UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number 001-39001

Blue

Hat Interactive Entertainment Technology

(Translation of registrant’s name into English)

7th Floor, Building C, No. 1010 Anling Road

Huli District, Xiamen, China 361009

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Blue Hat Interactive Entertainment Technology, a Cayman

Islands exempted company (the “Company”) furnishes under the cover of Form 6-K the following in connection with its extraordinary

general meeting of the shareholders:

| |

* |

Note to shareholders of record of the Company: The proxy card furnished hereto is a form for your reference only. You shall vote based on the proxy card you receive. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 14, 2025

| BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY |

|

| |

|

| By: |

/s/

Xiaodong Chen |

|

| |

Name: Xiaodong Chen |

|

| |

Title: Chief Executive Officer |

|

EXHIBIT 99.1

BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY

7th Floor, Building C, No. 1010 Anling Road

Huli District, Xiamen, China 361009

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

To be held on February 28, 2025 at 9:00 p.m. (Local

Time)

(or any adjournment or postponement thereof)

To the Shareholders of

Blue Hat Interactive Entertainment Technology

Notice is hereby given that the

Extraordinary General Meeting of the Shareholders of Blue Hat Interactive Entertainment Technology, a Cayman Islands exempted company

(the “Company”) will be held on February 28, 2025 at 9:00 p.m. local time (i.e., 8:00 a.m. February 28, 2025, E.T.) at 7th

Floor, Building C, No. 1010 Anling Road, Huli District, Xiamen, China 361009 (“Principal Executive Office”), and at any adjourned

or postponement thereof. The Extraordinary General Meeting is called for the following purposes:

| |

1. |

Proposal 1: To consider

and approve by an ordinary resolution that the share capital of the Company increase from “US$5,000,000 divided into 500,000,000

ordinary shares of US$0.01 par value each” to “US$500,000,000 divided into 50,000,000,000 ordinary shares of US$0.01

par value each by the creation of an additional 49,500,000,000 ordinary shares of a par value of US$0.01 each to rank pari passu

in all respects with the existing ordinary shares of the Company with immediate effect (the “Authorized Share Capital Increase”). |

| |

|

|

| |

2. |

Proposal 2: To consider

and approve by an ordinary resolution a share consolidation (the “Share Consolidation”) of the Company’s ordinary

shares, par value US$0.01 each in the authorized share capital of the Company (including issued and unissued share capital) at a

ratio of 50-1 or 100-1, with the exact ratio to be selected at the sole discretion of the Company’s Board. |

A Meeting Notice (as defined below)

providing information, and a form of proxy to vote, with respect to the foregoing matters accompany this notice. The Board of Directors

of the Company fixed the close of business on February 12, 2025 as the record date (the “Record Date”) for determining the

shareholders entitled to receive notice of and to vote at the Extraordinary General Meeting or any adjourned or postponement thereof.

The register of members of the Company will not be closed. A list of the shareholders entitled to vote at the Extraordinary General Meeting

may be examined at the Company’s offices during the 10-day period preceding the Extraordinary General Meeting.

Holders of record of the Company’s

ordinary shares as of the Record Date are cordially invited to attend the Extraordinary General Meeting in person. Your vote is important.

Whether or not you expect to attend the Extraordinary General Meeting in person, you are urged to complete, sign, date and return the

accompanying proxy form as promptly as possible. We must receive the proxy form no later than noon on the day of the Extraordinary General

Meeting to ensure your representation at such meeting. Shareholders who execute proxies retain the right to revoke them at any time prior

to the voting thereof, and may nevertheless vote in person at the Extraordinary General Meeting. You may obtain directions to the meeting

by calling our offices at +86-592-228-0081. Shareholders may obtain a copy of these materials, free of charge, by contacting the Corporate

Secretary at Principal Executive Office.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Xiaodong Chen |

| |

Xiaodong

Chen |

| |

Chairman

of the Board |

| |

Xiamen,

February 14, 2025 |

IMPORTANT

Whether or not you expect to attend the Extraordinary

General Meeting in person, you are urged to complete, sign, date and return the accompanying proxy form to ensure your representation

at such meeting.

If your shares are held in street name, your broker,

bank, custodian or other nominee holder cannot vote your shares, unless you direct the nominee holder how to vote, by marking your proxy

card.

BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY

TABLE OF CONTENTS

BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY

7th Floor, Building C, No. 1010 Anling Road

Huli District, Xiamen, China 361009

PROXY STATEMENT

for

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

To be held on February 28, 2025 at 9:00 p.m. (Local

Time)

(or any adjournment or postponement thereof)

PROXY SOLICITATION

This Meeting Notice is furnished

in connection with the solicitation of proxies by the Board of Directors (the “Board” or the “Board of Directors”)

of Blue Hat Interactive Entertainment Technology (the “Company,” “we,” “us,” or “our”)

for the Extraordinary General Meeting of Shareholders to be held at 7th Floor, Building C, No. 1010, Anling Road, Huli District, Xiamen,

China 361009 on February 22, 2025 at 9:00 p.m. local time (i.e., 8:00 a.m. February 28, 2025, E.T.) and for any adjournment or postponement

thereof, for the purposes set forth in the accompanying Notice of Extraordinary General Meeting of Shareholders. Any shareholder giving

such a proxy has the power to revoke it at any time before it is voted. Written notice of such revocation should be forwarded directly

to the Secretary of the Company, at the above stated address. Proxies may be solicited through the mails or direct communication with

certain shareholders or their representatives by Company officers, directors, or employees, who will receive no additional compensation

therefor. You may obtain directions to the meeting by calling our offices at +86-592-228-0081.

If the enclosed proxy is properly

executed and returned, the shares represented thereby will be voted in accordance with the directions thereon and otherwise in accordance

with the judgment of the persons designated as proxies. Any proxy on which no direction is specified will be voted in favor of the actions

described in this Proxy Statement.

The Company will bear the entire

cost of preparing, assembling, printing and mailing this Meeting Notice, the accompanying proxy form, and any additional material that

may be furnished to shareholders. The date on which this Meeting Notice and the accompanying Proxy Form will first be mailed or given

to the Company’s shareholders is on or about February 18, 2025.

We have elected to provide access

to our proxy materials both by sending you this full set of proxy materials, including the notice of our Extraordinary General Meeting,

this Meeting Notice and a proxy card to Shareholders.

Your vote is important.

Whether or not you expect to attend the Extraordinary General Meeting in person, you are urged to complete, sign, date and return the

accompanying proxy form as promptly as possible to ensure your representation at such meeting. Shareholders who execute proxies retain

the right to revoke them at any time prior to the voting thereof, and may nevertheless vote in person at the Extraordinary General Meeting.

If you hold your shares in street name and wish to vote your shares at the Extraordinary General Meeting, you should contact your broker,

bank, custodian or other nominee holder about getting a proxy appointing you to vote your shares.

QUESTIONS AND ANSWERS ABOUT THE EXTRAORDINARY GENERAL

MEETING

The following is information regarding

the Meeting Notice, Extraordinary General Meeting and voting is presented in a question and answer format.

| Q. |

What is the purpose of this document?

|

| |

A. |

This document serves as the Company’s meeting Notice, which is being provided to Company shareholders of record at the close of business on February 12, 2025 (the “Record Date”) because the Company’s Board of Directors is soliciting their proxies to vote at the Extraordinary General Meeting of Shareholders (“Extraordinary General Meeting”) on the item of business outlined in the Notice of Extraordinary General Meeting of Shareholders (the “Meeting Notice”). |

| |

|

|

| Q. |

Why am I receiving these materials?

|

| |

A. |

We have sent you this Meeting Notice and the enclosed

proxy card because the Board of Directors of the Company is soliciting your proxy to vote at the Extraordinary General Meeting, including

at any adjournments or postponements of the meeting. You are invited to attend the Extraordinary General Meeting to vote on the proposal

described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete,

sign and return the enclosed proxy card.

When you sign the enclosed proxy card, you appoint the proxy holder as your representative at the meeting. The proxy holder will vote

your shares as you have instructed in the proxy card, thereby ensuring that your shares will be voted whether or not you attend the meeting.

Even if you plan to attend the meeting, you should complete, sign and return your proxy card in advance of the meeting just in case your

plans change.

If you have signed and returned the proxy card and an issue comes up for a vote at the meeting that is not identified on the card, the

proxy holder will vote your shares, pursuant to your proxy, in accordance with his or her judgment.

The Company intends to mail this Meeting Notice and

accompanying proxy card on or about February 18, 2025 to all shareholders entitled to vote at the Extraordinary General Meeting. |

| Q. |

Who may vote and how many votes my I cast?

|

| |

A. |

Only shareholders on the Record Date, February 12, 2025, will be entitled to vote at the Extraordinary General Meeting. On the Record Date, there were 493,820,989 ordinary shares outstanding and entitled to vote. Each ordinary share is entitled to one vote on each matter. There are no preferred shares issued and outstanding. |

| Q. |

How do I vote?

|

| |

A. |

You may vote “For” or “Against”

the proposals, or “Abstain” from voting on such proposals. The procedures for voting are outlined below:

|

Shareholder of Record: Shares Registered in Your Name

If you are a shareholder of record, you may vote in

person at the Extraordinary General Meeting or vote by proxy using the enclosed proxy card.

| |

● |

To vote in person, come to

the Extraordinary General Meeting and we will give you a ballot when you arrive; or |

| |

|

|

| |

● |

To vote over the Internet,

go to https://ts.vstocktransfer.com/pxlogin and follow the steps outlined to complete an electronic

proxy card. You will be asked to provide the Company number and control number from the enclosed proxy card. Your vote must be received

by 11:59 p.m. E.T. on February 27, 2025 to be counted. |

| |

|

|

| |

● |

To vote using the proxy card,

simply complete, sign and date the enclosed proxy card and send a scanned copy to vote@vstocktransfer.com,

If you return your signed proxy card to us before the Special Meeting, your shares will be voted as you direct. |

Beneficial Owner: Shares Registered in the Name of a Broker, Bank, Custodian

or Other Nominee Holder

If you received this Meeting Notice

from your broker, bank, custodian or other nominee holder, your broker, bank, custodian or other nominee holder should have given you

instructions for directing how that person or entity should vote your shares. It will then be your broker, bank, custodian or other nominee

holder’s responsibility to vote your shares for you in the manner you direct. Please complete, execute and return the proxy card

in the envelope provided by your broker, bank, custodian or other nominee holder promptly.

Under the rules of various national

and regional securities exchanges, brokers generally may vote on routine matters, such as the ratification of the engagement of an independent

public accounting firm, but may not vote on non-routine matters unless they have received voting instructions from the person for whom

they are holding shares. The proposals are non-routine matters and, consequently, your broker, bank, custodian or other nominee holder

will not have discretionary authority to vote your shares on these matters. If your broker, bank, custodian or other nominee holder does

not receive instructions from you on how to vote on this matter, your broker, bank, custodian or other nominee holder will return the

proxy card to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a “broker

non-vote” and may affect the outcome of the voting.

We therefore encourage you to

provide directions to your broker, bank, custodian or other nominee holder as to how you want your shares voted on all matters to be brought

before the Extraordinary General Meeting. You should do this by carefully following the instructions your broker, bank, custodian or other

nominee holder gives you concerning its procedures. This ensures that your shares will be voted at the Extraordinary General Meeting.

You are also invited to attend

the Extraordinary General Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the

meeting unless you request and obtain a valid proxy from your broker, bank, custodian or other nominee holder.

| Q. |

What if I change my mind after I vote via proxy?

|

| |

A. |

If you hold your shares in your own name, you may revoke your proxy at any time before your shares are voted by: |

| |

|

● |

e-mailing a later dated proxy prior to the Extraordinary General Meeting; |

| |

|

|

| |

|

● |

delivering a written request in person to return the executed proxy; |

| |

|

|

| |

|

● |

voting in person at the Extraordinary General Meeting; or |

| |

|

|

| |

|

● |

providing written notice of revocation to the Corporate

Secretary of the Company at: 7th Floor, Building C, No. 1010 Anling Road, Huli District, Xiamen, China 361009.

|

If you hold your shares in the name of your broker,

bank, or other fiduciary, you will need to contact that person or entity to revoke your proxy.

| Q. |

What does it mean if I receive more than one proxy card or voting

instruction form?

|

| |

A. |

It means that you have multiple accounts at our transfer agent or with brokers, banks, or other fiduciaries. Please complete and return all proxy cards and voting instruction forms to ensure that all of your shares are voted. |

| Q. |

How many shares must be present to hold a valid meeting?

|

| |

A. |

For us to hold a valid Extraordinary General

Meeting, we must have a quorum, which means that Members holding not less than an aggregate of one-third in nominal value of the total

issued voting shares in the Company that are entitled to

cast a vote are present in person or by proxy at the Extraordinary General Meeting. Proxies received but marked as abstentions and Broker

Non-Votes will be treated as shares that are present and entitled to vote for purposes of determining a quorum. Your shares will be counted

as present at the Extraordinary General Meeting if you:

|

| |

|

|

| |

● |

properly submit a proxy card (even if you do not provide voting instructions); or |

| |

|

|

| |

● |

attend the Meeting and vote in person.

|

On February 12, 2025, the Record

Date, there were 493,820,989 ordinary shares outstanding. Therefore, at least 164,606,997 (one third of the outstanding ordinary shares)

shares need to be present in person or by proxy at the Extraordinary General Meeting in order to hold the meeting and conduct business.

| Q. |

How

many votes are required to approve an item of business?

Assuming a quorum as referenced above is reached –

|

| |

A. |

Proposal

1 will be approved if passed by a simple majority of the votes cast by the shareholders at the Extraordinary General Meeting. |

| |

B. |

Proposal

2 will be approved if passed by a simple majority of the votes cast by the shareholders at the Extraordinary General Meeting. |

Only shares that are voted are

taken into account in determining the proportion of votes cast for the proposals. Any shares not voted (whether by abstention, broker

non-vote or otherwise) will not impact any of the votes.

| Q. |

Who pays the cost for soliciting proxies?

|

| |

A. |

We will pay the cost for the solicitation of proxies by the Board of Directors. Our solicitation of proxies will be made primarily by mail. Proxies may also be solicited personally, by telephone, fax or e-mail by our officers, directors, and regular supervisory and executive employees, none of whom will receive any additional compensation for their services. We will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to beneficial holders to obtain the authorization for the execution of proxies. |

| |

|

|

| Q. |

Where can I find additional information about the Company?

|

| |

A. |

Our reports on 6-K, and other publicly available information, should be consulted for other important information about the Company. You can also find additional information about us on our web site at https://ir.bluehatgroup.com/. The mailing address and the location of the principal executive office of the Company is 7th Floor, Building C, No. 1010 Anling Road, Huli District, Xiamen, China 361009. The telephone number for the Company is +86-592-228-0081. |

Proposal 1

APPROVAL TO INCREASE AUTHORIZED

SHARE CAPITAL

General Plan to Increase Authorized Share Capital (the “Authorized

Share Capital Increase”)

To consider and approve a proposal

for the Company to increase its authorized share capital from “US$5,000,000 divided into 500,000,000 ordinary shares of US$0.01

par value each” to “US$500,000,000 divided into 50,000,000,000 ordinary shares of US$0.01 par value each” by

the creation of an additional 49,500,000,000 ordinary shares of a par value of US$0.01 each to rank pari passu in all respects with the

existing ordinary shares of the Company with immediate effect.

Vote Required to Approve Proposal 1

Proposal 1 will be approved only

it receives the affirmative vote of a simple majority of the votes cast at the Extraordinary General Meeting assuming a quorum reaches.

WE RECOMMEND A VOTE “FOR” THE PROPOSAL

TO APPROVE THE SHARE CAPITAL INCREASE

Proposal 2

AUTHORIZE THE BOARD OF DIRECTORS TO EFFECT A SHARE

CONSOLIDATION

Purpose and Background of the Share Consolidation

To consider and approve by an ordinary resolution a Share Consolidation of

the Company’s ordinary shares, par value US$0.01 each in the authorized share capital of the Company (including issued and unissued

share capital) at a ratio of 50-1 or 100-1, with the exact ratio to be selected at the sole discretion of the Company’s Board on

the effective date as determined by the Board, but must be on or before a date that is in compliance with the Cayman law.

On February 4, 2025, the Board

of Directors approved by written resolution the proposal authorizing the Share Consolidation because the Board of Directors believes that

effecting the Share Consolidation could, in some circumstances, be an effective means of maintaining, and regaining, compliance with the

minimum trading price requirement for continued listing of our ordinary shares on The Nasdaq Capital Market.

On September 6, 2024, the Company

received a letter from The Nasdaq Stock Market regarding the Company’s failure to comply with Nasdaq Continued Listing Rule (“Rules”)

5550(a)(2) (the “Price Rule”), which requires listed securities to maintain a minimum bid price of $1.00 per share. A failure

to comply with Rule 5550(a)(2) exists when listed securities fail to maintain a closing bid price of at least $1.00 per share for 30 consecutive

business days.

Under Rule 5810(c)(3)(A), the

Company was provided a compliance period of 180 calendar days, until March 5, 2025, to regain compliance. On January 24, 2025, it has

received a letter from The Nasdaq Stock Market LLC (“Nasdaq”), notifying that the Company is not in compliance with Nasdaq

Listing Rule 5810(c)(3)(A)(iii) (the “Low Priced Stocks Rule”), as the Company’s securities had a closing bid price

of $0.10 or less for ten consecutive trading days from January 8, 2025 through January 23, 2025. The letter indicated that, as a result,

the Nasdaq staff has determined to delist the Company’s ordinary shares from The Nasdaq Capital Market (the “Delisting Determination”).

The Delisting Determination ended the aforementioned compliance period before its expiration because the Company’s stock prices

have triggered the Low Priced Stocks Rule. The Company timely requested an appeal of the Delisting Determination to the hearing panel on

January 29, 2025.

To regain compliance, the bid

price of the Company’s ordinary shares must close at or above $1.00 per share for a minimum of ten consecutive business days. If

the Share Consolidation successfully increases the per share price of our ordinary shares, the Board of Directors believes this Share

Consolidation will enable us to maintain The Nasdaq Capital Market listing of our ordinary shares.

In the event that our ordinary

shares are delisted by the Nasdaq Stock Market, our ordinary shares would likely trade on the over-the-counter market. If our stocks were

to trade on the over-the-counter market, selling our ordinary shares could be more difficult because smaller quantities of stocks would

likely be bought and sold, and transactions could be delayed. In addition, in the event our ordinary shares are delisted, broker-dealers

have certain regulatory burdens imposed upon them, which may discourage broker-dealers from effecting transactions in our ordinary shares,

further limiting the liquidity of our ordinary shares. These factors could result in lower prices and larger spreads in the bid and ask

prices for ordinary shares. Such potential delisting from the Nasdaq and continued or further declines in our share price could also greatly

impair our ability to raise additional necessary capital through equity or debt financing, including short-term debt financing provided

by foreign lenders.

In approving this proposal, the

Board of Directors also considered the potential positive effects of an increased market price of our ordinary shares, including improved

marketability, liquidity, investors’ interest and trading in our stock. At current market price, the Company’s ordinary shares

may not appeal to brokerage firms that are reluctant to recommend lower priced securities to their clients. Investors may also be dissuaded

from purchasing lower priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for

such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower

priced stocks.

In light of the factors mentioned

above, our Board of Directors approved this proposal as a means of maintaining the price of our ordinary shares above $1.00 per share

to regain compliance with Price Rule.

Determination of the Ratio for the Share Consolidation

By approving this proposal, shareholders will approve the Board of Directors

to effect a Share Consolidation at the ratio of 50-1 or 100-1 as approved by the shareholders and the time when it deems in the best interests

of the Company and its shareholders, which shall be on or before a date that is in compliance with the Cayman law.

Principal Effects of the Share Consolidation

If implemented, the Share Consolidation

will be effected simultaneously for all issued and unissued ordinary shares. The Share Consolidation will affect all of our shareholders

uniformly and will not affect any shareholder’s percentage ownership interests in the Company, except to the extent that the Share

Consolidation would otherwise result in any of our shareholders owning a fractional share (in which case the fractional amount will be

rounded up to the next whole share). After the Share Consolidation, the shares of our ordinary shares will have the same voting rights

and rights to dividends and distributions and will be identical in all other respects to our ordinary shares now authorized. ordinary

shares issued pursuant to the Share Consolidation will remain fully paid and non-assessable. The Share Consolidation will not affect the

Company continuing to be subject to the periodic reporting requirements of the Exchange Act. The Share Consolidation is not intended to

be, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange Act.

The Share Consolidation may result

in some shareholders owning “odd-lots” of less than 100 shares of our Ordinary Shares. Brokerage commissions and other costs

of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples of 100 shares.

Following the effectiveness of

such Share Consolidation approved by the shareholders and implementation by the Board of Directors, current shareholders will hold fewer

shares of ordinary shares, but the rights and ownership percentages will remain the same.

IF THIS PROPOSAL IS NOT APPROVED,

WE WILL BE UNABLE TO MAINTAIN THE LISTING OF OUR ORDINARY SHARES ON THE NASDAQ STOCK MARKET, WHICH COULD ADVERSELY AFFECT THE LIQUIDITY

AND MARKETABILITY OF OUR ORDINARY SHARES.

Fractional Shares

No fractional shares will be issued

in connection with the Share Consolidation. Instead, we will issue one full share of the ordinary shares after Share Consolidation to

any shareholder who would have been entitled to receive a fractional share as a result of the Share Consolidation. Each ordinary shareholder

will hold the same percentage of the outstanding ordinary shares immediately following the Share Consolidation as that shareholder did

immediately prior to the Share Consolidation, except for minor adjustments due to the additional net share fractions that will need to

be issued as a result of the treatment of fractional shares.

Share Certificates

Mandatory surrender of certificates

is not required by our shareholders. The Company’s transfer agent will adjust the record books of the Company to reflect the Share

Consolidation as of the effective date of the Share Consolidation. New certificates will not be mailed to shareholders.

Resolutions

The Board proposes to solicit shareholder approval to effect a share consolidation

of the Company's ordinary shares at one of the ratios as set out below ((A) 50-1 or (B) 100-1) in the form of shareholder resolutions,

the shareholders to approve each ratio and to grant the Board a discretion to determine the most appropriate ratio and such consolidation

to be effective on such date as is determined by the Board, which shall be on or before a date that is in compliance with Cayman law.

The resolutions be put to the shareholders to consider and to vote upon at the Meeting in relation to amending the authorized share capital

of the Company are:

“IT IS RESOLVED THAT

immediately following the Authorised Share Capital Increase, the following resolutions shall be approved as ordinary resolutions of the

Company, and subject to and conditional upon that the Board determining which of the below resolutions is to be effective:

| (A) | Every 50 ordinary shares of par value of US$0.01 each in the authorized share

capital of the Company (including issued and unissued share capital) be consolidated into 1 ordinary share of par value of US$0.5 each,

and following such consolidation the authorised share capital of the Company is US$500,000,000 divided into 1,000,000,000 ordinary shares

of par value of US$0.5 each, with such consolidation to be effective on such date as determined by the Directors which date must be on

or before a date that is in compliance with Cayman law; or |

| (B) | Every 100 ordinary shares of par value of US$0.01 each in the authorized share

capital of the Company (including issued and unissued share capital) be consolidated into 1 ordinary share of par value of US$1 each,

and following such consolidation the authorised share capital of the Company is US$500,000,000 divided into 500,000,000 ordinary shares

of par value of US$1 each, with such consolidation to be effective on such date as determined by the Directors which date must be on or

before a date that is in compliance with Cayman law. |

Risks Associated with the Share Consolidation

There are risks associated with

the Share Consolidation. Shareholders should note that the effect of the Share Consolidation, if any, upon the market price for our ordinary

shares cannot be accurately predicted. In particular, we cannot assure you that prices for shares of our ordinary shares after the Share

Consolidation will be the number of times equals exactly to the ratio multiplied by the prices for shares of our Ordinary Shares immediately

prior to the Share Consolidation. Furthermore, even if the market price of our ordinary shares does rise following the Share Consolidation,

we cannot assure you that the market price of our ordinary shares immediately after the proposed Share Consolidation will be maintained

for any period of time. Even if an increased per-share price can be maintained, the Share Consolidation may not achieve the desired results

that have been outlined above. Moreover, because some investors may view the Share Consolidation negatively, we cannot assure you that

the Share Consolidation will not adversely impact the market price of our ordinary shares.

The market price of our ordinary

shares will also be based on our performance and other factors, some of which are unrelated to the Share Consolidation or the number of

shares outstanding. If the Share Consolidation is effected and the market price of our ordinary shares declines, the percentage declines

as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Share

Consolidation. The total market capitalization of our ordinary shares after implementation of the Share Consolidation, when and if implemented,

may also be lower than the total market capitalization before the Share Consolidation. Furthermore, the liquidity of our ordinary shares

could be adversely affected by the reduced number of shares that would be outstanding after the Share Consolidation.

While we believe that the Share

Consolidation will be sufficient to maintain our listing on The Nasdaq Stock Market, it is possible that, even if the Share Consolidation

results in a closing price for our ordinary shares that exceeds $1.00 per share, we may not be able to continue to satisfy other criteria

for continued listing of our ordinary shares on The Nasdaq Stock Market. Although we believe that we will continue satisfying all of the

other continued listing criteria, we cannot assure you that this will be the case.

Vote Required to Approve Proposal 2

The Proposal 2 will be approved

only it receives the affirmative vote of a simple majority of the votes cast at the Extraordinary General Meeting assuming a quorum reaches.

WE RECOMMEND A VOTE “FOR” THE PROPOSAL

TO AUTHORIZE THE BOARD OF DIRECTORS TO EFFECT THE SHARE CONSOLIDATION

Transfer Agent and Registrar

The transfer agent and registrar for our ordinary shares

is VStock Transfer, LLC. Its address is 18 Lafayette Place, Woodmere, New York 11598, and its telephone number is +1(212)828-8436.

Where You Can Find More Information

We file annual report and other

documents with the SEC under the Exchange Act. Our SEC filings made electronically through the SEC’s EDGAR system are available

to the public at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file with the SEC at the SEC’s

public reference room located at 100 F Street, NE, Room 1580, Washington, DC 20549. Please call the SEC at (800) SEC-0330 for further

information on the operation of the public reference room.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/

Mr. Xiaodong Chen |

| |

Chairman

of the Board |

February 14, 2025

|

|

Proxy Form

Refer to Exhibit 99.2 to the Report on Form 6-K filed

by Blue Hat Interactive Entertainment Technology, Inc. on February 14, 2025

|

10

EXHIBIT 99.2

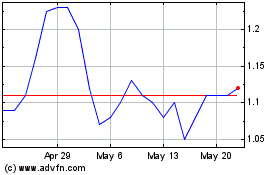

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Feb 2024 to Feb 2025