25 percent.

"The Federal Reserve is committed to using its full range of

tools to support the U.S. economy in this challenging time, thereby

promoting its maximum employment and price stability goals,"

according to the accompanying statement.

The central bank's emergency credit facilities are "wide open"

and "we can do more of that," Fed Chair Jerome Powell said in a

press conference.

Investors cheered positive news on Gilead Sciences' experimental

drug remdesivir.

Gilead Sciences cited positive data emerging from the National

Institute of Allergy and Infectious Diseases' study of its

investigational antiviral remdesivir for the treatment of COVID-19.

The company said the trial met its primary endpoint and that NIAID

will provide detailed information at an upcoming briefing.

Investors await U.S. weekly jobless claims for the week ended

April 24 and personal income and spending data for March due later

in the day for more direction.

The greenback depreciated to a weekly low of 0.9705 against the

franc, from Wednesday's closing value of 0.9733. Next key support

for the greenback is likely seen around the 0.96 region.

The greenback eased off to 106.41 against the Japanese yen and

held steady thereafter. The pair closed yesterday's deals at

106.61.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts declined for the ninth

month in a row in March.

Housing starts decreased 7.6 percent year-on-year in March,

following a 12.3 percent fall in February. This was the ninth

consecutive decrease in housing starts. Economists had forecast an

annual 16.0 percent decline.

The U.S. currency weakened to 1.0891 against the euro, its

lowest level since April 20. If the greenback declines further,

1.10 is likely seen as its next support level.

The greenback fell to 1.2498 against the pound, registering a

2-day low. On the downside, 1.28 is likely seen as the next support

for the greenback.

The greenback dropped to a 1-1/2-month low of 0.6154 against the

kiwi, near 2-month low of 0.6570 against the aussie and more than a

2-week low of 1.3858 against the loonie and held steady thereafter.

The greenback had ended yesterday's trading session at 0.6133

against the kiwi, 0.6555 against the aussie and 1.3880 against the

loonie.

Looking ahead, at 7:45 am ET, the European Central Bank

announces its decision on interest rates. Economists expect the

refi rate and the marginal lending facility rate to be kept at 0.00

percent and -0.50 percent, respectively.

In the New York session, Canada GDP data for February and

industrial product price index for March, as well as U.S. weekly

jobless claims for the week ended April 24 and personal income and

spending data for March are slated for release.

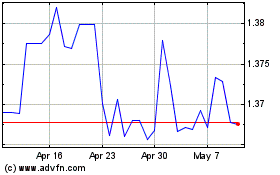

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024