false

0001354866

0001354866

2024-07-31

2024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

BYRNA TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| 333-132456 |

|

71-1050654 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

100 Burtt Road, Suite 115

Andover, MA 01810

(Address and Zip Code of principal executive offices)

(978) 868-5011

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, $0.001 par value

|

BYRN

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On July 31, 2024, the Board of Directors of Byrna Technologies Inc. (the “Company”) authorized a stock repurchase program (the “Program”). Under this Program the Company may repurchase up to $10 million of its common stock during a period of two years. The Program permits shares to be repurchased in open market transactions, through block trades and pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 of the Securities and Exchange Commission (each, a “Plan”).

Repurchases may be made under a Plan in amounts and at prices set therein based on management’s discretionary determination of prices management considers to be attractive and in the best interests of both the Company and its stockholders, subject to the availability of stock, general market conditions, the applicable trading price, future alternative advantageous uses for capital, and the Company’s financial performance. Such repurchases also will be conducted in accordance with the limitations set forth in Rule 10b-18 of the Securities and Exchange Commission and other applicable legal requirements.

The repurchase program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases.

The repurchase program does not obligate the Company to purchase any particular number of shares.

The Company issued a press release on August 5, 2024 that describes the stock repurchase program. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

104

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL Document.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BYRNA TECHNOLOGIES INC.

|

|

|

|

|

|

|

| Date: August 5, 2024 |

By:

|

/s/ Lauri Kearnes

|

|

|

|

|

Name: Lauri Kearnes |

|

|

|

|

Title: Chief Financial Officer |

|

Exhibit 99.1

Byrna Technologies Announces $10 Million Stock Repurchase Program

ANDOVER, Mass., August 5, 2024 - Byrna Technologies Inc. (“Byrna” or the “Company”) (Nasdaq: BYRN), a technology company, specializing in the development, manufacture, and sale of innovative less-lethal personal security solutions, today announced that its Board of Directors has approved a $10 million stock repurchase program. This program authorizes the Company to repurchase up to $10 million of its common stock over a twenty-four month period.

“Based on our continuing strong operating performance, primarily driven by our successful marketing strategies, we believe Byrna’s shares present a compelling investment opportunity at their current valuation,” said Byrna CEO Bryan Ganz. “We believe that our shares are currently undervalued by the market, and this repurchase program demonstrates our confidence in the long-term sustainability of our marketing strategies and business model. As we have done with previous repurchase programs, we aim to enhance shareholder value and demonstrate our commitment to delivering consistent returns by taking advantage of the current market conditions.”

Byrna has achieved impressive sequential revenue growth over the past several quarters, with Q2 2024 marking a company record for revenue, surpassing the previous record set in Q1 2024, all while improving profitability. This consistent growth reinforces management’s confidence in the Company’s long-term prospects. The stock repurchase program reflects management’s belief in the intrinsic value of Byrna and the Company’s dedication to utilizing its robust cash position to benefit shareholders. Management remains committed to driving returns for Byrna’s shareholders through strong operational performance and in the capital markets.

Under the stock repurchase program, the Company may buy back its common stock in the open market from time to time, in amounts, at prices, and at such times as the Company deems appropriate, subject to market conditions, pursuant to Rule 10b5-1 of the Securities Exchange Act of 1934, and federal and state laws governing such transactions. Byrna intends to fund the repurchases with its existing cash balance, including cash generated from operations, ensuring that the program does not impact operational capabilities or growth initiatives. There can be no assurances as to the exact number or aggregate value of shares that will be repurchased by Byrna.

During the Company’s previous stock repurchase programs, Byrna has repurchased $17.5 million of stock. The Company most recently had a stock repurchase program in place in 2022.

About Byrna Technologies Inc.

Byrna is a technology company specializing in the development, manufacture, and sale of innovative less-lethal personal security solutions. For more information on the Company, please visit the corporate website here or the Company's investor relations site here. The Company is the manufacturer of the Byrna® SD personal security device, a state-of-the-art handheld CO2 powered launcher designed to provide a less-lethal alternative to a firearm for the consumer, private security, and law enforcement markets. To purchase Byrna products, visit the Company's e-commerce store.

Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements contained in this news release, other than statements of current and historical fact, are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as: “may,” ”aim,” “will,” "plan," "expect," "intend," "anticipate," and "believe," "could," "should," "might," "occur," "achieved" and similar references to future periods. Forward-looking statements include descriptions of currently occurring matters which may continue in the future. Forward-looking statements in this news release include, but are not limited to, our statements related to the approval and implementation of the $10 million stock repurchase program, the potential repurchases of the Company’s common stock, the anticipated benefits of the stock repurchase program, the expected funding of the repurchase program with existing cash balance and cash generated from operations, and the continue strong performance and long-term growth opportunities of the Company. Forward-looking statements are based on, among other things, our opinions, assumptions, estimates, and analyses that, while considered reasonable by the Company at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies, and other factors that may cause actual results and events to be materially different from those expressed or implied. Any number of risk factors could affect our actual results and cause them to differ materially from those expressed or implied by the forward-looking statements in this news release, including, but not limited to, the risk that the stock repurchase program may not achieve the intended benefits, the risk that the market conditions may not be favorable for repurchases, fluctuations in stock price, liquidity, capital position, market disruptions, alternative opportunities or needs for use of surplus cash and the risk that the Company’s financial performance may not continue as anticipated. The order in which these factors appear should not be construed to indicate their relative importance or priority. We caution that these factors may not be exhaustive; accordingly, any forward-looking statements contained herein should not be relied upon as a prediction of actual results. Investors should carefully consider these and other relevant factors, including those risk factors in Part I, Item 1A, ("Risk Factors") in the Company's most recent Form 10-K, should understand it is impossible to predict or identify all such factors or risks, should not consider the foregoing list, or the risks identified in the Company's SEC filings, to be a complete discussion of all potential risks or uncertainties, and should not place undue reliance on forward-looking information. The Company assumes no obligation to update or revise any forward-looking information, except as required by applicable law.

Investor Contact:

Tom Colton and Alec Wilson

Gateway Group, Inc.

949-574-3860

BYRN@gateway-grp.com

v3.24.2.u1

Document And Entity Information

|

Jul. 31, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BYRNA TECHNOLOGIES INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 31, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

333-132456

|

| Entity, Tax Identification Number |

71-1050654

|

| Entity, Address, Address Line One |

100 Burtt Road

|

| Entity, Address, Address Line Two |

Suite 115

|

| Entity, Address, City or Town |

Andover

|

| Entity, Address, State or Province |

MA

|

| Entity, Address, Postal Zip Code |

01810

|

| City Area Code |

978

|

| Local Phone Number |

868-5011

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BYRN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001354866

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

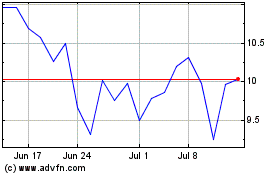

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Nov 2023 to Nov 2024