Black Ridge Acquisition Corp. Announces Intention to Further Adjourn Special Meeting of Stockholders Relating to Proposed Bus...

July 05 2019 - 4:35PM

Business Wire

-- Special Meeting of Stockholders Relating

to Proposed Business Combination Now to be Held on July 22,

2019

-- Stockholders Wishing to Remain Holders

through Extended Period Must Withdraw any Previous Conversion

Request

Black Ridge Acquisition Corp. (NASDAQ: BRAC), a public

acquisition vehicle (“Black Ridge”), today announced that it

intends to further adjourn its Special Meeting of Stockholders (the

“Special Meeting”) relating to its proposed business combination

with Allied Esports and the World Poker Tour. The adjournment will

allow BRAC to hold a vote on its previously announced proposal to

extend the time period it has to consummate the proposed business

combination through August 10, 2019. The Special Meeting for the

proposed business combination is now expected to be held on July

22, 2019, at 10:00 a.m., local time, at the offices of its general

counsel, Graubard Miller, located at The Chrysler Building, 405

Lexington Avenue, 11th Floor, New York, New York 10174.

As previously announced, Black Ridge entered into an Agreement

and Plan of Reorganization pursuant to which Black Ridge will

acquire Allied Esports and the World Poker Tour. The parties expect

the proposed transactions to be consummated shortly after the

Special Meeting is held and completed.

The Special Meeting was originally scheduled for June 28, 2019

and adjourned until July 8, 2019. The record date for determination

of stockholders entitled to vote at the Special Meeting, including

at all adjournments thereof, remains June 10, 2019.

The vote for the extension will be held on July 9, 2019. If the

extension proposal is approved, Black Ridge Oil & Gas, Inc.,

BRAC’s sponsor, has agreed to loan $30,000 to BRAC to be placed in

trust for the benefit of each public share that is not converted in

connection with the stockholder vote to approve the extension.

Accordingly, if the maximum number of shares permitted to be

converted as described in the proxy statement are converted, the

amount contributed into the trust account per share will be $0.062;

alternatively, if no shares are converted, the amount contributed

per share will be approximately $0.002.

Stockholders who previously requested conversion of their shares

for a pro rata portion of BRAC’s trust account in connection with

the upcoming vote on the business combination but who wish to

remain holders through the extended date are instructed to contact

BRAC’s transfer agent to withdraw their conversion request at the

following:

Mr. Mark Zimkind

Continental Stock Transfer & Trust

Company

1 State Street, 30th Floor

New York, New York 10004

E-mail: mzimkind@continentalstock.com

Holders can also contact BRAC’s proxy solicitor with questions

at the following:

Morrow Sodali LLP

470 West Avenue

Stamford CT 06902

Tel: (800) 662-5200 or banks and brokers

can call collect at (203) 658-9400

Email: BRAC.info@morrowsodali.com

About Black Ridge Acquisition Corp.

Black Ridge Acquisition Corp. is a special purpose acquisition

company sponsored by Black Ridge Oil & Gas, Inc. (OTCQB: ANFC)

for the purpose of effecting a merger, capital stock exchange,

asset acquisition, stock purchase, reorganization or similar

business combination with one or more businesses or assets. Black

Ridge Acquisition Corp. completed its initial public offering in

October 2017, raising $138 million in cash proceeds.

No Offer or Solicitation

This communication is for informational purposes only and is

neither an offer to sell or purchase, nor the solicitation of an

offer to buy or sell any securities, nor is it a solicitation of

any vote, consent, or approval in any jurisdiction pursuant to or

in connection with the business combination or otherwise, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law.

Participants in Solicitation

Black Ridge and its directors and executive officers may be

deemed participants in the solicitation of proxies of Black Ridge

stockholders in respect of the proposed business combination.

Information about the directors and executive officers of Black

Ridge is set forth in Black Ridge’s definitive proxy statement

relating to the business combination and Black Ridge’s other

reports filed with the Securities and Exchange Commission including

its Form 10-K for the year ended December 31, 2018. Information

about the directors and executive officers and more detailed

information regarding the identity of all potential participants,

and their direct and indirect interests, by security holdings or

otherwise, is set forth in Black Ridge’s definitive proxy

statement. Investors may obtain additional information about the

interests of such participants by reading such proxy statement on

the SEC’s website at www.sec.gov.

Forward Looking Statements

This press release includes forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 that involve risks and uncertainties.

Forward-looking statements are statements that are not historical

facts. Such forward-looking statements, based upon the current

beliefs and expectations of Black Ridge’s management, are subject

to risks and uncertainties, which could cause actual results to

differ from the forward-looking statements.

Forward-looking statements are inherently uncertain and subject

to a variety of events, factors and conditions, many of which are

beyond the control of Black Ridge and not all of which are known to

Black Ridge, including, without limitation those risk factors

described from time to time in Black Ridge’s reports filed with the

SEC, including the definitive proxy statement. Among the factors

that could cause actual results to differ materially are: the

successful completion of the Business Combination, amount of

redemptions and the ability to retain key personnel and the ability

to achieve stockholder and regulatory approvals. Most of these

factors are outside the control of Black Ridge and are difficult to

predict. The information set forth herein should be read in light

of such risks. Black Ridge does not assume any obligation to update

the information contained in this press release except as required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190705005296/en/

Investor Contact: Lasse Glassen Addo Investor Relations

lglassen@addoir.com 424-238-6249

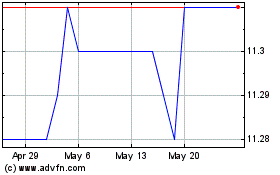

Broad Capital Acquisition (NASDAQ:BRAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

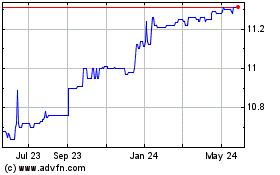

Broad Capital Acquisition (NASDAQ:BRAC)

Historical Stock Chart

From Feb 2024 to Feb 2025