U.S. Dollar Drops As Treasury Yields Retreat; Fed Minutes Due

January 05 2022 - 1:43AM

RTTF2

The U.S. dollar weakened against its major counterparts in the

European session on Wednesday, as the continued rise in coronavirus

cases in the country lifted the safe-haven treasuries, while

investors awaited minutes from the Federal Reserve's latest meeting

for more clues about the timing of the first rate hike.

Treasury yields retreated, with the benchmark yield on the

10-year note falling to 1.65 percent. Yields move inversely to bond

prices.

The U.S. recorded more than one million new Covid cases on

Monday, driven by a surge in the Omicron variant.

Total infections in the country exceeded 55 million and the

death toll surpassed 826,000.

The Federal Reserve will publish the minutes from the December

meeting later in the day.

Money markets are currently pricing in a high probability of a

Fed rate increase in May, followed by two more by the end of the

year.

The greenback held steady against its major rivals in the Asian

session, except the euro.

The greenback dropped to 2-day lows of 0.7260 against the aussie

and 1.1324 against the euro, from Tuesday's closing values of

0.7239 and 1.1287, respectively. The greenback is seen finding

support around 0.75 against the aussie and 1.16 against the

euro.

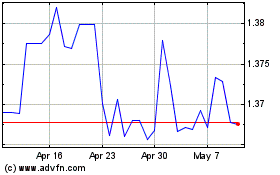

The greenback edged down to 1.3555 against the pound and 0.9141

against the franc, compared to yesterday's closing quotes of 1.3526

and 0.9156, respectively. The next likely support for the greenback

is seen around 1.37 against the pound and 0.90 against the

franc.

The greenback, which ended Tuesday's deals at 0.6806 against the

kiwi and 116.13. against the yen, dropped to 0.6822 and 115.62,

respectively. The currency may target support around 0.70 against

the kiwi and 112.00 against the yen.

The greenback, however, rose against the loonie with the pair

worth 1.2732. The greenback was trading at 1.2703 against the

loonie at yesterday's close. The greenback is likely to test

resistance around the 1.30 level.

Looking ahead, U.S. ADP private payrolls data for December is

scheduled for release at 8:15 am ET.

Canada building permits and new housing price index for November

will be published in the New York session.

The Fed minutes from the December 14-15 meeting are set for

release at 2:00 pm ET.

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024